Posts tagged ‘games’

"True poverty is not being able to afford some small principles" -- When Sarah Jeong Hammered the Powerless

This is one of the more remarkable pieces I have read in a long time. Shenzhen Tech Girl Naomi Wu describes how Sarah Jeong and Vice magazine refused to acknowledge that maybe a woman in China is in a different situation than a woman in Brooklyn and outed her for a few clicks. An excerpt:

These are not games you play in China, it doesn’t matter if the sum total of their experience living a warm sheltered life in America makes them think it will probably be ok. Things are not the same here. That is not how agreements with sources works, Vice wasn’t in a position to understand the exact nature of the risk I face or what limits have to operate within- and didn’t care to find out. It doesn’t matter if the story “reads positive” or “seems fine” to an American reader- they are not who I have to be concerned with....

It’s not that a White American can’t understand China- that is nonsense, there are countless American journalists and scholars here that are experts in this field that Jason Koebler or Vice could have contacted to verify what I was telling them, I begged them to. They simply didn’t care....

Then Sarah drops a veritable atom bomb of an Appeal to Authority, she is Korean (having lived a full week as an adult in Korea). South Korea is pretty much the same as Mainland China, therefore I was never in any danger. She invokes the monolithic Asian culture myth precisely because she knows her largely White audience believes this anyway.

You can get your full daily RDA of irony by reading it all.

Yet Again, Forgetting the Mix

I like reading Zero Hedge, though their laudable cynicism about government and financial markets sometimes edges into conspiracy theory.

Anyway, I wanted to highlight something in a post there today about BLS data. Various writers at the site have claimed for years that government economic data is being manipulated. I am not sure I buy it -- I distrust government a lot but am not sure their employees could sustain such a fraud over months and years. And besides, once you manipulate data one time to juice some metric, you have to keep doing it or the metric just reverses the next month. Corporations that play special quarter-end inventory games to increase reported sales learn this very quickly. Where there are apparent errors, I am much more willing to assume incompetence than conspiracy.

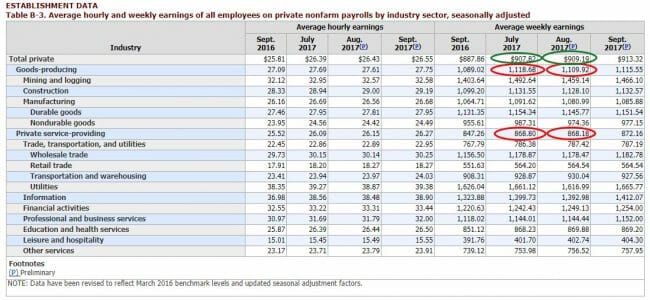

The example this week is from the BLS payrolls data, and I will quote from the article and show their chart:

Another way of showing the July to August data:

- Goods-Producing Weekly Earnings declined -0.8% from $1,118.68 to $1,109.92

- Private Service-Providing Weekly Earnings declined -0.1% from $868.80 to $868.18

- And yet, Total Private Hourly Earnings rose 0.2% from $907.82 to %909.19

What the above shows is, in a word, impossible: one can not have the two subcomponents of a sum-total decline, while the total increases. The math does not work.

Certainly this is an interesting catch and if I were producing the data I would take these observations as a reason to check my work. But the author is wrong to say that this is "impossible". The reason is that these are not, as he says, two sub-components of a sum. They are two sub-components of a weighted average. Total private average weekly earnings is going to be the goods producing weekly average times number of goods producing hours plus service producing weekly average times the number of service producing hours all over the total combined hours.

From this I hope you can see that even if the both sub averages go down, the total average can go up if the weights change. Specifically, the total average can still go up if there is a mix shift from service providing to goods producing hours, since the average weekly wages of the latter are much higher than the former. I will confess it would have to be a pretty big jump in mix. The percent goods producing hours would have to rise from 15.6% to almost 17%, which strikes me as a very large jump for one month. So I am not claiming this is what happened, but people miss the mix changes all the time. I had to explain it constantly back in my corporate days. Another example here.

How The Media Exaggerates to Scare You -- Often In Support of Growing the State

I find the WSJ to be more readable than most modern newspapers, but that does not mean it doesn't play exactly the same silly media games every other media outlet does.

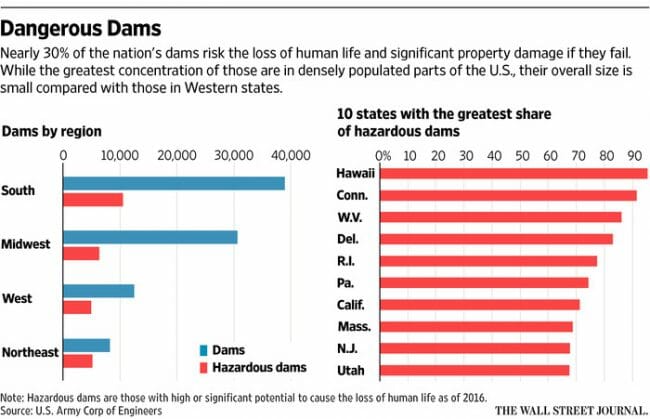

This article is about a legitimately dangerous dam in California that is being rebuilt to accommodate new learning about how earthen dams behave in seismic events. The authors attempt to extrapolate from this example to highlight a larger threat to the nation. They use this chart:

A reader who is not careful and does not read the fine print, which means probably most all of them, will assume that "dangerous" and "hazardous" as used in this chart refers to dams that are somehow deficient. But in fact, these terms in this chart refer only to the fact that IF a particular dam were to fail, people and property might be at risk. The data here say nothing about whether these dams are somehow deficient. Actually, if anything, I am surprised the number by this definition is as small as 30%.

The actual number of deficient dams that are dangerous to human life is actually an order of magnitude smaller than these numbers, as given in the text:

An estimated 27,380 or 30% of the 90,580 dams listed in the latest 2016 National Inventory of Dams are rated as posing a high or significant hazard. Of those, more than 2,170 are considered deficient and in need of upgrading, according to a report by the American Society of Civil Engineers. The inventory by the U.S. Army Corps of Engineers doesn’t break out which ones are deficient.

So if we accept the ASCE numbers as valid (and I am always skeptical of their numbers, they tend to exaggerate in order to try to generate business for their profession) the actual numbers of dams that are really hazardous is no more than 2,170. That strikes me as a reasonably high number, and certainly a good enough reason to write a story, but the media simply cannot help themselves and insist on exaggerating every risk higher than it is.

Yes, Let's Make Entrepreneurship and Business Formation Even Harder

I am on the road this week in Alabama and Tennessee, but I felt the need to comment on one issue of the day. These thoughts will be a bit rushed:

Well, it looks like the awesome team of Trump and Clinton may manage to take yet another shot at reducing entrepreneurship. It's all a result of the report that the Donald had a nearly billion dollar tax loss decades ago, and that - gasp - this tax loss might have shielded his income from taxes for years. Hillary's supporters are already demanding changes to the tax code and Trump, as usual, cannot muster an intelligent defense on even a moderately technical topic.

As someone who built a business over 10 years, I can't think of anything that would do more to screw up the already languishing rate of new business formation than to somehow limit the deductability of business losses on future years' taxes.

I lost money for years in my business -- trying to get it going, trying to grow it, engaging in more than a few failed experiments of new services. I would have been much less likely to do so had I known that I couldn't offset future profits on my taxes with current losses.

I will add that making changes to the deductability of losses will only lead to some screwed up accounting behavior. For example, had I known that the losses would not have been deductible, I probably would have found excuses to capitalize a lot of my expenses, reducing paper losses early and getting tax deductions later in the form of depreciation. I probably could have saved some of the deductions but only with a lot of extra bookkeeping and accounting effort. Is this really the way we want to revive the economy, by shifting sucking up more of entrepreneurs' time on useless paperwork games with the IRS/

Why Are We Making It So Hard For the Chinese to Provide Us With Lower-Cost Aluminum?

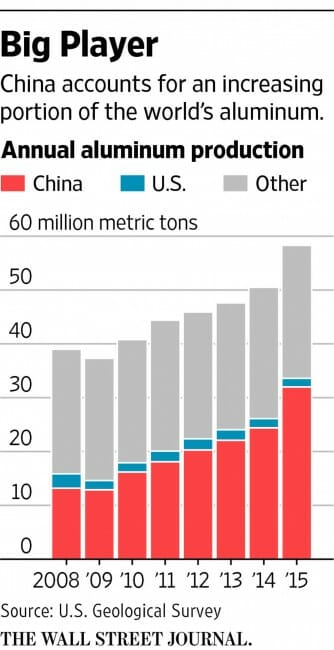

This WSJ article's hook is a huge cache of raw aluminum photographed in the Mexican desert. American aluminum manufacturers claim that this is Chinese aluminum being illegally transshipped through Mexico to get a lower tariff rate.

The U.S. Commerce Department says it is investigating the Mexican aluminum’s origin as part of a slew of trade complaints by the U.S. metals industry against China, many of which include allegations of transshipping.

China’s booming industrial production has reordered global markets, few more dramatically than aluminum. Fueled by access to inexpensive electricity and tax breaks, Chinese aluminum output doubled between 2010 and 2015. With local demand slowing,more of it was sent to the U.S., which was importing 40% of its aluminum by 2015—up from only 14% in 2010.

By the end of 2016, only five aluminum smelters will be operating in the U.S., down from 23 in 2000.

Alcoa Inc., the largest American aluminum maker, is splitting in two, isolating its profitable parts-making units from its troubled raw-aluminum operations. Alcoa Chief Executive Klaus Kleinfeld last year said illegitimate Chinese exports were “the major driver” of lower aluminum prices.

I suppose to an incumbent who has convinced himself that he has a God-given right to his historic market share, new sources of competition are always "illegitimate." But through the whole article I kept asking myself, why are we forcing these folks in China to jump through so many hoops just to bring us lower-cost aluminum? Given how fundamental aluminum is to almost every manufactured product today, we should be welcoming them as heroes, not forcing them to play silly games in the Mexican desert just to deliver their product at the price they want to sell it for.

It turns out that all this government effort to "protect" us from lower cost aluminum is to support an American aluminum industry that is tiny, maybe 2% of world production.

The industry would argue that the lower prices of Chinese imports are "illegitimate" in part because the sales price in the US is subsidized by Chinese taxpayers. To which I answer, "so what?" Or actually, to which I answer, "yay!" If another country's taxpayers want to pay higher taxes so that they can provide valuable raw materials to US industry at lower prices, why in the heck would we want to stop them?

Some Gaming News

A few random notes on computer games for those who share that interest:

- For those Diablo fans who loved Diablo II but were disappointed that Diablo III was not exactly the sequel they'd hoped for, I have a suggestion: Path of Exile from Grinding Gear Games. It is set up as an mmrpg (so you have to be online to play) but it plays just fine single player and all the map areas are dedicated instances such that you aren't fighting other players for kills and loot drops. The skill tree is famously enormous. A certain group of you will buy the game 2 minutes after clicking on the next link (I did). Here is the whole tree, it is absurd (the highlighted areas are the selections for one of my characters). The customization ability is simply staggering. Choosing a class like fighter or mage (they have different names in this game, but essentially these base classes) just changes your starting point on this map. But this is not the end of the customization. There is also an elaborate skill gem system where your attack and defense skills are based on your gem choices, both the main gems and support gems one adds to it. Seriously, the actual combat is not much more elaborate than the debuff then hack and slash and loot drop of other Diablo style games, but this game has more ability to fine tune and experiment with character design than any I have ever played.

- My absolute favorite, by far, board game has finally come out as a PC game -- Twilight Struggle. It is on Steam and I can't yet fully recommend it because I have not played through all the way online. I am told the AI needs to be tougher but it should be fine for noobs. There is also online person to person play. I love the gameplay and it has also been a platform for my son and I to have a lot of discussions about recent history. If you are a total noob, here are a few lessons for the Soviet player (which I have the most experience playing)

- The Soviets have to rush. The game has three periods, and you have big advantages in period 1 and disadvantages in period 3. You HAVE to build up a lead early or you are toast later on. I have seen a 15 point lead evaporate in the last third of the game. The best outcome is to win the game outright by the smear rule (20 point lead) by turn 7.

- Your first move is to coup Iran. Asia is yours in the early game if you succeed. The only alternative is to first turn coup in Italy, but that is a riskier strategy and can only be justified if your first turn hand is really tuned to that approach.

- Coup every turn ASAP. Coups are your most powerful weapon (other than events) and couping first thing every turn denies that ability to the US

- The space race is for dumping your worst cards, not an end in and of itself (always exceptions, of course). Twilight Struggle's best dynamic is how you end up with your opponents cards in your hand that you end up having to play for them-- the space race is one way to dump the worst of these cards (e.g. grain sales to the Soviets). Since the cards you can play become more restricted as you advance in the space race track, there are even some advantages to failing your rolls early on.

- If you play the China card, it needs to be for a BIG goal - like improving your scoring of Asia right before you play the Asia scoring card. In many cases, it is better to not play the China card at all than to have it pass to the Allies.

- Cards that allow you to play influence on any country should be used to get access to places where you have no adjoining influence -- don't use it to add to existing influence or enter countries to which you already are adjacent. This is the only way in initially to places like South America and much of Africa.. Decolonization is your friend.

- Learn to love this site. Not only does it give you a LOT of strategy, but it also answers complex card interaction questions for every card.

Appliances: Apparently the Last Bastion for Bricks and Mortar Retail

Sears is opening an all-appliance store:

Sears, which has been struggling financially due to falling sales, is opening a store that will be dedicated solely to the sale of appliances.

The retailer says that the 10,000 square foot store opening in Ft. Collins, Colorado on May 19th will be its first solely featuring appliances, the product category that has been one of its core businesses. .

“Appliances is one of our best categories,’’ said Leena Munjal. senior vice president, customer experience and integrated retail, for Sears Holdings. “We’re trying to figure out how you take the physical store and complement it with the online capability to make it a really powerful experience for our customers.’’

I essentially predicted this here several years ago:

I see the same thing now at Best Buy, with workout equipment and other oddball products. I told my son on a visit a year ago to Best Buy to expect to see the a larger appliance selection next time we visit. He asked why, and I said "because Wal-Mart does not generally sell them, and not a lot of people buy their large appliances at Amazon." Sure enough, you see more appliances nowadays.

But it probably was no accident that the article was illustrated with this picture:

What don't you see there? CD's, DVD's, speakers, DVD players, computer games and most of the other stuff that used to make up a lot of Best Buy's floor space. Because they have already been demolished by online retailers in those categories. The picture above is of appliances, one of the few high dollar categories that has not migrated to the web. Go to Best Buy and you will see appliances, health equipment, and TV's, all categories where bricks and mortar stores have some advantages over online.

This makes perfect sense, but don't tell me Best Buy is ready to take on the online retailers. They are bobbing and weaving, ducking this competition wherever they can.

I wrote specifically about the Sears appliance business here

Why Did GE Leave For Another High-Tax State? Do Corporate Giveaways Trump Tax Rates in a HQ Move?

General Electric (GE) has complained for years about Connecticut's (its current corporate home) taxation and regulatory policies. Recently, it said it was moving for greener pastures, and was leaving for... Massachusetts?

Seriously? This is like moving from North Korea to China to get more freedom of speech. Boston's top state income tax bracket is perhaps a point lower than CT's but Florida or Texas have rates of zero, and a much lower cost of living and real estate.

Granted that Boston has its attractions for a company trying to change its public perception to being a technology company. But I can't shake the suspicion this has something to do with a relocation giveaway to GE from the city and state. GE has become one of the biggest supporters and beneficiaries of crony capitalism in the country. I have to believe they cut some sweetheart deal that will eventually funnel a bunch of Massachusetts taxpayer money into GE coffers. After all, if cities will throw away a half billion dollars in taxpayer money to attract an NFL team that does business for just 24 hours a year in the city (8 games x 3 hours per game), how much will politicians pay of their citizens' money to be able to list "attracting GE" as a lead bullet in their re-election talking points?

A Modest Proposal for Fixing NFL Thursday Night Games -- Take Advantage of the Bye Week

NFL coaches hate Thursday night games, because their players have essentially only half the preparation and recovery time as they do on a normal Sunday game schedule.

So here is my (partial) solution. Where possible, teams playing Thursday night should have their bye week the previous weekend. For teams with the bye week the previous week, a Thursday night game is no issue -- in fact, it might even be a benefit, breaking up a single long-preparation period between games into two longer-than-average periods.

This is probably only a partial solution. Only 8 weeks have bye weeks, and since for week 1 the Thursday game is no issue, this only solves the Thursday problem on 9 of the 17 regular season weeks. I suppose we could extend by weeks to more weeks of the season, but even as they exist today a partial solution is better than none at all, right?

Beware Applied Underwriters Workers Compensation Insurance

Update 2/1/2016: I will not comment further at the moment on Applied Underwriters as they are currently suing me to have this article below removed. So you will need to look elsewhere for news on AU, of which there appears to be plenty. For example, here and here. The State of California Insurance Commission, via an Administrative Law Judge's decision, has ruled on the legality of the AU product discussed below. That ruling (pdf) can be downloaded here. I would love to comment on it but I will have to leave the evaluation to you. If you can't read the whole thing pages 33 and 34 are worth your time, as well as the conclusions that begin on page 59.

After you read this, there are more updates on 4/18

Well, I have managed to get myself into a scam. It is not your normal scam, like the ones that are run by some mafia boiler room with guys working under aliases. This scam comes via a major insurance company called Applied Underwriters (working under the names California Insurance Company and Continental Indemnity Company) which is owned by Berkshire Hathaway and none other than Warren Buffett. If you feel sorry for Warren Buffett and want to give him a large interest-free loan for an indeterminate number of years, this is your program.

Update 4/16: Let me insert here that Applied Underwriters has sent me a letter threatening a libel suit if I do not take down this post and a parallel review at Yelp. AU Takedown demand here (pdf). The gist of the matter seems to be the word "scam". By the text of their letter, they seem to believe that "scam" is libelous because their company is well-rated financially and that they provide reasonable claims service. I concede both these facts. However, I called it a "scam" because there is a big undisclosed cost to their product that was never mentioned in the sales process, and that could only be recognized by its omission in the contract I signed -- that there is nothing in the contract committing them to any time-frame under which to return deposits and excess premiums I have paid, which may well amount to hundreds of thousands of dollars. This fact about the contract is confirmed by their customer service staff, who have said further that the typical time-frame to return such over-collections and deposits is 3-7 years after the contract ends, or at least 6-10 years after the first of the deposits was made.

So is this a "scam"? I believe that this issue is costly enough, and hard enough to detect, and far enough outside of expected business practices to be called such. You may have your own opinion, but ask yourself -- When you enter into, say, a lease and have to put down a security deposit, is it your reasonable expectation that the landlord has the right in your lease to keep your deposit for 3-7 years (or more) after you move out? /Update

Anyway, let's take a step back and look at this in detail.

First, I need to give a bit of background on how workers comp works. When you are a new company, they assign you an experience rating -- that is a multiplier of your premium based on past loss experience. There is some default starting number that if I remember right, in most states, is a bit over 1.0x. Each year, the workers comp world looks back at your past history and computes a new loss rating -- higher if you have had more payouts, lower if not. Generally it is based on three years experience not counting the last year (so 2-4 years in the past). Your future premiums get multiplied by this loss rating.

Several years ago we had a couple bad injuries that drove our loss number into the 1.7-1.9x area. Neither were really due to a bad safety issue, but both involved workers in their seventies where a minor initial injury led to all sorts of complications. Anyway, my agent at the time calls me one day a couple of weeks before renewal and says that none of the major companies will renew me. This seemed odd to me -- I understood that my recent claims history was not good, but isn't that what the premium multiplier was for? In fact, if my loss history returned to normal, they would make a fortune as I paid high rates based on old losses but had fewer new ones.

Apparently, though, insurance companies have fixed rules that keep them from underwriting higher loss ratings. Probably for the same reason Vegas won't take action on Ivy League football games any more -- just too much variability. I found out later with my new broker we could probably have overcome this, but I learned that too late.

My broker at the time put me into a 3-year program from Applied Underwriters, in part because they were taking everybody. This program was set up differently from most workers comp programs. You had a basic policy, but there was a second (almost indecipherable to laymen) reinsurance agreement that adjusted the rates of the basic policy based on you actual claims. Here is the agreement (pdf) In other words, based on your claims, they would figure up at the end how much you owed and what your premium multiplier would be.

I saw two red flags that I ignored in signing up. 1) The reinsurance agreement was impossible to understand, violating one of my foundational rules that I shouldn't sign things I don't understand. And 2) The rate structure was very suspicious. They touted a rate structure that could go as low as, say, $100,000 a year and was capped around $400,000 a year. But when you pulled out a calculator, the $100,000 was virtually unobtainable. It would require about zero claims. If there were any claims at all, even for a few bandaids, the price would march up to $400,000 really fast. It was the equivalent of a credit card teaser rate, and it should have made me suspicious.

Anyway, I was desperate. For a business like mine, being told I had no workers comp insurance just a few weeks before the old policy ran out was a death sentence. No one would write me or even quote me a policy that fast. So I took the Applied Underwriters offer. Shame on me, I should have worked on this much harder.

I won't bore you further with my voyage of discovery in trying to figure out how this thing works. I will just tell you the results that I have found. There are apparently other companies with similar issues, one of which is documented here: Applied Underwriter Suit (pdf)Newsletter publisher objected to scan of article, so I have taken it down at their request. Here is a link to roughly the same article.

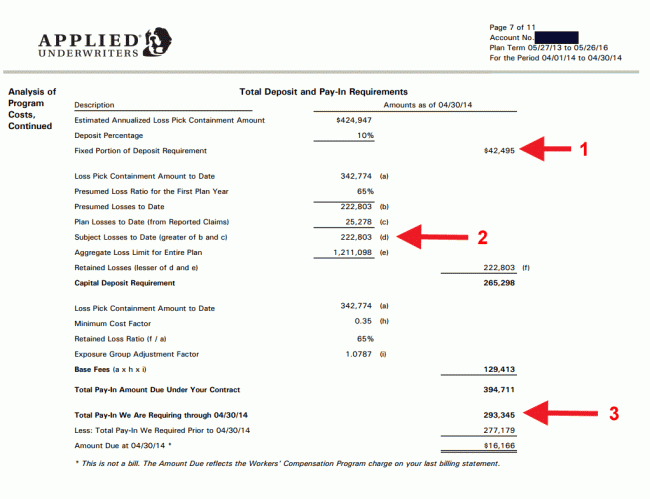

I spent hours and hours trying to figure out AU's statements. There is a whole set of terminology to learn that is actually not used in most of the rest of the workers comp world. The key page of the statement is page 7, which I will show below because it highlights several of the issues with Applied. Page 7 is the page where the monthly premium is "calculated". I have added the red numbers and arrows for the discussion below.

Here are some of the Applied Underwriter problems:

- Large deposits that must be made each year and may never be returned. You can see that I am making deposits over $40,000 a year. And that is each year. The first year deposit is not returned. The second year and third year are just added to it. And I have found out since I joined this program that they are not contractually obligated to return them in any time frame. Maybe some guy who was hurt in his thirties has a relapse and claims more money when he is 75. Gotta keep your deposit just in case, don't we? The timing of the return of your deposits (and overpaid premiums below) is entirely at their discretion, and that has been confirmed by their customer service staff. In fact, their standard answer is that on average, such monies are not returned to customers for 3-7 years after the contract ends, or at least 6-10 years after the first deposits were made.

- Premiums based on the worst of your experience and their estimate of your losses, and they keep the difference for years and years. For those in the same trap as me, I will try to explain the numbers above. The estimated loss pick containment at the top is basically their estimate of your losses. Note that it drives every number on the page and is basically their arbitrary number -- they could have set it anywhere. The loss pick containment to date is just pro rated for the amount of the year that has gone by. The 65% is an arbitrary number. The $25,278 is my actual losses to date. You can see where I point with #2 above, though, that my losses are irrelevant to my premiums. They take the higher of my losses and what is essentially their estimate of my losses and I pay based on that. Note that their higher number is not based on the reserved amounts on actual claims -- the $25,278 includes their reserves. It is just the number they established at the beginning of my policy they think my claims are going to be and gosh darnit they are going to stick to that (and my claims even in my worst year in history were never even half of their estimate). Yes, at the end of the policy if my losses stay low, they owe me money back for all the premium they overcharged me based on their arbitrarily high estimates. But see #1 above -- there is no time horizon under which they have to return the money. They can keep it for years and years.

- The final premium is, after all these calculations, entirely arbitrary. So after this loss calculation (which essentially just defaults to their arbitrarily high estimate and not my actual loss history) they do some premium calculations. These actually sort of make sense if you stare at the agreements for a really long time. But then we get to the line I point to in red labelled 3. It is the actual amount I owe. But it does not foot to any other number on the page. How do they come up with this? They won't say. To anyone. It might as well be arbitrary. I actually had some dead time and took all my reports and tried to regress to a formula they use for this, but I couldn't figure it out. So all the calculation on this page is just a sham, it's the mechanical wizard in the Wizard of Oz. It looks good, but does not actually directly lead to what you are billed.

So I thought I understood my problems. I put in large deposits and overpaid premiums based on arbitrarily high loss estimates they make -- all of which will take me years and years of effort to maybe get back. It turns out that I likely will have a third problem. In the lawsuit linked above, the plaintiff complains that when they left the program after three years, Applied arbitrarily wrote up all their estimated losses on open claims to stratospheric levels and then demanded a large final premium payment at the end. Folks on Yelp complain of the same thing. You should know how this works by now -- the plaintiff will theoretically get all this back someday, maybe, when the claims prove to be less costly, but in the mean time Warren Buffet gets to invest the money for years and years (cost of capital = 0) until it is returned.

This is why I think Applied Underwriters actually likes companies with high lost histories. Rather than costs, losses for them are excuses to over-collect on deposits and premiums -- money that can then be invested and held for years free of charge.

As an aside, I want to thank my new agents at Interwest Insurance for helping decipher all of this. They actually flew a guy in to help me understand this policy. They didn't get me into it, but they are helping me pick up the pieces as best we can.

$400 Million Dollars in Public Money for a Building Used 30 Hours a Year

I love to watch the NFL but that organization and its team owners are some of the worst cronies in the country. A huge portion of their teams' increase in net worth over the last 30 years has come from public funding of its stadiums. These NFL stadiums are used by their teams for 8 regular season games and at most 2 pre-season games a year, or for a total of about 30 hours a year. Taxpayers are being forced to buy buildings with a 0.3% occupancy.

St. Louis is the next to propose a taxpayer fleecing, proposing to spend $400 million before they have even paid off the enclosed stadium they built 20 years ago. What a farce.

Years and years ago I described this as an awful sort of prisoner's dilemma game. If governments colluded in a promise not to subsidize teams, we would still have NFL teams in roughly the same cities but without the billions of dollars in taxpayer money having been passed on to 32 billionaires.

Poof. There Goes My Free Time

The new installment in the Civilization computer game series is out. This review dings it a bit for being too like the last installment (Civ 5), but I am sure I will like it because I still evidence addictive behavior whenever I go back to Civ 5. Just one more turn.... After how badly the Sim City franchise has been trashed in recent installments, I will take a Civ game that is safely similar to the old Civ games. Though my life, the Civilization game series is probably second only to having children in terms of sucking up my free time.

Thoughts On Campus Speech 1: Hitler Would Have Been The Most Valuable Campus Speaker

Yesterday, Yale did not cave to pressure from certain parts of the student body and Ayaan Hirsi Ali spoke on campus. As with many controversial speakers, mostly consisting of folks not on the political Left, a number of campus groups tried to force Yale to cancel her speech because they expressed themselves offended by her. Among politically correct colleges, there has been a growing trend towards enforcing a right not to be offended, though this enforcement tends to be asymmetric -- Muslims apparently have a right not to be offended, but Christians do not. Women have it but men do not. Greenpeace has it but Exxon does not.

People of prominence who offend us or with whom we violently disagree should not be the least but the most welcome speakers on campus. I will demonstrate this by using the most extreme of all possible examples: An imaginary speaking tour by Adolph Hitler, say in December of 1938. Could there be a more distasteful person, the leader of Nazi Germany just weeks after the Reichskristallnacht? But I think he would have been the most valuable speaker I could possibly imagine.

If he were honest, which Hitler likely couldn't have stopped himself from being, what valuable insights we could have gained. The West made numerous mistakes in the late thirties and even into the forties because it just could not believe the full extent of Hitler's objectives and hatreds**. Perhaps we would have understood sooner and better exactly what we were dealing with.

Even if he were dishonest, and tried to "convert" the office without discussing specific plans, that would still be fascinating. What arguments did he use? Could we get insights into why he struck a chord among the German people? Would his rhetoric be compelling to American audiences? I despise the guy and almost everything he stood for but I would have loved to have him on campus as a speaker.

I will tell one of my favorite stories about the rise of Hitler. You have heard the story of Jesse Owens at the Berlin Olympics. Supposedly this was a slap in the face to Hitler, to have a black man winning medals. But one of the last events of the games was a four man relay race. The US was certainly going to win. But one of the US runners was Jewish and the US pulled the runner from the race and substituted Owens. The US didn't want to embarrass Hitler by making him hand a medal to a Jew. This sounds odd to put it this way, but one of the problems we had in really taking the worst of the Holocaust seriously as it was happening is that we were not able to see that Hitler's anti-semitism was so much more dangerous than the ubiquitous and run-of-the-mill anti-semitism that obtained all over Britain and America. We should always have a policy of letting even the most extreme people talk as much as they like. We might learn that they have a point and adjust our thinking on something, or we might learn that they are even batshit crazier than we thought. Either outcome is useful.

Ready for the World Cup Finals

As a former hater, I have really enjoyed the World Cup this year. I think an unsung part of why so many people have been coming around in the States is having ESPN broadcast every game, instead of just seeing two or three here. Seeing all the games lets one start getting to know the players and the teams, develop favorites, etc.

However, like most Americans, I do find it, at best, humorous to watch folks act like they have been gut-shot every time someone brushes their jersey. I talked to a friend of mine who used to manage NHL teams, and said that it would be funny to do a parody with ice hockey players falling and writhing on the ground every time they were touched. There would be 10 guys laying on the ice in about 30 seconds.

Not quite the same idea, but I thought this parody was pretty funny

IOS App Recommendation -- Tripcase

I really am not a productivity app sort of guy. I have a lot of games, but most apps strike me as just dedicated browsers for someone's web site. To date I am a big user of the Kindle app and the Feedly RSS feed reader app and the Gmail app. Oh, and Google maps (the Apple maps program still sucks). And that is about it.

But I have been using Tripcase (free) to bring together all my travel info and I really like it. All one has to do is forward airline, hotel, car rental, restaurant, etc confirmations to a certain email address and the program parses out what information it needs. The only work is that each confirmation gets set up as a separate trip, but it is easy to merge three or four together to get all of one trip in a single record. It provides a nice interface with travel information and provides notifications for such things as flight delays and gate changes.

App Addictions of the Day

My kids are working to waste large swathes of my time by introducing me to addictive games

2048, via my daughter

QuizUp, via my son

Those are the quickies. For more serious gaming on the iPad, I have been playing a bunch of euro-style board game ports, including Lords of Waterdeep, Agricola, Eclipse, Dominant Species, Small World, Ticket to Ride. All recommended. I have heard rumors of iOS apps for Dominion and 7 Wonders, two of my current favorite board games, but I have seen anything appear. Board Game Geek has an iOS blog (beware, the format is uglier than a geocities page). I downloaded Pandemic but have not played it. There are also ports of Carcasonne and Settlers of Catan but neither of those are my favorites.

I have also enjoyed the port of Baldur's Gate II to the iPad. This is still, perhaps with Neverwinter Nights 2, the best AD&D rules RPG for the computer. The only problem with Baldurs Gate is the graphics on the PC are dated, but they work fine on the iPad. I downloaded a Master of Orion port the other day but have not tried it yet.

But for REAL time wasting, I look forward to this fall when there is apparently a new version of Civilization / Alpha Centauri coming out. Trying to have my desk cleared before then.

It is Time to End Favored Tax Treatment of Capital Gains

My new column is up at Forbes.com, and asks why we fetishize capital gains over regular income

Let's consider two investors. Investor A buys a piece of land and builds a campground on it, intending to run the campground for decades. Investor A gets her return on investment from the profits each year running the campground, profits that are taxed as regular income (Full disclosure: In my business life, I am essentially investor A).

On the other hand, Investor B buys the same piece of land and builds the same campground on it, but in about a year Investor B sells the newly developed facility, making a profit on the sale over his original investment. Investor B likely will pay taxes on this gain at reduced capital gains tax rates.

But why? When Investor B sold the property, the price he got was probably something like the present value of the expected cash flows from operating the campground. Both Investor A and B created essentially the same value., but Investor B took the value as a single lump sum rather than as a stream of income over time. Why is Investor B's approach preferred in the tax code? Or, stated another way, why does the tax code favor asset flipping over long-term operations?

Is Bing "Managing" Search Suggestions

Go into Google and search "Windows 8 is " and you will get auto-suggestions "Crap, Rubbish, Awful, Terrible, Horrible, Slow, A Disaster, A Flop". When this was first noticed, folks suggested Google was playing games, though personally having tried Windows 8 a couple of times I thought the suggestions were dead on. So Don Charisma tried the same thing with Microsoft's search engine Bing:

It appears that Microsoft got the message and has done a little managing of their algorithm, because now you get this:

Cool? Great? Amazing? Seriously, who are they fooling? Even Yahoo, which is powered by Bing (I think) doesn't give this kind of result

The Obsession with the Home Run -- A Stupid Sports Trade

Nothing seems to obsess general managers (and fans) as much as the home run. And with the steroid era (maybe) in the past, there are a lot fewer of those out there to find. Which means that given the perhaps irrationally high demand and the declining supply, the price for them is going to go up. Which is a very good reason to be skeptical of deals for power hitters.

Unfortunately, the Diamondbacks just can't quite get over their sense that they need more power on the team. So they have made a deal to acquire Mark Trumbo from the Angels. To my eye, Trumbo is the reincarnation of former Diamondback Mark Reynolds -- 30-35 home runs, a batting average south of .250, and nearly 200 strikeouts a year. I wouldn't take this kind of player if you gave him to me. He is an inning killer who manages to hit one out of the park every five games or so. I suppose he is cheap in money terms (has a couple of years until free agency) but we traded two good players who had down years last year. In stock market terms, we are selling at the bottom and buying at the top.

The Greatest Bit of Color Commentary in Baseball History

Today is the anniversary of what is probably the greatest moment in Arizona sports history. But it is also the occasion of the most precient bit of sports commentary I have ever heard. Watch this brief clip. Listen to Tim McCarver's comment just before the second pitch and then see what happens. He called it exactly.

I suppose we Arizonans are biased, but the whole game is one of the best baseball games I have ever watched. Randy Johnson relieving Curt Schilling. Mariano Rivera relieving Roger Clemens. You can watch it all here.

Best Buy Says It's Not Afraid of "Showrooming". Really?

Best Buy says it is not afraid of showrooming, the practice of testing products at a physical retailer and then buying it online. Best Buy says it is confident it can convert visitors into buyers, even if their intent was to buy online.

Well, that is a brave front. And I wish them luck -- I certainly like having bricks and mortar retailers around when I need something fast and can't wait for the UPS truck. But it probably was no accident that the article was illustrated with this picture:

What don't you see there? CD's, DVD's, speakers, DVD players, computer games and most of the other stuff that used to make up a lot of Best Buy's floor space. Because they have already been demolished by online retailers in those categories. The picture above is of appliances, one of the few high dollar categories that has not migrated to the web. Go to Best Buy and you will see appliances, health equipment, and TV's, all categories where bricks and mortar stores have some advantages over online.

This makes perfect sense, but don't tell me Best Buy is ready to take on the online retailers. They are bobbing and weaving, ducking this competition wherever they can.

Postscript: Best Buy is hoping that having "trained" sales people to help customers will garner business. There are two problems with this. One, the training of their sales staff has always been spotty, and likely will not get better as their financials go south. And two, I find that Amazon.com reviews are far more helpful, and often more knowledgeable, than most in-store sales staff. But on the positive side, who doesn't enjoy getting hassled for an extended warranty at checkout?

M.U.L.E. Returns

One of my favorite early C64 games may be returning to mobile platforms. M.U.L.E. would work great as a networked iPhone game. Hopefully these folks do a good job with it.

The Greatest Product Ever for Hyperactive Adults with the Attention Span of a Four Year Old

The Red Zone channel from DirecTV. Basically the show's producers channel surf for you, flipping obsessively between as many as 8 simultaneous pro football games (sometimes with two split-screened at a time). My wife says she gets a headache from watching it even for a few minutes. But I think its awesome. I actually flip back and forth between the RZC and whatever game I have chosen to watch that day for extra hyperactive bonus points.

Photoshop Practice

I am working on a couple of euro-style strategy card games at the moment. The first is a business start-up game, and the second is a space-themed game loosely based on my experiences playing the Traveler role-playing game years ago. A good stock image account (I use Shutterstock) gets me everything in terms of card images I need for the first game, but royalty-free space images are harder. However, it is actually possible to start with prosaic industrial and other images and hack them to look futuristic, but it takes some work.

So I have been working on Photoshop skills. If I could digitally paint, I would paint beautiful concept art, but I cannot. So my Photoshop training has focused not on painting per se but on hacking images together and overlaying effects. A LOT of the work is learning to do selections well to mash up images and then overlaying a few effects. I can make a really good laser beam now, for example. Take a modern weapon, have a laser beam come out, wala a pretty functional sci fi gun (Don't believe me? Look at the Death Star Turrets in the original Star Wars movie and tell me those aren't essentially current-era battleship turrets with green and red light coming out). I wrote earlier about the lessons I followed in making custom planets.

As an example, here is the lesson I did last night. It is not production value because it started with a low-res iPhone photo my daughter sent me and as you can tell from the edges and especially the hair, I did not spend much effort getting the edge selection just right. But my daughter liked being a cyborg:

She has dark brown hair and dark brown eyes, so she is not the ideal model for this because those are hard to colorize well. Blondes may or may not have more fun, but they are much easier to colorize. The downsize of the exercise is that she loved the hair and now wants to color it that way for real.