Actually Dr. Krugman, They Are Unrelated

Via Cafe Hayek, Paul Krugman says:

And surely the fact that the United States is the only major advanced nation without some form of universal health care is at least part of the reason life expectancy is much lower in America than in Canada or Western Europe.

If I were a cynical person, I might think that the tortured and overly coy syntax of this statement is due to the fact that Krugman knows very well that the causation he is implying here is simply not the case. Rather than rehash this age-old issue here on Coyote Blog, let's roll tape from a post a few years ago:

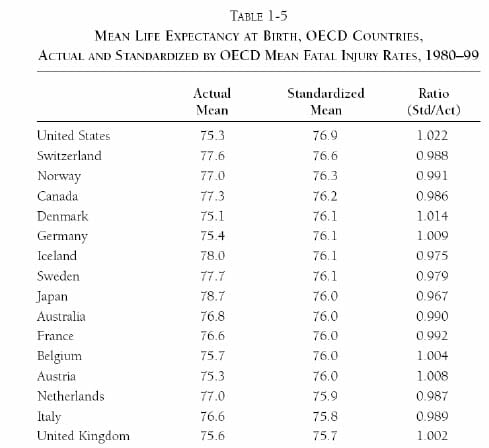

Supporters of government medicine often quote a statistic that shows life expectancy in the US lower than most European nations with government-run health systems. But what they never mention is that this ranking is mainly due to lifestyle and social factors that have nothing to do with health care. Removing just two factors - death from accidents (mainly car crashes) and murders - vaults the US to the top of the list. Here, via Carpe Diem, are the raw and corrected numbers:

And so I will fire back and say, "And surely the fact that the United States is the only major advanced nation without some form of universal health care is at least part of the reason life expectancy related to health care outcomes is so much higher in America than in Canada or Western Europe.

And check out the other chart in that post from that study:

US cancer survival rates dwarf, yes dwarf those of other western nations. Even black males in the US, who one would suppose to be the victims of our rapacious health care system, have higher cancer survival rates than the average in most western nations (black American women seem to have uniquely poor cancer survival rates, I am not sure why. Early detection issues?)

All this data came originally from a post at Carpe Diem, which I refer you to for source links and methodologies.