The Apparent Cash Crisis At Tesla -- Is The $TSLA Thursday Model Y Reveal Really Just a Stealth Emergency Financing Gambit?

I was listening this evening to the excellent Hidden Forces podcast on Tesla and they said something that really resonated with me -- its hard to discuss Tesla because there is so much crazy stuff going on: A CEO who in many ways channels Donald Trump's worst characteristics; multiple SEC investigations, an ongoing contempt hearing; a story yesterday about thuggish behavior towards a whistle blower; strategic moves that are made, unmade, and then changed again in just a few weeks; astoundingly high turnover in management ranks, including an esteemed general counsel who couldn't hung around for even 60 days and then purged all reference to Tesla from his CV; fantastically passionate bull and bear communities; expansive promises that are seldom kept; outright fraud -- all in a company valued at $60 billion dollars and whose stock price rose 2% today under a barrage of negative news that would melt companies that have 100-year track records. I have been meaning to do an update on Tesla but where to start? How can I even bring readers unfamiliar with the story up to date? I have started and stopped this article about three times, but now I am going to plow through and get something out. If it is not entirely coherent and far from complete, my apologies. If you want more, go to @teslacharts on Twitter as a starting point and you will discover a lot of really smart people who are, believe it or not, even more obsessed by the Tesla train wreck than I.

In the past I have limited myself to two issues. The first is the outright fraud of the Tesla acquisition of SolarCity, another Musk company that was going down the drain until Tesla bailed it out. The transaction appeared (even at the time) so transparently self-serving to Musk and his family that it just screamed fraud, and time has only made this clearer. Musk sold the synergy-less acquisition to Tesla shareholders based on a solar shingle technology he portrayed as ready to go, but that still has not seen the light of day 2 years later. In retrospect, it is crystal clear the solar shingle was a sham that was fraudulently hyped to make the deal go through. This fire and forget approach to new product announcements has become very familiar at Tesla -- Musk scored extra subsidies from California with a battery swap technology he demonstrated one time and then has never been seen again, and Musk announced a new Semi truck and harvested a number of deposits for the vehicle and then has not even mentioned the product for months. Since the acquisition, SolarCity new installations have fallen precipitously every quarter, demonstrating that Tesla had no real commitment to the enterprise, and this is only going to get worse as Musk announced that its last remaining sales channel is going to be closed.

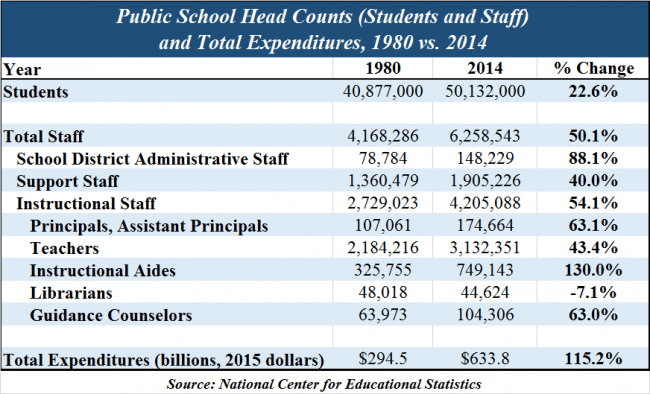

The second Tesla issue I have tangled with is the strategic dead end that Tesla has reached, and the bizarre fact that a company in a capital intensive industry that is valued as a growth company has, over the last 12 months, virtually shut down R&D spending and now does less capital spending for its size than does even staid companies like Ford. I won't cover all this ground again, I refer you to posts here and here-- If you are new to the Tesla story, start with these. But in short, Musk made the fateful choice to take what was already destined to be an uphill climb for a new company to penetrate an extraordinarily capital intensive industry and made it an order of magnitude more capital intensive by his strategic decisions. Specifically, Musk chose not only to start up car manufacturing from scratch, but to also build out his own sales and service network AND build out his own fueling network. Kia was the last brand I can remember that penetrated the US market, and it only had to worry about investing in building cars -- it relied on third parties like Roger Penske and Exxon to build the sales, service, and fueling networks. But Tesla is committed to building out all three.

This strategic decision really began to drag on the company in 2018. Tesla's decision to do its own manufacturing -- in freaking California no less -- held back its growth as it spent years relearning auto manufacturing lessons already well-known to other players. It has fallen behind in Model 3 production vs. its own stated goals and there is no apparent progress adding manufacturing capacity for a raft of announced but still theoretical products (semi, coupe, Model crossover, pickup truck, revamped S&X). A better approach might have been to contract for manufacturing like Apple does with the iPhone, especially since there seems to be a lot of excess capacity right now in Chinese auto production. Even worse, as their fleet grew with the Model 3 ramp, Tesla was not able to invest fast enough to grow its sales, distribution, and service networks in proportion, leading to a lot of disgruntled customers that had bad delivery and servicing experiences. The same is true for their charger network, where they have again not been able to keep up with investment and are now falling behind technologically as new entrants have faster charging times, times Tesla can't match without a major investment in upgrade of its network. More manufacturing capacity, a better distribution network, more sales locations, more servicing capacity, more body shop capacity, more parts production capacity, more chargers and massive charger upgrades -- Tesla fell behind on ALL of these in 2018.

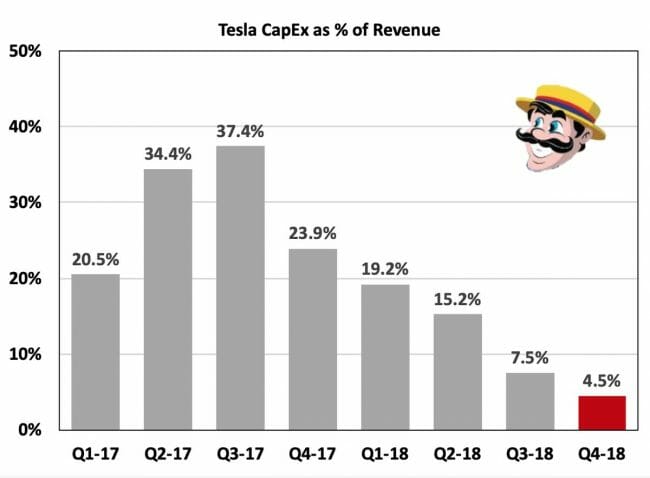

And then the really weird thing happened. Sometimes growth companies fall behind when they grow to fast, but Tesla seemed to have stopped even trying to keep up with capital needs in the second half of 2018. Their R&D fell, despite many promised new products that were a long way from delivery. Their Capex levels fell to barely maintenance levels (what might be expected to just keep current plant running) and were reduced to levels as a percentage of sales that were lower than staid, traditional, non-growth auto makers. Right when they really needed to make a capex push to make their strategy a reality, they stopped spending.

Tesla claimed, and claims to this day, that any slowdown is just the result of efficiency and responsible management. But this is crazy. Growth companies slow down and focus on profitability when the market is saturated and the growth phase is over. Uber has not slowed down. Even Amazon 20+ years in has not slowed down. Slowing down is death for the stock price of a growth company, and Musk is -- if anything -- obsessively focused on the stock price. Tesla is currently valued north of $60 billion. Without enormous growth expectations, a $20 billion valuation might be too high. Added to this is the fact that after having the luxury EV market to itself for years, competition is finally coming from nearly every luxury care maker. Tesla's 10-year moat is down to maybe 6 months. It needs to be updating the S & X and rushing new products out ahead of competitors. But they have almost given up on the S & X and Audi has beaten them to the market by at least a year and maybe two with a crossover model (the e-tron), a very popular format in the US right now.

And at first there does not appear to be any reason for this slowdown in spending. Tesla has a stock that a dedicated group of fans gorge themselves on. With a $60 billion valuation and a passionate fan base that thinks the company is still undervalued by at least a third, this company should be able to raise billions of capital easily. They could theoretically raise $5 billion with less than 10% dilution -- Tesla almost dilutes itself that much every few years just from employee stock-based compensation. Add its lofty valuation to what was reportedly $3.5 billion or so of cash on their balance sheet at the end of last year and consumer demand that the CEO describes as near-infinite, and this does not look like a company that should be slowing down.

How do we reconcile these facts -- a near halt in growth investments despite lots of cash and a sky-high stock valuation? Here are a few things going on under the surface:

- While Tesla had over $3 billion in cash, they also had over $2 billion in payables. The company has a reputation of stretching payables to the absolute limit. It may well be that the end of year cash number was the result of a lot of window dressing. In fact, Tesla skeptics have looked at the interest they earned on their free cash in the fourth quarter and have argued that for this number to be as low as it was, Tesla's average cash balance must have been much lower than their end of year reported number.

- Savvy observers (of which I am not one) who know Wall Street argue that Tesla may well have either regulatory (e.g. SEC investigations) or practical (e.g. information they do not want to disclose in a prospectus) barriers to raising capital, and that the lack of a capital raise for many months can only mean that for some reason Tesla can't raise.

- Tesla just had to pay off nearly a billion dollars in convertible bonds when the stock price was not high enough to trigger the conversion

- Demand for Tesla cars in the US has fallen substantially in the first 2 months of this quarter. Musk liked to portray the huge Model 3 sales ramp in 3Q18 and 4Q18 as the start of an S-curve, but now those quarters look more like a one-time bulge as Tesla blew through over 2 years in orders in just a few months. Aggressive pull-forwards of demand by Tesla in the fourth quarter as well as the reduction in US and Dutch EV subsidies have also hurt. [I have to add one note here just for color. The Tesla fan boys have argued to me on Twitter that Musk has already explained this to their satisfaction -- that Tesla is diverting cars away from the US for their European Model 3 introduction. This makes ZERO strategic sense. What company ever enters a new market by giving up hard-won market share in their core market? There is plenty of evidence that everyone who wants to buy a Tesla in the US is getting one with a very short lead time, implying this is a real demand drop and not Musk's typical supply-constraint story.]

A month or so ago I thought it very possible given these headwinds that Tesla may soon be facing a cash crunch if it cannot do an equity raise. However, new events that have occurred over the last week convince me that this cash crush is almost a certainty. There is no way I can explain Tesla's most recent actions as anything but a company desperately trying to stave off a near-term bankruptcy. These actions include:

- In early March, Tesla's February sales numbers in the US were announced, and they were a disaster. Within mere hours of this reveal, Musk teased an announcement (on Twitter, where else). This event turned out to be a quasi-secret invite-only conference call involving what appeared to be hand-selected media members who had historically been generous to Tesla (only a later uproar by bulls and bears alike forced Musk to release a transcript. On the call Musk announced two things --

- Tesla would begin taking deposits for the long-awaited $35,000 Model 3 (though delivery dates were hard to pin down). Musk had said not too long ago that Tesla was not able to make this car yet profitably, and he refused to discuss margins on the vehicle. Skeptics like myself suspected that the car can't be made right now for a positive gross margin, and instead this was a back-door attempt to gain new financing via customer deposits. A couple hundred thousand (theoretically) deposits of $2000 each could yield some real money for a cash-strapped company. The only thing Musk would say about controlling costs on this product was #2:

- In a totally unexpected (even to most of Tesla employees and management) announcement, Musk said Tesla was closing its stores and going to an online-only sales model. This would supposedly save 6% of the cost of the new cheaper Model 3's, ignoring of course that SG&A reductions do nothing to fix a zero or negative gross margin. Everyone, including most especially Tesla store employees and maybe even the Tesla BOD, was stunned. Here is a company whose US sales are going over a demand cliff and they respond by ... eliminating their stores and sales force?

- Simultaneously, Tesla has been announcing a series of price cuts on, worryingly, many of their highest margin products including the S and X and high-margin upgrades like paint and autopilot on the Model 3. Almost no one can see how the company makes any sort of viable gross margin at these prices, and they have the look of desperation. All these cuts did was aggravate buyers who had just paid the higher prices and who faced a suddenly lowered resale value for their car.

- Within days of the store closing announcement, the WSJ and others published stories about how Tesla was unlikely to see much savings from these closures as their leases all had expensive cancellation clauses that Tesla could still be on the hook for as much as $1.5+ billion. Incredibly, this seemed to come as a surprise to Musk and helped reveal just how slapdash these announcements were. Since then Tesla has announced that maybe some stores would stay open and maybe some sales people would not be fired but just have their bonus eliminated. As I write this, no one really knows what Tesla is going to do, but to many observers this move looks more like what one does in a bankruptcy than in the normal course of growing a business (in fact, bankruptcy is the one time lease cancellation costs can sometimes be evaded).

- Tesla, furthering their management Abbot and Costello act, partially reversed their price cuts saying that prices would now rise a few percent, barely days after they were cut. The net of the two announcements still result in vehicle prices substantially lower than in 4Q2018.

- In an incredibly bizarre move (and there is a pretty high, or low, bar with Tesla for saying something is truly bizarre), it was recently revealed that Tesla last November bought a trucking company, or really they bought a bunch of trucks, with stock. Essentially, this is a $60 billion company with supposedly $3+ billion in cash and they are paying their suppliers in stock. Oh, and by the way, remember when I said above that Tesla had already vertically integrated too much and could not afford their capital needs already? Well, this is yet another silly vertical integration. Tesla has no business being in the trucking business, a highly competitive business with a lot of incentives to offer good deals and great service for an incremental bit of demand from a growing company like Tesla. My sense was always that there is plenty of 3rd party trucking capacity out there, but that truckers just did not like serving Tesla because Tesla pays its bills so slowly and acts so unpredictably and imperiously.

- Tesla continues to produce Model 3's near full volume (around 5500 a week, despite what the nutty Bloomberg model says) even given a fall in demand. Tesla seems to be building inventory, and certainly the recent price cuts are not a sign they are supply constrained (as Musk continues to insist). Tesla skeptics believe that Musk has signed a number of supplier deals where Tesla got rebates and price cuts in exchange for volume guarantees, and that Tesla is stuck over-producing cars or it will have to return a lot of money. [update: @Paul91701736 who goes by Machine Planet on Twitter spends a lot of time observing and researching Model 3 production and says "there's one thing in this piece I can't agree with, a 5500/wk Model 3 production rate. I think ~4700 is the absolute max sustainable rate and it's been well below that most of the quarter"]

- Tesla is asking customers in Europe, as they did late in 4Q18 in the US, to pay Tesla the full price of the car even before they see it or schedule a delivery. Frankly, I am staggered anyone would buy a car this way, especially with the fit and finish problems Tesla model 3 customers have found on delivery.

- Tesla added about $500 millon to its asset-back bank line of credit and continues to roll over some SolarCity debt.

- When it was obvious that the Model 3 announcement had not created enough deposit activity, Musk then announced they would introduce the long-awaited Model Y crossover, in a reveal set for Thursday afternoon March 14.

Tesla has admitted that it still has not even decided where to build the Model Y, much less started building the plant and tooling up for it. Given that, the car HAS to be 18-24 months away. So why reveal now? Remember that Musk and Tesla have a history of using new product reveals as fund raising tools. The fake solar shingle product got Tesla to buy SolarCity. The fake battery change demonstration got Tesla millions in added subsidies from California. The complete vaporware Tesla semi reveal gained Tesla millions in deposits from corporations that probably didn't expect to ever get the truck but wanted to virtue signal their green credentials (Tesla seldom mentions this product and has announced no plans for actually building it). The announcement in April, 2016 of early reservations for a $35,000 Model 3 which turned out to be over 2 years ahead of it ever being available in volume occurred just ahead of a funding round. I am sure experienced Tesla observers could list many more examples, but the point is that there is very good reason to believe that the Model Y reveal (and maybe a pickup reveal in the same way the coupe was thrown in on the semi reveal) is a cynical, desperate attempt by Tesla to raise some cash from consumer deposits. My guess is that it will not work so well -- the recent $35,000 Model 3 announcement garnered few deposits and Tesla had disappointing deposit activity when they opened up Europe. Surely folks have observed that putting down a deposit does not get one a car any faster, and just makes one an unsecured creditor of the company (and may even, as was the case recently, sign one up to pay a higher price than folks who come in only a few weeks later).

As an aside, you folks know that as a libertarian I do not advocate for a lot of extra regulation so take the following as a prediction rather than necessarily a recommendation. Tesla has pioneered the deposit-taking, go-fund-me model for new car introductions, and I think that when this all blows up and the dust clears, one of the results will be tighter regulation of how companies handle deposits on their books. I would expect the SEC to require better transparency on deposit numbers and that customer deposits be escrowed in some way and not co-mingled with general operating funds. And while we are at it, I will recommend one regulatory / accounting change -- the ability of car companies to leave ZEV credits off their balance sheet entirely and use them like magic pixie dust out of the blue to spice up random quarters needs to end. These are real assets and need to be disclosed on the books like real assets.

Disclosure: I am short Tesla via long-dated puts. Shorting Tesla seems to make a lot of sense but it can be dangerous and harrowing. Yesterday we were looking at news of Elon Musk acting like a Mafia thug with whistleblowers and still dealing with the fallout of Tesla's rapidly changing and contradictory strategic announcements, and the stock was up 2%. Be careful.