Great Example of Concentrated Benefits / Dispersed Costs Cronyism: New Phoenix Rail Tax

The hefty sales tax that funds Phoenix light rail deficits is about to expire, and as is usual, politicians not only don't want it to expire but they want to double it so they can build more over-priced rail lines.

One of the reasons that stuff like this is so hard to fight is a phenomenon called "concentrated benefits but dispersed costs." This means that, particularly for certain crony handouts, the benefits accrue to just a few actors who, due to the size of these giveaways, have a lot of financial incentive to promote and defend them. The costs, on the other hand, are dispersed such that the final bill might only be a few dollars per taxpayer, such that no individual has much incentive to really pay up to support the fight.

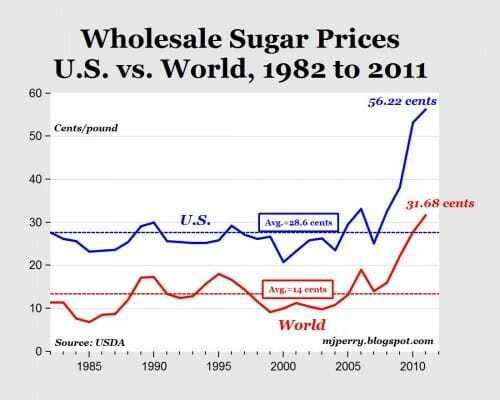

A great example of this is sugar tariffs. These raise the price of sugar (as well as reducing our choices and effectively promoting imperfect substitutes like HFCS) so we as consumers should all fight them. But the higher cost of sugar might only cost us, say, $20 each a year individually. Are you really going to donate $100 in a political cause to save $20? On the other side, these tariffs create millions and millions of dollars in profit for a few sugar producers, such that they have a lot of money and incentive to spend big on lobbying to keep the tariffs in place.

The new Phoenix light rail tax increase gives us a yet another sad example of the phenomenon:

Construction companies, engineering firms and transit service providers are the biggest early supporters of the Proposition 104 campaign to expand Phoenix transportation, while the group fighting the proposed tax increase still seeks major funding.

The MovePHX campaign, supporting the bus, light rail and street improvement plan going before city voters in August, raised $382,900 from March through the end of May, according to finance reports filed Monday.

Opposition group Taken for A Ride — No on Prop 104 received just under $417 from individuals over the same period. A second campaign committee opposed to the proposition formed after the contribution reporting period ended....

More than half of the contributions to the MovePHX campaign during the reporting period came from engineering, design and construction firms, including many that were hired for design and consultation on the Valley's first stretch of light rail.

The largest single donation came from We Build Arizona, a group of engineering, contracting and transit organizations that donated $125,000 to the campaign. TransDev and Alternate Concepts, Inc., which hold bus and light rail service contracts, contributed more than $35,000 combined.

A combined $30,000 came from police, firefighter and food and commercial worker union political action committees.

$382,900 to $417. That is why cronyism is so prevalent.