Is The Carbon Tax A Pricing Signal To Reduce CO2, Or A Funding Mechanism for a Patronage System to Feed Various Constituencies?

This is an absolutely fascinating article at Vox on efforts by green forces and the Left to defeat a carbon tax ballot initiative in Washington State. The ballot initiative was written very similarly to my proposed plan, where a carbon tax would be made revenue neutral by offsetting other taxes, particularly regressive ones.

Apparently, the Left is opposing the initiative in part because

- It turns out the carbon tax, for many on the Left, is more about increasing the size of government rather than really (or at least solely) for climate policy, and thus they do not like the revenue neutrality aspects. They see carbon taxes as one of the last new frontiers in new government revenue generation, and feel like it would be wasted to make it revenue neutral

- The Greens have made common cause with the social justice warrior types, so they dislike the Washington initiative because it fails to allow various social justice and ethnic groups cash in.

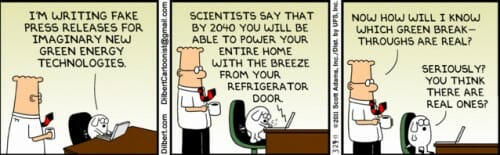

- Apparently, folks on both the Left and the Right actually like government picking winners and tinkering in individual subsidies and programs, such as funding various green energy and conservation initiatives. To me, that stuff is all a total waste and made irrelevant by a carbon tax, whose whole point is to allow markets to make the most efficient CO2 reduction choices, but looking at this election it would not be the first time the electorate was ignorant on basic economics.

There is a real disconnect here that it is important to understand. I don't think I really understood how many of us could use the term "carbon tax" but understand its operation in fundamentally different ways, but I think that is the case.

The authors of the law, like me, see the carbon tax as a pricing signal to efficiently change behaviors in the market around use of carbon-based fuels. The whole point of a carbon tax is to let individual actions and market forces shape how solutions are created. But the Left seems to see the carbon tax totally differently. They don't understand, or don't accept, the power of the pricing signal in the market, or else they would not say things like they want a "put a fee on emissions and reinvest that revenue in clean energy" -- the latter is a redundant and pointless government action if one accepts the power of the tax, since individuals will already be responding by making such investments. The Left instead sees the carbon tax as the source of a new kitty of money that then must be fought over in some sort of political process.

Check out this passage, and consider whether these folks are thinking of the carbon tax as a pricing signal or a source of new money to be spread around:

Either way, state social justice groups did not feel consulted. "Rather than engaging with these communities," wrote Rich Stolz and De'Sean Quinn of environmental justice group OneAmerica, "I-732 organizers patronized and ignored concerns raised by these stakeholders."

White people who work with other white people — and the white people who write about them — tend to slough off this critique. What matters, they insist, is the effect of the policy, not the historical accident of who wrote it down.

Bauman points to a set of policy demands posted by Black Lives Matter. Among them: "shift from sales taxes to taxing externalities such as environmental damage." Also: "Expand the earned income tax credit."

"Well," Bauman says, "we did both those things, right?"

But communities of color want more than for mostly white environmental groups to take their welfare into account. Most of all, affected groups want some say in what constitutes their welfare. "All of us want to be included from the beginning of any decision," says Schaefer. "We don't want to be told after the fact, ‘Hey, by the way, we decided all this stuff for you.’"

This tension within the climate movement has played out most recently in California, where low-income and minority groups have won substantial changes to the state’s climate law, ensuring that a larger portion of cap-and-trade revenue is directed to their communities. Given demographic changes sweeping the country — and climate funders’ newfound attention to building up the capacity of those groups — those tensions are unlikely to remain confined to the West Coast.

These folks see the carbon tax as a pool of money to fund a patronage system, and are thus scared that any groups not involved in crafting the legislation will be left out of the benefits of the patronage -- after all, that is how most programs from the Left are put together. The Obama stimulus program back in 2009 was such a patronage project, and those who were in on crafting it got windfalls, and those who were left out of the process had to pay for it all. Either the Left assume that everything works this way, even when it does not, or they want everything to work this way -- I don't know which.

One thing I do know is that I fear I am going to lose this argument in the future. Here is one way to look at it -- are more people graduating from college looking at the world through the lens of markets and economics and incentives or are more graduating structuring issues in terms of social justice and government authority?