Apparently, the leftish-progressive talking point du jour is that oil speculators (and wouldn't you know it, those apparently include new libertarian uber-villains the Koch brothers) are artificially raising prices above what a "natural" market clearing price would be.

I have always presumed this to be possible for short periods of time - probably hours, perhaps days. But if, for any longer period of time, market prices (I am talking here about prices for current oil and immediate delivery, not futures prices) stay above the market clearing price one would normally expect from current supply and demand, then oil has to be building up somewhere. People would be bending over backwards to sell oil into the market, and customers would be using less.

If futures speculation has somehow unanaturally driven up current prices, where is the oil building up? I understand the price can go up for future oil, because in futures the inventory is just paper. But the argument is that futures trading is driving up current oil prices. When the Hunt brothers tried to corner the silver market, they had to buy and buy and keep buying to sop up the inventory.

Sure, some folks may be storing oil on speculation (and by the way most oil companies are inventorying oil and gasoline this time of year in the annual build up between heating oil season and summer driving season) -- but storing physical oil is really expensive. And the total capacity to do so incrementally is trivial compared to world daily demand. A few tanker loads sitting offshore is not going to mean squat (total world crude inventory is something like 350 million barrels at any one time, so adding a million barrels into storage only increases inventory by 0.3% or about. Another way to look at it is that storing a million barrels of oil represents about 17 minutes of daily demand. If the price is really being held above the market clearing price, then we are talking about the necessity of buying millions of barrels of oil each and every day and storing them, and to keep doing so day after day after day to keep the price up. And then once you stop, the price is just going to crash before you can sell it because of the very fact that word got out you are selling it.

I dealt with this in a lot more depth here. I want to repost it in full. It's a bit dated (different prices) but still relevant. Note in particular the irony of my friends point #5 -- this was a real view held by many on the progressive Left. Ironic, huh?

I had an odd and slightly depressing conversation with a friend the other night. He is quite intelligent and well-educated, and in business is probably substantially more successful, at least financially, than I.

Somehow we got in a discussion of oil markets, and he seemed to find my position suggesting that oil prices are generally set by supply and demand laughable, so much so he eventually gave up with me as one might give up and change the subject on someone who insists the Apollo moon landings were faked. I found the conversation odd, like having a discussion with a fellow

chemistry PHD and suddenly having them start defending the phlogiston

theory of combustion. His core position, as best I could follow, was this:

- Limitations on supply in the US, specifically limitations on new oil field development and refinery construction, are engineered by oil companies attempting to keep prices high.

- Oil prices are set at the whim of oil traders in London and New York, who are controlled by US oil companies. The natural price of oil today should be $30 or $40, but oil traders keep it up at $60. While players upstream and downstream may have limited market shares, these traders act as a choke point that controls the whole market. All commodity markets are manipulated, or at least manipulatable, in this manner

- Oil supply and demand is nearly perfectly inelastic.

- If there really was a supply and demand reason for oil prices to shoot up to $60, then why aren’t we seeing any shortages?

- Oil prices only rise when Texas Republicans are in office. They will fall back to $30 as soon as there is a Democratic president. On the day oil executives were called to testify in front of the Democratic Congress recently, oil prices fell from $60 to $45 on that day, and then went right back up.

Ignoring the Laws of Economics (Price caps and floors)

While everyone (mostly) knows that we are suspending disbelief when the James Bond villain seems to be violating the laws of physics, there is a large cadre of folks that do believe that our economic overlords can suspend the laws of supply and demand. As it turns out, these laws cannot be suspended, but they can certainly be ignored. Individuals who ignore supply and demand in their investment and economic decision making are generally called "bankrupt," at least eventually, so we don’t always hear their stories (the Hunt brothers attempt to corner the silver market is probably the best example I can think of). However, the US government has provided us with countless examples of actions that ignore economic reality.

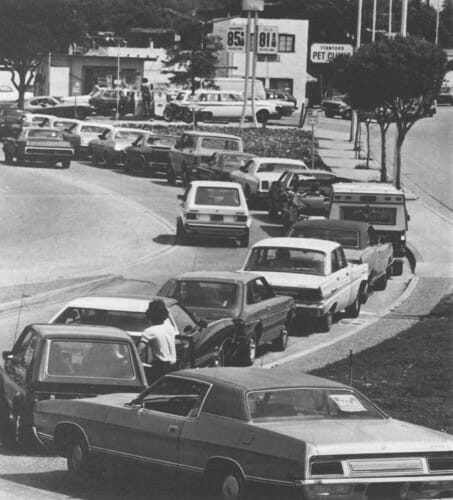

The most typical example is in placing price caps. The most visible example was probably the 1970′s era caps on oil, gasoline, and natural gas prices and later "windfall profit" taxes. The result was gasoline lines and outright shortages. With prices suppressed below the market clearing price, demand was higher and supply was lower than they would be in balance.

The my friend raised is different, one where price floors are imposed by industry participants or the government or more likely both working in concert. The crux of my argument was not that government would shy away from protecting an industry by limiting supply, because they do this all the time. The real problem with the example at hand is that, by the laws of supply and demand, a price floor above the market clearing price should yield a supply glut. As it turns out, supply guts associated with cartel actions to keep prices high tend to require significant, very visible, and often expensive actions to mitigate. Consider two examples:

Realtors and their trade group have worked for years to maintain a tight cartel, demanding a 6% or higher agency fee that appears to be increasingly above the market clearing price. The result of maintaining this price floor has been a huge glut of real estate agents. The US is swimming in agents. In an attempt to manage this supply down, realtors have convinced most state governments to institute onerous licensing requirements, with arcane tests written and administered by… the realtor’s trade group. The tests are hard not because realtors really need to know this stuff, but because they are trying to keep the supply down. And still the supply is in glut. Outsiders who try to discount or sell their own home without a realtor (ie, bring even more cheap capacity into the system) are punished ruthlessly with blackballs. I have moved many times and have had realtors show me over 300 houses — and you know how many For Sale By Owner homes I have been shown? Zero. A HUGE amount of effort is expended by the real estate industry to try to keep supply in check, a supply glut caused by holding rates artificially high.

A second example of price floors is in agriculture. The US Government, for whatever political reasons, maintains price floors in a number of crops. The result, of course, has been a supply glut in these commodities. Sopping up this supply glut costs the US taxpayer billions. In some cases the government pays to keep fields fallow, in others the government buys up extra commodities and either stores them (cheese) or gives them away overseas. In cases like sugar, the government puts up huge tarriff barriers to imports, otherwise the market would be glutted with overseas suppliers attracted by the artificially high prices. In fact, most of the current subsidy programs for ethanol, which makes almost zero environmental or energy policy sense, can be thought of as another government program to sop up excess farm commodity supply so the price floor can be maintained.

I guess my point from these examples is not that producers haven’t tried to impose price floors above the market clearing price, because they have. And it is not even that these floors are not sustainable, because they can be if the government steps in to help with their coercive power and our tax money to back them. My point is, though, that the laws of supply and demand are not suspended in these cases. Price floors above the market clearing price lead to supply gluts, which require very extensive, highly visible, and often expensive efforts to manage. As we turn now to oil markets, we’ll try to see if there is evidence of such actions taking place.

The reasons behind US oil production and refining capacity constraints

As to his first point, that oil companies are conspiring with the government to artificially limit oil production and refining capacity, this certainly would not be unprecedented in industry, as discussed above. However, any historical study of these issues in the oil industry would make it really hard to reach this conclusion here. There is a pretty clear documented record of oil companies pushing to explore more areas (ANWR, offshore) that are kept off-limits due to environmental pressures. While we have trouble imagining the last 30 years without Alaskan oil, the US oil companies had to beg Congress to let them build the pipeline, and the issue was touch and go for a number of years. The same story holds in refining, where environmental pressure and NIMBY concerns have prevented any new refinery construction since the 1970′s (though after years and years, we may be close in Arizona). I know people are willing to credit oil companies with just about unlimited levels of Machiavellianism, but it would truly be a PR coup of unprecedented proportions to have maintained such a strong public stance to allow more capacity in the US while at the same time working in the back room for just the opposite.

The real reason this assertion is not credible is that capacity limitations in the US have very clearly worked against the interests of US oil companies. In production, US companies produce on much better terms from domestic fields than they do when negotiating with totalitarian regimes overseas, and they don’t have to deal with instability issues (e.g. kidnapping in Nigeria) and expropriation concerns. In refining, US companies have seen their market shares in refined products fall since the 1970s. This is because when we stopped allowing refinery construction in this country, producing countries like Saudi Arabia went on a building boom. Today, instead of importing our gasoline as crude to be refined in US refineries, we import gas directly from foreign refineries. If the government is secretly helping oil companies maintain a refining capacity shortage in this country, someone forgot to tell them they need to raise import duties to keep foreign suppliers from taking their place.

What Oil Traders can and cannot do

As to the power of traders, I certainly believe that if the traders could move oil prices for sustained periods as much as 50% above or below the market clearing price, they would do so if it profited them. I also think that speculative actions, and even speculative bubbles, can push commodity prices to short-term extremes that are difficult to explain by market fundamentals. Futures contracts and options, with their built in leverage, allow even smaller players to take market-moving positions. The question on the table, though, is whether oil traders can maintain oil prices 50% over the market clearing prices for years at a time. I think not.

What is often forgotten is that companies like Exxon and Shell control something like 4-5% each of world production (and that number is over-stated, since much of their production is as operator for state-owned oil companies who have the real control over production rates). As a point of comparison, this is roughly the same market Toshiba has in the US computer market and well below Acer’s. As a result, there is not one player, or even several working in tandem, who hold any real power in crude markets. Unless one posits, as my friend does, that NY and London traders somehow sit astride a choke point in the world markets.

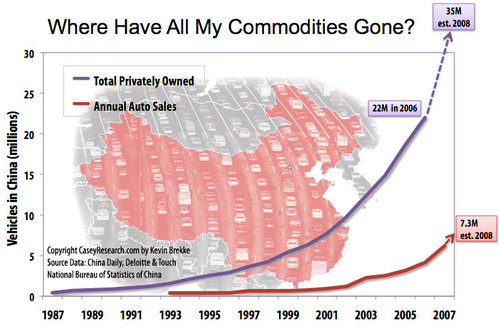

But here is the real problem with saying that these traders have kept oil prices 50% above the market clearing price for the last 2-3 years: What do they do with the supply glut? We know from economics, as well as the historic examples reviewed above, that price floors above the clearing price should result in a supply glut. Where is all the oil?

Return to the example of when the Hunt’s tried to corner the silver market. Over six months, they managed to drive the price from the single digits to almost $50 an ounce. Leverage in futures markets allowed them to control a huge chunk of the available world supply. But to profit from it (beyond a paper profit) the Hunts either had to take delivery (which they were financially unable to do, as they were already operating form leveraged positions) or find a buyer who accepted $50 as the new "right" price for silver, which they could not. No one wanted to buy at $50, particularly from the Hunts, since they knew the moment the Hunt’s started selling, the price would crash. As new supplies poured onto the market at the higher prices, the only way the Hunt’s could keep the price up was to pour hundreds of millions of dollars in to buy up this excess supply. Eventually, of course, they went bankrupt. But remember the takeaway: They only could maintain the artificially higher commodity price as long as they kept buying excess capacity, a leveraged Ponzi game that eventually collapsed.

So how do oil traders’ supposedly pull off this feat of keeping oil prices elevated about the market clearing price? Well, there is only one way: It has to be stored, either in tanks or in the ground. The option of storing the extra supplies in tanks is absurd, especially over a period of years – after all, at its peak, $60 of silver would sit on the tip of my finger, but $60 of oil won’t fit in the trunk of my car. The world oil storage capacity is orders of magnitude too low. So the only real option is to store it in the ground, ie don’t allow it to get produced.

How do traders pull this off? I have no idea. Despite people’s image, the oil producer’s market is incredibly fragmented. The biggest companies in the world have less than 5%, and it rapidly steps down from there. It is actually even more fragmented than that, because most oil production is co-owned by royalty holders who get a percentage of the production. These royalty holders are a very fragmented and independent group, and will complain at the first sign of their operator not producing fast and hard enough when prices are high. To keep the extra oil off the market, you would have to send signals to a LOT of people. And it has to be a strong and clear signal, because price is already sending the opposite signal. The main purpose of price is in its communication value — a $60 price tells producers a lot about what and how much oil should be produced (and by the way tells consumers how careful to be with its use). To override this signal, with thousands of producers, to achieve exactly the opposite effect being signaled with price, without a single person breaking the pack, is impossible. Remember our examples and the economics – a sustained effort to keep prices substantially above market clearing prices has to result in visible and extensive efforts to manage excess supply.

Also, the other point that is often forgotten is that private exchanges can only survive when both Sellers AND buyers perceive them to be fair. Buyers are quickly going to find alternatives to exchanges that are perceived to allow sellers to manipulate oil prices 50% above the market price for years at a time. Remember, we think of oil sellers as Machiavellian, but oil buyers are big boys too, and are not unsophisticated dupes. In fact, it was the private silver exchanges, in response to just such pressure, that changed their exchange rules to stop the Hunt family from continuing to try to corner the market. They knew they needed to maintain the perception of fairness for both sellers and buyers.

Supply and Demand Elasticity

From here, the discussion started becoming, if possible, less grounded in economic reality. In response to the supply/demand matching issues I raised, he asserted that oil demand and supply are nearly perfectly inelastic. Well, if both supply and demand are unaffected by price, then I would certainly accept that oil is a very, very different kind of commodity. But in fact, neither assertion is true, as shown by example here and here. In particular, supply is quite elastic. As I have written before, there is a very wide range of investments one can make even in an old existing field to stimulate production as prices rise. And many, many operators are doing so, as evidenced by rig counts, sales at oil field services companies, and even by spam investment pitches arriving in my in box.

I found the statement "if oil prices really belong this high, why have we not seen any shortages" to be particularly depressing. Can anyone who sat in at least one lecture in economics 101 answer this query? Of course, the answer is, that we have not seen shortages precisely because prices have risen, fulfilling their supply-demand matching utility, and in the process demonstrating that both supply and demand curves for oil do indeed have a slope. In fact, shortages (e.g. gas lines or gas stations without gas at all) are typically a result of government-induced breakdowns of the pricing mechanism. In the 1970′s, oil price controls combined with silly government interventions (such as gas distribution rules**) resulted in awful shortages and long gas lines. More recently, fear of "price-gouging" legislation in the Katrina aftermath prevented prices from rising as much as they needed to, leading to shortages and inefficient distribution.

Manipulating Oil Prices for Political Benefit

As to manipulating oil or gas prices timed with political events (say an election or Congressional hearings), well, that is a challenge that comes up all the time. It is possible nearly always to make this claim because there is nearly always a political event going on, so natural volatility in oil markets can always be tied to some concurrent "event." In this specific case, the drop from $60 to $35 just for a Congressional hearing is not even coincidence, it is urban legend. No such drop has occurred since prices hit 60, though prices did drop briefly to 50. (I am no expert, but in this case the pricing pattern seen is fairly common for a commodity that has seen a runup, and then experiences some see-sawing as prices find their level.)

This does not mean that Congressional hearings did not have a hand in helping to drive oil price futures. Futures traders are constantly checking a variety of tarot cards, and indications of government regulatory activity or legislation is certainly part of it. While I guess traders purposely driving down oil prices ahead of the hearing to make oil companies look better is one possible explanation; a more plausible one (short of coincidence, since Congress has hearings on oil and energy about every other month) is that traders might have been anticipating some regulatory outcome in advance of the hearing, that became more less likely once the hearings actually occurred. *Shrug* Readers are welcome to make large short bets in advance of future Congressional energy hearings if they really think the former is what is occurring.

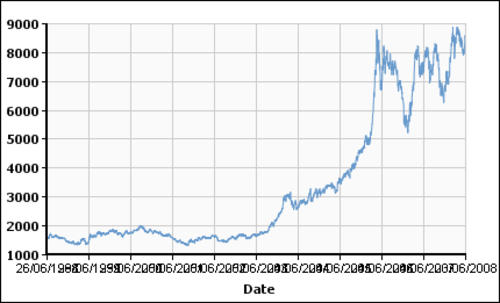

As to a relationship between oil prices and the occupant of the White House, that is just political hubris. As we can see, real oil prices rose during Nixon, fell during Ford, rose during Carter, fell precipitously during Reagan, were flat end to end for Bush 1 (though with a rise in the middle) and flat end to end for Clinton. I can’t see a pattern.

If Oil Companies Arbitrarily Set Prices, Why Aren’t They Making More Money?

A couple of final thoughts. First, in these heady days of "windfall" profits, Exxon-Mobil is making a profit margin of about 9% – 10% of sales, which is a pretty average to low industrial profit margin. So if they really have the power to manipulate oil prices at whim, why aren’t they making more money? In fact, for the two decades from 1983 to 2002, real oil prices languished at levels that put many smaller oil operators out of business and led to years of layoffs and down sizings at oil companies. Profit margins even for the larges players was 6-8% of sales, below the average for industrial companies. In fact, here is the profitability, as a percent of sales, for Exxon-Mobil over the last 5 years:

2006: 10.5%

2005: 9.7%

2004: 8.5%

2003: 8.5%

2002: 5.4%

2001: 7.1%

Before 2001, going back to the early 80′s, Exxon’s profits were a dog. Over the last five years, the best five years they have had in decades, their return on average assets has been 14.58%, which is probably less than most public utility commissions allow their regulated utilities. So who had their hand on the pricing throttle through those years, because they sure weren’t doing a very good job! But if you really want to take these profits away (and in the process nuke all the investment incentives in the industry) you could get yourself a 15 to 20 cent decrease in gas prices. Don’t spend it all in one place.

** One of the odder and forgotten pieces of legislation during and after the 1972 oil embargo was the law that divided the country into zones (I don’t remember how, by counties perhaps). It then said that an oil company had to deliver the same proportion of gas to each zone as it did in the prior year (yes, someone clearly took this right out of directive 10-289). It seemed that every Representative somehow suspected that oil companies in some other district would mysteriously be hoarding gas to their district’s detriment. Whatever the reason, the law ignored the fact that use patterns were always changing, but were particularly different during this shortage. Everyone canceled plans for that long-distance drive to Yellowstone. The rural interstate gas stations saw demand fall way off. However, the law forced oil companies to send just as much gas to these stations (proportionally) as they had the prior year. The result was that rural interstates were awash in gas, while cities had run dry. Thanks again Congress.