Tiffany's is (hypothetically) handing out coupons for 50% off diamond necklaces. This generates a lot of press, but you do not get a coupon. Are you, without a coupon, more likely to buy a necklace anyway given all the publicity? Or is your behavior unchanged, because you received no inventive? Or are you perhaps less likely to buy, with the full retail price you would be paying now seeming higher as compared to the 50% off others are getting?

This issue seems to be at the heart of the conflict between the Obama administration and Edmunds.com (what is it about this administration and picking battles with media companies?) In their analysis, Edmunds said that only about 250,000 of the auto sales during the cash-for-clunkers period were incremental. The White House says they are underestimating, because even people who did not qualify for the program bought more cars because of the program:

The White House said [totally great car-buying, car-selling, and all-around-awesome-info site for every goddamn great and awful car website] Edmunds based its analysis on the "implausible" assumption that "the market for cars that didn't qualify for cash for clunkers was completely unaffected by this program. In other words, all the other cars were being sold on Mars, while the rest of the country was caught up in the excitement of the cash for clunkers program."...

Edmunds stands by its analysis.

"Instead of shooting the messenger, government officials should take heart from the core message of the analysis: The fundamentals of the auto marketplace are improving faster than the current sales numbers suggest," [Edmunds jefe Jeremy] Anwyl wrote.

The central issue, Anwyl said, "is how many of these sales would have occurred anyway. Apparently, the $24,000 figure caught many by surprise. It shouldn't have. The truth is that consumer incentive programs are always hugely expensive when calculated by incremental sales -- always in the tens of thousands of dollars."

Edmunds rejected the White House suggestion that people got caught up in the excitement of the program and bought cars, even if they didn't qualify. And it discarded the notion that automakers boosted production solely because of the program.

"No manufacturer increases production, a decision with long-term consequences, based on the 30-day sales blip triggered by an event like cash for clunkers," Edmunds wrote.

Its an interesting question. I would tend to come down on Edmunds' side from my own experience running promotions, but it is not totally cut and dried. I can think of at least two examples where a discount to person A yields more sales to person B, but neither are really applicable here

- Example 1: Ladies night. Cheap drinks for the ladies bring in male customers, on the theory that that are looking for bars with, frankly, lots of drunk women

- Example 2: Kids eat free. Restaurants have programs with discounted or free kids meals to get their parent's business

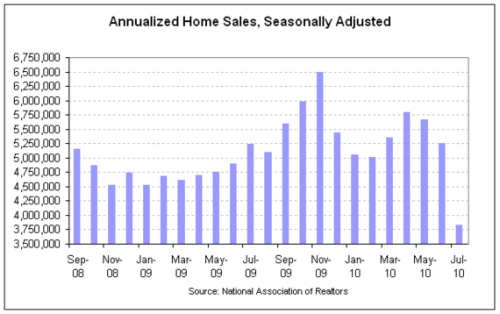

I think one could actually make the argument that people who did not get the clunker discount would be less likely to buy, as its really hard to buy something for X when you know all the people around you are getting it for (X-$3000)**. This isn't an absolute rule - after all, people fly all the time next to folks who paid more or less for the same service. But I do think it is a psychological issue that would tend to offset the general excitement around the program. In the end, we won't have to guess, once we get sales data for the rest of the year and we can see if clunkers merely moved sales forward a few months or generated incremental sales.

** As shown here, cash for clunkers amounted to about a $3000 subsidy per buyer, above and beyond the blue book value of the car turned in.