Adding Solar to Our House -- Here Is Why

UPDATE: This article has been heavily edited. It turns out that solar installations without extensive battery systems do NOT act as a backup to grid outages. By utility rules, the solar system has to shut itself down when the grid shuts down. I should have done better research, but frankly I could not believe that the system shuts down EXACTLY when you most need it. For me this revelation (which came from several readers, thanks!!) was a bit like finding out that your flashlight has software to shut down when it is dark outside.

Our house has always been a good candidate for solar. It has a large flat roof, good sightlines to the south, and we live in just about the best solar location in the country (Phoenix). The problem has been two-fold:

- Even with large tax rebates and other subsidies (e.g. ability to sell power into the grid at retail rather than wholesale rates), the payback periods are long.

- Given that we are working in 10+ year paybacks, it has never been clear to me that most panels have the life needed. All solar panels degrade with time and sometimes fail and I am not sure most economics include those factors.

What finally changed our minds was a question my wife asked me a few months back. She would really be distressed at losing the A/C during a Phoenix summer, and asked if we should get a backup generator. I told her such generators were large and expensive, but that if we really wanted some grid backup in Phoenix, solar seems to make sense. Sure, it only backs up in the day, but that is when we really need it here. The backup aspect was the cherry on top of the economics that put us over the top.

We knew we did not want some sort of leasing or pay-for-power arrangement that would encumber our home if we ever had to sell it so that meant we could shop for about any sort of panel we wanted. In shopping for things nowadays, there is seldom consensus on the best, but right now there seems to be a near consensus in solar panels. The SunPower panels have the best efficiency, the lowest efficiency reduction from high temperatures, the least efficiency drop off with time, and the longest warranty. You pay for all that of course and they are pricey, but I decided to go with the pricier panels where I could be more sure of the economics in the out years. We have made other investments in our home that have essentially represented a decision to stay for the long-term, so we invested for the long-term here. I will say that it is possible we could have gotten better economics with another panel that was cheaper, even considering a shorter life, but I did not do the math for every panel.*** The panels we are buying are a huge step ahead of the old ones, as they have built -in inverters in each panel and so they produce AC directly. This greatly reduces the wiring and installation costs.

Interestingly, the efficiency did not buy us much (at least today) because our total installation was limited by our service panel limits, which total to 400 amps. This means that the efficiency really only saved us roof space which we had more than enough of. However, while I chose not to do a battery system this time around (too expensive and too many safety questions), I may do one in the future so I wanted space for more panels to charge a future battery system.

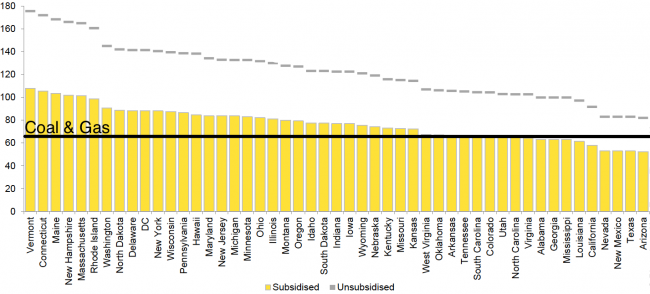

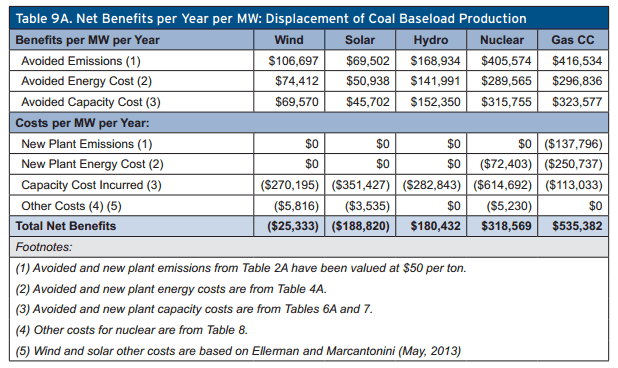

The total payback comes to just about 10 years for our system. At historic cost of capital numbers this probably does not pencil out but today with ZIRP it makes sense, especially with the extra benefit of some immunity from outages. Even to get to these numbers you folks had to chip in to help my economics, in the form of the 30% tax rebate you are giving me and the above-wholesale price you are paying me for power I put into the grid. This payback is mainly from getting rid of a LOT of our on-peak power usage, which costs us way more per KwH than off-peak. A second project to add more solar charging batteries for evening use will have more challenging economics and will likely have to be justified purely on grid independence. On the other hand, your economics in another location may be better, since our off-peak power costs of around 10-12 cents is pretty cheap. On the gripping hand, you may not have as good of a solar insolation factor where you live. My summary is that if you live in certain parts of SoCal with high electricity rates, this is a no brainer; if you live where I do it is marginal but works if you value some grid independence; and most everywhere else it is a real stretch and maybe closer to a rich man's toy than a sensible investment**. However, those of you who have had good economics doing this elsewhere are welcome to comment below.

I will give more reports in the future as we go through this.

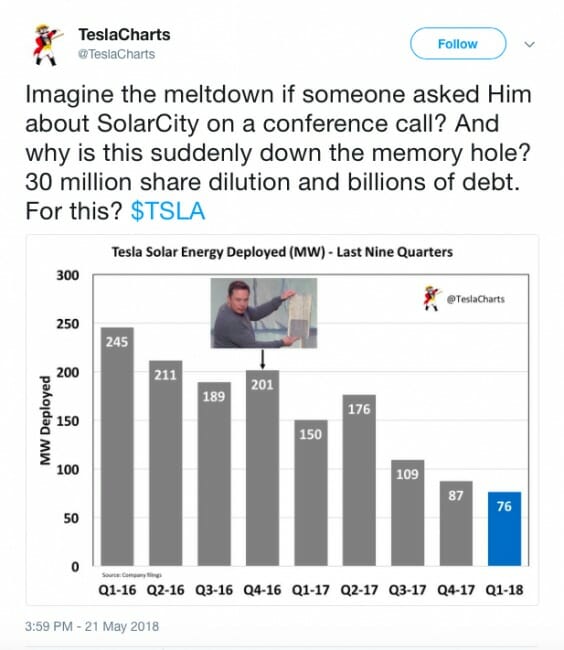

** I would argue that experience from some place like SolarCity does not necessarily count as they never have and (as part of Tesla) likely never will make money, so there is an added subsidy in the equation there from well-meaning but naive stockholders.

*** It is hard also to do the full installation math on every panel as most installers have a limited range they work with and we only had the energy and time to engage a few installers for quotes.