Leveraging Up The World in Good Times -- The Madness of Modern Central Banking

The European Central Bank’s corporate-bond-buying program has stirred so much action in credit markets that some investment banks and companies are creating new debt especially for the central bank to buy.

In two instances, the ECB has bought bonds directly from European companies through so-called private placements, in which debt is sold to a tight circle of buyers without the formality of a wider auction.

It is a startling example of how banks and companies are quickly adapting to the extremes of monetary policy in what is an already unconventional age. In the past decade, wide-scale purchases of government bonds—a bid to lower the cost of borrowing in the economy and persuade investors to take more risk—have become commonplace. Central banks more recently have moved to negative interest rates, flipping on their head the ancient customs of money lending. Now, they are all but inviting private actors to concoct specific things for them to buy so they can continue pumping money into the financial system.

The ECB doesn’t directly instruct companies to create specific bonds. But it makes plain that it is an eager purchaser, and it lays out the specifics of its wish list. And the ECB isn’t alone: The Bank of Japan said late last year it would buy exchange-traded funds comprising shares of companies that spend a growing amount on “physical and human capital,” essentially steering fund managers to make such ETFs available to buy.

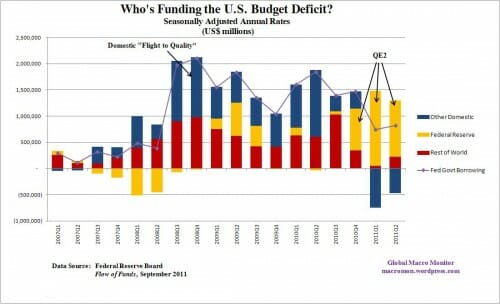

Note that none of the criteria for the debt purchases is anything like, "the company has sensible plans for investing the money." It is merely buying debt for debt's sake. In the US, private companies are using most of their debt issues to buy back stock, a nearly pointless exercise that channels money from central banks to propping up equity valuations. I wouldn't be surprised if European companies do the same.

Folks, it may not feel like it, but we are at the top of the economic cycle. We have negative interest rates and central banks buying up every available debt issues in relatively good times, when these were formerly considered tools for the deepest point in a recession. I am not a big believer in government stimulus, but these folks are. What are they counting on in the bad times, when nothing will be left in the tank?

But now, we see central banks going one step further, encouraging private companies to lever up at the top of the business cycle. Historically, this has been a formula for disaster. The oil industry has been a preview of this. Take ExxonMobil (XOM). XOM, given its size, has never been very good at developing certain sorts of plays (e.g. the shale boom). What it has done historically is use its size and balance sheet to swoop in during inevitable periods of low oil prices and producer losses to buy up developed fields at good prices. But this time around, XOM has only had limited ability to do this, because it spent the boom years levering up its balance sheet and buying back stock. Other large oil companies are in even more dire straights, facing real cash flow crises because, again, they levered up to repurchase stock when they should have been cleaning up their balance sheet.