Is the World Trade System "Unfair?" -- A Response to the Trump Tariffs

The defenders of the Trump tariffs are starting to coalesce on a few different arguments, but what all these arguments seem to have in common is a core assumption that the current world trade system is "unfair." From Victor Davis Hanson via Powerline:

Our trading partners have taken advantage of us for decades after tariffs were no longer needed to help them rebuild their economies after WWII.

Or this:

I could write a book on this, and many people have, but what follows is my reaction to these tariffs and in particular to the notion that our trading partners are being "unfair."

Yes, many other countries have trade practices that are unfair -- unfair to their own citizens! I went to business school in the late 1980's and at the time it was all the rage a) to bash Japan for "cheating" the US and running a trade surplus and b) to wish to emulate Japan and their MITI-style economic management. I disagreed. I was fairly sure that MITI's control of capital flows was causing unseen distortions that would hurt the Japanese economy in the long-term (I had read my Hayek). At the same time, the Japanese were screwing their own consumers who had to pay far more than Americans for food and most manufactured goods, with far less choice and availability. It was not long after that Japan entered 20 years of stagnation as its trade subsidies and economic distortions just served to nuke their own economy.

Later, about 10-15 years ago, our Chinese exchange student and her friends came to the US for the first time. These kids, as it so happened, live only a few miles from one of the Apple assembly plants. They all brought huge empty suitcases to buy things in the US, including what seemed like a score of iPhones for their friends. The iPhones were far cheaper here in the US than in China where they are made and where many of the other things they bought were not available in China at all. So who is China's trade policy being unfair to? Me, or their own citizens?

I love foreign-subsidized trade. Nothing confuses me more than when people complain about foreign subsidies of exports to the US. Why? If the taxpayers and consumers of Germany wish to subsidize cheaper products in the US market, we should absolutely let them. I mean, I would be pissed off if I were a German citizen, paying higher prices and taxes so a few wealthy manufacturers can meet their quarterly profit goals, but why a US consumer should be unhappy is beyond me. (**see Panda Blog column in the postscript). And remember, we are not just talking about cars and vacuum cleaners, but raw materials and intermediate products bought by US manufacturers and support our domestic manufacturing.

Just as I was about to hit publish on this article, I saw this from Commerce Secretary Howard Lutnick defending tariffs:

He further urged, “these people have all been living in our house. They have been driving our car. They come by and visit, open our fridge and eat our food whenever they want.”

“They have taken advantage of us,” he emphasised [sic].

I am sure he will have all the hard-core MAGA types nodding sagely but what the hell does this really mean? In part this is the kind of confusion that results from aggregating what are in fact discrete transactions. Everything Americans buy we pay the asking price for, and everything the Chinese buy they pay our asking price for. How is someone getting cheated? How is there any fraud? Lutnick if pressed would obviously argue that fraud comes from the prices we are paying to the Chinese being artificially low. If that is the case, who is eating out of whose fridge? If I pay $20 less for shoes and $200 less for a phone and that difference is being subsidized by the Chinese people/government, then it is I that is getting over on them. Thanks for the free lunch, China. (update: Even Dave Chappelle agrees)

Hate me if you wish, but compared to consumers, manufacturers are a special interest. 13 million people or so are employed in US manufacturing firms, out of a total workforce of about 160 million, or something like 8%. And by no means are these all in jobs vulnerable to foreign competition -- in fact I would bet at least as many work for companies that are dependent on foreign raw materials for success as there are those working for companies that live at knife-edge vulnerability to competition.

Let me give you an example of a domestic industry entirely vulnerable to foreign competition that tariffs entirely support: Sugar. The US sugar industry would likely disappear if not for tariff's and import restrictions that raise the US sugar price to more than double the world price. We simply do not have the climate or land costs or labor costs to support competitive growing and manufacture of sugar in this country. As a result of tariffs, 300+ million Americans pay more than double for sugar, and perhaps worse, because of the high cost of sugar, food manufacturers in this country have largely abandoned sugar in favor of alternatives like HFCS that are far less healthy. And in exchange for this cost? We are protecting about 12,000 direct jobs. For nearly every tariff in every industry, you will find -- at its heart -- this sort of special interest math.

The history of sacrificing the mass of consumers to the profitability of a few elite producers goes all the way back to the horrible British corn laws. Economists refer to the problem as "concentrated benefits, dispersed costs." Costs are dispersed such that no one person bearing them really has the financial incentive to take on the costs of fighting them, while benefits are concentrated in a few hands that have the incentive and the means to fight to the death to protect their special privilege.

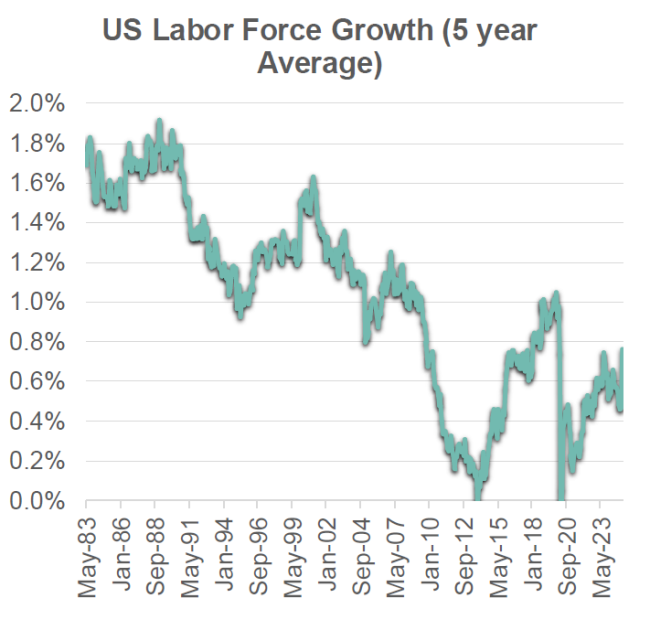

By the way, who is going to work in all these new on-shored manufacturing plants? Due to falling birth rates, the US labor force has been growing only very slowly:

This actually understates the problem, because there is a huge shortage of labor with the right skills for manufacturing. With the US near full employment (though with a relatively low workforce participation), its not clear how we will staff these theoretical new factories. Manufacturers are already screaming they can't get the people they need in the US:

“BlueForge Alliance calls me and they say, we need to hire some tradespeople, and we were wondering if you and your foundation could help.” “I said, I’ll try, as you probably learned, it’s pretty skinny out there … how many do you need?” “They said 100,000.” “100,000 tradespeople for one industry that most people don’t even think about.” “They said, we’ve looked everywhere … do you know where they are?” “I said, yeah I do, they’re in the eighth grade.” “That’s 100,000 building submarines. There’s 80,000 in the automotive industry alone for technicians. Right now … 80,000 openings.” “You start to go down the list and you begin to realize our workforce is wildly out of balance.”

Historically we have had two answers for this problem: 1) more immigration and 2) taking advantage of foreign labor through imports. This administration is trying to cut off both. (Long term there is an education opportunity, that will be addressed below).

If this foreign interventionist trade strategy is superior, why is the US doing so much better? The economies of most major trading nations are all on their back -- except the US. The US is doing very well and still is richer than most any other large nation. Countries like Germany and France that are supposedly so smart to be "cheating" in trade are clearly not doing a very good job of it, because every nation in the EU would be poorer on a GDP per capital basis than the poorest US state (Mississippi). Great Britain through most of the 20th century ran their economy into the ground through protectionism, leaving their industry bloated and inefficient. The US did the exact same thing in its auto and steel industries until tariffs were lifted in the 1970s. We have a smaller auto industry than we did then, but it is healthier and makes FAR better products.

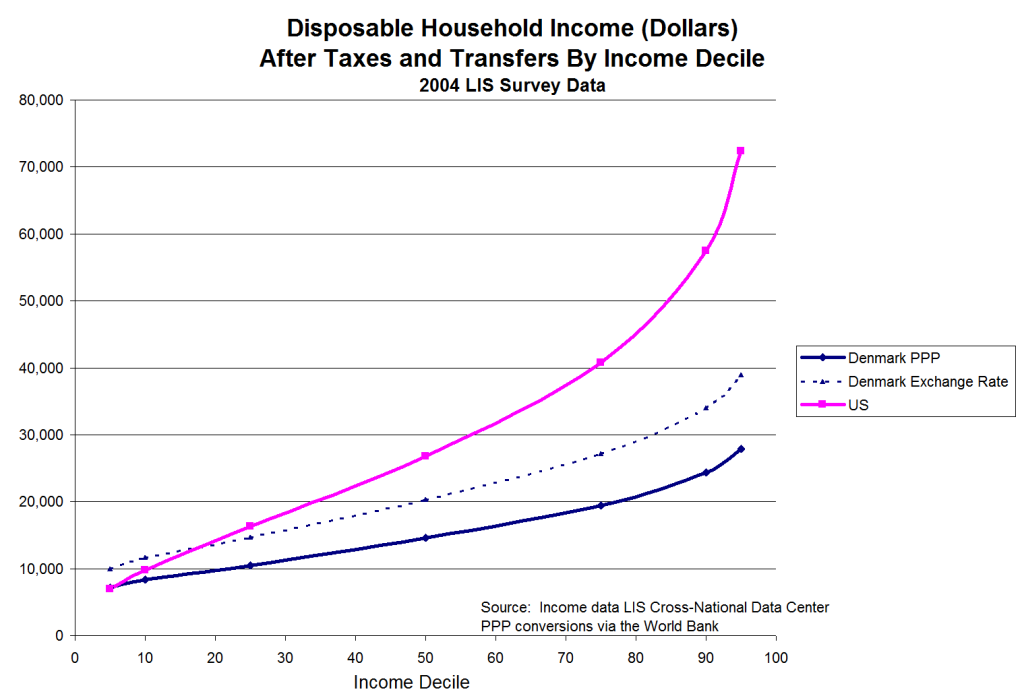

The US is wealthier across the whole of the income spectrum than, say, countries in the EU. Our rich are richer than their rich and our middle class is richer than their middle class and our poor are better of than their poor, even considering the net of taxes and transfers. I have not updated this analysis for over a decade but I am pretty sure it is still directionally accurate.

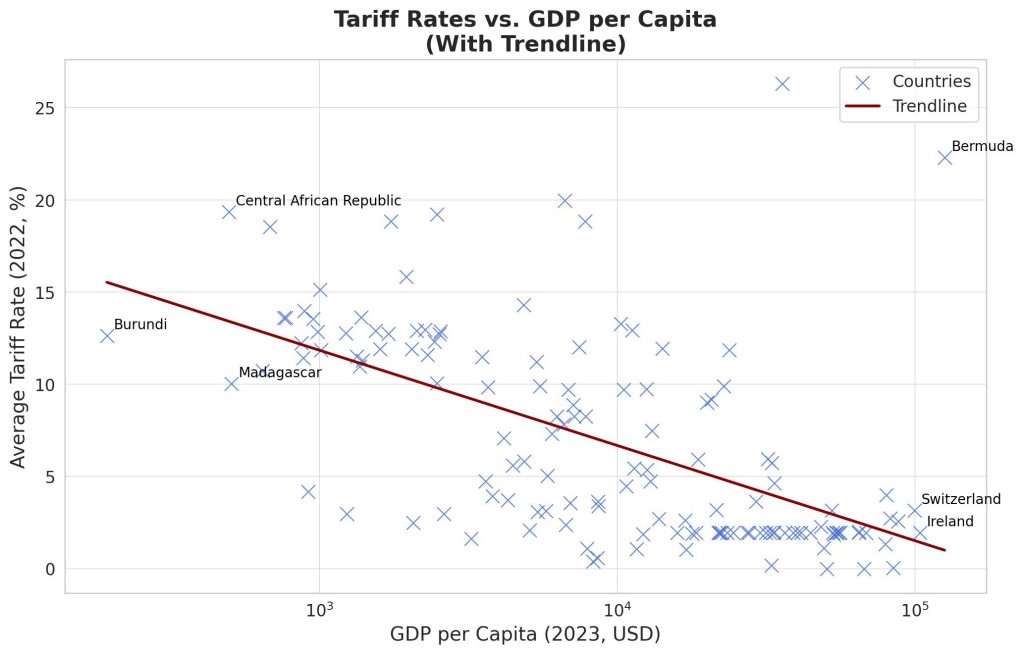

In fact, there is a fairly direct correlation between low tariffs and citizen well-being:

I don't know where the average South Korean's or Thai's head is at on all of this, but I can say with some confidence that the average Western European citizen would be shocked at the notion that a) their country is somehow beating up on the United States and b) that they personally are getting rich at the expense of American citizens.

It should be noted that even when all else is equal, the fact that US citizens are substantially wealthier than their peers in other nations, it is almost mathematically guaranteed that we will buy more (ie import) than we sell in return in exports.

The Shifting of Jobs Out of Manufacturing Is A Normal Part of Economic Growth. Certainly a smaller percentage of Americans work in factories today than they did 30 or 40 years ago (ignore the Trump stat about 90,000 factories disappearing, though, it is totally fake). You know what other industry has lost jobs through US history? Agriculture. Today about 2% of the population works in farming vs well over 80% in the year 1800. I am pretty sure few today are pining away for a return to the life in a small farm -- I guarantee farmers and ranchers work way harder than most folks want to work today.

As the economy gets wealthier and technology advances, the nature of work keeps shifting. We are upgrading lower-skill, lower-productivity jobs for higher productivity jobs, just as we have since the start of the industrial and agricultural revolutions. We still need the things made in those lower skill, lower productivity jobs, so they shift to other countries (which in turn helps them get wealthier too). No one is demanding we shift workers back from manufacturing to agriculture, and no one should be arguing that we shift folks working on AI back to manufacturing.

Of course this process can have costs for individuals and communities. But we almost never wish to turn back the clock on past such transitions while still greatly wishing to block the current one.

These tariffs are not strategic. I have seen the most enthusiastic of Trump supporters try to argue that this is really about returning certain manufacturing to the US for strategic reasons. But this can't possibly be correct, or if it is, then its a really odd approach since these tariffs apply to every single country and every single product.

This may yet be another Trump negotiating ploy, but its a really expensive and high risk one. Trump supporters who have more than half a brain like Victor Davis Hanson are arguing this is just Trump putting a negotiating token out there. Perhaps. That is certainly Trump's style, to make an irrational demand and soften it only when he gets something back. Secretary Lutnick explicitly says this is the plan, and I will believe him. This is obviously expensive and high-risk, and to some extent still doesn't make a lot of sense since Trump slapped high tariffs on countries like Switzerland that have close to zero tariffs themselves and are largely productive partners.

It may well turn out that much of this ends up being performative. I need to remind everyone of Trump's much ballyhooed deal to get Foxconn to commit to a $10 billion plant in Wisconsin. I don't know if Foxconn ever intended to follow through, but in the end they never made most of this investment and the whole effort turned out to be performative. One interesting aspect of this article is that Foxconn backing out was not the only problem, there was a lot of local opposition as well for a variety of environmental, land use, and public policy reasons. It illustrates that the manufacturing labor shortage discussed above may not be the only reason manufacturing is shrinking in the US.

Trump supporters need to admit there is some vanity here. Trump likes to have people come to him hat in hand as a supplicant -- to kiss the ring, to thank him, to apologize, whatever. He blasted Zelenskyy for not doing just this on his White House visit (though I will confess I find Zelenskyy to be immature, irritating, and possibly corrupt). Trump supporters will say that what he really wants is for countries to show respect for America, and I suppose this is part of it, but I am convinced ego is a part of it as well.

There is more risk here than just price increases. Consumers are going to lose choices and many of those choices are going to be the low-cost options. Already Mercedes has hinted it may stop selling its entry level cars in the US. And yes, I know it is hard to cry for the Mercedes buyer, but the same math that causes the tariffs to hit hardest at their entry-level products (as they tend to have the lowest margins and the highest customer price sensitivity) is going to apply to about every other consumer product.

Ironically, one huge risk is to manufacturing investment. Trump's goal seems mainly to get more manufacturing investment in the US, but as long as the tariffs keep changing week to week -- and they will continue to if Trump is really using them as a bargaining chip -- no manufacturer in their right mind is going to make a major new investment. They are going to sit on their hands and wait. Many historians and economists of late have been coalescing around a theory that regime uncertainty in the 1930s -- ie the constant changing of regulatory rules and frameworks -- did much to cause the Great Depression to drag out longer.

And then there is the risk of cronyism. A system of high tariffs gives a huge new playing field for politicians to trade favors with favored companies, giving them special exemptions or hitting their competitors with extra costs. If you look at European politics around tariffs, it is a relatively ugly picture of favoritism to a few select elite. I guarantee you the special favors for Nike and Apple are already being discussed in the back rooms. Just look at the Foxconn deal discussed above, where Trump and WI governor Walker bought a trade-related election talking point for $4.5 billion in subsidies.

Update: And of course there is the threat to the rule of law. I left this out on the first draft because, frankly, I don't think the faithful of either party gives a sh*t about the rule of law if it is their agenda hat is being rammed through. Certainly Democrats didn't have any problem with Biden's lawless attempts to forgive a trillion dollars in student loans and I don't think Trump's supporters care about the legality of this tariff actions. The power to set tariff's is enshrined in the Constitution (that document Republicans used to care about) as a power of Congress. Weak-kneed and lazy Congresses have delegated some of this power to President's, but only very narrowly. The picture is complicated and illegal actions by the President can be hard to review in court. But looking at the 4-6 major delegations to the President of tariff authority, it is difficult to see that any of them apply simultaneously to every country on Earth and every single product manufactured anywhere. Certainly there is no precedent for them being enacted by the President on anything but a far far narrower basis (eg steel from China).

I also left out the issue of honorable dealings, which again I don't think political partisans of any flavor give a crap about. But Trump is violating any number of agreements, including not just lame President-only agreements like much of the climate stuff but real treaties that were legally passed by the Senate. He is also explicitly repudiating deals he personally made with Mexico, Canada, and the EU, among others. I suppose it is fine for him to behave this way in his personal negotiations for his personal businesses -- it is only his honor involved. But there is a real cost involved to the honor and reputation of the nation which makes it harder in the future for such agreements to be made.

So let me end by offering a few alternatives to tariffs to achieve some of Trump's stated goals.

Alternative 1: If you really want to reduce trade deficits, cut the government budget deficit. As I said above, the US is likely always going to run trade deficits as long as it is wealthier than the rest of the world. But probably the #1 thing that has caused these deficits to be higher than they would otherwise be is the huge Federal debt. Every year now we are issuing trillions of dollars of new US Federal debt. This pushes the interest rate for these bonds higher than the #1 risk-free world investment might otherwise be. This in turn attracts foreign capital, which buys dollars in order to buy of these bonds, which in turn increases the value of the dollar. This artificial inflation of the value of the dollar certainly helps consumers, by reducing the cost of imported goods, but hurts exporters by increasing the cost of their goods in local currencies of buying nations. The net effect is that government borrowing increases the trade deficit. Close the budget hole, and the trade deficit will come down over time.

Alternative 2: If you really want to increase US manufacturing, you need to increase the number of workers with trade skills. We talked above that US manufacturing is already limited by the lack of workers in skilled trades. In part this is due to government programs that pay people just enough that they play Call of Duty all day and still eat. But it is also due to the great fuck-up of our educational system. Public education has become complete crap. But even worse for manufacturing is the fact that we have for thirty years promoted a value system where it is high status to go to college and get a degree in the Lesbian poetry of Peru while it is low status to get a trade and go to work in manufacturing. The economic signals are pretty good -- the Lesbian poetry grad is probably unemployable while my friend with no college degree but welding skills makes 6 figures at SpaceX. But for some reason we have an entire hierarchy in education that says its wrong to encourage kids into trade schools -- they need to go to college. Starting to fix this is beyond the scope of this post but far more essential to US manufacturing than tariffs are.

**Postscript: I will conclude by recognizing that none of the above is recently adopted out of TDS, which I don't have. I would love certain parts of Trump's agenda to be succesful. But I have been making these same points for 20 years. Below is a post I wrote for my imaginary Chinese affiliate "Panda Blog" from an imagined Chinese citizen in 2006:

Our Chinese government continues to pursue a policy of export promotion, patting itself on the back for its trade surplus in manufactured goods with the United States. The Chinese government does so through a number of avenues, including:

- Limiting yuan convertibility, and keeping the yuan's value artificially low

- Imposing strict capital controls that limit dollar reinvestment to low-yield securities like US government T-bills

- Selling exports below cost and well below domestic prices (what the Americans call "dumping") and subsidizing products for export

It is important to note that each and every one of these government interventions subsidizes US citizens and consumers at the expense of Chinese citizens and consumers. A low yuan makes Chinese products cheap for Americans but makes imports relatively dear for Chinese. So-called "dumping" represents an even clearer direct subsidy of American consumers over their Chinese counterparts. And limiting foreign exchange re-investments to low-yield government bonds has acted as a direct subsidy of American taxpayers and the American government, saddling China with extraordinarily low yields on our nearly $1 trillion in foreign exchange. Every single step China takes to promote exports is in effect a subsidy of American consumers by Chinese citizens.

This policy of raping the domestic market in pursuit of exports and trade surpluses was one that Japan followed in the seventies and eighties. It sacrificed its own consumers, protecting local producers in the domestic market while subsidizing exports. Japanese consumers had to live with some of the highest prices in the world, so that Americans could get some of the lowest prices on those same goods. Japanese customers endured limited product choices and a horrendously outdated retail sector that were all protected by government regulation, all in the name of creating trade surpluses. And surpluses they did create. Japan achieved massive trade surpluses with the US, and built the largest accumulation of foreign exchange (mostly dollars) in the world. And what did this get them? Fifteen years of recession, from which the country is only now emerging, while the US economy happily continued to grow and create wealth in astonishing proportions, seemingly unaware that is was supposed to have been "defeated" by Japan.

We at Panda Blog believe it is insane for our Chinese government to continue to chase the chimera of ever-growing foreign exchange and trade surpluses. These achieved nothing lasting for Japan and they will achieve nothing for China. In fact, the only thing that amazes us more than China's subsidize-Americans strategy is that the Americans seem to complain about it so much. They complain about their trade deficits, which are nothing more than a reflection of their incredible wealth. They complain about the yuan exchange rate, which is set today to give discounts to Americans and price premiums to Chinese. They complain about China buying their government bonds, which does nothing more than reduce the costs of their Congress's insane deficit spending. They even complain about dumping, which is nothing more than a direct subsidy by China of lower prices for American consumers.

And, incredibly, the Americans complain that it is they that run a security risk with their current trade deficit with China! This claim is so crazy, we at Panda Blog have come to the conclusion that it must be the result of a misdirection campaign by CIA-controlled American media. After all, the fact that China exports more to the US than the US does to China means that by definition, more of China's economic production is dependent on the well-being of the American economy than vice-versa. And, with nearly a trillion dollars in foreign exchange invested heavily in US government bonds, it is China that has the most riding on the continued stability of the American government, rather than the reverse. American commentators invent scenarios where the Chinese could hurt the American economy, which we could, but only at the cost of hurting ourselves worse. Mutual Assured Destruction is alive and well, but today it is not just a feature of nuclear strategy but a fact of the global economy.

Postscript: I have always been amazed that greens get all misty-eyed at European rail. Sure, its cool to ride a fast train, but the cost of having an extensive passenger rail system is that most of Europe's freight pounds along highways, rather than via rail. In the US, the mix is opposite, with few passengers on trains but much more of our freight moving by rail. I would have thought that preferentially moving freight over rail rather than passengers was a much greener approach.

Postscript: I have always been amazed that greens get all misty-eyed at European rail. Sure, its cool to ride a fast train, but the cost of having an extensive passenger rail system is that most of Europe's freight pounds along highways, rather than via rail. In the US, the mix is opposite, with few passengers on trains but much more of our freight moving by rail. I would have thought that preferentially moving freight over rail rather than passengers was a much greener approach.