Mind of the Statist

David Roberts (via Kevin Drum) gives us a simply outstanding view of the mind of a statist:

In these grim economic times, one U.S. industry has defied gravity. Not only is it growing, it's thefastest growing industry in the country. It now employs 100,000 Americans at 5,000 mostly small businesses spread across all 50 states. Unlike in so many others, in this industry the U.S. has a positive trade balance with China; it is a net exporter of high-tech manufactured products....

The startling counter-cyclical growth of this industry had been unleashed by a modest bit of economic stimulus: a cash grant program that helps project developers compensate for the crippling credit crunch. In contrast to the familiar tax credits -- which tend to go to large, mature companies that have enough profit to benefit from them -- cash grants help small, innovative, growing businesses that are plowing revenue into growth. In fact, a recent study found that they work twice as well as tax credits. In 2009, this cash grant program pulled in $4.50 of private capital for every public dollar it invested.

The cash grant program expires at the end of the year. Extending it for a single year could support 37,000 additional jobs over and above the industry's baseline. And here's the capper: Since the cash grant program is simply repurposing money that's already devoted to a tax credit program, it requires no new federal revenue.

So you'd think this would be a home run, right? At a time when jobs are at the top of every politician's mind, surely a bit of low-cost economic stimulus that doesn't increase the deficit and leverages tons of private capital and creates tens of thousands of jobs can serve as the rare locus of bipartisan cooperation. Right?

Except the industry in question is the solar industry. And because this industry involves clean energy rather than, I dunno, tractor parts, it has been sucked into conservatives' endless culture war. Rather than lining up to support the recession's rare economic success story, Republicans are trying to use the failure of a single company -- Solyndra -- as a wedge to crush support for the whole industry. Odds are they're going to succeed and the cash grant program (Sec. 1603) won't be renewed next year.

Do you see the basic assumption -- if we don't take money from taxpayers and give it to businesses in a certain industry, that means we don't like that business. Really? That means that there is not a single industry in this country that I like, since I don't support subsidies for any of them. Unless you believe the state is mother and father to us all, the fact that I don't support state subsidies does not mean that I don't like the industry somehow. Kevin Drum even goes so far as to say that opposition to solar power subsidies is an aspect of the culture wars. Huh? Oh and by the way, the politicization of this loan process is just amazing to me. More and more people at Solyndra seem to be fund raisers for Obama, and here is a story of how a cleaning products company turned donations to Democratic candidates into taxpayers subsidies for themselves.

It is interesting that he would mention tractor parts. Guess what, folks who don't like the solar subsidies probably don't support subsidies for tractor parts either. I was going to say something like, "guess what, we don't subsidize tractor parts" but in our screwed up corporate state, we probably do at some level, like with some special export program snagged by a John Deere lobbyist. But I can pretty much guarantee that we don't subsidize anywhere near the total value of the tractor parts industry like we do the solar industry.

In one silly passage, he says

"In addition to being successful, this industry is wildly popular with the American public, across regions, demographics, and political parties. It has been embraced by mainstream institutions from Walmart to the U.S. military"

I could say the same thing for iPods too, but no one is rushing to provide grant programs for their manufacture. If it is so wildly popular, why does its use require so many government incentives and subsidies. Because the author pulls the trick of looking at one narrow solar program, and attributing the entire solar industry growth to that one program. And then he says, see, look how much benefit we get from this tiny sensible expenditure.

But solar's growth (I don't have the data, but I am willing to be real money that his "fastest growing industry" claim is BS) is due not to just this tiny programs but to a plethora of federal, state, and local subsidies and mandates. The government gives money to capitalize companies, and then then provides tax credits for up to 30-50% of their customer's purchase, and then through public utility commissions enforce above-market feed-in tariff rates for solar power. One reason we export so much (the export market for US solar is nearly entirely to Europe) is that European governments have feed-in tariffs for solar power more than 5 times higher than the market rate for electricity. They are paying something like 70 cents a kilowatt for solar electricity.

So of course solar is growing. If the government were to buy small cars for $150,000 each, there would be big growth in car manufacturing. This does not mean the product makes sense -- in fact, the necessity for so many government supports at every step of the process means almost by definition that it does not make sense economically. Look at corn ethanol. Corn ethanol is the stupidest product ever, but it has grown like crazy due to the same combination of government subsidies, price floors, and mandates.

By the way, I am a huge fan of solar, in theory. I honestly think that solar will some day be the power system of choice in this country, as companies figure out how to roll solar sheets out of the factory as cheaply and quickly as carpet comes out of Dalton, Georgia. We are not there yet, and I am not at all convinced that the current approaches are anything but dead end technologies. Beyond wasting a lot of money, there is a real risk the government actually slow ultimate implementation of sensible and economic solar, just as I would argue they did by forcing manned space flight and the transcontinental railroad ahead of their time.

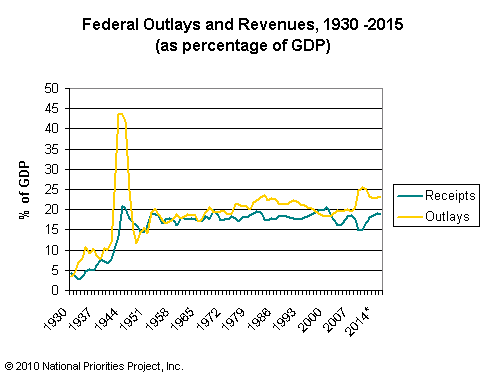

Update: Here is the data

Update: Here is the data