How Imports Raise Incomes

Opponents of free trade will often say publicly that they are all for free trade but it must be "fair," which they generally would define as balanced between imports and exports. This is a dodge, because they know many of our trading partners are not going to open up trade to be entirely free so they can use that inevitability as an excuse not to remove American protectionist barriers.

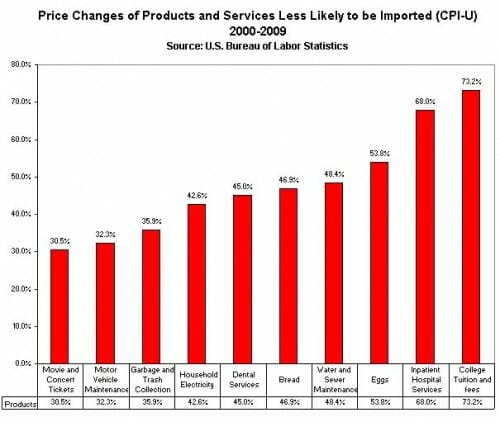

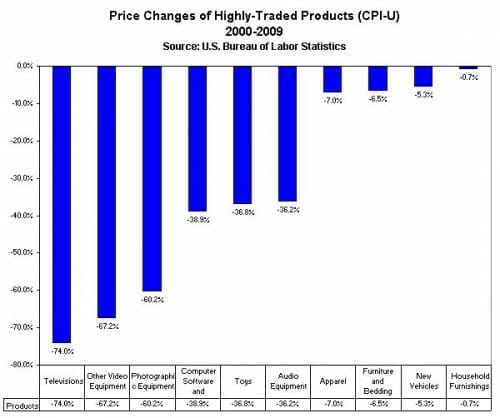

But trade does not need to be balanced to create wealth, and in fact it is not just exports that provide a boost to real incomes. Daniel Ikenson at Cato has these two charts comparing the CPI for items that face competition from imports and those that don't:

See his article for more discussion.

This is also related to something I read about a while back, that we may be underestimating income gains among the lower income quartiles in this country because we adjust to real wages based on an average inflation rate. The argument was that the inflation rate for the poor has been lower (the Wal-Mart effect) than the inflation rate for the rich (prices at the Four Seasons keep going up). One estimate put the difference in inflation rates as high as 6 percentage points, in part because the poor proportionally consume a lot of goods that are imported while the rich consume proportionally a lot of services that are produced domestically with high cost labor.

Warren,

"But trade does not need to be balanced to create wealth, and in fact it is not just exports that provide a boost to real incomes..."

This is still wrong. Exports are costs, not benefits. The only reason to export is that foreign producers would otherwise quickly lose their appetite for little green pieces of paper.

When Boeing exports an airliner to China the copper, aluminum and other resources involved, including labor, are denied to the US domestic economy resulting in a diminished supply and higher prices. Also the dollars paid by China will tend to increase the US money supply, also raising prices. Nor are the highly paid export jobs a benefit to anyone except those workers themselves. Everyone else is a little worse off as the highly paid export workers are more effective at bidding away goods and services from everyone else.

Regards, Don

Don is of course correct, but his comment leaves a bit of an impression that exports are 'bad'.

They are in fact good (well, OK, as good as it gets in this world) in that when an export is traded for something, both parties are enriched. The exporter wants the thing exported less than he wants what he got in return.

Only lefties expect unlimited imports for no exports.

Jobs too are a cost and not a benefit of any project. Whenever some government flack touts more jobs as a benefit, I groan. Especially 'green jobs' which all amount to increased costs for the same end product.

Hey buddy, your workday now ends at 6 instead of 5 for the same pay, for Gaia and the kiddies, OK?

These are all from (less than accurate I'm sure) memory:

Inflation is always and everywhere a monetary phenomenon.

Milton Friedman

My grocer never buys anything from me so there is a lopsided trade imbalance between us.

Walter Williams

The root cause of most of the world's problems are because of un-anchored fiat currencies, led by the dollar. Jude Wanniski

Good reading to be found at Prof. Antal E. Fekete's site:

http://www.professorfekete.com/moneycredit.asp

Except from the first pdf:

A Chinese Tale

Once upon a time the standard of measuring length, the foot, was defined in China as the length of the foot of the emperor. A change of the standard occurred upon the death of the old emperor, as a proclamation heralding the length of the foot of the new emperor was made. Later emperors discovered to their delight that they did not have to die in order to bring about a change of the standard. Imperial pleasure could proclaim a change in imperial footage at any time.

With the drop in price also comes a larger drop in quality.

The highly traded products are bound to be junk.

Never mind that you're comparing apples-oranges by the categories used for each graph.

When someone uses a sub-national example of imports/exports, they are talking about an academic exercise- not reality.

Look at those items again. Most of the "high inflation" ones are characterized by either huge tax-funded subsidies (colleges/ hospitals) or unusually severe government meddling/ regulation/ licensing/ restriction-of-supply (garbage[1]/ sewers/ electricity/ dentistry).

I don't know for sure about bread and eggs, but their prices may be driven by some combination of agriculture subsidies/ restrictions and fuel ethanol schemes driving up grain prices.

By contrast, prices for six of the ten negative-inflation items cited are obviously driven by advances in microelectronics.[2] While I do think global trade keeps prices down in all traded goods, the difference between inflation rates for "TV's" and "apparel" is technological change, not global trade.

I think your numbers say more about direct government intervention in specified industries than the effects of free trade (and again, I favor (really) free trade).

[1] One of my pet peeves is local governments granting monopolies to garbage haulers in return for naked bribes. I wish all the Kevin-Drum-type googoos would direct some of their ire at city and county bureaucrooks.

[2] Those "inflation" numbers were adjusted by "hedonic" or "quality" factors because, for example, people continue to buy TV's for $500 each, but nowadays you get a 40-inch HDTV instead of a 20-inch SDTV for your $500. The new TV's picture is at least 4 times better than the old one's so BLS calculates the TV inflation rate at -75%. I won't bore you here with the dubious assumptions and/or cynical manipulations hidden in some of BLS' hedonic adjustments. The BLS also assumes computerized toys are more fun to play with than simpler ones.