Posts tagged ‘LA’

My New Favorite Attraction in LA and it NEVER Gets Any Publicity

A couple of weeks ago my wife and I were in Pasadena and we visited the Huntington. I almost never see it on list of things to do in LA. This list has 22 things including some odd choices but no mention of the Huntington.

The Huntington is the mansion and grounds of one of the heirs to railroad magnate Collis P Huntington. Perhaps one of the reasons it is not well-known is that it is hard to exactly categorize what this place is. First, it is an amazing garden (pictures below) that has a desert garden, a tropical garden, a temperate garden, a Japanese garden, the bonsai garden, a Chinese garden, a water garden, a rose garden and an herb garden. I have been to a lot of gardens and arboretums around the world and this compares to the best. More enjoyable, for example, than either major arboretum in Singapore which top tourist lists. Then, there are the art museums, actually two. We only made it to the European art museum, which was in the original mansion -- it contained a lot of large portraiture by Sargent and Gainsborough, among other works. And then there is what is actually the centerpiece of the facility, the library. Only a small part of the collection is on display, but what is there is amazing -- from fabulous illuminated manuscripts to a Gutenberg Bible to a number of signature historical documents. As icing on the cake, there is the chance to walk through a couple of great mansions with a good part of the original furnishings intact.

The closest analog I can come up with is the Getty. The Getty gets top billing in many LA must-do lists, and I can tell you that the Huntington blows the Getty away. Sure, you should see the Getty, but I have never had a desire to go back. I will be back to the Huntington as soon as I can.

I could fill this post with pictures, but I will simply provide a few teasers:

US Trade Deficit: Foreigners Are Consuming US Goods, But Consuming Them in the US (So They Don't "Count" As An Export)

Greg Ip writes that “The U.S. runs a trade deficit because it consumes more than it produces while its trading partners, collectively, do the opposite” (“How the Tax Cut President Trump Loves Will Deepen Trade Deficits He Hates,” April 19).

Here is how I like to explain why this is wrong. The trade deficit exists in large part because foreigners are more likely to consume the American-made goods and services they buy right here in the US, rather than take them back to their home country, while US consumers tend to bring foreign goods back to America to consume them. Let me unpack this.

First, over any reasonable length of time, payments between countries are going to balance. If this were not true, there would be some mattress in China that has trillions of dollar bills stuffed in it, and no reasonable person nowadays just lets money sit around lying fallow. There are some payments between countries for each others' goods. And there are some payments for each others' services. And there are some payments for various investments. All these ultimately balance, which makes fixating on just one part of this circular flow, the payments for physical goods, sort of insane. If we have a trade "deficit" in physical goods, then we must have a trade surplus in services (which we do) and in investments (which we do) to balance things out.

But what do we mean by an investment surplus? It means that, for example, folks from China are spending more money in the US for things like real estate and buildings and equipment -- either directly or through purchases of American equity and debt securities -- than US citizens are buying in China. But note that another name for investment is just stuff that foreigners buy in this country that stays in this country and they don't take back home. If a Chinese citizen buys a house in Los Angeles (something that apparently happens quite a bit), that is just as much "consumption" as when I buy a TV made in China. But unlike my TV purchase (which counts as an import), because of the arbitrary way trade statistics are calculated, selling a Chinese citizen a house in LA does not count as an export because they keep and use the house here. Let's say one Chinese person sells 10,000 TV's to Americans, and then uses the proceeds to build a multi-million dollar house in Hawaii. This would show up as a huge trade deficit, but there is no asymmetry of consumption or production -- Chinese and American citizens involved in this example are producing and consuming the same amounts. The same is true when the Chinese build a manufacturing plant here. Or when then invest capital in a company like Tesla and it builds a manufacturing plant here.

Our bizarre fixation on the trade deficit number would imply that, if trade deficits are inherently bad, then we would be better off if the Chinese person who bought the house in LA dismantled it and then shipped the material back to China. Then it would show up as an export. Same with the factory -- if we fixated on reducing the trade deficit then we should prefer that the Chinese buy the equipment for their factory here but have it all shipped home and built in China rather than built here. Is this really what you want?

I am willing to concede one exception -- when Chinese use trade proceeds to buy US government debt securities. This is where my lack of formal economics training may lead me astray, but I would say that the US government is the one major American institution that is able to consume more than it produces. Specifically, by running enormous deficits it is able to -- year in and year out -- allow people to consume more than they produce. Trade proceeds from foreigners that buy this debt in some sense help subsidize this.

However, I don't think one can blame trade for this situation. Government deficits are enabled by feckless politicians who pander to the electorate in order to be re-elected, a dynamic that has little to do with trade. I suppose one could argue that by increasing the demand for government securities, foreigners are reducing the cost of debt and thus perhaps enabling more spending, though I am not sure politicians are at all price sensitive to interest rates when they run up debt -- as a minimum their demand curve is really, really steep. There is a relation between government borrowing and trade but the relationship is reversed -- Increased borrowing will tend, all things being equal, to increase the value of the dollar which will in turn make imports cheaper and exports more expensive, perhaps increasing the trade deficit.

Thank God We Don't Have Cable Neutrality

Time Warner Cable, the owners of the Dodgers local broadcast rights is continuing to battle with local cable channels to be added to their cable package. Like last year, it appears that no deal will be forthcoming and the Dodgers (and perhaps more disheartening, Vin Scully in his last year) won't be on many TV sets this summer in LA. Kevin Drum essentially says bravo to the cable companies for opposing the Dodgers bid to jack up basic cable rates in the area.

Boo hoo. They tried everything—everything, I tell you. Except, of course, for the one thing that would have worked: the right to make the Dodgers an extra-cost option, not part of basic cable. Most cable operators see no reason that every television viewer in the LA basin should have to pay 60 bucks a year more in cable fees regardless of whether or not they care about baseball.

And that's the one thing TWC won't do. Why? Because then it will become crystal clear just how few households actually care enough about the Dodgers to pay for them. And that would truly be a disaster beyond reckoning. There's a limit to the amount of sports programming that people are willing to have crammed down their throats!

I actually agree with him, and will add that it is always great to see a progressive acknowledge consumers do actually exercise accountability on businesses.

But I will observe that had we adopted cable neutrality rules** as we have for net neutrality, the cable companies would have found it impossible, or at least much more difficult, to oppose carriage by a pushy and expensive content provider. It is this sort of intra-supply-chain tug of war that generally benefits consumers in the long run (as it has in LA, at least for Drum) that is essentially outlawed by net neutrality rules which basically declare content providers the victors by default. As I wrote before:

Net Neutrality is one of those Orwellian words that mean exactly the opposite of what they sound like. There is a battle that goes on in the marketplace in virtually every communication medium between content creators and content deliverers. We can certainly see this in cable TV, as media companies and the cable companies that deliver their product occasionally have battles that break out in public. But one could argue similar things go on even in, say, shipping, where magazine publishers push for special postal rates and Amazon negotiates special bulk UPS rates.

In fact, this fight for rents across a vertical supply chain exists in virtually every industry. Consumers will pay so much for a finished product. Any vertical supply chain is constantly battling over how much each step in the chain gets of the final consumer price.

What "net neutrality" actually means is that certain people, including apparently the President, want to tip the balance in this negotiation towards the content creators (no surprise given Hollywood's support for Democrats). Netflix, for example, takes a huge amount of bandwidth that costs ISP's a lot of money to provide. But Netflix doesn't want the ISP's to be be able to charge for this extra bandwidth Netflix uses - Netflix wants to get all the benefit of taking up the lion's share of ISP bandwidth investments without having to pay for it. Net Neutrality is corporate welfare for content creators....

I am still pretty sure the net effect of these regulations, whether they really affect net neutrality or not, will be to disarm ISP's in favor of content providers in the typical supply chain vertical wars that occur in a free market. At the end of the day, an ISP's last resort in negotiating with a content provider is to shut them out for a time, just as the content provider can do the same in reverse to the ISP's customers. Banning an ISP from doing so is like banning a union from striking.

** Footnote: OK, we sortof did have cable neutrality in one respect -- over the air broadcasters were able to obtain crony legislation that cable companies had to carry every locally broadcast channel. So that channel 59 that you never bothered to watch now get's equal treatment with the NBC affiliate. This was a huge boon for these stations, and the value of these often tiny stations exploded with this must-carry rule. Essentially they were given an asset for free, ie position in a cable lineup, that other competitors had to fight for.

Al Gore, as an aside, actually became rich with exactly this game. It is hard to fight your way into a cable lineup nowadays. Al Gore did it with this Current TV startup based on his name and a promise of a sort of MTV for politics. The channel went nowhere and lost a lot of money, but it now had one valuable asset -- placement in cable TV lineups. So it sold this asset to Al Jazzera, which had struggled to get placement.

Warren Meyer Speaking in LA on Lukewarmer Climate Position on Wednesday, February 24 -- Come See Me!

I am speaking on Wednesday night at the Athenaeum at Claremont-McKenna College near Pomona on Wednesday, February 24. It is open to the public and is free. Come by a say hi if you are in the area. You can just walk in to the presentation which begins at 6:45 but if you want to attend the pre-dinner at 5:30, there is a $20 charge and you need to reserve a spot by calling 909-621-8244.

I really hope if you are in the LA area you will come by. The presentation is about 45 minutes plus a Q&A afterwards.

One of My Favorite Web Sites Coming to An End

Scouting New York is coming to an end, as the proprietor appears to be moving up from film location scouting to perhaps writing and producing his own films in LA. For which I wish him luck. But I will miss his long posts on quirky and interesting New York City locations. His archives are still there, and fans of NYC or urban architecture in general are encouraged to look at his past work.

But of course, he just started Scouting LA

CA Labor Commission Has Just Killed Uber, Though It May Take Years to Bleed Out

A while back I wrote a long article about all the ways the government is making it nearly impossible to employ low-skilled labor. I worried that because it is getting harder and harder to profitably employ low-skill labor, the country would soon sort itself into those with skills and jobs and those on government assistance, with little or no opportunity for people in the second category to move to the first.

As part of that article, I observed that much of the capital in this country is flowing to new business models that use minimal numbers of employees. I wrote:

Is it any surprise that most entrepreneurs are pursuing business models where they leverage revenues via technology and a relatively small, high-skill workforce? Uber and Lyft at first seem to buck this trend, with their thousands of drivers. But in fact they prove the rule. Uber and Lyft are very very careful to define themselves and their service in a way that all those drivers don't work for them. I would go so far to say that if Uber were forced to actually put all of those drivers on their payroll, and deal with they myriad of labor compliance issues, their model would fall apart.

Well, we are going to find out if my last statement is true.

The California labor commission has ruled that an Uber driver qualifies as an employee, not a contractor, of the company. As a result Uber will have to reimburse a driver for expenses accumulated in the line of duty. That includes $256 in tolls and the IRS rate of $0.56 per mile for use of a personal vehicle for business purposes.

The actual issue in this case of reimbursement of expenses is pretty narrow, and actually kind of stupid. Uber is already paying drivers effectively by the mile by giving them a percentage of the mileage-based fee customers pay. All this will do is cause Uber to reduce the share of revenues drivers get by something like 56 cents a mile and then hand the $0.56 to them in a separate check. Its an extra accounting and paperwork hassle, but business people deal with mitigating such government-imposed stupidity 10 times a day.

No, the real danger of this ruling lies far beyond expense reimbursement. A few top of head thoughts

- This would obviously make Uber drivers subject to minimum wage. How does one even figure that out? Now that there are local minimum wages (e.g. LA soon to be $15 an hour) how do you compute minimum wage for a trip that begins outside of LA but ends inside the city? Or vice versa?

- Uber drivers currently only get paid for transporting passengers, but what about their time driving around waiting for a passenger? Will that be classified as standby time for which the employer must pay for? You can expect the standby time class action in California in 3..2..1..

- This changes the whole relationship between Uber and its drivers. Currently, Uber does not have to worry about driver productivity or work ethic, as long as they get good customer ratings when they do drive. Why? Because Uber is not paying them except when they haul a passenger. Now, if they have to pay them by the hour, Uber suddenly must police them for productivity and set minimum revenue generation targets for drivers. The flexibility that drivers love will be gone.

- And then there is Obamacare. If drivers drive more than 29 hours a week, Uber would have to provide health care or pay really expensive penalties. Will Uber find it necessary, as my company has and many other service businesses have, to cap driver hours at 29 hours a week max?

- What about California break law? Employers have an affirmative duty to make sure employees take a 30 minute unpaid meal break after X hours. And just allowing for it (ie allowing drivers to put themselves in unavailable status) is not enough - employers have to have processes and documentation in place to make sure the employee takes their break (I kid you not).

- What about CalOSHA? Is Uber suddenly responsible for working conditions and safety in the vehicle? And how does it do that if it does not own the vehicle?

- Every employee is essentially his or her own manager. Does that now make Uber subject to ensuring every driver has all state-mandated manager training, such as sexual harassment training?

- Employers are typically liable for actions by their employees, even if those employees are breaking the rules and ignoring the employer's wishes. Is Uber now liable for a driver who, say, verbally harasses a passenger? In the past, that gets sorted out pretty fast by the rating system, but does Uber have to take a more direct hand now do avoid a deluge of lawsuits?

- As of July 1, California employers must provide paid sick leave to employees. They must provide unpaid leave under the family and medical leave acts. In fact, California requires employers provide and track literally dozens of forms of mandatory paid and unpaid leave (including leave for victims of stalkers, just as one example of the scope of these requirements)

- The taxes and required fees owed by employers for each employee are myriad. State and Federal income tax must be withheld, Social Security and Medicare taxes paid, California state disability tax paid, unemployment tax paid, and workers compensation premiums paid.

- Unemployment could be real nightmare. Can drivers choose to drive for a while, then take unemployment for a while, maybe while tourist season in San Francisco is slow, then go back to driving? You think that can't happen? A number of my seasonal employees work in the summer, then take unemployment all winter despite having no intention of trying to find work in the winter. I pay 7% of wages in California as unemployment taxes and would pay more except that scale is capped and I can't get in a worse category than my current F-.

- Then there are a myriad of smaller issues that probably can be solved but consume bandwidth of a company's management that would otherwise be innovating. As one small example, one has to post about 20 different state and Federal labor posters in CA where all employees can see them. Where would that be for Uber drivers?

Listening to California Parks People Discuss Climate Change

Some random highlights:

- I watched a 20 minute presentation in which a woman from LA parks talked repeatedly about the urban heat island being a result of global warming

- I just saw that California State Parks, which is constantly short of money and has perhaps a billion dollars in unfunded maintenance needs, just spent millions of dollars to remove a road from a beachfront park based solely (they claimed) based on projections that 55 inches of sea level rise would cause the road to be a problem. Sea level has been rising 3-4mm a year for over 150 years and even the IPCC, based on old much higher temperature increase forecasts, predicted about a foot of rise.

- One presenter said that a 3-5C temperature rise over the next century represent the low end of reasonable forecasts. Most studies of later are showing a climate sensitivity of 1.5-2.0 C (I still predict 1C) with warming over the rest of the century of about 1C, or about what we saw last century

- I watched them brag for half an hour about spending tons of extra money on make LEED certified buildings. As written here any number of times, most LEED savings come through BS gaming of the rules, like putting in dedicated electric vehicle parking sites (that do not even need a charger to get credit). In a brief moment of honesty, the architect presenting admitted that most of the LEED score for one building came from using used rather than new furniture in the building.

- They said that LEED buildings were not any more efficient than most other commercial buildings getting built, just a matter of whether you wanted to pay for LEED certification -- it was stated that the certification was mostly for the plaque. Which I suppose is fine for private businesses looking for PR, but why are cash-strapped public agencies doing it?

Apparently, Corporations Are Not Investing Because They Are Not "Socially Engaged"

Paul Roberts has an editorial in the LA Times that sortof, kindof mirrors my post the other day that observed that corporate stock buybacks (and investments to reduce tax rates) were likely signs of a bad investment climate. Until he starts talking about solutions

Roberts begins in a similar manner

Here's a depressing statistic: Last year, U.S. companies spent a whopping $598 billion — not to develop new technologies, open new markets or to hire new workers but to buy up their own shares. By removing shares from circulation, companies made remaining shares pricier, thus creating the impression of a healthier business without the risks of actual business activity.

Share buybacks aren't illegal, and, to be fair, they make sense when companies truly don't have something better to reinvest their profits in. But U.S. companies do have something better: They could be reinvesting in the U.S. economy in ways that spur growth and generate jobs. The fact that they're not explains a lot about the weakness of the job market and the sliding prospects of the American middle class.

I suppose I would dispute him in his implication that there is something unseemly about buybacks. They are actually a great mechanism for economic efficiency. If companies do not have good investment prospects, we WANT them returning the cash to their shareholders, rather than doing things like the boneheaded diversification of the 1960's and 1970's (that made investment bankers so rich unwinding in the 1980's). That way, individuals can redeploy capital in more promising places. The lack of investment opportunities and return of capital to shareholders is a bad sign for investment prospects of large companies, but it is not at all a bad sign for the ethics of corporate management. I would argue this is the most ethical possible thing for corporations to do if they honestly do not feel they have a productive use for their cash.

The bigger story here is what might be called the Great Narrowing of the Corporate Mind: the growing willingness by business to pursue an agenda separate from, and even entirely at odds with, the broader goals of society. We saw this before the 2008 crash, when top U.S. banks used dodgy financial tools to score quick profits while shoving the risk onto taxpayers. We're seeing it again as U.S. companies reincorporate overseas to avoid paying U.S. taxes. This narrow mind-set is also evident in the way companies slash spending, not just on staffing but also on socially essential activities, such as long-term research or maintenance, to hit earnings targets and to keep share prices up....

It wasn't always like this. From the 1920s to the early 1970s, American business was far more in step with the larger social enterprise. Corporations were just as hungry for profits, but more of those profits were reinvested in new plants, new technologies and new, better-trained workers — "assets" whose returns benefited not only corporations but the broader society.

Yes, much of that corporate oblige was coerced: After the excesses of the Roaring '20s, regulators kept a rein on business, even as powerful unions exploited tight labor markets to win concessions. But companies also saw that investing in workers, communities and other stakeholders was key to sustainable profits. That such enlightened corporate self-interest corresponds with the long postwar period of broadly based prosperity is hardly a coincidence....

Without a more socially engaged corporate culture, the U.S. economy will continue to lose the capacity to generate long-term prosperity, compete globally or solve complicated economic challenges, such as climate change. We need to restore a broader sense of the corporation as a social citizen — no less focused on profit but far more cognizant of the fact that, in an interconnected economic world, there is no such thing as narrow self-interest.

There is so much crap here it is hard to know where to start. Since I work for a living rather than write editorials, I will just pound out some quick thoughts

- As is so typical with Leftist nostalgia for the 1950's, his view is entirely focused on large corporations. But the innovation model has changed in a lot of industries. Small companies and entrepreneurs are doing innovation, then get bought by large corporations with access to markets and capital needed to expanded (the drug industry increasingly works this way). Corporate buybacks return capital to the hands of individuals and potential entrepreneurs and funding angels.

- But the Left is working hard to kill innovation and entrepreneurship and solidify the position of large corporations. Large corporations increasingly have the scale to manage regulatory compliance that chokes smaller companies. And for areas that Mr. Roberts mentions, like climate and green energy, the government manages that whole sector as a crony enterprise, giving capital to political donors and people who can afford lobbyists and ignoring everyone else. "Socially engaged" investing is nearly always managed like this, as cronyism where the politician you held a fundraiser for is more important than your technology or business plan. *cough* Solyndra *cough*

- One enormous reason that companies are buying back their own stock is the Federal Reserve's quantitative easing program, which I would bet anything Mr. Roberts fully supports. This program concentrates capital in the hands of a few large banks and corporations, and encourages low-risk financial investments of capital over operational investments

- All those "Social engagement" folks on the Left seem to spend more time stopping investment rather than encouraging it. They fight tooth and nail the single most productive investment area in the US right now (fracking), they fight new construction in many places (e.g. most all places in California), they fight for workers in entrenched competitors against new business models like Lyft and Uber, they fight every urban Wal-Mart that attempts to get built. I would argue one large reason for the lack of operational investment is that the Left blocks and/or makes more expensive the investments corporations want to make, offering for alternatives only crap like green energy which doesn't work as an investment unless it is subsidized and you can't count on the subsidies unless you held an Obama fundraiser lately.

- If corporations make bad investments and tick off their workers and do all the things he suggests, they get run out of business. And incredibly, he even acknowledges this: "And here is the paradox. Companies are so obsessed with short-term performance that they are undermining their long-term self-interest. Employees have been demoralized by constant cutbacks. Investment in equipment upgrades, worker training and research — all essential to long-term profitability and competitiveness — is falling." So fine, the problem corrects itself over time.

- He even acknowledges that corporations that are following his preferred investment strategy exist and are prospering -- he points to Google. Google is a great example of exactly what he is missing. Search engines and Internet functionality that Google thrives on were not developed in corporate R&D departments. I don't get how he can write so fondly about Google and simultaneously write that he wishes, say, US Steel, were investing more in R&D. I would think having dinosaur corporations eschew trying to invest in these new areas, and having them return the money to their shareholders, and then having those individuals invest the money in startups like Google would be a good thing. But like many Leftists he just can't get around the 1950's model. At the end of the day, entrepreneurship is too chaotic -- the Left wants large corporations that it can easily see and control.

Obamacare Newly Insured Numbers Miss by at least 50% vs. Projections

With our new prosthetic memory, called the Internet, it should be easy to go back and look at past predictions and see how well those predictions played out. Heck, sports talk radio hosts do it all the time, comparing their beginning of season predictions with what actually happened. But no one ever seems to hold the government or politicians similarly accountable.

Here is one I found by accident. In July of 2011, Kevin Drum quotes this prediction from the CMS (Center for Medicare and Medicaid Services, a government agency).

In 2014, the Affordable Care Act will greatly expand access to insurance coverage, mainly through Medicaid and new state health insurance exchanges which will facilitate the purchase of insurance. The result will be an estimated 22.9 million newly insured people.

In March of 2014 Kevin Drum quotes this from the LA Times

As the law's initial enrollment period closes, at least 9.5 million previously uninsured people have gained coverage. Some have done so through marketplaces created by the law, some through other private insurance and others through Medicaid, which has expanded under the law in about half the states.

The tally draws from a review of state and federal enrollment reports, surveys and interviews with insurance executives and government officials nationwide.

....Republican critics of the law have suggested that the cancellations last fall have led to a net reduction in coverage. That is not supported by survey data or insurance companies, many of which report they have retained the vast majority of their 2013 customers by renewing old policies, which is permitted in about half the states, or by moving customers to new plans.

This is presented as a great victory, but in fact it is nearly 60% below expectations of less than two years earlier. We don't know the final number. Drum, who should be expected to be on the optimistic end of projections, has upped his estimate to 11-13 million, but this is still barely half what was expected. The disastrous Obamacare exchange rollout did one thing at least -- it hammered expectations so low that even a 50% miss is considered a great victory.

Is Their a Guinsess Record for the Longest Correction?

This correction by Michel Taylor of something called the Australian Independent Media Network has got to be the longest correction in history. You know it is an incredible correction when this is just a tiny part of the errors admitted:

- Evans does not believe, and has never believed, that 9/11 was an inside job perpetrated by the Rothschild family, that US President Barack Obama is a secret Jew, that the Holocaust never happened or that Jewish bankers and the Rothschild family have assassinated at least two US Presidents.

The author also admits to getting Evans' education, occupation, organization, and sources of funding wrong.

In part I suppose kudos are owed to Mr. Taylor for being so honest, but seriously, how can one be so comprehensively wrong? (I will actually explain why in a minute). The correction runs on so long in part because he Taylor also has to correct an earlier correction where he blamed one of his original sources for being intentionally misleading. He also apologizes for that.

I would likely have posted this anyway just because it is sort of funny. But it just so happens to tie into what I wrote yesterday here. Because it is clear that Mr. Taylor's core mistake is that he researched the positions of a climate skeptic (Mr. Evans) solely by asking climate alarmists (and climate alarmist web sites) what this skeptic believed. He felt no need to hear the skeptic case from the skeptic himself. And what do you know, the descriptions of Mr. Evans' beliefs as portrayed by his ideological enemies were full of errors, exaggerations, straw men, and outright lies. Who would have thought?

We can laugh at Mr. Taylor, but at least he admitted his mistakes in great depth. But outlets such as the LA Times and the BBC have recently made it a rule they will never allow skeptic voices into their reporting. They have institutionalized Mr. Taylor's mistake.

A Milestone to Celebrate: I Have Closed All My Businesses in Ventura County, California

Normally, the closure of a business operation or division is not grounds for a celebration, but in this case I am going to make an exception. At midnight on December 31, I not only drank a toast to the new year, but also to finally getting all my business operations out of Ventura County, California.

Never have I operated in a more difficult environment. Ventura County combines a difficult government environment with a difficult employee base with a difficult customer base.

- It took years in Ventura County to make even the simplest modifications to the campground we ran. For example, it took 7 separate permits from the County (each requiring a substantial payment) just to remove a wooden deck that the County inspector had condemned. In order to allow us to temporarily park a small concession trailer in the parking lot, we had to (among other steps) take a soil sample of the dirt under the asphalt of the parking lot. It took 3 years to permit a simple 500 gallon fuel tank with CARB and the County equivilent. The entire campground desperately needed a major renovation but the smallest change would have triggered millions of dollars of new facility requirements from the County that we simply could not afford.

- In most states we pay a percent or two of wages for unemployment insurance. In California we pay almost 7%. Our summer seasonal employees often take the winter off, working only in the summer, but claim unemployment insurance anyway. They are supposed to be looking for work, but they seldom are and California refuses to police the matter. Several couples spend the whole winter in Mexico, collecting unemployment all the while. So I have to pay a fortune to support these folks' winter vacations.

- California is raising minimum wages over the next 2 years by $2. Many of our prices are frozen by our landlord based on past agreements they have entered into, so we had no way to offset these extra costs. At some point, Obamacare will stop waiving its employer mandate and we will owe $2000-$3000 extra additional for each employee. There was simply no way to support these costs without expanding to increase our size, which is impossible (see above) due to County regulations.

- A local attorney held regular evening meetings with my employees to brainstorm new ways the could sue our company under arcane California law. For example, we went through three iterations of rules and procedures trying to comply with California break law and changing "safe" harbors supposedly provided by California court decisions. We only successfully stopped the suits by implementing a fingerprint timekeeping system and making it an automatic termination offense to work through lunch. This operation has about 25 employees vs. 400 for the rest of the company. 100% of our lawsuits from employees over our entire 10-year history came from this one site. At first we thought it was a manager issue, so we kept sending in our best managers from around the country to run the place, but the suits just continued.

- Ask anyone in the recreation business where their most difficult customers are, and they likely will name the Los Angeles area. It is impossible to generalize of course, because there are great customers from any location, but LA seems to have more than its fair share of difficult, unruly, entitled customers. LA residents are, for example, by far the worst litterers in the country, at least from our experience. Draw a map of California with concentric circles around LA and the further out one gets, the lower the litter clean-up costs we have. But what really killed it for me in Ventura County was the crazy irresponsible drinking and behavior. Ventura County is the only location out of nearly 200 in the country where we had to hire full-time law enforcement help to provide security. At most locations, we would get 1 arrest every month or two (at most). In Ventura we could get 5-10 arrests a day. In the end, I found myself running a location where I would never take my own family.

And so I got out. Hallelujah.

PS- People frequently talk about taxes in California being what makes the state "anti-business." That may be, but I guess I never made enough money to have the taxes really bite. But taxes are only a small part of the equation.

Update: Wow, reading this again, I left out so much! An employee once sued us at this location for harassment and intimidation by her manager -- when the manager was her sister! It cost me over $20,000 in legal expenses to get the case dismissed. I had an older couple file a state complaint for age discrimination when they were terminated -- despite the fact that our entire business model is to hire retired people and the vast majority of our employees are 70 and older. And how could I have forgotten the process of getting a liquor license? I suppose I left it out because while tedious (my wife and I had to fly to California to get fingerprinted, for example), it is not really worse than in other places -- liquor license processes are universally bad, a feature and not a bug for the established businesses one is trying to compete with. We gave the license up pretty quickly, when we saw how crazy and irresponsible much of the customer base was. Trying to make the place safer and more family friendly, we banned alcohol from the lake area, and faced a series of lawsuit threats over that.

Binge Listening 2013

I find it almost impossible to keep up with all the great music that has been enabled by digital distribution. So I end up waiting for year-end best lists and then binge listening for a few days. One of the lists I have come to trust as fitting my tastes pretty well is from LA writer and Coyote Blog reader Steven Humphries. Here is his 2013 list. I will echo that I really enjoyed the new Steven Wilson album,which I have had for a while based on his recommendation. But I had never heard of Vertical Horizon and particularly enjoyed their album on the list.

By the way, this is not 2013-related, but if there are those of you out there who are 60's, 70's, 80's classic rock guys who struggle to engage with rap, a fantastic gateway drug is Girl Talk. Their All Day album can be downloaded free. This is the only modern album in my household that migrated from me to my kids rather than vice versa.

Single-Minded Obsession on Home Ownership

This article from the LA Times confused me greatly:

Advocates for borrowers took such comments to mean that the banks would prioritize debt write-downs on first mortgages, which banks resisted before the [$25 billion] settlement. Now, with nearly all the promised relief handed out, it is clear that the banks had other ideas.

The vast majority of the aid to borrowers, it turns out, came in the form of short sales and forgiveness of second mortgages. Just 20% of the aid doled out under the national settlement went to forgiveness of first-mortgage principal, the kind of help most likely to keep troubled borrowers in their homes. In terms of borrowers helped, just 15% of the total received first-mortgage forgiveness.

The five banks collectively delivered twice as much aid using short sales, in which owners sell their homes for less than the amount owed and move out, with the shortfall forgiven.

In all, the lenders sought credit for nearly $21 billion related to short sales and $15 billion related to second mortgages. That compares with $10.4 billion in write-downs on first mortgages.

Critics on the Left (example) are calling this a failure of the program, that most of the relief went to short-sales and 2nd mortgage forgiveness rather than first mortgage forgiveness. The original article has this quote:

"It just shows you that the banks are running the government," Marks said. "There's virtually no benefit to borrowers, and yet you give the banks credit for short sales and getting second liens wiped out — something they were going to have to do anyway."

Hmm, well I am not the biggest fan of bankers in the world, but short sales and second lien forgiveness are principle forgiveness as well, just of a different form. If they wanted a settlement that was first-lien forgiveness only, they should have specified that.

In fact, both short sales and second lien forgiveness have tremendous value to individuals if one considers individual well-being one's goal rather than just this obsessive fixation on home ownership.

For many people, the worst part of their negative equity is that it created a barrier to their moving. Perhaps they could find a job in another part of the state or country, or they wanted to move into a home or apartment with less expensive payments but were stuck in their current home because they could not afford to bring tens of thousands of dollars to closing. In such cases, a short sale is exactly what the homeowner needs and facilitating and expediting this likely helped a ton of people (It is also an example of just how unique our mortgage rules are in the US -- in almost any other country in the world, the amount of the negative equity in a short sale would get hung on the seller as a lien that must be paid off over time. Only in the US do buyers routinely walk away clean from such situations). Given that first mortgage loan forgiveness more often than not does not save the loan (ie it eventually ends in foreclosure anyway), short sales are the one approach that lets lenders get away clean for a fresh start.

As for second mortgages, I can tell you from personal experience that it is virtually impossible in the current environment to restructure or refinance a first mortgage with a second lien on the house -- even in my case where everything is performing and the underlying home value is well above the total of the two liens. Seriously, what is the point in reducing principle in the first mortgage if there is a second mortgage there, particularly when the second mortgage is likely far more expensive? For people with a second mortgage, forgiveness of that is probably the first and best gift they could get. They may end up still losing their home, but they can't even begin to discuss a restructure or refinance without that other mortgage going away.

Using the the Criminal Activity that Results from Prohibition to Justify Prohibition

Apparently, Los Angeles has tough anti-ticket scalping laws. This means that one is able to resell virtually any item one owns but no longer has a use for except tickets. In this case, government officials yet again don't like someone who places little value on an item selling it to someone who places more value on that item (a concept that is otherwise the basis for our entire economy). We can see the effect of such laws in London, where stadiums full of empty seats are juxtaposed against thousands who want to attend but can't get tickets, all because for some reason we have decided we don't like the secondary market for tickets.

A great example is embedded in this line in today's LA Times about crackdowns on scalping:

Jose Eskenazi, an associate athletic director at USC, said the university distributed football and basketball tickets free to several children's community groups but that scalpers obtained those tickets and sold them "at enormous profits."

I like the coy use of "obtained" in this sentence. Absent a more direct accusation, I have to assume that this means that scalpers bought the tickets from the community groups. Which likely means that strapped for cash to maintain their operations, these groups valued cash from the tickets more that the ability to send kids to a USC football game (in fact, taking them to a USC football game would involve extra costs to the community group of transportation, security, and feeding the kids at inflated stadium prices). It was probably entirely rational for the community groups to sell the tickets -- this is in fact a positive story. Selling the tickets likely got them out of an expensive obligation they could not afford and generated resources for the agency. Sure, USC was deprived of the PR boost, but if they really want the kids to come to the game, they can do it a different way (e.g. by organizing the entire trip). This is not a reason for curtailing my right to sell my tickets for a profit.

Anyway, I have ranted about this before. Sports team owners and music promoters have out-sized political influence (particularly in LA) and have enlisted governments to clamp down on the secondary markets for their products.

What I thought was new and interesting in this LA Times story was the evolving justification for banning ticket scalpers. Those who have followed the war on drugs or prostitution will recognize the argument immediately:

Lee Zeidman, general manager of Staples Center/Nokia Theatre and L.A. Live, said in a separate declaration that scalpers "frequently adopt aggressive and oftentimes intimidating tactics.... To the extent that ticket scalpers are allowed to create an environment that makes guests of ours feel uncomfortable, harassed or threatened, that jeopardizes our ability to attract those guests to our property."

In court papers, prosecutors accuse scalpers of endangering citizens, creating traffic hazards and diverting scarce police resources.

"Defendants personally act as magnets for theft, robbery, and crimes of violence," the filing states. "Areas with high levels of illegal ticket sales have disproportionately high levels of theft, robbery, crimes of violence and narcotics sales and use."

Wow, you mean that if we criminalize a routine type of transaction, then criminals will tend to dominate those who engage in this transaction? Who would have thought? If this were true, we might expect activities that normally are run by normal, honest participants -- say, for example, alcohol distribution -- to be replaced with gangs and violent criminals if the activity is prohibited.

It's amazing to me that people can still use the the criminal activity that results from prohibition to justify prohibition.

Update: John Stossel has an article on the London ticket scalping ban

LA Traffic Bleg

OK, I have to drive on Thursday from San Diego to make a meeting around 10AM just north of LA off I-5. I am willing to believe that there is no good way across town this time of day, and the only reasonable approach is to leave early and bring emergency rations. However, if anyone has any advice as to the best way to thread my way south to north through LA during morning rush hour, leave a comment.

Update: Thanks everyone. I actually have to be in Ventura County via Santa Clarita so I will probably take the 15 and go around. I also decided to take my (teenage) kids along to get the carpool lane. Going to ditch them at Magic Mountain (not a bad fate) as I pass by. I have my iPad charged with traffic, and will just get up early.

YouTube Mysteries

Via my daughter. It's a suckers game to try to analyze what is popular on YouTube, but the view count for this video is just staggering. It apparently also has about a thousand imitators. If I am going to watch a cover video, why wouldn't I rather one with LA cheerleaders? But I have to credit Harvard as a trendsetter. Who knew there could be a whole new genre of videos about lip syncing pop tunes in a moving passenger van?

When the Media Loses Its Skepticism - High Speed Rail Edition

I have said for a long time that I don't really think there is a lot of outright media bias in the sense of conspiring to bury or promote certain memes. But there are real issues with the leftish monoculture of the media losing its skepticism on certain topics.

For example, high speed rail is one of those things we are just supposed to do, from the Leftish view. Harry Reid's justification for a high speed rail line is typical: he wants to see "America catch up with the rest of the world". Everyone else has these things, so it must be some failing of ours that we don't. For the left, the benefits of high speed rail are a given, they are part of the liturgy and not to be questioned. Which means that it is up to outsiders to do the media's work of applying some degree of skepticism whenever a high speed rail project is proposed.

Thus we get to this article on high speed rail about a supposedly "private" rail line from LA to Las Vegas. As is usual in the media, none of the assumptions are questioned.

Greg Pollowitz gets at some of the more obvious problems. First, it is fairly heroic spin to call a line that currently is getting $4.9 billion in public subsidies "privately funded." Second, he points out that, like the proposed California high speed rail line, this is a train to nowhere as well

And second of all, having grown up in Los Angeles — and having lied to my parents to drive to Vegas since the time I was 16 years old — I consider myself somewhat of an expert on the Los Angeles to Vegas drive. (CNN, Fox, MSDNC — call me!) I remember Victorville fondly as the place where we’d make our food-stop and pick up some In-N-Out burgers for the final half of the journey. And I can tell you this: There is no way anybody would ever drive through L.A.’s notorious traffic only to stop halfway and hop on a train on the other side of the El Cajon Pass and in doing so give up their personal transportation once they actually get to Vegas.

I want to reality-check their usage numbers.

DesertXpress estimates that it will carry around five million round trip passengers in the first full year of operation,with the company charging fares of around $50 for a one-way trip.

OK, right now there are about 3.7 annual air passengers between Las Vegas and the southern California airports, according to rail supporters. It is hard to get at drivers, but the Las Vegas tourism folks believe that 25% of 36 million annual visitors to Vegas come from Southern California, so that would mean about 9 million total or about 5 million driving.

What this means is that to make this work, they are counting on more than half of all visitors from Southern California (and remember this includes San Diego) taking the train. Is this reasonable?

- The train is supposedly $50 (I will believe that when I see it). Currently JetBlue flies from Burbank to Las Vegas for $56 in a flight that takes 69 minutes (vs. 84 for the train and remember that is from Victorville). The standard rate from LAX, Burbank, or Long Beach seems to be around $74-77.

- Airplanes leave for Las Vegas from airports all around LA and in San Diego. Let's take a couple of locations. Say you live near downtown LA, not because that is likely but it is relatively central and does not feel like cherry picking. Victorville is a 84 mile 90 minute drive AT BEST, with no traffic. The Burbank airport is a 15 mile, 18 minute drive from LA. LAX is just a bit further. Victorville is 82 miles and 90 minutes from Irvine and 146 miles/144 minutes from San Diego. Both of these Southern California towns are just a few minutes from an airport with $70-ish flights to Vegas

So are drivers going to stop half way to Vegas, once they have completed the hard part of the drive, to get on a train? Are flyers going to drive 1-2 hours further to get to the rail terminal to say $20? Some will. But will more than half? No way.

Postscript: If you really want to promote the train, forget shoveling tax money at it and pass a law that the TSA may not set up screening operations at its terminus. That might get a few customers, though the odds this would happen, or that it would stick over time, are minuscule.

This Is How Screwed Up Our Concept of Health "Insurance" Has Become

Kevin Drum quotes favorably from Chad Terhune at the LA Times

Some insurers are chasing after much smaller customers with new plans designed to limit employer payouts for big claims using what's called stop-loss policies. This guarantees that businesses won't be responsible for anything over a certain amount per employee, perhaps as low as $10,000 or $20,000, with the rest paid by an insurer. Regulators and health-policy experts say this arrangement undercuts the notion of self-insurance since employers aren't bearing much of the risk, and it allows companies to circumvent some state insurance rules.

"This is not real self-insurance. This is clearly a sham," said Mark Hall, a professor of law and public health at Wake Forest University who has studied the small-business insurance market. "Regulators have good reason to be concerned about the potential harm to the market."

Self-insurance is attractive for many reasons, particularly the prospect of lower costs. It's exempt from state insurance regulations such as mandated benefits, granting employers the flexibility to design their own benefit package and the opportunity to reap some of the savings from employee wellness programs. A federal law, the Employee Retirement Income Security Act, or ERISA, governs self-funded plans. Some aspects of the Affordable Care Act do apply to self-insurance, such as the elimination of caps on lifetime benefits and some preventive care at no cost.

Yeah, it's a scam.

In a reasonably sane world, and in all other contexts outside of health care, insurance is obtained at relatively low prices to cover only catastrophic events that would be potentially bankrupting. Car insurance does not cover oil changes and home insurance does not cover oven repairs. So why is it that Drum is arguing that we should ban insurance policies that only cover catastrophic losses and not routine costs? After all, the second sentence in the first paragraph from the LA Times sure seems to define exactly what insurance should be (and is similar to my personal policy, which has a high deductible attached to a health savings account).

The problem is that when Drum and the Left use the word "health insurance" they are actually referring to a bundle of four items

- Traditional catastrophic insurance against large, unexpected, bankrupting charges

- Third party payment / capitation for entirely routine and expected health expenditures, from physicals to contraception

- Crony payoffs for favored constituencies, mainly via mandated benefits rules. This payoff may be to consumers, e.g. young women like Sandra Fluke who have the rest of us pay to maintain her sex life; or it may be to corporate cronies, who are able to get their particular device or procedure or service included in the mandated benefits, guaranteeing a large stream of customers who don't care a bit what the product or service costs because it is now paid for by a third party.

- Social engineering, in the form of embedded incentives to promote certain favored behaviors like seeking preventative care or eating better. And when the government is paying the bill, the policy becomes a Trojon horse for government micro-management of our lives in the name of health cost reduction.

The second item seems to be a paradigm embedded in the mind of everyone in the US today, that health plans somehow need to cover every imaginable health-related expense. Outside of an HMO model where these expenses are managed, this is a recipe for a cost explosion. If we all had pre-paid car policies that bought our cars for us with low deductibles, no one would be driving a seven-year-old Nova. The third and fourth items are Trojan horses for state control and cronyism that politicians are desperate to preserve. So it is not surprising that efforts to roll back insurance to just be, well, insurance is met with anger by would-be authoritarians. The question is, why do we listen to them?

Triumphalism Indeed

For years I have argued that most high-speed rail makes no sense economically -- that in fact it is an example of the political impulse towards triumphalism. Government leaders through the ages have wanted to use other people's money and sweat to build vast monuments to themselves that would last through the ages.

I meant that as ridicule, and assumed most readers would recognize it as such, but apparently not the LA Times, which editorialized in favor of California high speed rail in part because its just like the pyramids

Worthwhile things seldom come without cost or sacrifice. That was as true in ancient times as it is now; pharaoh Sneferu, builder of Egypt's first pyramids, had to try three times before he got it right, with the first two either collapsing under their own weight or leaning precipitously. But who remembers that now? Not many people have heard of Sneferu, but his pyramids and those of his successors are wonders of the world.

As a reminder, this is what I wrote at the article linked above in Forbes

What is it about intellectuals that seem to, generation after generation, fall in love with totalitarian regimes because of their grand and triumphal projects? Whether it was the trains running on time in Italy, or the Moscow subways, or now high-speed rail lines in China, western dupes constantly fall for the lure of the great pyramid without seeing the diversion of resources and loss of liberty that went into building it.

Los Angeles and Litter

The LA Times talks about the trash and litter cleanup at the OWS site in LA. For reasons I don't fully understand, the absolute worst trash and litter problems we have in running campgrounds around the country are around LA. For some reason, the closer a recreation area is to LA, the more trash we get dumped on the ground. Nowhere else in the country comes close.

Least Surprising Statistic

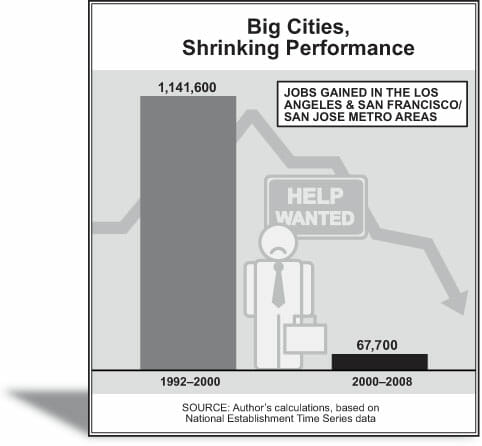

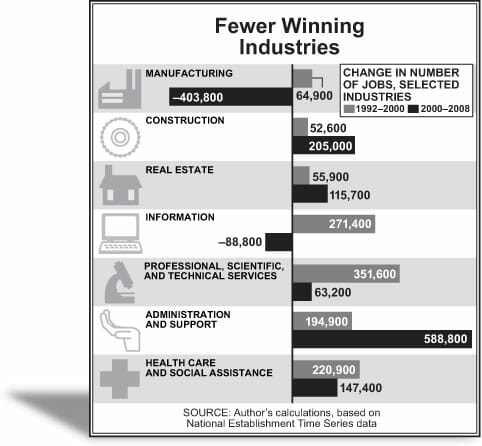

via here, which has a lot of good data on California job losses.

If you have a service business, I can understand the desire to get access to the large and wealthy populations in these areas. I even started a service operation in the LA area about 4 years ago, though I regret it intensely (other operations we have in rural CA are difficult but much easier than in LA). But even so, why would anyone ever, ever start a manufacturing or any other business in these locations if it could be located anywhere else?

I was at a cocktail party the other night lamenting to a number of business owners (more successful folks than I) about problems I am having in CA. Usually I get sympathy, but there was none to be had. They looked at me like I was a moron, like I was the guy who went $30,000 in debt for a puppetry degree. They said they had gotten out of CA years ago, would never go back, and (essentially) if I was stupid enough to be there, it was my own damn fault.

Unfortunately, a lot of the recreation is there, and for better or for worse, we have found that we are better and more efficient at dealing with a lot of the CA-induced mess than other companies. But I often wonder if I am crazy to be there.

PS- as an example, it took us 4-1/2 years to get a permit for a 1000 gallon double wall gas tank at a marina in Ventura County. We just got it approved last month, so at last we can stop hauling truckloads of 5-gallon fuel tanks from the gas station. We are in the third year of trying to get permitting approval to replace (in kind, same size and features) a bathroom building in a campground.

Update: All the job gains are in industries, like health care and construction, where the jobs have to be near the population served. Compare that to manufacturing and tech.

Are We Getting Anything Out of Transit Spending?

In the 2012 budget, the DOT will spend about $59.4 billion on highways and $30.2 billion on transit and rail (source). Highways are getting a smaller and smaller portion of what we think of as the Federal highway budget, with transit and rail spending almost 50% the size of highway spending. For what results?

Despite huge efforts to get people out of single-occupancy vehicles, nearly 8 million more people drove alone to work in 2010 than in 2000, according to data released by the Census Bureau. Wendell Cox’s review of the data show that the other big gainer was “worked at home,” which grew by nearly 2 million over the decade.

Transit gained less than a million, but transit numbers were so small in 2000 that its share grew from 4.6 percent to 4.9 percent of total workers. While drive alone grew from 75.6 percent to 76.5 percent, the big loser was carpooling, which declined by more than 2 million workers. As a result, driving’s share as a whole declined from 87.9 percent to 86.2 percent.

Though they get less money in absolute dollars, transit and rail have for years gotten wildly disproportionate amounts of money compared to their ridership. This is not an accident of timing -- rail and mass transit costs per passenger mile are simply way higher than for cars in all but a few very specific high-density urban areas.

Much of this Federal spending is a huge waste of money, made worse by the fact that local authorities who get this money have little incentive to use it wisely. Its time for the Feds to get out of the transit funding business. If LA wants more subways, let them pay for it.

Cloudy with 100% Chance of Corporate State

It does not appear that Rick Perry is the guy to dismantle our growing corporate state.

The LA Times investigates the big-money culture of Texas politics, which has gotten even bigger and money-er since Rick Perry became governor:

Perry has received a total of $37 million over the last decade from just 150 individuals and couples, who are likely to form the backbone of his new effort to win the Republican presidential nomination....Nearly half of those mega-donors received hefty business contracts, tax breaks or appointments under Perry, according to a Los Angeles Times analysis.

Perry, campaigning Monday at the Iowa State Fair in Des Moines, declined to comment when asked how he separated the interests of his donors from the needs of his state. His aides vigorously dispute that his contributors received any perks. "They get the same thing that all Texans get," said spokesman Mark Miner.

Nearly half! And this doesn't even include anything about David Nance and the largesse Perry distributes via his $200 million state-managed venture capital slush fund. Doling out political favors in industrial quantities is obviously something that isn't frowned upon by Texas political culture, and Perry has taken it to whole new levels.

Kudos to the LA Times and folks like Kevin Drum for digging this up, but everyone involved should be embarrassed by just how partisan outrage on this kind of thing can be. The same folks who are rightly upset at Perry actively cheered on Obama as he took ownership of GM away from the secured creditors and handed it to his major campaign supporters in the UAW. His stimulus program has been a trillion dollar slush fund to pay off nearly every liberal constituency, and while I find the idea of a state-run venture capital fund horrifying, I see no difference here with Obama's green job investments, many of which have gone triends, campaign supporters, and even spouses of prominent administration officials.

As I asked the other day, if the President is really supposed to be our VC in chief (an absurd thought) who in the hell would pick Obama for the job? As one random example out of my feed reader:

Last year, Seattle Mayor Mike McGinn announced the city had won a coveted $20 million federal grant to invest in weatherization. The unglamorous work of insulating crawl spaces and attics had emerged as a silver bullet in a bleak economy – able to create jobs and shrink carbon footprint – and the announcement came with great fanfare.

McGinn had joined Vice President Joe Biden in the White House to make it. It came on the eve of Earth Day. It had heady goals: creating 2,000 living-wage jobs in Seattle and retrofitting 2,000 homes in poorer neighborhoods.

But more than a year later, Seattle's numbers are lackluster. As of last week, only three homes had been retrofitted and just 14 new jobs have emerged from the program. Many of the jobs are administrative, and not the entry-level pathways once dreamed of for low-income workers. Some people wonder if the original goals are now achievable.

"The jobs haven't surfaced yet," said Michael Woo, director of Got Green, a Seattle community organizing group focused on the environment and social justice.

"It's been a very slow and tedious process. It's almost painful, the number of meetings people have gone to. Those are the people who got jobs. There's been no real investment for the broader public."

At the same time, heavily subsidized Evergreen Solar is going bankrupt.

Bloomberg News reports that the firm Evergreen Solar will file for bankruptcy and close its operation in Midland, Mich. The maker of solar cells cites over-capacity in the industry, competition from China and fewer government subsidies as contributing factors. According to Bloomberg, the firm has 133 employees worldwide.

Given a Michigan location and participation in a politically faddish industry, readers won't be surprised that Evergreen was the beneficiary of special state subsidies and a local tax break. Specifically, three years ago Evergreen Solar was offered a $1.8 million "refundable" tax credit by the Michigan Economic Growth Authority. For firms with little or no tax liability, this amounts to an outright cash subsidy, contingent on attaining certain employment and investment milestones. Evergreen Solar's specific tax liability is not public information.

The deal was based on crystal-ball projections from the Michigan Economic Development Corporation using a software program known as REMI, which predicted that an Evergreen deal would create exactly 596 direct and "spin-off" jobs by 2018, producing $18.5 million in new state tax revenue.

The city of Midland also granted property tax abatements worth $3.9 million over 12 years, according to Mlive.com. It's not known how much, if any, of these subsidies and tax breaks were ever collected by the company.

This actually understates the total subsidies, as it ignores subsidies to its customers, incoluding above market geed-in tariffs, to buy the solar panels.

Closer to home, a Tucson solar panel manufacturer that was opened to great fanfare with the help of Janet Napolitano and Gabby Giffords just closed after being open barely 2 years. They scored some subsidies, got some large government and utility contracts on the promise of local employment, and then packed up shop for China. Apparently they were attempting to compete in the commodity solar panel market on a strategy of having a higher fit and finish on their product, a product that sits on the roof and no one ever looks at. Good plan.

PS- Yes, private investments fail all the time, but they are 1) not using my money, unless I voluntarily offer it and 2) there are real consequences for those who make bad investments

Movie Recommendation

Well, I hesitate to recommend this movie, because the first three people I told about this as if it was some kind of clever discovery of mine said "Oh, yeah, loved it, saw it years ago." So maybe everyone else saw this movie a decade ago and I just missed it. But I really enjoyed an older Christopher Nolan (Inception) directed movie called Memento. It stars Guy Pierce (LA Confidential, one of my favorite movies) and Carrie-Anne Moss (Matrix).

The movie is about a man trying to get revenge on his wife's murderer. The only problem is that somehow, from roughly the point in time his wife died, he lost all of his short term memory. So he can never remember things more than a few minutes. He has to trust notes he has written (including tattoos on his body) for clues that he pursues.

The clever part of the movie is that it is shot backwards. Well, I don't mean everyone walks backwards. It is shot in a series of 3-10 minute clips with normal forward action, but then the clips are reassembled in the film in reverse order. The end of each scene is therefore usually the beginning of the previous one (though there is a second thread in black and white that moves through the movie in a slightly different way).

This seems crazy and confusing, until you realize that at any point in the movie, you are in exactly the same place as the protagonist - you know nothing about the past, or even, in the start of the clip, how you got there. Its not a casual movie that you can watch while you are doing something else, it requires some concentration, but it worked well for me. The most incredible thing is that despite the fact you know how it all comes out, the movie is incredibly tense and exciting -- you don't know why it came out that way, and the movie is full of twists and turns.

Postscript: There was a movie last year of completely different style - straight forward plot line, uneven acting, more of an action movie - that had a sortof kindof similar plot. The movie was called Vengence, and it was about a man who was losing his memory and slowly degenerating trying to find his daughter's killer. It is a totally different movie, but cribs some of the Memento plot devices, such as labelled Polaroid pictures as a memory device. It is pretty good, particularly for fans of Asian-style action movies, and is directed by Johnnie To.