Immigration -- A Pox on Both Your Houses

It is almost impossible to have a discussion on immigration with either Republicans or Democrats because the conversation quickly devolves into a pointless blame game, eg "how can you defend x when other defenders of x have done so many things wrong" where x = something like "the virtues of immigration" or "consistent enforcement of current immigration laws." Well, I can give you the definitive answer to this blame game -- it is both their faults.

Before getting into it, a bit of history.

In my lifetime, IMO the country has never allowed enough legal immigration. The reasons are complicated but I used to say simplistically that Republicans wanted immigrants to work but not vote (appreciating their economic contribution but fearful of their political impact) while Democrats wanted immigrants to vote but not work (assuming the immigrants would support Democrats but bowing to pressure from unions fearful of employment and wage competition from immigrants). Bernie Sanders, who is as Left as they come, was opposed immigration for years for exactly these wage competition concerns.

The problem was that the legal immigration level was really too low to support our economic growth, and thus there were always opportunities and relative prosperity for immigrants even when they did not enter legally. From time to time Congress would be forced to act, generally giving amnesties every so often to immigrants already here and fairly well integrated into the economy. Immigrants from certain countries were restricted (sometimes for bad reasons, but sometimes for good reasons (eg immigrants from low-trust societies that had dominant clan or tribal relationships -- think Sicily in the early 1900s). And a good number of immigrants were rejected or deported, often for criminal ties and it is useful to note that until 10 years ago there was pretty solid bipartisan support for doing so.

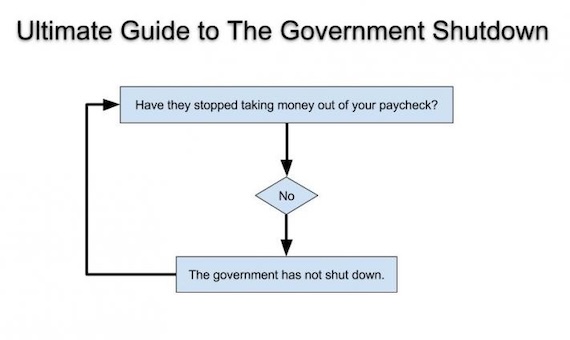

Beyond the ideological and policy changes over the last 10 years I will describe below, a couple of other changes have been happening that make the immigration problem worse. First, Presidents have largely given up on the hard work of taking policy choices to Congress and now manage issues like immigration through Presidential decree. In this environment no engagement with the other side is necessary, which is entirely against the original design of our country. People get frustrated that Congress does not move fast enough on contentious issues, but in fact that was never the intention. If the country is divided 51-49 on some issue and the Congress is divided 51-49 and the President was elected 51-49, it should not be possible to stampede an extreme solution to the issue through executive action, but that is the growing approach we have seen over 20 years (at least).

The second changing factor is one of polarization. The country has any number of times been severely polarized around certain issues, but seldom has it been polarized around ALL issues. This is largely a result, in my observation, of the knee-jerk partisan behavior we see today. For example, I wrote the other day that I don't think there is any way to reasonably explain the Left's embrace of Islam, which in its current manifestation tends to be hostile to many of the Left's other values such as secularity, empowerment of women, and sexual tolerance, except as a tit for tat opposition to Conservative post-9/11 criticisms of Islam. So when one side says that we need less immigration, the other side says we want to take immigration to infinity, and the other side then says we want it negative.

A pox on Republicans, and in particular Trump.

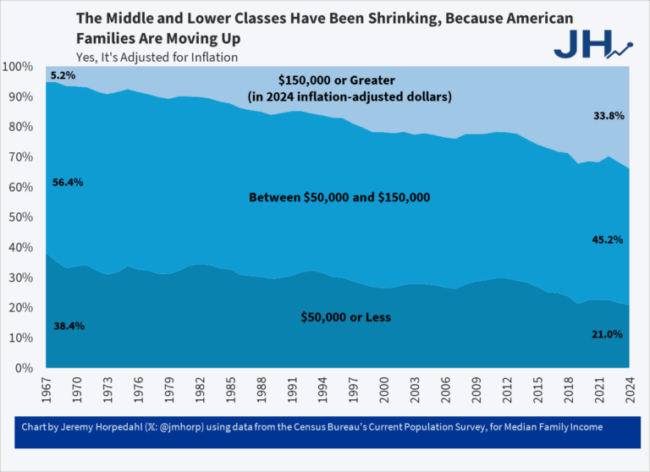

If I had to teach American history thematically, rather than chronologically, one of the top five themes that made the US the nation it is today has to be immigration. It is impossible to understate the net positive impact of immigration in our history, both in aggregate as well as the many great individuals. And for our growth and greatness to continue, we need more immigration. Every economist I have seen present over the last several years (including to such crazy left-wing groups like the board of the California Chamber of Commerce) has said that the economic growth rates we have experienced in the past and wish to see in the future are impossible without substantial increased immigration (I know there is some argument that reduced immigration will lead to re-entry of US citizens into the workforce, which will certainly happen in some small way but not enough to sustain growth and besides, the exit of citizens from the workforce likely has more to do with entitlements than immigration). Remember that fertility levels in the US have fallen well below replacement levels, which means our native population will begin to shrink with the passing of us baby boomers.

And this is not even to consider the desire we should have to continue to import the best and most talented people into our country. For decades, other countries have lamented their "brain drain" to the United States as being such an obvious advantage to the US. Their best and brightest would take a job in the US and never come back. Their brightest kids would go to US colleges and come to love the country so much they wanted to stay. It is hard to come up with any parallel case in modern history -- we have lots of examples of talented people running away from certain countries, but I can think of only one where so many talented people ran towards a country. And insanely, Trump wants to end that because some small percentage are vocal and irritating. His plan to fight China is to keep their students out of the country. My plan to fight China would be to take 100,000 of their top kids into our universities every year and offer automatic green cards to the top half of these on graduation. Skim a million of their best youth off over a generation.

Perhaps driven by years of his private zero-sum deal-making (e.g either the lenders retain more out of bankruptcy or Trump does), Trump brings a really harmful zero-sum thinking to both trade policy and immigration law. He sees each new immigrant as taking a job from a US citizen, just as he sees each import as reducing US output by the same amount. This is incredibly narrow thinking that is not born out in theory or in 200 years of practice. New people and sources of supply allow the US to shift people and capital to more productive pursuits, while accessing the whole world of talent via immigration and trade spurs new ideas and technologies. This zero-sum thinking is ironic to see in a Republican, because traditionally most Progressive-Left-Marxist economics are founded on zero-sum thinking. Specifically, trade protectionism and immigration restrictions as a means to protect US jobs has always been the Left's policy position, yet another reason I find Trump to be more Left than Right in much of his economic policy.

Whatever the background, Trump and his MAGA followers cheered the news in 2025 that the US had achieved negative net immigration, a policy I consider entirely equivalent to net-zero climate policy and just as destructive to economic growth. Traditional Conservatives may try to argue that, well, he is only fixing the worst features of Biden-era immigration policy. But in fact he goes much further than this, blaming immigration of all sorts as a net harm and infecting his followers with an unhealthy mythology about the evils of immigration. Worse, the over-wrought language about immigration, even calling it an invasion, is being used to justify extreme enforcement tactics up to and including the use of the military for regular policing, something that has always been an anathema in this country. The tactics have become provocative and dangerous --perhaps even purposefully so -- and Trump really hit a new low by cutting a deal to send the deportees he liked the least to the horrible prisons of El Salvador, which I once called Trump's Constitution-free zone. Precedents last forever, and frankly I don't care how bad a criminal immigrant is, nothing justifies escalating enforcement to such terrible levels.

A pox on Democrats, and particularly Progressives.

Had the Left set out in 2020 to do everything they could to turn the central third of the political spectrum against immigration, they could not have done a better job. They actively encouraged people to pour through the deserts of Mexico creating a series of humanitarian crises while at the same time overwhelming the country's ability to humanely receive and integrate them. They tossed out historic vetting of immigrants with problematic backgrounds. In the midst of a housing crisis in many cities, they took over whole hotels and housing projects and filled them with these recently arrived immigrants, handing them taxpayer money to live on (necessary because while blue cities tolerated or encouraged their presence, they did not allow them to work). If you wanted to try to piss off the middle band of Americans who are not hard-core Left or Right, one couldn't do much better than the picture of unvetted immigrants who are effectively exempted from current immigration law living in government funded housing (that many Americans were struggling to afford) and receiving generous government assistance.

And then there is the issue of criminality. Contrary to mythology on the Right, neither immigrants in general nor illegal immigrants in particular have historically (at least prior to 2020 and maybe still) had higher crime rates than native born Americans. In fact, much of the data I have seen tends to show them committing fewer crimes. This does not, by the way, come as a surprise to me from living in Arizona. These folks were coming here to work and seek prosperity, and nothing would get them tossed out of the American dream faster than encountering the law. Years ago, I once only slightly tongue in cheek observed that the best way to spot an illegal immigrant in Phoenix was to find the only car actually driving the speed limit.

There was a pretty bipartisan left-right consensus that -- even if we all disagree on the correct level of immigration -- immigrants without permanent residency that commit crimes get sent back via a fairly speedy process. This is the deal with Joe Sixpack, who is skeptical of immigration but largely accepts it as long as the criminals are stopped at the gates or sent home. But this consensus got interrupted by the sanctuary city movement.

I will admit that at first, the sanctuary city idea sounded OK to me. For years I used to rail at our former Sheriff Joe Arpaio (lol just search this site for his name) who used to do crazy stuff like descend on a local business, zip-tie everyone with brown skin, and release them only when some panicked family member brought proof of their legal residency. Having seen my city actively harassing peaceful, productive people who were in violation of immigration laws (only), I thought at first that sanctuary city meant that the city would allow their illegal immigrants to live in peace.

But it turns out this was not exactly what sanctuary city means in practice. Phoenix was something of an outlier on this and most cities never had their police actively searching out immigration violations among peaceful, law-abiding residents. The only time city police really got involved with immigration was when they arrested someone for a crime (eg robbery or assault) and it turned out the person was not a legal immigrant. Thus the main actual impact of sanctuary city status is that the city does not turn over criminals for deportation, breaking the old deal with Joe Sixpack. And it has had the additional effect that every high profile, make-the-national-news story about the Left fighting a deportation in the streets or in the courts usually involves a criminal for whom few in the middle are going to have sympathy. My hard-working and friendly yard guy was deported 9 months ago without a peep of support, but the Left is seen on the news rallying for Venezuelan gang leaders. The optics are terrible.

Some suggestions (none of which is likely to happen)

- In the short term, back off in Minneapolis. It is dangerous there and both sides are to blame for being purposely provocative, though I must admit that Waltz and the rest of the Minnesota government has done what I thought was impossible -- they are being even more outrageous than Trump, purposefully painting targets on law enforcement officers and encouraging their citizens to get into dangerous confrontations. The Feds are going to have to make the first move to de-escalate -- F*ck saving face, and its only like 1% of the country anyway. Even Patton had to back off and try again later a few times.

- In the short term, I would love to see the Feds and sanctuary cities negotiating local agreements to avoid the Minnesota chaos. The Feds could agree that if the city cooperates on immigrants who have committed crimes on an agreed list, they will not take enforcement actions against others in the city. In other words, the Feds agree that if the city will hand over their violent and repeat offenders, the Feds will leave the day laborers at the Home Depot alone. Then if the city still objects, the Feds can publicly proclaim that they only wanted to deport criminals and the city wanted to keep them. The PR battle they are losing now could go the other way.

- Longer-term, Congress has to act. Yes, given that the Senate will remain close to 50-50 for years to come, some sort of compromise will have to happen but this is what is supposed to happen on issues where the citizenry is equally divided. My guess is that in such a compromise Republicans will have to accept some sort of amnesty and higher immigration limits while Democrats would have to accept greater enforcement activity, more vetting, limits on certain government assistance to immigrants and perhaps more voter ID requirements. I know this is possible because similar deals have happened in the past. I am not optimistic as the moderates in the Senate like Krysten Sinema and Jeff Flake have all been driven out and such a compromise can only come with Presidential leadership and its not going to happen here. More than wanting their stuff, partisans will demand the other guys don't get their stuff. I would see the Right screaming against anything with amnesty regardless of what they get in return and the Left screaming about voter ID.

Update: about an hour after I hit publish, the Trump Administration began signaling that looks very close to the first two suggestions above. We shall see, though this Administration tends to stick to a policy position about as long as a 5-year-old who has mainlined 3 Hershey Bars stays on task.