Life is too short to spend much time on the Democratic Underground, but this article by Ernest Partridge popped up in one of my Google watch lists. I highlight only because it contains this straw man:

The dogmatism of free market absolutism resides in the belief that the unregulated market never fails to be beneficial to all; the belief, in other words, that there are no malevolent effects of unconstrained market activity, no "back of the invisible hand." From this belief follows the insistence that the free market is self-correcting, and that there is thus no need for regulation � that, in Ronald Reagan�s enduring words, "government is not the solution to our problems, government is the problem."

I can't think of any thoughtful defender of capitalism and free markets that ever would have said that the market "never fails" or that it is "beneficial to all" or that there are never bad outcomes or that the market is perfectly self-correcting.

Bad, stupid shit happens all the time in free markets. For example, BP idiotically dumps a few zillion barrels of oil into the Gulf of Mexico. In a free society, BP will be out billions of dollars in cleanup costs and damage settlements -- it might even bankrupt itself if governments allow that to happen, and thus will never again be able to do something so careless. Markets can't prevent a first dumb action, like huge leveraged bets on ever-increasing housing prices, but markets can make sure the folks involved don't have the resources to do it again -- that is, except if governments bail them out from their mistakes.

The point is not that markets are perfect -- the point is that they are superior in both function and the retention of personal liberty to the alternative of giving governments coercive power to use force against individuals to change market outcomes. The point is not that individuals don't do destructive things within the context of free markets. The point is that they have a lot less power to do harmful things over long periods of time than if one gave that person coercive power in a government job backed by police forces and armies. There is only a limited amount of damage anyone can do when they depend on the uncoerced cooperation and agreement of their counter-party. A tobacco company CEO doesn't have a hundredth the power to ruin peoples lives as does one member of Congress. Fifty years of slimy cigarette advertising doesn't have the power of one Congressional mandate. Go to Chicago, Detroit, Baltimore -- which has been worse for these cities -- the private campaign to sell cigarettes or the government led war on drugs?

Its clear from later in the article that the author is yet another person with a list of pet peeves who wants to use force on the American citizenry to get his way. The author doesn't like cigarettes, so intervention with tobacco companies is a valid role for government. OK, well I can't stand reality TV shows, so much so that I would rather be in a room of smokers than a room with "the biggest loser" on TV, but you don't see me wanting to give government power to do something about it.

But what is amazing to me is how much his examples actually make the libertarian point for limitation of government. Try his first one:

Private Prisons. Good for the corporations: more prisoners, "three strikes" laws, mandatory sentencing. The cost to society: less rehabilitation and early release, increased government expenditures and taxes. It is noteworthy that the United States has the largest prisoner to population ratio in the industrialized world.

You have to really re-read history to come to the conclusion that American incarceration rates are mainly driven by privatization of prisons. My sense is the causality is the other direction - we have passed crazy drug laws and mandatory sentencing for sometimes petty crimes and have had to turn to private actors with private capital to keep up with the demand to construct new prisons.

Like the author, I hate this incarceration trend, but its really a stretch to blame this on privatization. And, I am the first to deride the symbiotic relationship between powerful corporations and the government. I have written on any number of occasions that both political parties in this country seem to be trying to build a European-style corporate state. So, even if I don't think he has history quite right here, I am willing to concede the point. Because, in fact, this seems to me an indictment of exactly what he is trying to defend -- the government interventionist state.

The only reason corporations lobby the government is that the government has the unique power to coercively intervene in markets. Corporations try to engage this power for their own benefit and to step on competitors, both current and future. The root cause failure here is not the fact that private companies try to engage this power, but that this power exists at all.

Amazingly, he makes the same argument about war:

War, Inc. Good for the corporations (i.e., the military-industrial complex and "private contractors" such as Halliburton and Blackwater): more wars, expenditure of rockets, bombs and ammunition (requiring restocking of inventories). Cost to society: avoidance of diplomatic solutions, increased military budget and battlefield casualties, disobedience to international law (e.g., the Geneva and Nuremberg protocols).

I am staggered to see that someone who is defending giving more power to the government is simultaneously highlighting examples where this power is misused so horribly (and what could be a more despicable crime by legislators than incarcerating more people or starting wars just to help a favored corporate interests). I don't think wars are started primarily to help armaments manufacturers, but if they are, then this kind of failure by politicians is FAR worse than any he could point out in unregulated markets, only making my point for me. Markets are not perfect, but the cure of government use of force is worse than the disease.

Since the author dwells on cigarettes, just look at the so-called tobacco settlement. Supposedly, this was the great government hammer wielded against cigarette companies to punish them for years of selling a dangerous product. But in fact, all the settlement did was cement the market position of largest tobacco companies. The settlement effectively made government a financial partner with tobacco companies, and since it was implemented, the government has wielded its power to protect the companies who were involved in the settlement against competition (particularly from low-price upstarts) so as to protect its own cash flow. The position of the major tobacco companies has never been as secure and profitable.

I think the author's response would be that if we ban corporate election spending, then all would be well. This does not pass any kind of smell test. First, corporate giving has been effectively banned (or at least severely limited) for 20 years, and we see the staggering influence corporations have none-the-less. We only have to look at Europe, where the troika of politicians, large corporations, and large unions run those states to their own benefit, to the detriment of all others (e.g. smaller businesses, business without political contacts, workers outside of favored fields like autos, young workers, etc.) This symbiotic relationship occurs without campaign cash being a major element.

If you want to understand how this works, just look at recent legislation like cap-and-trad and health care. Legislators propose some populist interventions in a market to help themselves get re-elected. Corporations who might naturally oppose such interventions agree to support legislation in exchange for a number of subsidies and special protections. Trades occur that have little to do with campaign contributions. Just look at the influence GE wields in getting special deals for itself.

The GM bankruptcy was a classic example. GM is given a big taxpayer bailout and some cuts in labor costs. In exchange for labor cost cuts, unions get the government to squash secured creditors of GM in their favor in dividing up ownership and also get some special considerations in pending health care legislation. Secured creditors allow this to occur because they got TARP funds from the government. Politicians get active support from GM and the UAW in getting out the vote, positive PR, etc. The only people who lose are taxpayers, all the other automobile competitors, and workers in every other industry who must pay taxes to support auto workers special deal.

By the way, don't tell me that this is not what you want, that if only we have the right people (e.g. yourself) in power this will never happen. Wrong. It always happens. Every dang time. The incentives are overwhelming. Given politicians the power to do that one good intervention you want, and you have also given them the power to do a thousand that you don't want.

Postscript: By the way, please do not ever take a "progressive" seriously when they say they care about the poor. Take this for example:

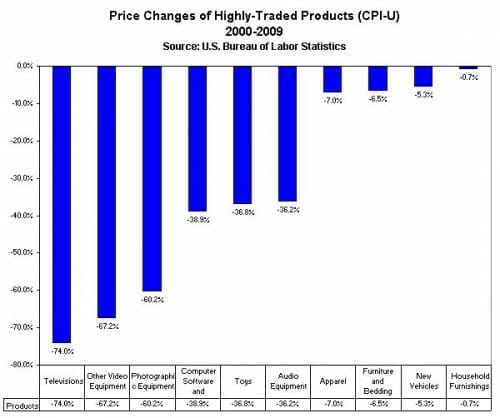

Outsourcing of jobs. Good for the corporation: increased profits and return on investment of stockholders. Cost to society: poverty, loss of educational opportunities, redistribution of wealth "upward," shrinkage of customer base, economic depression.

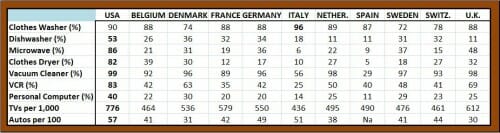

Another way of stating outsourcing is say that it is "transferring a job from a rich American to a poor person in a developing nation." As a country becomes richer and more educated, low-skilled jobs are not going to continue to get done by college grads. PhD's, in general, are not going to stitch underwear. Low skilled jobs in a wealthy society do get outsourced, and these new low-skilled jobs in developing nations become the seed or the catalyst for future wealth-creation and development.

This is one ironic problem that progressives in this country have -- even the poorest Americans would be middle class in many of the countries of the world. If progressives really want to transfer wealth from the rich to the poor, everyone in the US would pay and no one would receive a dime, it would all flow to other countries.