Wal-Mart and Income Inequality

First, I have not doubt that income inequality-- in whatever way the folks who care about such things measure it -- has increased. The analysis that has been making the rounds of liberal blogs show the rich "capturing a higher share" of total output. The very terminology here reveals their faulty core assumption, treating wealth as a zero-sum that must be grabbed and fought for and can only be gained to someone else's disadvantage. They always write about incomes as if GDP is a sort of natural fountain in the desert, and the piggy rich crowd in too close to get more than their fair share of water from the fountain.

This is silly. Wealth is created from the minds of human beings, and there are human minds that create far more wealth than others, and are able to keep some of that wealth for themselves as a reward. I say "some" because even the richest people tend to keep only a small percentage of the wealth they create. Sum up the benefits we all get from our iPods and iPhones and iPads, and the total number dwarfs what Apple shareholders have made from these devices.

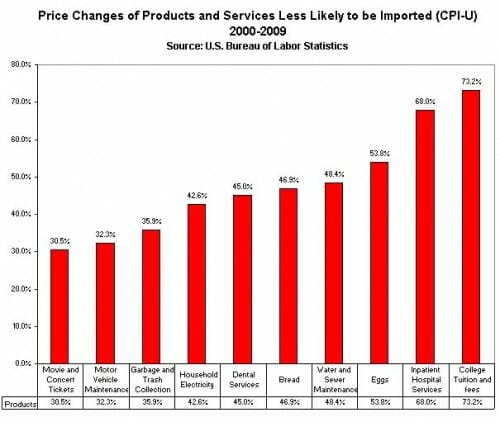

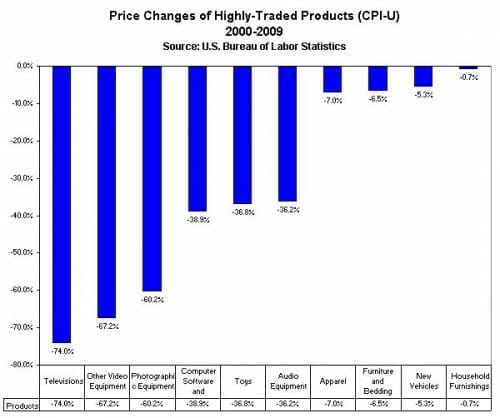

Anyway, the actual point of this post was to revisit the notion that there are different inflation rates for the rich and poor (via Carpe Diem) that may be skewing income inequality numbers

Using scanner data on household consumption of non-durable goods between 1994 and 2005, we document that the relative prices of low-quality products that are consumed disproportionately by low-income households were falling over this period. This implies that non-durable inflation for the 10th percentile of the income distribution has only been 4.3 percent between 1994 and 2005 (0.4 percent per annum), while the non-durable inflation for the 90th percentile has been 11.9 percent (1.0 percent annually), and 13.4 percent (1.2 percent annually) for the richest 5 percent of households in the sample (see chart above)."...

"A large literature has focused on the rising inequality observed in official statistics, but have mostly abstracted from the fact that these official measures are based on a single price index for a representative consumer. This assumption is not crucial in a world with a stationary relative price distribution or where an identical basket of goods is consumed by different income groups. However, using household data on non-durable consumption, we document that the relative prices of low-quality products that are consumed disproportionately by low-income consumers have been falling over this period.

This fact implies that measured against the prices of products that poorer consumers actually buy, their "real" incomes have been rising steadily. As a consequence, we find that around half of the increase in conventional inequality measures during 1994"“2005 is the result of using the same price index for non-durable goods across different income groups. Moreover, given that the increase in price dispersion does not seem to be specific to our sample or time period, the overstatement in the increases in inequality from official measures can be even more significant, changing our view of how progress has been distributed in recent decades substantially."

The price of a night at the Four Seasons has gone up more than the price of a shirt at Wal-Mart.