Archive for March 2011

California Points Gun At Own Head, Pulls Trigger

Earlier today, the California Assembly passed a bill that would oblige state utilities to get a third of their energy from renewable sources by 2020. It is one of the most aggressive standards in the world.

The Senate passed the legislation in February, and Governor Brown is expected to sign the bill.

How big a deal is it? Well, according to Peter Miller, a senior scientist at NRDC, "As a result of the RPS program, renewable energy generation in California in 2020 will be roughly equal to total current U.S. renewable generation, and supply enough clean energy to power nearly 9 million homes" or, according to the Union of Concerned Scientists, drive 3 million cars.

This is an absolutely amazing case of wishful thinking. Note the "will be" in the last paragraph. Really? Can I have the other side of that bet? The California legislature can legislate a unicorn in every garage but that does not mean it will happen by 2020.

Forgetting for a moment the absolutely horrible cost and/or reliability position of most "green" energy technologies, there is no way, absolutely no way, that California can permit and construct a replacement for a third of its electric generation in 9 years. And I shudder to even think how large of a broken window obsoleting and forcing replacement of a third of electrical generation capacity will be.

A final thought, via Dilbert:

You Thought I Was Joking About Dictator Retirement Island

Efforts appear to be under way to offer Muammar Gaddafi a way of escape from Libya, with Italy saying it was trying to organise an African haven for him, and the US signalling it would not try to stop the dictator from fleeing....

A senior American official signalled that a solution in which Gaddafi flees to a country beyond the reach of the international criminal court (ICC), which is investigating war crimes charges against him, would be acceptable to Washington, pointing out that Barack Obama had repeatedly called on Gaddafi to leave.

Out This Week

On a college visit trip in New England with my son. We will be at Cornell, Amherst, Williams, Dartmouth, Bowdoin, Colby, Bates, Brown, Yale, Princeton. If your best friend is admissions director or the baseball coach at any of these schools and is desperately searching for smart kids from Arizona who blog and hit for power, you are welcome to email me :=)

Two Lame People Who Are Even Lamer Together

Just when I thought I couldn't dislike either actor Steven Seagal or Sheriff Joe Arpaio any more, they team up to set a new low. The short story -- Arpaio sent Seagal in a tank to knock down the walls of a home that was suspected of having cockfighting on the premises. Really.

Auto Bailouts and the Rule of Law

Todd Zwicki has a great article on the auto bailouts. Here is a brief excerpt of a long and very comprehensive article.

Of the two proceedings, Chrysler's was clearly the more egregious. In the years leading up to the economic crisis, Chrysler had been unable to acquire routine financing and so had been forced to turn to so-called secured debt in order to fund its operations. Secured debt takes first priority in payment; it is also typically preserved during bankruptcy under what is referred to as the "absolute priority" rule — since the lender of secured debt offers a loan to a troubled borrower only because he is guaranteed first repayment when the loan is up. In the Chrysler case, however, creditors who held the company's secured bonds were steamrolled into accepting 29 cents on the dollar for their loans. Meanwhile, the underfunded pension plans of the United Auto Workers — unsecured creditors, but possessed of better political connections — received more than 40 cents on the dollar.

Moreover, in a typical bankruptcy case in which a secured creditor is not paid in full, he is entitled to a "deficiency claim" — the terms of which keep the bankrupt company liable for a portion of the unpaid debt. In both the Chrysler and GM bankruptcies, however, no deficiency claims were awarded to the wronged creditors. Were bankruptcy experts to comb through American history, they would be hard-pressed to identify any bankruptcy case with similar terms.

To make matters worse, both bankruptcies were orchestrated as so-called "section 363" sales. This meant that essentially all the assets of "old Chrysler" were sold to "new Chrysler" (and "old GM" to "new GM"), and were pushed through in a rush. These sales violated the longstanding bankruptcy principle that an asset sale should not be functionally equivalent to a plan of re-organization for an entire company — what bankruptcy lawyers call a "sub rosa plan." The reason is that the re-organization process offers all creditors the right to vote on the proposed plan as well as a chance to offer competing re-organization plans, while an asset sale can be carried out without such a vote.

In the cases of GM and Chrysler, however, the government essentially pushed through a re-organization disguised as a sale, and so denied the creditors their rights. As the University of Pennsylvania's David Skeel observed last year, "selling" an entire company of GM or Chrysler's size and complexity in this manner was unprecedented. Even on a smaller scale, it would have been highly irregular: While rush bankruptcy sales of much smaller companies were once common, the bankruptcy laws were overhauled in 1978 precisely to eliminate this practice.

At first, the fact that the companies' creditors (and especially Chrysler's creditors, who were so badly mistreated) put up with such terms and waived their property rights seems astonishing. But it becomes less so — and sheds more light on how this entire process imperils the rule of law — when one considers the enormous leverage the federal government had over most of these creditors. Many of Chrysler's secured-bond holders were large financial institutions — several of which had previously been saved from failure by TARP. Though there is no explicit evidence that support from TARP funds bought these bond holders' acquiescence in the Chrysler case, their silence in the face of a massive financial haircut is otherwise very difficult to explain.

Indeed, those secured-bond holders who were not supported by TARP did not go nearly as quietly.

Patent Process Officially Broken

Google awarded a patent for changing the Google logo on particular days with date-relevent doodles. Really. From the patent award

A system provides a periodically changing story line and/or a special event company logo to entice users to access a web page. For the story line, the system may receive objects that tell a story according to the story line and successively provide the objects on the web page for predetermined or random amounts of time. For the special event company logo, the system may modify a standard company logo for a special event to create a special event logo, associate one or more search terms with the special event logo, and upload the special event logo to the web page. The system may then receive a user selection of the special event logo and provide search results relating to the special event.

Put a turkey on Thanksgiving in your website banner, and just wait for the Google lawyers to call. Outstanding.

Get Down In The Mud With The Rest Of Us

I wanted to leave Glendale's proposed $100 million subsidy of the purchase of the Phoenix Coyotes hockey team by Matthew Hulzinger behind for a while, but I had to comment on something in the paper yesterday.

The Arizona Republic, which is an interested party given that a good part of their revenues depend on having major sports teams in town, had an amazing editorial on Tuesday. Basically, it said that Goldwater, who has sued to bock the bond issue under Arizona's gift clause, needed to stop being so pure in its beliefs and defense of the Constitution and that it should jump down in the political muck with everyone else.

I encourage you to read the article and imagine that it involved defense of any other Constitutional provision, say free-speech rights or civil rights. The tone of the editorial would be unthinkable if aimed at any other defense of a Constitutional protection. Someone always has utilitarian arguments for voiding things like free speech protections -- that is why defenders of such rights have to protect them zealously and consistently. The ACLU doesn't get into arguments whether particular speech is right or wrong or positive or negative -- it just defends the principle. Can't Goldwater do the same?

My thoughts on the Coyotes deal are here and her. Rather than dealing with the editorial line by line, which spends graph after graph trying to convince readers that Darcy Olsen, head of the Goldwater Institute, is "snotty," here are some questions that the AZ Republic could be asking if it were not in the tank for this deal

- How smart is it for the taxpayers of Glendale to have spent $200 million plus the proposed $100 million more to keep a team valued at most at $117 million? (several other teams have sold lately for less than $100 million) And, despite $300 million in taxpayer investments, the city has no equity in the team -- just the opposite, it has promised a sweetheart no-bid stadium management deal of an additional $100 million over 5 years on top of the $300 million.

- The Phoenix Coyotes has never made money in Arizona, and lost something like $40 million last year. Why has no one pushed the buyer for his plan to profitability? The $100 million Glendale taxpayers are putting up is essentially an equity investment for which it gets no equity. If the team fails, the revenue to pay the bonds goes away. The team needs to show a plan that makes sense before they get the money -- heck the new owners admit they will continue to lose money in the foreseeable future. I have heard folks suggest that the Chicago Blackhawks (Hulzinger's home town team) are a potential model, given that they really turned themselves around. But at least one former NHL executive has told me this is absurd. The Blackhawks were a storied franchise run into the ground by horrible management. Turning them around was like turning around the Red Sox in baseball. Turning around the Coyotes is like turning around the Tampa Bay Rays. The fact is that the team lost $40 million this year despite the marketing value of having been in the playoffs last year and having the second lowest payroll in the league. The tickets are cheap and there is (at least for now) free parking and still they draw the lowest attendance in the NHL. Part of the problem is Glendale itself, located on the ass-end of the metro area (the stadium is 45 minutes away for me, and I live near the centerline of Phoenix).

- If taxpayers are really getting items worth $100 million in this deal (e.g. parking rights which Glendale probably already owns, a lease guarantee, etc) why can't the team buyer use this same collateral to get the financing privately? I have seen the AZ Republic write article after article with quote after quote from Hulzinger but have not seen one reporter ask him this obvious question. I have asked Hulzinger associates this question and have never gotten anything but vague non-answers. A likely answer is what I explained yesterday, that Hulzinger is a smart guy and knows the team is not worth more than $100 million, but the NHL won't sell it for less than $200 million (based on a promise the Commissioner made to other owners when they took ownership of the team). Hulzinger needed a partner who was desperate enough to make up the $100 million the NHL is trying to overcharge him -- enter the City of Glendale, who, like a losing gambler, keeps begging for more credit to double down to try to make good its previous losses.

- Glendale often cites a $500 million figure in losses if the team moves. Has anyone questioned or shown any skepticism for this number? My presumption is that it includes lost revenue at all the restaurants and stores around the stadium, but is that revenue really going to go away entirely, or just move to other area businesses? If your favorite restaurant goes out of business, do you stop going out to eat or just go somewhere different?

- We hear about government subsidies to move businesses from other countries to the US, or other states to Arizona, and these tend to be of dubious value. Does it really make sense for Glendale taxpayers to pay $400 million to move business to another part of the Phoenix metropolitan area?

- Why do parties keep insisting that Goldwater sit down and "negotiate?" Goldwater does not have the power to change the Constitutional provision. Do folks similarly call on the NAACP to "negotiate" over repeal of Jim Crow laws? Call on the ACLU to negotiate over "don't ask, don't tell"? This may be the way Chicago politics works, with community organizers holding deals ransom in return for a negotiated payoff, but I am not sure that is why Goldwater is in this fight. The Gift Clause is a fantastic Constitutional provision that the US Constitution has, and should be defended.

- Jim Balsillie offered to buy out the team (and move it to Canada) without public help and to pay off $50 million of the existing Glendale debt as an exit fee. Thus the city would have had $150 in debt and no team. Now, it will be $300 million in debt and on the hook for $100 million more and may still not have a team in five years when, almost inevitably, another hubristic rich guy finds he is not magically smarter about hockey and can't make the team work in Arizona. Has anyone compared these two deals? Private businesses cut losses all the time -- politicians almost never do, in part because they are playing with house money (ours).

Arizona's Gift Clause

I am becoming increasingly enamored of the Arizona Constitution's "gift clause," even if it has not been enforced evenly in the past. This sensible Constitutional provision requires that neither the state nor any municipality in it may “give or loan its credit in the aid of, or make any donation or grant, by subsidy or otherwise, to any individual, association, or corporation.”

This has been interpreted by the courts as meaning that if a state or municipal government gives money to a private company, it must get something of value back - ie it pays money to GM and gets a work truck back. But politicians will be politicians and have stretched this rule in the past out of all meaning, by saying that they are getting "soft" benefits back. In other words, they could subsidize the rent of a bookstore because reading is important to the community. Silly? Not in California:

The city spent $1.6 million in federal grant money to bring Borders into the Pico Rivera Towne Center and to help pay its rent for nearly eight years.

Now the bookstore at 8852 Washington Blvd. is among the 200 Borders stores closing by April in the wake of the company filing for Chapter 11 bankruptcy reorganization.

But the city still faces paying rent on the soon-to-be vacated 18,100-square-foot site, along with other costs associated with 2002 agreements it made with Borders and with Vestar Development Co., which owns the Towne Center....

Officials said the decision to bring a bookstore into the community was a quality-of-life issue.

So the gift clause originally was authored to stop handouts to railroads and such, but certainly should prevent stuff like this. When it did not, our Goldwater Institute sued, and it was successful in reigning in these gift clause exclusions. This is the ruling from a suit over a $97 giveaway to a new mall (the giveaway was nominally disguised as a parking lot).

Indeed, in today’s unanimous decision, penned by Chief Justice Andrew D. Hurwitz, the five Supreme Court judges say that indirect public benefits — like, apparently, beating out Scottsdale for the sale tax from Bloomingdales — aren’t enough to justify a giveaway to a private party.

Previous courts who’ve held that, they say, have misread precedent.

“In short, although neither [of two Supreme Court precedents] held that indirect benefits enjoyed by a public agency as a result of buying something from a private entity constitute consideration, we understand how that notion might have been mistakenly inferred from language in our opinions,” they say. Now that they’ve clarified, the justices seem to be saying, the appellate court must examine whether the direct benefit the city of Phoenix gets — aka. those parking spaces — is enough to justify the giveaway.

For the record, the Supreme Court suggests that the parking garage is not, likely, benefit enough to justify such a tax giveaway.

“We find it difficult to believe that the 3,180 parking places have a value anywhere near the payment potentially required under the Agreement,” its opinion finds. “The Agreement therefore quite likely violates the Gift Clause.”

This was a particularly awful subsidy which tried to move a Nordstrom's one whole mile, over the Scottsdale border into Phoenix (update here).

This is the heart of why Goldwater needs to continue to stand strong against the proposed $100 million Glendale subsidy of the Phoenix Coyote's hockey team purchase. The city of Glendale and the buyer Matthew Hulzinger (who claims the bond issues is totally guaranteed and safe, raising the question of why he could not have gotten private financing instead) have rallied everyone from our local paper to John McCain to to task of excoriating Goldwater for standing up for the state Constitution. They claim the deal makes a lot of financial sense.

Beyond the cities BS "total impact" numbers, I ask, "so what?" This is an important Constitutional principle. As America slides into a European-style corporate state, I can't think of anything more appropriate than drawing the line on corporate welfare here in Arizona (its certainly a more useful endeavor than some of the goofy legislation currently pouring out of our state house). Heck, I would like to see a gift clause in the US Constitution

Recording Industry Responsible For Entire World Economic Output

Apparently the RIAA has demanded $75 trillion in damages from file sharing site Lime Wire. Via Overlawyered.

Deceptive Chartsmanship

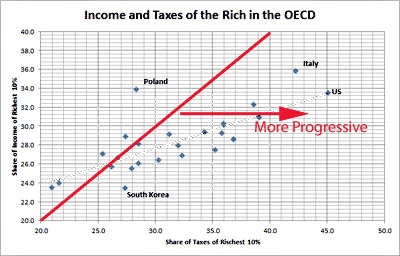

Kevin Drum reports this chart on tax progressivity, with the comment that "the US is more or less right on target."

This is wildly deceptive chartsmanship. Just because there is apparently a trend line here does NOT mean that all of the countries on that line have equal tax progressivity. That would only be the case if the line were at 45-degrees. But in fact, the tax share is increasing by 10 percentage points for every 4 points in income share. This means that, even for countries on the line, the farther right one goes (on the chart, not politically) the more progressive the tax system is, at least vis a vis the top 10% (Drum is probably right that you would get different results for the top 1%, but I think he is wrong to say that state tax systems are wildly regressive).

Here is the corrected chart. The further right of the red line, the more progressive, making the US system (again for the top-10% measure) the most progressive of those on the chart.

It is interesting to note that the original chart tells us one thing -- countries with wider income distributions have the most progressive tax systems. Which is an interesting and not necessarily expected outcome. Certainly it seems to refute much of the purpose for such systems in the first place.

Update: I am guess these are the data points on the chart, with analysis at the always terrific Carpe Diem

Beautiful Photography by Stanley Kubrick

Before he made movies, he apparently was a really good photographer.

Gas Prices

I find it sort of hilarious that it is Conservatives that are demagoguing gas prices and Liberals who are trying to explain that they really are not that high. Yet another example of the Coke and Pepsi parties swapping political positions based on whose team is in the White House.

But I thought this graph was interesting, and supports a point I have made for years (Via Flowing Data)

I have worked in oil fields drilling miles below the surface and on offshore platforms in mile-deep water. I have seen the Alaska pipeline under construction and worked in a 400 thousand barrel a day refinery. And I can say with confidence that no other product on this list even is in the same order of magnitude as gasoline in terms of the capital investment, effort, and technology that does into delivering a gallon of gas. The ability to deliver gas for even $4.00 a gallon is almost unbelievable. Yet no other industry on this list or any other list gets 1/100th the grief oil companies do for being rapacious, greedy, and detrimental to society.

Beating A Dead Horse

Apparently the Left is still trying to argue that the stimulus (the process of taking money out of private hands to have it spent by government officials instead) was really a super-fabulous idea and only failed because it was too small. Here is Kevin Drum:

But another reason [the stimulus failed] is that at the same time the feds were spending more money, state governments were cutting back. The chart below from CBPP tells the story. They have data for all but six states, and on average for 2012, "those 44 states plan to spend 9.4 percent less than their states spent before the recession, adjusted for inflation." That's not just less than last year, it's less than 2008. That wiped out nearly the entire effect of the federal stimulus pacakge [sic].

I have a different take. A number of states, because they don't own a printing press as does Uncle Sam, actually tried to deal with economic reality and cut their bloated spending, an effort that was largely wiped out by Obama's "stimulus" spending.

Quote of the Day

The President does not have power under the Constitution to unilaterally authorize a military attack in a situation that does not involve stopping an actual or imminent threat to the nation.

-- Barack Obama, December, 2007

NCAA Bracket Challenge Update

Here is the top 10 in the bracket challenge after the first week. Sadly, both of my brackets are in the bottom half. Apparently, it is statistically impossible for me to do better than 15th place (thank God for technology so that hope is dashed and I can no longer fool myself about my future chances). Even worse, my son made the top 10. More results here.

| Bracket | Rank | Points | Correct Games |

Upset Risk % |

Possible Games |

|---|---|---|---|---|---|

| Kevin Spires #2 | 1 | 98 | 31 | 26.6 | 43 |

| strattner2 | 2 | 82 | 35 | 27.8 | 48 |

| Chuck Jones #2 | 3 | 80 | 35 | 15.4 | 46 |

| Ron Coker | 4 | 75 | 35 | 20.3 | 48 |

| Paul Dubuc | 5 | 73 | 37 | 15.8 | 46 |

| Mark Horn / Barack Obama | 6 | 71 | 39 | 5.4 | 51 |

| Chris Smith | 7 | 70 | 32 | 30.9 | 45 |

| Kevin Spires | 8 | 68 | 34 | 17.6 | 42 |

| Grant Smith #2 | 9 | 68 | 31 | 46.3 | 41 |

| Nic Meyer | 10 | 67 | 33 | 23.7 | 41 |

It is good to see the President take time out of his busy schedule to submit a bracket in our competition.

Spacechem

Spent the weekend playing Spacechem while watching the NCAA basketball tournament. Though nominally about tearing apart and building molecules, its really a simulation of assembly line design, since you molecular engineering happens mechanically (ie carry atom over here, bond it in reactor, move it over there, etc). There is a kind of built in re-playability, as most of the puzzles are not that hard to solve in some fashion, but can be very hard to solve efficiently. For example, the level "No Ordinary Headache" will allow the player up to three reactors, but a one reactor solution is possible. Took me forever to finally get it. This one is not mine but is not too different from my solution.

To that end, the game provides a distribution curve of other player's solutions based on three stats (number of process cylces required, number of reactors required, number of components required). Even if you get the puzzle right, you may see you solution was way less efficient than other folks, driving one to try again. I like this dynamic - it is sort of like duplicate bridge, where one is not judged by just winning the hand, but by how well one scored with the hand vs. other players playing the same hand.

Here is another positive review at South Bend Seven. And just search "spacechem" in youtube to find zillions of videos of various game solutions, it will give you a feel for the game.

The Dictator Retirement Island

Looking over the last 35 years of history, I want to make the following proposal: the Dictator Retirement Island.

Here is how it works. The US puts a sum of money in a Swiss account for the dictator. The US moves dictator to a lush island complete with lavish lifestyle complete with personal performances from US pop stars (this seems to be a very popular activity for both dictators and US singers). The US guards the dictator from vengeful rebel groups, human rights organizations, threats if extradition, etc. In exchange the dictator gives up power and allows the US to impose an interim Constitution and supervise free elections.

It used to be that deposed kings/emperors/strong men could find a home in exile somewhere. The promise of exile probably helped prevent scorched-Earth battles by dictators who know that loss of power will mean torture and death. The German Kaiser lived in exile for 20 years in the Netherlands after WWI.

Advantages:

- A whole lot cheaper than military action -- the first 10 minutes of our involvement in Libya when we launched a bunch of cruise missiles cost over $100 million.

- Saves a lot of lives, both citizens and US military

- Increases frequency of positive regime changes

Disadvantages:

- To say the least, monetary rewards heaped on ruthless dictators are fairly unsatisfying

- Ticks off human rights groups. More importantly, ticks off rebel groups in home country (even giving medical care in US to deposed Shah was a huge problem for Iranian rebels)

- Many still might not accept, even when backed into a wall. It's the power that is compelling, not just the money and lifestyle, and most dictators are really good at denying reality

Dispatches from The Corporate State

This is the kind of story I always thought typical of corporate states like France. It is sad to see this happening so frequently in the US

Recently, President Obama selected General Electric CEO Jeffrey Immelt to chair his Economic Advisory Board. GE is awash in windmills waiting to be subsidized so they can provide unreliable, expensive power.

Consequently, and soon after his appointment, Immelt announced that GE will buy 50,000 Volts in the next two years, or half the total produced. Assuming the corporation qualifies for the same tax credit, we (you and me) just shelled out $375,000,000 to a company to buy cars that no one else wants so that GM will not tank and produce even more cars that no one wants. And this guy is the chair of Obama's Economic Advisory Board?

This is the classic kind of cozy relationship between large industrial corporations and government that has been a feature of European states for years.

By This Definition, the Entire Administration is Full of Terrorists

Via Politico, from the liberty dollar trial

Attempts to undermine the legitimate currency of this country are simplya unique form of domestic terrorism,†U.S. Attorney Tompkins said in announcing the verdict.

“While these forms of anti-government activities do not involve violence, they are every bit as insidious and represent a clear and present danger to the economic stability of this country,†she added. “We are determined to meet these threats through infiltration, disruption and dismantling of organizations which seek to challenge the legitimacy of our democratic form of government.

My guess is that QE2 and TARP and the stimulus did a lot more to undermine the US dollar than any efforts by Bernard Von NotHaus. I would rather accept his silver dollars than, say, the script handed out by the State of California last year when they ran out of money.

The Chicago Political Paradigm

Over the last few weeks I have been following the story of the city of Glendale, AZ, in order to protect a previous $200 million public investment in our hockey team, proposing to issue another $100 million bond issue to help subsidize the purchase of the hockey team out of bankruptcy.

The real furor began when the Goldwater Institute, a local libertarian-conservative think tank, said they were considering suing over the bond issue because it violates the gift clause of the Arizona Constitution, which basically bans municipal governments from providing direct subsidies or lending their credit to private institutions. The gift clause has been frequently breached in the past (politicians do love to subsidize high-profile businesses), but of late Goldwater has successfully challenged several public expenditures under the gift clause.

I won't rehash the whole argument, but I found this bit from Senator McCain interesting

He called on the Goldwater Institute, a Valley watchdog that intends to sue to block the deal, to sit down and negotiate to keep the team

The buyer Matthew Hulsizer and his staff have taken this position throughout the deal -- they have lamented that they are more than willing to "negotiate" with Goldwater, and they are frustrated Goldwater won't come to the table with them.

This claim seems bizarre to me. If Goldwater thinks the deal is un-Constitutional, what is to "negotiate?" I don't know Hulsizer or anything about him, but it strikes me that he is working from a Chicago paradigm, and is treating Goldwater as if it were a community organizer. In Chicago, community organizers try to use third parties to protest various deals, like the opening of a Wal-Mart or a new bank. These third-parties are nominally protesting on ideological grounds, but in fact they are merely trying to throw a spanner in the works in order to get a pay off from the deal makers, almost like a protection racket. The payoff might be money or some concession for the group (e.g. guarantee of X% jobs for this group in project, $X in loans earmarked for group, etc).

Everything I have seen tells me Hulsizer is approaching Goldwater in this paradigm. Even going out and rounding up the most prominent politician in the state (McCain) to put pressure on Goldwater is part of this same Chicago paradigm.

Here by the way is what Hulsizer is apparently offering

As one part of the deal, Glendale would sell bonds to pay Hulsizer $100 million, which the Chicago investor would use to purchase the team for $210 million from the National Hockey League.

Hulsizer said he notified Goldwater he would guarantee the team will pay Glendale at least $100 million during its lease on the city's Jobing.com Arena through $75 million in team rent and fees and by covering $25 million in team losses that the city promised to pay the NHL this season, which is included in the hockey team's purchase price.

"We need to move forward now," he said. "I expect that Goldwater and other people who have come out against this deal will hopefully recognize the benefits of it and will now use all of that energy and tenacity and aggressiveness to go out and help us sell these bonds and make hockey work in the desert forever."

Hulsizer said Goldwater had not yet responded to him.

By the way, I hesitate to trust the Arizona Republic to report such deal terms correctly, but if what is reported above is correct, the offer appears to be non-sense

- What kind of guarantee is he offering? Is it a guarantee by the corporate vehicle buying the team, because if it is, this is worthless. The last team ownership group promised to pay the lease for 30 years -- what does that mean once they went bankrupt? I am sure Borders Books promised to pay a lot of real estate owners money for leases, and many of them are going to end up empty-handed in the bankruptcy. If this is a personal guarantee, that is a nice step forward, though not enough because....

- The $75 million in rent is largely irrelevant to the new bond issue -- these rents support the old $200 million bond issue. What they are saying is "issue a new $100 million bond issue for us and we will guarantee you can make 40% of the payments for the old bond issue." So? When Balsillie wanted to move the team, he didn't ask for an additional bond issue and agreed to pay off $50 million of the old one as an exit fee.

- At the end of the day, if the $100 million is not a subsidy, not at risk, and fully backed by guaranteed cash flows, then Hulsizer should go out and get a $100 million private loan. Period.

Unfortunately, this might be enough to get the deal through the courts. Glendale will argue that for the $100 million, they will get $100 million paid against their existing bond issues that would not otherwise be paid if the team folds or leaves town. This may fly with the courts, unfortunately, but it still sucks for taxpayers. At the end of the day, nothing about this offer makes the $100 million bond issue any safer. If the team goes bankrupt, it is lost. That is an equity risk the city is taking with taxpayer funds, and equity risk for which we are getting no equity. See here for full discussion of the risks and problems.

Postscript: The following is pure speculation, but I think it is close to correct. The team is worth about $110 million at best (remember, it has never made money in AZ). Forbes values it at $117 million but several similar franchises have sold for under $100 million lately. The reason it is selling for $210 million is that the NHL, which bought it out of bankruptcy, guaranteed its other owners the league would not lose a penny on the team. But the team has been racking up losses, and the accumulated cost to the NHL is now $210 million. The NHL is insisting on a price that is $100 million north of where it should be. In effect, the taxpayers of Glendale are bailing out the NHL for this crazy promise to its owners.

I can just see the negotiation. Hulsizer, who by every evidence is a savvy financial guy, is not going to pay $210 million for an asset worth $110 million. Glendale has way too many chips on the table to fold now, so it rides in and says it will contribute the $100 million difference. In fact, the best evidence this is a subsidy is the difference between the purchase price and any reasonable team value. Someone has to make up the ridiculous gap between the NHL asking price and reality, and Hulsizer is too smart to do it. I have been calling this a subsidy of Hulsizer, but in fact this is really a subsidy of the NHL. The NHL has Glendale by the short hairs, because Glendale knows (from the Balsillie offer, among others) that the only way the NHL can get a $210 million price is from a buyer who wants to move the team.

This, by the way, is EXACTLY the reason I opposed the original stadium funding deal. Once they built the stadium, and then went further and lured businesses to develop around it, they were wide open to blackmail of this sort.

The problem with doubling down at this point is that the team has never made money and has no real public plan for doing so. I have talked to NHL executives and none of them see how the turnaround is possible. So how many years will it be before the new owners tire of their plaything and throw the team back into bankruptcy, so that Glendale will be in the exact same spot except $300 million, rather than $200 million, in debt.

Great Moments in Alarmism

From March 21, 1996 (via Real Science)

Scientists studying Creutzfeldt-Jakob Disease in the field are still deeply divided about whether BSE can be transmitted to humans, and about the potentially terrifying consequences for the population.

"It's too late for adults, but children should not be fed beef. It is as simple as that," said Stephen Dealler, consultant medical microbiologist at Burnley General Hospital, who has studied the epidemic nature of BSE and its human form, Creutzfeldt-Jakob Disease, since 1988.

He believes that the infectious agent would incubate in children and lead to an epidemic sometime in the next decade.

"Any epidemic in humans would start about 15 years after that in cattle, and about 250,000 BSE-infected cows were eaten in 1990. There could be an epidemic of this new form in the year 2005. These 10 cases were probably infected sometime before the BSE epidemic started."

His worst case scenario, assuming a high level of infection, would be 10 million people struck down by CJD by 2010. He thought it was now "too late" to assume the most optimistic scenario of only about 100 cases.

One of the great things about the Internet is that it is going to be much easier to hold alarmists accountable for wild scare-mongering predictions that prove to be absurd. Though, I suppose Paul Ehrlich still gets respect in some quarters despite being 0-for-every-prediction-he-has-ever-made, so maybe its too much to hope for accountability.

The NCAA and Worker Exploitation

I took my blog post from earlier this week and expanded it to a full-blown column on the NCAA and its efforts to never, ever let its athletes make a dime from their skills. An excerpt:

University presidents with lucrative athletic programs will do about anything to distract attention from just how much money their Universities are making off of essentially unpaid labor. Their favorite mantra is to claim they are holding up an ideal of “amateurism.”

The whole amateur ideal is just a tired holdover from the British aristocracy, the blue-blooded notion that a true “gentleman” did not actually work for a living but sponged off the local gentry while perfecting his golf or polo game. These ideas permeated British universities like Oxford and Cambridge, which in turn served as the model for many US colleges. Even the Olympics, though, finally gave up the stupid distinction of amateur status years ago, allowing the best athletes to compete whether or not someone has ever paid them for anything.

In fact, were we to try to impose this same notion of “amateurism” in any other part of society, or even any other corner of University life, it would be considered absurd. Do we make an amateur distinction with engineers? Economists? Poets?

When Brooke Shields was at Princeton, she still was able to perform in the “amateur” school shows despite the fact she had already been paid as an actress. Engineering students are still allowed to study engineering at a University even if a private party pays them for their labor over the summer. Students don’t get kicked out of the school glee club just because they make money at night singing in a bar. The student council president isn’t going to be suspended by her school if she makes money over the summer at a policy think tank.

In fact, of all the activities on campus, the only one a student cannot pursue while simultaneously getting paid is athletics. I am sure that it is just coincidence that athletics happens to be, by orders of magnitude, far more lucrative to universities than all the other student activities combined.

Princeton Loses in Final Seconds :=(

Princeton continues its designated role in the universe of scaring the crap out of high NCAA tournament seeds, but fell just short when Kentucky took the lead with 2 seconds left. I engaged in emotional diversification by picking against them in my brackets, so I would have both joy and pain either way.