Deceptive Chartsmanship

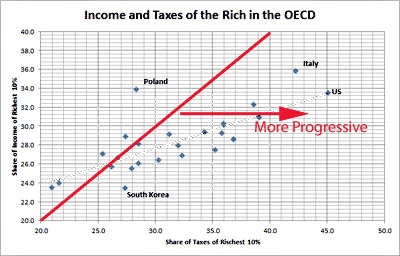

Kevin Drum reports this chart on tax progressivity, with the comment that "the US is more or less right on target."

This is wildly deceptive chartsmanship. Just because there is apparently a trend line here does NOT mean that all of the countries on that line have equal tax progressivity. That would only be the case if the line were at 45-degrees. But in fact, the tax share is increasing by 10 percentage points for every 4 points in income share. This means that, even for countries on the line, the farther right one goes (on the chart, not politically) the more progressive the tax system is, at least vis a vis the top 10% (Drum is probably right that you would get different results for the top 1%, but I think he is wrong to say that state tax systems are wildly regressive).

Here is the corrected chart. The further right of the red line, the more progressive, making the US system (again for the top-10% measure) the most progressive of those on the chart.

It is interesting to note that the original chart tells us one thing -- countries with wider income distributions have the most progressive tax systems. Which is an interesting and not necessarily expected outcome. Certainly it seems to refute much of the purpose for such systems in the first place.

Update: I am guess these are the data points on the chart, with analysis at the always terrific Carpe Diem

Kind of a nit, but the adjusted chart needs to be further adjusted so that the x and y axes have the same scale. Doing so would further emphasize the point you're making.

I don't think your analysis is right. The 45 degree line is not one where there is equal progressivity. If you are on that 45 degree line, by the definition of progressive tax you do not have a progressive tax (assuming no stupid nonmonotonicities). If you are to the left of the line your system is regressive, and to the right of the line your system is progressive. Right on the line you have neither. In order for a tax system to be progressive, the tax RATE must increase as income increases, thus the share of the taxes paid must be more than the share of the income.

I think the result that a more progressive income tax system leads to a wider distribution in pre-tax income is entirely expected. Consider a simple example where you have two possible jobs that are differentiated by the risk of the job. The pre-tax income is 50,000 for the risky job and 25,000 for the non-risky job. The wages are set competitively, so the optimal ratio of risky:non-risky is 2:1. If the tax is flat (say 10%), the after-tax income is: 45,000 and 22,500. This maintains the 2:1 ratio.

Now let's make the tax progressive: 20% on high incomes, 10% on low. Now after-tax income is 40,000 and 22,500. The ratio is 1.78:1. This ratio is too low and that means people are being underpaid for the risky job. At the margin, then, people will leave the risky job and go into the riskless job until the after-tax ratio is reset to 2:1.

Fixing the riskless job after-tax wage at 22,500 we see the risky job has to have an after-tax wage of 45,000. At the new 20% tax rate, the gross wage must be 56,250.

Thus, progressive taxes lead to wider income distributions.

state income tax regressive? you have got to be kidding me. state income taxes are wildly more progressive than even the federal system.

one of the reasons i was so eager to move out of california was its state income tax.

most of my income is in the form of long term capital gains.

this meant that i was paying california more than i was paying the feds.

while this sounds counter intuitive, thing about it this way:

if you manage it well, you take your losses as short term and your gains as long term.

federally, the rates are different. i pay 15% on gains, and write off losses at 39% (assuming i have regular income to shield). thus, if i have $100 in LT gains and $38 in ST losses, i pay no net tax is i have that much regular income to shield.

not so in CA where the tax and the write off are both 10.7%.

this drove my state tax liabilities to be higher than my federal ones.

this is true of many of the wealthier folks who get a significant proportion of their income from capital gains.

to pay 10.7 in CA on top of 15 is 71% increase in tax rate...

delurking-

i think you misunderstood his argument.

his point is that the trend line in drumm's analysis is meaningless.

a 45 degree line is perfect proportionality. (flat tax rate)

this means that drumm's 30 degree line means nothing in terms of comparing systems. it's just a data clustering.

moving to the right on that line indicates increasingly progressive tax.

I think it's unfair to call Kevin Drum "deceptive". That assumes he has the intellectual capacity to realize that he's made an error here, but continues to make it anyway. I don't believe that of Drum.

I'm a big fan of assuming the best of your ideological opponents (for example, while I disagree with almost everything Ezra Klein says, I think he's a first-rate thinker and a very formidable adversary). But with Kevin Drum, I'm afraid he's just not deserving of it.

I don't like graphs whose axes don't strt at zero.

If you don't include VAT for European countries the whole data is just flat out bad. Yes, VAT is regressive by nature, but it raises the overall revenues hugely. The data does not include VAT because it can't be measured but the whole argument for or against US tax rates is impossible without it. We generally pay higher marginal rates. Vat rates typically run between 15 and 20 percent which more than make up for our higher marginal rates.

Are these numbers based on actual taxes collected or government stated rates?

People with lots of income have extra money to hire the thousands of Accountants and Financial Planners who find ways to reduce the taxes they have to paid.

I'm self-employed and pay myself a very small salary. My taxes are low because they are based on my salary and I can deduct expenses for my home-office.

People working for a salary don't have the same flexibility.