I am, perhaps surprisingly to many readers, NOT going to go on a rant about the Supreme Court's decision yesterday that states can collect sales tax on interstate sales over the Internet, at least I am not going to rant about taxing internet sales per se. Realistically, it was never realistic to think the government would keep its hands off this piggy bank, especially as Internet sales have skyrocketed. However, this decision creates absolutely enormous practical problems for small businesses and Congress needs to act quickly to mitigate some of these.

The problem is the management problem this presents, particularly for many small retailers, and I don't think most consumers understand this. Sales taxes seem simple from the consumer point of view -- say your sales tax rate is 7%, the cash register collects 7% and it all seems to be handled automatically. But even at your local store, things can get complicated. Your food purchases may well be taxed at a different rate (perhaps even 0%) than your other purchases. You probably don't notice, but if you go over the city limits into a neighboring town or unincorporated area, the rates may suddenly be different.

Take Arizona, which seems from my experience to be roughly average. The sales tax rate table is 18 pages long in a small font. There are 29 separate rate categories which each have different rates in each of Arizona's 15 counties. My business is in 6 counties and we have 3 rate categories that apply, or 4 if you consider items with no tax as another rate category. This is 24 different state/county sales tax rates we charge. But that is the easy part. Because then there are, in addition to county taxes, 92 different towns and cities that have their own rate tables with up to 29 different rate categories that add to the base state/county rate. Other states such as Washington (rule of thumb -- if the state has no income tax then it has a LABYRINTHIAN sales and business tax systems) have additional overlay taxes such as for transit and stadium districts.

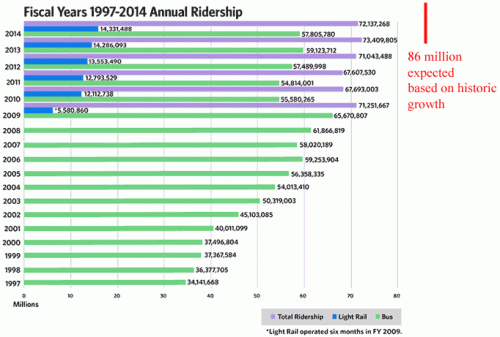

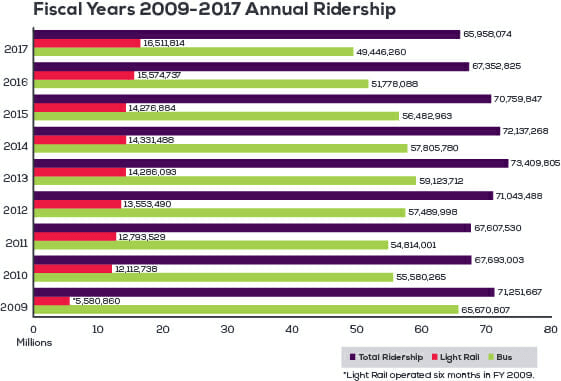

When my company opens a new location, we have to spend hours on the Internet and with maps trying to figure out what sales taxes to collect, and even with good due diligence we sometimes get it wrong and find in an audit we are actually just inside or outside some line where the rate changes (we once had a location 30 miles outside of Seattle on a long dirt road where we found we had to collect the Seattle Rapid Transit tax). Thatcher, AZ is a town of like 4000 people but has its own special sales tax rates -- do you know where the town line is? Well neither do they, because last time I checked they did not have any sort of online lookup system to tell one automatically if the address is inside or outside the town and its sales tax district.

So it's a hassle for my business, but a one time hassle when we open a new location. Now imagine that you are a small retailer on the internet selling fruit cakes. You don't go out and establish sales tax locations, in some sense the location comes to you. John Smith wants to buy a fruitcake and has an address that says Thatcher, AZ, but in the rural world one can easily have a town's name in your address but live outside of the town (we have a campground with a Grant, Alabama address that is well outside of the city and tax limits of Grant but the town fathers come after us every year or so trying to see why we are not collecting their sales tax). What sales tax do I collect from this customer? Is there even a tax on food in that location? If there is, there might be separate rates (as in California, for example) for prepared vs. packaged food. What kind of food is my fruitcake?

But it actually gets even worse. Because now all I have done is collect some amount of tax. That is the easy part! The hard part is registering with all the sales tax authorities to collect and pay the tax. Well, you say, I guess I have to grit my teeth and register 50 times, which I can tell you is a gigantic pain in the ass because every state manages the process differently.

But even after registering in all 50 states, you are STILL not done, because many states don't have a fully unified sales tax collection system. In Arizona, for example, the larger cities require their own registration and monthly reporting. Each of these towns in AZ require a separate registration and monthly report:

Apache Junction,

Avondale,

Chandler,

Douglas,

Flagstaff,

Glendale,

Mesa,

Nogales,

Peoria,

Phoenix,

Prescott,

Scottsdale,

Sedona,

Tempe,

Tucson

Douglas, Arizona is a town of freaking 16,000 people but make sales there and you have to have a separate local registration and reporting. And this list is for one not-very-urban state. Currently my company does business in 9 states but we are registered and pay sales taxes to about 25 different authorities -- and we are mostly a rural business, so we are not in the larger urban areas that are more likely to have their own sales tax systems.

By the way, you might be thinking, "well, if I am a small business, I can just file with such and such authority in the months I have a sale there." Wrong. Once you register and file once, you will be expected to file every time, even if they are zero reports. The one source of relief is some states allow less frequent reporting. It used to be there were states where I had low volume we filed once a year, but that seems to be a thing of the past. Most states seem to have a minimum of quarterly reporting, no matter the volume. Politicians want their money NOW (last sentence should be pronounced using Veruca Salt voice).

This is why businesses tend to have to sign up for very expensive sales tax management services. But even that is not the end of difficulties, because registering for sales tax in an authority also forces one to register and pay other taxes and fees. For example, Tennessee has another tax called the state and county business tax, which is essentially a revenue tax. Even if you are an out of state company, you must file and pay this tax on any revenues. If you sell in all of TN, that is one additional state registration and 95 different county registrations and 95 different county tax forms (our company has to do about 8). But wait, there is more! Because a business also has to register with any of about 200+ cities in TN for payment of city business tax. If you are selling all over TN, that is another 200+ registrations and 200+ annual reports (if this seems all very complex in TN, remember that TN has no income tax and note what I said earlier about the sales and business tax systems of states with no income tax).

I have written many times that regulation tends to benefit larger companies at the expense of smaller companies. Who is more likely to be able to comply in this world I have described, Amazon or the fruitcake company? Jeff Bezos is turning handsprings today because a) this kills a lot of his competition and b) to survive, many small venders will have to move to larger retailing platforms that can do some of the sales tax work, of which the largest and best is.... Amazon.

Congress needs to act. It is going to have to be a compromise, because states are going to be putting a lot of pressure to let this situation stand because they want the money. I would propose a national sales tax system on interstate retail sales that preempts any state sales taxes. It will be hard to keep it from growing out of hand but it would be nice to establish a principal in law that the tax would be some sort of weighted average of the states' internal sales taxes. The Feds would add a percent or two for themselves and there would be one registration for all -- as easy for me to do as it is for Bezos. Yes, I know all the problems with this, but I don't think the status quo is tenable and I don't think Congress has the votes to go back to the old untaxed system, so this is the best we can expect.