Climate Socialism

The climate catastrophists are starting to show their true socialist colors in Bali.

Dispatches from District 48

The climate catastrophists are starting to show their true socialist colors in Bali.

CompUSA is apparently closing shop, something that is not too surprising observing the follies at my local store. I can understand how CompUSA was killed by the likes of Best Buy and Fry's Electronics (not to mention Newegg.com, which is my favorite source). What I cannot understand is how Radio Shack continues to plod along and survive. I buy a couple of things a year there (usually something like a transformer replacement or some kind of oddball splitter) but I am always kind of surprised to still find them there -- its like finding a Woolworth's in the local mall. Though it still seems to make money, with a TTM after-tax margin of about 5%, which is not bad for a retailer.

Update: here

The unfortunately named and horrendously ill-conceived and over-priced Seattle trolley takes to the streets today. The Anti-Planner has an overview in the third in his series on light rail follies.

From the Washington Post, via Tom Nelson, comes a nice summary of the consequences of Congress's addiction to ethanol mandates and subsidies. The last sentence in particular is one I have warned about for a while on this issue.

To be sure, some farmers in these countries benefit from higher prices.

But many poor countries -- including most in sub-Saharan Africa -- are

net grain importers, says the International Food Policy Research

Institute, a Washington-based think tank. In some of these countries, the poorest of the poor spend 70 percent or more of their budgets on food.

About a third of the population of sub-Saharan Africa is

undernourished, according to the Food and Agriculture Organization of

the United Nations. That proportion has barely changed since the early

1990s. High food prices make gains harder.

...

It's

the extra demand for grains to make biofuels, spurred heavily in the

United States by government tax subsidies and fuel mandates, that has

pushed prices dramatically higher. The Economist rightly calls

these U.S. government subsidies "reckless." Since 2000, the share of

the U.S. corn crop devoted to ethanol production has increased from

about 6 percent to about 25 percent -- and is still headed up.

...

This

is not a case of unintended consequences. A new generation of

"cellulosic" fuels (made from grasses, crop residue or wood chips)

might deliver benefits, but the adverse effects of corn-based ethanol

were widely anticipated. Government subsidies reflect the careless and

cynical manipulation of worthy public goals for selfish ends. That the

new farm bill may expand the ethanol mandates confirms an old lesson:

Having embraced a giveaway, politicians cannot stop it, no matter how

dubious.

I was perusing the US electricity generation data a minute ago, and noticed this trend in nuclear generation in the US (all numbers in millions of MW-hours, from here):

1995..........673

1996..........675

1997..........629

1998..........674

1999..........725

2000..........705

2001..........534

2002..........507

2003..........459

2004..........476

2005..........436

2006..........425

I am wondering at the fall of 300 million megawatts-hours from 1999 to 2006. My guess is that maybe some of the really old US government-owned plants closed. But to the extent that this decline is due to aging plants and regulations limiting capacity, it strikes me that if someone in government really wanted to come up with a plan by 2020 to reduce CO2 in utility plant emissions, that regaining a portion of this lost nuclear capacity might be the cheapest and fastest approach. After all, 300 million MWH is about 20% of total coal-fired generation and about 45 times more capacity than the sum of all US generation from non-hydro renewables (which don't really reduce CO2 anyway).

These are the guys trying to take over the world economy in the name of environmentalism:

...But after a full week of attending plenary sessions and contact

groups I can see why the process can be frustrating. I sat in a session

about Carbon Capture and Storage last Thursday that exemplified the

kind of frustration I think they were referring to. After 45 minutes of discussing how the discussion should take place, the facilitator noted that time was up and dismissed the meeting.

Seriously? I was reasonably appalled at the productivity with which

such an important part of the global conference was conducted.

The Democrats of late seem to be pining for the "Ward Cleaver" economy of the 1950's, lamenting that a) the middle class is worse off today financially, b) it takes two income earners to "survive" today rather than one and c) the middle class faces more risk without any additional reward. Rather than refute all this mess in detail yet again, I will leave you with this quiz, via TJIC, from Tamara K:

1) The balance on Ward Cleaver's three most frequently used credit cards is?

2)

Does Wally have an Xbox3 hooked to a flatscreen TV in his room, or is

he making do with an old Play Station hooked to a hand-me-down 19" Sony?3)

In addition to electricity, water, and the telephone, the Cleaver's

largest monthly bill is: a. Cellular Service, b. Cable TV, c. Broadband

Internet Access, or d. Late Fees At Blockbuster.4) The Cleaver's timeshare is in: a.) Destin, or b.) Gatlinburg.

5) June's bread maker was made by: a.) Sunbeam, or b.) Krupps.

6)

The amount of money Ward loses annually playing Powerball, Online Slots

at home, and Texas Hold 'Em on vacation in Branson, Missouri is: $____

(Round to the nearest dollar.)

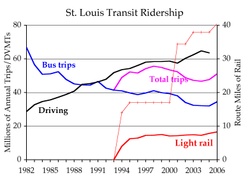

The Anti-Planner has a series of posts of late on light rail that in total point to a perverse moral hazard in public transportation funding that helps to explain why states and cities are building so many rail projects, when the numbers almost never make any sense (as I blogged for LA, Phoenix, and Albuquerque). Though the Anti-Planner does not state these rules, from his recent posts I have inferred three rules:

For most public transportation goals, particularly in spread out western and southern cities, buses are a cheaper and higher service solution than rail. They can carry the same passenger traffic for far less total dollars (capital plus operating costs) and they can cover far more routes. In fact, one can argue that rail lines are inherently regressive, as they tend to serve commuting corridors of the middle and upper classes rather than the typical routes of the poor, for whom the systems are nominally built.

So what can one expect by the application of these three rules? Well, we would expect local authorities to favor large, expensive capital rail projects rather than refurbishment or expansion of bus systems. As operating costs rise for the trains, we would expect bus service to be cut back to pay for the rail operating deficit.

Which is exactly what happens. In fact, rail tends not to increase total ridership at all, at best shifting ridership from inexpensive buses to expensive trains, and at worst decreasing total ridership as rail lines with just a few stations and routes replace more extensive webs of bus transport. And, in twenty years, when these rails systems need extensive capital overhauls, we find cities with huge albatrosses on their hands that they are unable to maintain or update.

One of the things I have observed in the past is that our poorest 20% would be upper middle class in most countries of the world, and would be far richer than 99.9% of people who have ever lived. Somehow the following burning concern in the LA City Hall seems to bring this message home quite clearly:

To protect the character of neighborhoods being dwarfed by the

construction of oversized homes, Los Angeles officials are weighing a

law that would radically limit the square-footage of new or remodeled

houses across the city's flatlands.The proposed

anti-mansionization measure would stem a trend fueled by the meteoric

rise in home values and address a backlash from residents who complain

that the spread of large, boxy homes is spoiling the architectural

flavor of established single-family neighborhoods.

Somehow, I don't thing "mansionization" is a major problem in most countries of the world.

Here is a snippet from the energy bill that just passed the House:

On Thursday, just over a year after winning the majority, Democrats in

the House of Representatives voted through an energy bill that

represents a stark departure from the administration's approach. It

would raise vehicle fuel efficiency (Cafe) standards for the first time

in over 30 years, by 40%, to 35 miles per gallon for both cars and

light trucks and SUVs. A renewable energy standard mandates that

utilities generate 15% of their power from renewables by 2020. It would

set a renewable fuel standard aiming to generate 36 billion gallons of

ethanol a year by 2022. A tax package would roll back some $13.5bn in

oil industry subsidies and tax breaks to help pay for $21bn worth of

investments in clean energy development, mainly in the form of

investment tax credits for wind and solar, along with the development

and purchase of plug-in hybrid vehicles. And it would raise efficiency

standards for appliances and buildings.

Let's look at a couple of pieces very quickly. Recognize that this is based on 10 whole minutes of research, far more than a busy Congressman could possibly be expected to muster.

These were leases for drilling rights in the Gulf of

Mexico signed between oil companies and the Clinton Administration's

Interior Department in 1998-99. At that time the world oil price had

fallen to as low as $10 a barrel and the contracts were signed without

a requirement of royalty payments if the price of oil rose above $35 a

barrel.Interior's Inspector General investigated and found

that this standard royalty clause was omitted not because of any

conspiracy by big oil, but rather because of bureaucratic bungling in

the Clinton Administration. The same report found that a year after

these contracts were signed Chevron and other oil companies alerted

Interior to the absence of royalty fees, and that Interior replied that

the contracts should go forward nonetheless.The companies have since invested billions of dollars

in the Gulf on the basis of those lease agreements, and only when the

price of oil surged to $70 a barrel did anyone start expressing outrage

that Big Oil was "cheating" taxpayers out of royalties. Some oil

companies have voluntarily offered to renegotiate these contracts. The

Democrats are now demanding that all these firms do so -- even though

the government signed binding contracts.

Update: More thoughts here. My climate skeptic video is here.

Another milestone has been reached in DRM lameness: Western Digital, which I considered, at least until today, to be the clear leader in the hard drive wars, has instituted DRM on its hard drives:

Western Digital's 1TB MyBook external hard drives won't share media files over network connections (UPDATE: Don't install the "required" client software! See workaround below). From the product page:

"Due to unverifiable media license authentication, the most common

audio and video file types cannot be shared with different users using

WD Anywhere Access."It doesn't matter what

the files are: If you try to share these formats over a network,

Western Digital assumes not just that you're a criminal, but that it is

its job to police users. You see, MP3, DivX, AVI, WMV and Quicktime files are copy-protected formats.

Here is the list of 30 file extensions the hard drive won't let you share. It does not matter if those mp3 files are just dictation files you created yourself using an MP3 recorder -- you still can't share them. Really lame. Why WD feels the need to get into the business of policing this stuff is beyond me. Can you imagine the product meeting. Gee, I think we should jump into the DRM fray, even though we don't receive a dime from the media companies and it will really piss all of our customers off. Corry Doctorow also comments.

I have to agree with Roger at Maggie's Farm: I really love all the silly weirdness on the Internet as well. I already Rick-rolled my readers once (belated apologies) a while back so I won't do it again. Instead, I will link with full discloser to this mash-up of Hitler doing Rick Astley.

Sixty-six years ago today, the Japanese attacked Pearl Harbor, which turned out to be about as smart of a strategic move as taunting the New England Patriots just before the game. During subsequent years, there was an inevitable investigation into why and how the US got caught so flat-footed, and who, if anyone, was to blame.

Decades later, revisionist historians reopened this debate. In the 1970's, not coincidently in the time of Watergate and lingering questions about the Kennedy assassination and the Gulf of Tonkin, it was fairly popular to blame Pearl Harbor on ... FDR. The logic was (and still is, among a number of historians) that FDR was anxious to bring the US into the war, but was having trouble doing so given the country's incredibly isolationist outlook during the 1920's and 1930's. These historians argue that FDR knew about the Pearl Harbor attack but did nothing (or in the most aggressive theories, actually maneuvered to encourage the attack) in order to give FDR an excuse to bring America into the war. The evidence is basically in three parts:

I have always been pretty skeptical of this theory, for several reasons:

When the same set of facts can be explained equally well by

- A massive conspiracy coordinated without a single leak between hundreds or even thousands of people -OR -

- Sustained stupidity, confusion and/or incompetence

Assume stupidity.

I think it is more than consistent with human history to assume that if Pearl Harbor was stupidly unprepared, that the reason was in fact stupidity, and not a clever conspiracy

It is interesting how so much of this parallels the logic of the 9/11 conspiracists. And, in fact, I have the same answer for both: I don't trust the government. I don't put such actions and motivations past our leaders. But I don't think the facts support either conspiracy. And I don't think the government is capable of maintaining such a conspiracy for so long.

New today from the new Australian government, who to date have placed themselves solidly in the catastrophic camp:

PRIME Minister Kevin Rudd last night did an about-face on deep cuts to

greenhouse gas emissions, days after Australia's delegation backed the

plan at the climate talks in Bali.A government representative at the talks this week said Australia backed a 25-40 per cent cut on 1990 emission levels by 2020.

But after warnings it would lead to huge rises in electricity prices, Mr Rudd said the Government would not support the target.

The

repudiation of the delegate's position represents the first stumble by

the new Government's in its approach to climate change.

We offer Wi-fi services to campers and recreators in some of the facilities we manage. But I am shutting it all down if I am put in the position of policing how my customers use the Internet.

I get a number of search engine hits from people coming to this blog looking for information on, you know, coyotes. I actually get a lot of questions about coyote behavior, which I struggle to answer since by knowledge of the animals generally is limited to:

Via a reader, this is the woman you need to be visiting for real coyotes. She also seems to be a marvelous photographer. This, for example, is beautiful.

"This prehistoric pet interacts and behaves like a one-week-old dinosaur."

Uh, right. Based on substantial observational data, I am sure. More correct statement: "This toy behaves just like the baby dinosaurs you saw that were so cute in that Spielberg movie."

Many free websites (like newspapers and forums) require an email address to sign up. To make sure you give them a real one, they send you a password or activation code, usually within 60 seconds, by email.

Guerrilla Mail will issue you an email address that is good for 15 minutes. You don't even have to leave the web site, just hit refresh and any emails you receive show up there on the screen and can even be replied to. The only problem is that this will leave you with an impossible list of user ID's, but it is great for, say, forums where I only need to post one time (say with a customer support question).

Via this list, via Tom Kirkendall

Sports columnist Stephen A. Smith fires off an over-the-top rant at bloggers:

"And when you look at the internet business, what's dangerous about it

is that people who are clearly unqualified get to disseminate their

piece to the masses. I respect the journalism industry, and the fact of

the matter is ...someone with no training should not be allowed to have

any kind of format whatsoever to disseminate to the masses to the level

which they can. They are not trained. Not experts."

Despite its wackiness, we can still draw some useful observations:

"Therefore, there's a total disregard, a level of wrecklessness that

ends up being a domino effect. And the people who suffer are the common

viewers out there and, more importantly, those in the industry who

haven't been fortunate to get a radio or television deal and only rely

on the written word. And now they've been sabotaged. Not because of me.

Or like me. But because of the industry or the world has allowed the

average joe to resemble a professional without any credentials

whatsoever."He can't even complete the sentence with the window dressing justification that this is for the consumers before he gets to the real people he is trying to protect, ie traditional media personalities like himself. You know, trained professionals. You could subsititute attorneys, doctors, nurses, real estate agents, funeral directors, massage therapists, hair braiders, fishing guides and any other licensed or unionized professional and find the same speech given somewhere at some time.

I end such a discussion, as always, with Milton Friedman:

The justification offered [for licensing] is always the same: to protect the consumer. However, the reason

is demonstrated by observing who lobbies at the state legislature for

the imposition or strengthening of licensure. The lobbyists are

invariably representatives of the occupation in question rather than of

the customers. True enough, plumbers presumably know better than anyone

else what their customers need to be protected against. However, it is

hard to regard altruistic concern for their customers as the primary

motive behind their determined efforts to get legal power to decide who

may be a plumber.

I wasted a lot of time yesterday with this geometry problem. I have about 12 pieces of paper here that look like a Mondrian retrospective, cutting new triangles and parallel lines. Still don't have the proof yet, so I thought I would see if I could pull some of your productivity down with mine. If you are like me, you will decide that the answer is trivial about twice in the first five minutes, both times discovering you have not actually gotten to the answer.

The Question, as asked (surprisingly) by a global warming believer:

One curious aspect of this result is that it

is also well known [Houghton et al., 2001] that the same models that

agree in simulating the anomaly in surface air temperature differ

significantly in their predicted climate sensitivity. The cited range

in climate sensitivity from a wide collection of models is usually 1.5

to 4.5 deg C for a doubling of CO2, where most global climate models

used for climate change studies vary by at least a factor of two in

equilibrium sensitivity.The question is: if climate models differ by a factor of 2

to 3 in their climate sensitivity, how can they all simulate the global

temperature record with a reasonable degree of accuracy. Kerr

[2007] and S. E. Schwartz et al. (Quantifying climate change"“too rosy a

picture?, available at www.nature.com/reports/climatechange, 2007)

recently pointed out the importance of understanding the answer to this

question. Indeed, Kerr [2007] referred to the present work and the

current paper provides the "˜"˜widely circulated analysis'' referred to

by Kerr [2007]. This report investigates the most probable explanation

for such an agreement. It uses published results from a wide variety of

model simulations to understand this apparent paradox between model

climate responses for the 20th century, but diverse climate model

sensitivity.

Yesterday, I noted Al Gore bragging that he played a critical role in passing current biofuel mandates, making him the father of ethanol, not just the Internet. The great goddess of irony is having a field day:

Environmentalists are warning against expanding the production of

biofuels, noting the proposed solution to global warming is actually

causing more harm than it is designed to alleviate. Experts report

biodiesel production, in particular, is causing the destruction of

virgin rainforests and their rich biodiversity, as well as a sharp rise

in greenhouse gas emissions.Opponents of biofuels read like a Who's Who of environmental

activist groups. The Worldwatch Institute, World Conservation Union,

and the global charity Oxfam warn that by directing food staples to the

production of transport fuels, biofuels policy is leading to the

starvation and further impoverishment of the world's poor.On November 15, Greenpeace's Rainbow Warrior unfurled a large banner

reading "Palm Oil Kills Forests and Climate" and blockaded a tanker

attempting to leave Indonesia with a cargo full of palm oil.

Greenpeace, which warns of an imminent "climate bomb" due to the

destruction of rich forests and peat bogs that currently serve as a

massive carbon sink, reports groups such as the World Wildlife Fund,

Conservation International, and Flora and Fauna International have

joined them in calling for an end to the conversion of forests to

croplands for the production of biofuels"The rush to address speculative global warming concerns is once

again proving the law of unintended consequences," said James M.

Taylor, senior fellow for environment policy at The Heartland

Institute. "Biofuels mandates and subsidies are causing the destruction

of forests and the development of previously pristine lands in a

counterproductive attempt to improve the environment."Some of the world's most effective carbon sinks are being destroyed

and long-stored carbon is now being released into the atmosphere in

massive quantities, merely to make wealthy Westerners feel like they

are 'doing something' to address global warming. The reality is, they

are making things worse," Taylor noted.

Many government programs have both a stated justification as well as a second, unstated justification which is the real reason that politicians support the program. For example, many regulations are portrayed as pro-consumer when in fact their real utility is in protecting a favored company or political donor from new competition.

The same is true for progressive taxation. The public logic is usually about the rich paying a "fair share" or reducing income inequality (by cutting down the oaks to give the maples more sunshine). However, progressive taxation pays rich dividends to politicians looking to increase the size of government and their own personal power. Some time in the last 10 years, we crossed an invisible line where less than half of American families pay for effectively all government programs (leaving aside Social Security).

This means that when any politician stands up and proposes a new program, a majority of Americans know that they are not going to pay for it. In fact, the situation is even more obvious when you consider new programs at the margin. If you listen to the Democratic debates, nearly every candidate is proposing to pay for his or her expensive programs via new taxes aimed solely at the top 10 or 20% of earners. Every time they propose a program, there is an unstated but increasing clear clause "and 80% of you won't have to pay anything for this." Already, we see many states funding new programs with surcharges on the rich. Here is but one example:

California voters agreed to tax the rich to support public mental health

services.More than half of them (53.3 percent) voted last month in favor of

Proposition 63, which will impose a tax surcharge of 1 percent on the taxable

personal income above $1 million to pay for services offered through the

state's existing mental health system. The initiative will generate an

estimated $700 million a year....Richard A. Shadoan, M.D., a past president of the CPA, wrote in Viewpoints

in the September 3 issue of Psychiatric News, "The scope of the

program and its tax-the-rich source will provoke a debate. But it's an

argument worth having to make California face the neglect of not providing

treatment to more than 1 million people with mental illness."

So what happened? I don't know how many people make a million dollars in California, but it is certainly less than 5% of the population. So the headline should read "53.3% of people voted to have less than 5% of the people pay for an expensive new program." If the 53.3% thought it was so valuable, why didn't they pay for it? Well, it is clear from the article that the populace in general has been asked to do so in the past and refused. So only when offered the chance to approve the program if a small minority paid for it did they finally agree. This is the real reason for progressive taxation. (by the way, these 53.3% will now feel really good about themselves, despite the fact they will contribute nothing, and will likely piss on millionaires next chance they get, despite the fact that they are the ones who will pay for the program).

Ultimate Example of Progressive Taxation

My story today comes from the Roman Empire just after the death of Julius Caesar. At the time, three groups vied for power: Octavian (Augustus) Caesar, Mark Antony, and republican senators under Brutus and Cassius. Long story short, Octavian and Antony join forces, and try to raise an army to fight the republicans, who have fled Italy. They needed money, but worried that a general tax would turn shaky public opinion in Rome against them. So they settled on the ultimate progressive tax: They named about 2500 rich men and ordered them killed, with their estates confiscated by the state.

This approach of "proscriptions" had been used before (e.g. Sulla) but never quite as obviously just for the money. In the case of Octavian and Antony, though nominally sold to the public as a way to eliminate enemies of Rome, the purpose was very clearly to raise money. All of their really dangerous foes had left Rome with the Republicans. The proscriptions targeted men of wealth, some of whom had been irritants to Octavian or Antony in the past (e.g. Cicero) but many of whom had nothing to do with anything. Proscribed men were quoted as saying "I have been killed by my estates."

I wonder how many of today's progressives would be secretly pleased by this approach?

Many government programs have both a stated justification as well as a second, unstated justification which is the real reason that politicians support the program. For example, many regulations are portrayed as pro-consumer when in fact their real utility is in protecting a favored company or political donor from new competition.

The same is true for progressive taxation. The public logic is usually about the rich paying a "fair share" or reducing income inequality (by cutting down the oaks to give the maples more sunshine). However, progressive taxation pays rich dividends to politicians looking to increase the size of government and their own personal power. Some time in the last 10 years, we crossed an invisible line where less than half of American families pay for effectively all government programs (leaving aside Social Security).

This means that when any politician stands up and proposes a new program, a majority of Americans know that they are not going to pay for it. In fact, the situation is even more obvious when you consider new programs at the margin. If you listen to the Democratic debates, nearly every candidate is proposing to pay for his or her expensive programs via new taxes aimed solely at the top 10 or 20% of earners. Every time they propose a program, there is an unstated but increasing clear clause "and 80% of you won't have to pay anything for this." Already, we see many states funding new programs with surcharges on the rich. Here is but one example:

California voters agreed to tax the rich to support public mental health

services.More than half of them (53.3 percent) voted last month in favor of

Proposition 63, which will impose a tax surcharge of 1 percent on the taxable

personal income above $1 million to pay for services offered through the

state's existing mental health system. The initiative will generate an

estimated $700 million a year....Richard A. Shadoan, M.D., a past president of the CPA, wrote in Viewpoints

in the September 3 issue of Psychiatric News, "The scope of the

program and its tax-the-rich source will provoke a debate. But it's an

argument worth having to make California face the neglect of not providing

treatment to more than 1 million people with mental illness."

So what happened? I don't know how many people make a million dollars in California, but it is certainly less than 5% of the population. So the headline should read "53.3% of people voted to have less than 5% of the people pay for an expensive new program." If the 53.3% thought it was so valuable, why didn't they pay for it? Well, it is clear from the article that the populace in general has been asked to do so in the past and refused. So only when offered the chance to approve the program if a small minority paid for it did they finally agree. This is the real reason for progressive taxation. (by the way, these 53.3% will now feel really good about themselves, despite the fact they will contribute nothing, and will likely piss on millionaires next chance they get, despite the fact that they are the ones who will pay for the program).

Ultimate Example of Progressive Taxation

My story today comes from the Roman Empire just after the death of Julius Caesar. At the time, three groups vied for power: Octavian (Augustus) Caesar, Mark Antony, and republican senators under Brutus and Cassius. Long story short, Octavian and Antony join forces, and try to raise an army to fight the republicans, who have fled Italy. They needed money, but worried that a general tax would turn shaky public opinion in Rome against them. So they settled on the ultimate progressive tax: They named about 2500 rich men and ordered them killed, with their estates confiscated by the state.

This approach of "proscriptions" had been used before (e.g. Sulla) but never quite as obviously just for the money. In the case of Octavian and Antony, though nominally sold to the public as a way to eliminate enemies of Rome, the purpose was very clearly to raise money. All of their really dangerous foes had left Rome with the Republicans. The proscriptions targeted men of wealth, some of whom had been irritants to Octavian or Antony in the past (e.g. Cicero) but many of whom had nothing to do with anything. Proscribed men were quoted as saying "I have been killed by my estates."

I wonder how many of today's progressives would be secretly pleased by this approach?

I really wanted to make a serious point about TJIC's post on Medicare overpaying for medical devices. However, that may be nearly impossible because the post selects "penis pumps" as the example medical device, and it is difficult to have a meaningful political dialog over penis pumps:

amount Medicare spent last year on penis pumps so that old can could stand at attention: $21 million

average price/ pump Medicare paid: $450

cost of the identical pump online: $108

Well, I will try anyway. I am sure if someone pointed this out in the Democratic debate as a potential issue with letting the government, famed for buying $800 hammers, run our health care system, they would all have stated piously that such things would not happen under their plan. But how? I mean, this kind of government waste has been going on for time immemorial. It is so closely tied to the unchangeable incentives of government managers that it could rightly be called a feature of rather than a bug in the system.

But I think I have figured it out. This is why most socialized health care systems do not allow one to go out of system to get private care. By banning all private care, the government eliminates all those irritating private analogs that might demonstrate they are inefficient. So, in the example above, the government typically tackles the problem not by reducing the $450 paid by Medicare, but banning the private sales of such devices so no annoying snoop can uncover the fact that a private system could have delivered it for 1/4 the price. Genius!