Understanding the Data One References

I am certain that I have made this mistake myself, but Kevin Drum is careless about using data just because it 1) is labeled in a way he thinks he understands and 2) it supports his pre-conceived notions.

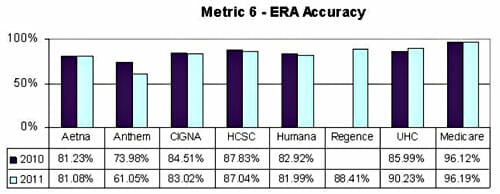

He tries to use the above chart to make the point that Medicare is superior to private insurers because it is more "accurate." Accuracy in claims seems like a good thing, but I started to wonder how it was defined in this study.

So I spent like 30 whole seconds clicking through to the study. It turns out the data is based on surveys of doctors. This chart is explained this way:

Description: On what percentage of claim lines does the payer's allowed amount equal the physician practice's expected allowed amount?

So really, this chart is not a measure of insurance company accuracy, it is really a measure of doctor accuracy in estimating insurance company claims payment behavior, or perhaps of insurance company claims transparency. Because Medicare pays fixed, published, below-market rates, and because they are so large, it is not at all surprising doctors are better at predicting what Medicare will pay on a claim.

In other words, doctors disagree with Aetna on claims more frequently than they disagree with Medicare? Is this bad or good. I have no idea.

But one could go further and say that another way of heading this chart, rather than "accuracy," would be "willingness of insurer to roll over and pay whatever the doctor asks for."

In the past, Drum and others on the Left have also bragged that Medicare's overhead is lower than private insurers. These are all related issues. Private insurers put more scrutiny on claims, which costs more in overhead and causes claims to get paid slower, but presumably results in lower claims payments and less fraud.

Medicare's approach may be net better (ie overhead savings could be larger than claims and fraud savings) or it could be worse, but this chart in isolation tells us nothing.

PS - this is not the first time I have found Drum running health care numbers that do not mean what he thinks they mean.

There are other issues with the expense argument. Medicare is for people over 65, who have much higher average dollar claim sizes. So $ expenses over $claims is very different for medicare as opposed to a commercial insurer.

Here's heritage, who takes the opposite (and also flawed view):

http://www.heritage.org/research/reports/2009/06/medicare-administrative-costs-are-higher-not-lower-than-for-private-insurance

Medicare claims are going to be more complex, as well as larger, right?...Room for partisans to data mine what they like.

"In other words, doctors disagree with Aetna on claims more frequently than they disagree with Medicare"

Maybe, or maybe not...there's no way to derive that from these numbers. All you can say for sure is that doctors are better at predicting the final outcome of a transaction in which the terms amount to "take it or leave it", than they are of a trasnaction in which there's not so much a prospect as a certainty that some negotiation will take place between their own billing staff and the insurance companies' claim departments. It doesn't matter if the doctor agrees with Medicare or not...the only choices the doctor has are to accept what Medicare pays, or not get paid at all for Medicare patients.

In other news, the sun rose in the East this morning, and water continues to be wet. :)

Another fact ignored by Drum and Commonwealth is that Medicare claims are, on average, much bigger than claims from younger people. So the percentage of the claim used in processing it is smaller.

And your point on fraud is a good one. medicare fraud is a huge problem, but not so huge in the private sector because the claims are policed better.

"Drum and others on the Left have also bragged that Medicare’s overhead is lower than private insurers."

Medicare's "overhead" is lower than private insurers for multiple reasons:

1. The government never includes the sunk costs of the buildings, parking lots, roads, etc. that its Medicare staff uses. Private insurers have to include full costs, including amortization of real estate, buildings, and capital equipment.

2. The government only includes the direct operating costs of Medicare staff. It does not add the indirect costs of maintenance personnel, payroll and benefits staff, security, shipping and receiving, mail delivery, information technology staff, utility costs, etc. Private insurers have to apportion all the above costs to their health insurance divisions.

3. Medicare shifts data handling costs onto providers by forcing them to use specific applications to file claims. Private insurers have to develop data transfer protocols that will work with a wide variety of hospital, physician, laboratory, and pharmacy information systems.

4. Medicare has far more hospitalization claims than almost all private insurers. A single hospital claim can be $100,000 or more, but the costs of handling that one claim are much less than a private insurer handling 1000 doctor's office or lab test claims of $100 each. It's like comparing the labor costs of picking one watermelon to picking thousands of blueberries.

If one did a true comparison of Medicare's costs of handling hospital and non-hospital claims to private healthcare insurers costs of handling similar claims, I am confident that nearly all the private insurers would do better than Medicare with its overly expensive buildings and overpaid, underproductive, unionized employees.

He writes for leftie publications. They don't demand accuracy in anything but meeting their preconceptions.