1. Eliminate all deductions in the individual income tax code

2. Eliminate the corporate income tax.

3. Tax capital gains and dividends as regular income.

4. Eliminate the death tax as well as the write-up of asset values at death

I don't have any idea if this revenue positive or negative (I suspect it would be short-term positive, and long-term very positive), but I don't care. This would:

- Substantially reduce the government's ability to play preference games and give crony special help in the tax code.

- Completely eliminate the huge unproductive drag of corporate tax law expenses and substantially reduce the cost of individual tax preparation.

- Eliminate the enormous unproductive drag of estate tax planning

- Eliminate forced sales of family farms and businesses at death in order to pay the taxes (taxes are paid instead on capital gains when sold).

- Substantially reduce government-induced distortions on flows of capital (e.g. current promotion of home ownership over renting, of corporate debt over equity financing, of capital gains over income, etc).

- Eliminate most double taxations in the code, since there is now only the individual income tax.

I would be happy to make this revenue neutral (even if it required an individual income tax rate hike) and sell this to the Tea Party and Occupy Wall Street alike as a plan to reduce waste, corporatism, and crony meddling. The OWS might be upset about 2 & 4, but corporate profits eventually show up as either capital gains or dividends, so they will eventually get taxed on the individual income tax return. Ditto death taxes - currently they are largely offset by the ability to write-up asset basis at death and aggressive tax planning. And anyway, the death tax is a trivial sources of government revenues.

Postscript: I know there is all sorts of literature that supposedly promotes a lower capital gains tax as an economic positive. Frankly, I don't trust it any more than any other literature genned up to promote special tax breaks to any group because that group is supposedly economically more important. In my mind, a lower capital gains tax rate (which means a higher regular income tax rate) is just another way of government expressing an artificial preference for one economic activity over another. Specifically, a lower capital gains rate creates a preference for real estate and stock investors over business owners. Currently, I invest in a second home and flip it for a profit and I get a tax break on the capital gains. But if I invest in a business instead that pays off with regular income, I get no tax break. Why? Why is one type of investing better than another? The answer is that it is not, but the people who buy and sell equities and real estate in large quantities have more political clout than small business owners.

Postscript #2: And Medicare taxes have to go up, at least until the program is restructured.

Postscript #3: This is a great example of what I want to make go away. I consider it far more destructive in the long run than a percentage point rate change. In case it is behind a paywall, here is a bit of it (these giveaways to the rich were in the very same bill that was supposed to be to soak the rich):

Thus Michigan Democrat Debbie Stabenow was able to retain an accelerated tax write-off for owners of Nascar tracks (cost: $78 million) to benefit the paupers who control the Michigan International Speedway. New Mexico's Jeff Bingaman saved a tax credit for companies operating in American Samoa ($62 million), including a StarKist factory.

Distillers are able to drink to a $222 million rum tax rebate. Perhaps this will help to finance more of those fabulous Bacardi TV ads with all those beautiful rich people. Businesses located on Indian reservations will receive $222 million in accelerated depreciation. And there are breaks for railroads, "New York Liberty Zone" bonds and so much more.

But a special award goes to Chris Dodd, the former Senator who now roams Gucci Gulch lobbying for Hollywood's movie studios. The Senate summary of his tax victory is worth quoting in full: "The bill extends for two years, through 2013, the provision that allows film and television producers to expense the first $15 million of production costs incurred in the United States ($20 million if the costs are incurred in economically depressed areas in the United States)."

You gotta love that "depressed areas" bit. The impoverished impresarios of Brentwood get an extra writeoff if they take their film crews into, say, deepest Flatbush. Is that because they have to pay extra to the caterers from Dean & DeLuca to make the trip? It sure can't be because they hire the jobless locals for the production crew. Those are union jobs, mate, and don't you forget it.

The Joint Tax Committee says this Hollywood special will cost the Treasury a mere $248 million over 10 years, but over fiscal years 2013 and 2014 the cost is really $430 million because it is supposed to expire at the end of this year. In reality Mr. Dodd will wrangle another extension next year, and the year after that, and . . . . Investing a couple million in Mr. Dodd in return for $430 million in tax breaks sure beats trying to make better movies.

Then there are the green-energy giveaways that are also quickly becoming entitlements. The wind production tax credit got another one-year reprieve, thanks to Mr. Obama and GOP Senators John Thune (South Dakota) and Chuck Grassley (Iowa). This freebie for the likes of the neediest at General Electric GE -0.82% andSiemens SIE.XE +0.20% —which benefit indirectly by making wind turbine gear—is now 20 years old. Cost to taxpayers: $12 billion.

Cellulosic biofuels—the great white whale of renewable energy—also had their tax credit continued, and the definition of what qualifies was expanded to include producers of "algae-based fuel" ($59 million.) Speaking of sludge, biodiesel and "renewable diesel" will continue receiving their $1 per gallon tax credit ($2.2 billion). The U.S. is experiencing a natural gas and oil drilling boom, but Congress still thinks algae and wind will power the future.

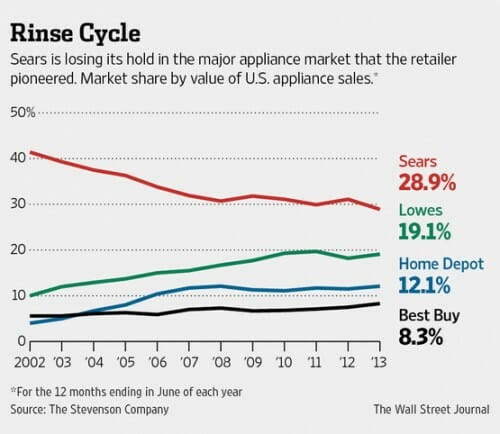

Meanwhile, consumers will get tax credits for buying plug-in motorcycles ($7 million), while the manufacturers of energy-efficient appliances ($650 million) and builders of energy-efficient homes ($154 million) also retain tax credits. Manufacturers like Whirlpool love these subsidies, and they are one reason that company paid no net taxes in recent years.