The Anti-Planner has an absolutely fabulous article about a Wisconsin passenger rail proposal, but in fact what the article really is about is how government decisions get made.

According to RTA's latest newsletter,

the KRM would cost about $200 million to start up and would require a

$6.3 million annual operating subsidy. For that it would carry about

1.7 million trips per year, which translates to 6,700 per weekday.

In other words, RTA wants to spend $200 million to take 3,350 people

to and from work each day. The Milwaukee-Racine-Kenosha urbanized areas

have about 750,000 commuters, so RTA's proposal would take less than

half a percent of them to work. But they would all have to pay for it

in the form of some local taxes plus a diversion of a share of federal

and state gasoline taxes to fund the rail line.

By the way, though this post isn't meant to be entirely about rail itself, let's use Coyote's test on this rail proposal. As a reminder, here is Coyote's test:

Take the total capital charge and compare it to the cost of buying every projected rider at $22,000 Prius. Then, take the operating subsidy (which is always higher than projected) and see how it compares to the average gas consumption in a year of said Prius's. If the projected capital charge and subsidy could have bought every rider a car and all the gas they need to drive it, then the rail line is not only an average run-of-the-mill government boondoggle, but a total and complete ripoff.

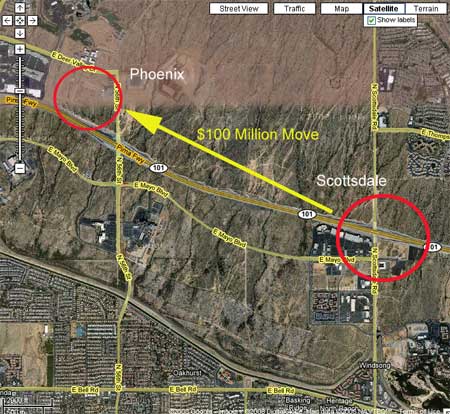

And, the KRM... FAILS. And fails miserably. The $200 million charge would have bought every rider TWO Prius's and still have some money left over, and the operating subsidy, sure to be larger in reality, would buy each rider about 627 gallons of gas a year, which at 30mpg would get them 19,000 miles per year. But don't worry, KRM, every single new rail system to which I have applied the test has failed (Phoenix, Houston, LA, Albuquerque).

But lets continue:

The planned commuter line would run 14 round trips per day, which

means each train would have about 240 people on board. That's about

five bus loads. So why not just buy five buses for each planned

trainset and move people by bus instead?

The newsletter explains that RTA considered a bus alternative, but

it would attract only a third as many people as the rail line. It would

also cost only an eighth as much to start up, so I always wonder why

don't they just invest three-eighths as much in buses and carry as many

people as the rail line.

But then I noticed that the rail line was projected to have seven

stops between Milwaukee and Kenosha, while the bus line would stop 27

times. As a result, the bus would take almost twice as long as the

train. No wonder it attracted so few people!

The train would average just 38 miles per hour and RTA admits that

it would not go significantly faster than motor vehicles, so there is

no reason why buses could not be run on schedules similar to the train.

So why didn't they consider an alternative in which buses stopped only

seven times?

It turns out they did. The report

from the consultant hired by RTA included a bus-rapid transit

alternative that stopped fewer times than the regular bus alternative.

It included some exclusive busways, so it cost a lot more than the

regular bus alternative, but it would cost only half as much as the

train. Moreover, it was projected to carry as many riders as the train.

Naturally, RTA told the consultant to drop this alternative from further consideration.

The Anti-Planner shoots back what to me looks like a really good proposal:

The consultant had also estimated that the bus-rapid transit

alternative would disrupt traffic more than the trains. But if the

busways (which would move no more than about 5 buses per hour) were

opened to low-occupancy vehicles that pay a toll, they would actually

relieve congestion. Plus, the tolls would pay for most if not all of

the new lanes, and by varying the toll, the lanes would never get

congested so the buses could meet their schedules. This would result in

transportation improvements for both auto drivers and transit riders,

and at a very low cost to taxpayers