A Bug or a Feature?

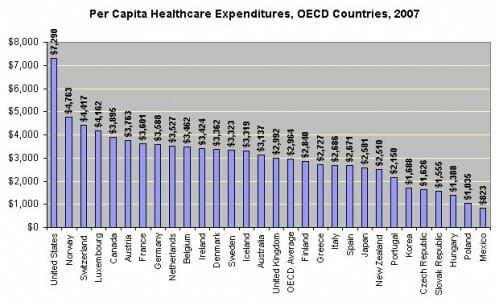

Kevin Drum shows this chart as evidence we need government health care like the rest of the "civilized" world:

I write back in the comments:

I wonder if the graph you show is a bug or a feature. My guess is that you could draw the same chart in the same shape with the US on the far left for consumption of items as diverse as "big screen TVs" and "pro sports tickets." We would chalk up spending in any other area as simply a result of wealth. Why not on health care? Why is it so bad that we spend more money on something like health care which is arguably less frivolous and more critical than TV's or baseball games?

I would understand it if the argument was that we are not getting our money's worth, but that meme is just about dead. The evidence is pretty clear that though life expectancy in the US is lower than some of these other countries, this is due to issues unrelated to health care (specifically murders and auto accidents). When the cause of death is limited to things amenable to the health care system, the US ranks #1 in the world in life expectancy. This is not even to mention the customer experience in accessing the health care system, which for all its irritations, is still ranked the best in the world. We pay the most, and get the best results, because we can afford the best.

It makes me nervous that you think this is a problem.

PS- I certainly think there are efficiencies that could be wrung out from the health care system if people actually shopped with their own money for their own health care, as they do for every other product and service they buy. This is proved out in the falling prices for non-insurance covered health procedures, such as laser eye surgery. But it is a laugh to think the government will wring these savings out. The government has never, ever, ever made a process more efficient. All it can do to cut costs is a) institute price controls on suppliers, which eventually lead to shortages and reduced R&D and/or b) Eliminate services.

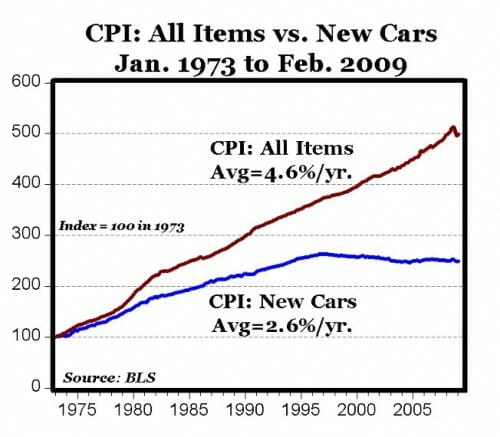

Update: OMG, we need government take over of the automotive sector, because we spend more money on cars than any other country, and by the left's logic that is a sign of failure of the status quo.