Posts tagged ‘Thailand’

Google Fi Review, and (Finally!) International Roaming Rates May be Set to Drop

For years I have been frustrated with the costs of trying to take my cell phone on international travel. Yes, one can buy cheap sim cards locally, but you obviously lose access to your domestic phone number for the duration (leaving aside dual-sim phones and some tricky and expensive forwarding tricks). If you wanted to keep your phone number so people can still reach you on the number they already know, you were in for some crazy roaming charges -- particularly on data. I use Verizon (mainly because my business takes me to out of the way places where Verizon is the last available carrier) but until recently their international rates were awful, charging one 50 cents per text and $25 per 100mb of data in addition to a $25 a month international plan fee.

I use a lot of data when overseas and outside my hotel room, so I really wanted a cheaper data plan (Google maps is a lifesaver when one is walking streets with signs all written in Thai). My go-to solution in the past was to have a T-Mobile account I turned on and off on an unlocked phone (an old Nexus 5). T-mobile has plans that allow unlimited text and data without roaming charges in most countries, and it is still a good international solution, though I met with a few technical irritants in some of the countries I have visited.

A while back, I accidentally killed my old Nexus 5 and bought a new Nexus 5x with the intention of swapping in my T-mobile sim card from the old phone. However, I saw an article that said the Nexus 5x was one of the couple of phones that would work with the new Google Fi service, so I signed up to try that. $20 a month unlimited domestic calls and text and unlimited international texts. Pretty cheap international calling rates and the phone defaults to calling by wifi if possible to save any charges. Data at $10 per 1GB anywhere in the world, with any unused data credited at the end of the month (so the $10 is pro rated if you use less, essentially).

I used the phone in Thailand, Singapore, and Hong Kong, and not just in large cities -- we got out in the smaller cities well away from the tourist areas of Thailand. Service was flawless everywhere with one exception (discussed in a minute). Wifi calling worked fine and I had a good signal everywhere, even in smaller towns. Charges were exactly as promised. It was a very impressive service. It uses the T-mobile network in most places, so I am a little reluctant to make it my full-time service because when I tested T-mobile several years ago, it just didn't reach far enough to the out-of-the way domestic locations I visit, but I plan to try again. I would really love to be on this service rather than Verizon and believe it would save me a lot of money.

I only had two problems with it. The minor problem was that I had some issues with wifi calling disconnects in one hotel, though this could easily have been due to the notoriously low-bandwidth of many hotel wifi systems**. Switching off wifi and making a regular cell call worked fine. Google says that the service automatically chooses between wifi and cellular based on bandwidth and conditions, but it may be this algorithm needs more work.

The more irritating problem was that the phone would simply not get a cellular data connection in Hong Kong. I contacted Google service (this was a great process that involved sending them a message and them calling me back immediately, a better process in my mind when travelling internationally). After some fiddling around, the service agent checked came back to me to say, "known problem in Hong Kong with internet access. You will need to buy a local sim card. We know this is a hassle, so we just credited your bill $20 to offset the cost." It would have been better to not have this hassle -- I was switching sim cards every night to see if I had any texts at my domestic number -- but I thought they dealt with it as well as possible, and they were a hell of a lot more helpful than T-mobile was when I had an international roaming issue with them.

Under the T-mobile and Google Fi pressure (which really means due to T-mobile, since Google Fi is largely possible because of T-mobile), I am starting to see cracks in the pricing of Verizon. They seem to have a new plan that allows one to keep their domestic data, text, and voice pricing and allowances while roaming internationally for a $10 a day charge. This is still more expensive than T-Mobile and Google Fi but literally an order of magnitude, and maybe two, cheaper than what they were offering for international travel a year ago.

**Footnote: I have way more sympathy for hotels and their wifi systems. We installed a wifi system in a 100 site campground in Alabama. That system has become a data black hole -- no matter how much bandwidth I invest in, people use more. Every night it seems like there are 300 people on 100 campsites all trying to stream a movie in HD. I am not sure it will ever enough, and we get no end of speed complaints despite having an absurd T1 bandwidth into the system. I can't see myself ever investing in such a system again.

Postscript: It is a good habit to point out data that is inconsistent with one's hypotheses. I am incredibly skeptical of US anti-trust law, particularly since it seems to have morphed into protecting politically-connected competitors (e.g. cases against Microsoft and Google) vs. protecting consumer choice. I will say though that the killing of the acquisition of T-mobile by AT&T seems to be a godsend for consumers in the cell phone business, as T-mobile has become a hugely disruptive force generally benefiting consumers.

Greetings from Thailand

Actually, I am back, but here is me with two of my college roommates carrying .... something or other in a Thai wedding ceremony in Roi Et.

Some of you may be familiar with the groom, my friend Brink Lindsey of the Cato Institute. The wedding was amazing and I will try to post some more pictures later.

Thailand was wonderful, and if there is a country that has friendlier people, I have never been to it. I will post some thoughts on Thailand later, but a few top of head items:

- Business models can be really, really different in a country with lower-cost labor. There were dudes in my hotel in Bangkok whose sole job seemed to be to time out my walk toward the elevator and hit the up button at the perfect moment.

- One sidebar to this is that in restaurants and bars, they have waiters who simply hover around constantly. They keep the alcohol bottles on a nearby table and essentially every time you take a sip, they fill your beer or scotch back up to the top. It is like drinking from a glass with a transporter beam in the bottom keeping it full. This makes it virtually impossible to regulate one's drinking.

- The whole country is like a gentrifying neighborhood in the US. It is totally normal to see a teeth-achingly modern building right next to a total hovel.

And This is Different from the US, How?

I am out of the country (currently in Thailand for a wedding). I read this in the local Asian WSJ, an article about money and patronage in the Malaysian political process. And while I suppose I was supposed to think "wow, Malaysia is sure screwed up" -- all I was really left with at the end of this article was "how is this any different from the US?" How does 1MDB differ from, say, various green energy funds at the Federal level or community development funds at the local level?

Malaysian Prime Minister Najib Razak was fighting for his political life this summer after revelations that almost $700 million from an undisclosed source had entered his personal bank accounts.

Under pressure within his party to resign, he called together a group of senior leaders in July to remind them everyone had benefited from the money.

The funds, Mr. Najib said, weren’t used for his personal enrichment. Instead, they were channeled to politicians or into spending on projects aimed at helping the ruling party win elections in 2013, he said, according to a cabinet minister who was present.

“I took the money to spend for us,” the minister quoted Mr. Najib as saying.

It still isn’t clear where the $700 million came from or where it went. But a six-month Wall Street Journal examination revealed that public entities spent hundreds of millions of dollars on a massive patronage machine to help ensure Mr. Najib’s United Malays National Organization stayed in power. The payments, while legal, represented a new milestone in Malaysia’s freewheeling electoral system, according to ruling-party officials....

The effort relied heavily on the state investment fund Mr. Najib controlled, 1Malaysia Development Bhd., according to minutes from 1MDB board meetings seen by The Wall Street Journal and interviews with people who worked there.

The prime minister, who is chairman of 1MDB’s board of advisers, promised repeatedly that the fund would boost Malaysia’s economy by attracting foreign capital. It rolled up more than $11 billion in debt without luring major investments.

Yet Mr. Najib used the fund to funnel at least $140 million to charity projects such as schools and low-cost housing in ways that boosted UMNO’s election chances, the Journal investigation found.

The minutes portray a fund that repeatedly prioritized political spending, even when 1MDB’s cash flow was insufficient to cover its debt payments.

This illustrates one (of many) reasons why those lobbying to reduce campaign spending are on the wrong track. Because no matter how much one limits the direct spending in elections, no country, including the US, ever limits politicians from these sorts of patronage projects, which are essentially vote-buying schemes with my tax money.

The reason there is so much money in politics is because supporters of large government have raised the stakes for elections. Want to see money leave politics? -- eliminate the government's ability to sacrifice one group to another while subsidizing a third, and no one will spend spend a billion dollars to get his guy elected to public office.

By the way, in this current Presidential election we are seeing a vivid demonstration of another reason campaign spending limits are misguided. With strict spending limits, the advantage goes to the incumbent. The only people who can break through this advantage are people who are either a) already famous for some other reason or b) people who resort to the craziest populist rhetoric. Both of which describe Donald Trump to a T (update: Trump has spent virtually no money in this election, so he should be the dream candidate of clean elections folks, right?)

Krugman Dead Wrong on Capital Controls

I am a bit late to the game in addressing Krugman's comments several days ago when he said:

But the truth, hard as it may be for ideologues to accept, is that unrestricted movement of capital is looking more and more like a failed experiment.

This was in response to the implosion of Cyprus banks, which was exacerbated (but not necessarily caused) by the banks being a home for a lot of international hot money - deposits so large they actually dwarfed the country's GDP.

I generally rely on Bastiat's definition of the role of the economist, which I will quote from Wikipedia (being too lazy on this Friday morning to find a better source):

One of Bastiat's most important contributions to the field of economics was his admonition to the effect that good economic decisions can be made only by taking into account the "full picture." That is, economic truths should be arrived at by observing not only the immediate consequences – that is, benefits or liabilities – of an economic decision, but also by examining the long-term second and third consequences. Additionally, one must examine the decision's effect not only on a single group of people (say candlemakers) or a single industry (say candlemaking), but on all people and all industries in the society as a whole. As Bastiat famously put it, an economist must take into account both "What is Seen and What is Not Seen."

By this definition, Krugman has become the world's leading anti-economist. Rather than reject the immediate and obvious (in favor of the larger picture and the unseen), he panders to it. He increasingly spends his time giving intellectual justification to the political predilection for addressing symptoms rather than root causes. He has become the patron saint of the candle-makers petition.

I am not naive to the fact that there are pools of international hot money that seem to be some of the dumbest money out there. Over the last few years it has piled into one market or another, creating local asset bubbles as it goes.

But to suggest that international capital flows need to be greatly curtailed merely to slow down this dumb money, without even considering the costs, is tantamount to economic malpractice.

You want to know what much of the world outside of Western Europe and the US would look like without free capital flows? It would look like Africa. In fact, for the younger folks out there, when I grew up, countries like China and India and Taiwan and Vietnam and Thailand looked just like Africa. They were poor and economically backwards. Capital flows from developed nations seeking new markets and lower cost labor has changed all of that. Over the last decade, more people have escaped grinding subsistence poverty in these nations than at any other time in history.

So we have the seen: A million people in Cyprus face years of economic turmoil

And the unseen: A billion people exiting poverty

By pandering to those who want to expand politicians' power based on a trivial understanding of the seen and a blindness to the unseen, Krugman has failed the most important role of an economist.

Other thoughts: I would offer a few other random, related thoughts on Cyprus

- Capital controls are like gun and narcotics controls: They stop honest people and do little to deter the dishonest. In the case of Cyprus, Krugman obviously would have wanted capital controls to avoid the enormous influx of Russian money the overwhelmed the government's effort to stabilize the banks. But over the last several weeks, the Cyprus banks have had absolute capital controls in place - supposedly no withdrawals were allowed. And yet when the banks reopened, it become increasingly clear that many of the Russians had gotten their money out. Capital controls don't work as a deterrence to money that is already corrupt and being hidden.

- No matter what anyone says, the huge capital inflows into Cyprus had nothing to do with the banking collapse. The banks had the ability to invest the money in a range of international securities, and the money was tiny compared to the size of those security pools. So this is not like, say, a housing market where in influx of money might cause a bubble. The only harm caused by the size of the Russian investments is that once the bank went bad, the huge size of the problem meant that the Cyprus government did not have the resources to bail out the bank and protect depositors from losses.

- Capital controls are as likely to make bubbles worse as they are to make them better. Certainly a lot of international money piling into a small market can cause a bubble. But do capital controls really create fewer bubbles? One could easily argue that the Japanese asset bubble of the late 80's would have been worse if all the money were bottled up in the country. When the Japanese went around the world buying up American movie studios and landmark real estate, that was in some sense a safety valve reducing the inflationary pressure in Japan.

- Capital controls are the worst sort of government expropriation. You hear on the news that the "haircut" taken by depositors in Cyprus might be 20% or 80% or whatever. But in my mind it does not matter. Because once the government put strict capital controls in place, the haircut effectively became 100%, at least for honest people that don't have the criminal ability or crony connections to beat the system. Cyprus basically produces nothing. Since money is only useful to the extent that it can buy or invest in something, then bottling up one's money in Cyprus basically makes it worthless.

- Capital controls are a prelude to protectionism. First, international trade is impossible without free flow of capital. No way Apple is going to sell ipods in Cyprus if they cannot at some point repatriate their profits. Capital controls can also lead to export controls. If I can't export money, I might instead buy jets, fly them out of the country, and then sell the jets.

- Let's not forget that the core of this entire problem is a government, not a private, failure. Banks and investors treated sovereign euro-denominated debt as a risk-free investment, and banking law (e.g. Basil II) and pension law in most countries built this assumption into law. Cyprus banks went belly-up because the Greeks, in whom they had (unwisely) invested most of their funds, can't exercise any fiscal responsibility in their government. If European countries could exercise fiscal responsibility in their government borrowing, 80% of the banking crisis would not exist (housing bubbles and bad mortgage securities have contributed in some countries like Spain). There is a circle here: Politicians like to deficit spend. They write regulations to encourage banks to preferentially invest in this government paper. When the government debt gets iffy, and the banks face collapse, the governments have to bail them out because otherwise there is no home for their future debt. The bailouts get paid for with more debt, which gets crammed back into increasingly over-leveraged banks. What a mess.

- All of this creates an interesting business school problem for the future: What happens when there are no longer risk-free investments? Throughout finance one talks about risk free rates and all other risks and risk premiums and discussed in reference to this risk-free benchmark. In regulation, much of banking capital regulation and pension regulation is based on there being a core of risk free, liquid investments. But what if these do not exist any more?

- I have thought a lot about a banking model where the bank accepts deposits and provides basic services but does no lending - a pure deposit bank with absolute transparency on its balance sheet and investments. I think about a web site depositors can check every day to see exactly where depositors money is invested and its real time values. Only listed, liquid securities with daily mark to market. Open source investing, as it were. In the past, deposit insurance has basically killed this business model, but I think public confidence in deposit insurance just took a big-ass hit this week.

Postscript: I don't want to fall into a Godwin's law trap here, but I am currently reading Eichmann in Jerusalem and it is impossible for me to ignore the role strict capital controls played in Nazi Germany's trapping and liquidation of the Jews.

PS#2: Oops,

The extent of the control over all life that economic control confers is nowhere better illustrated than in the field of foreign exchanges. Nothing would at first seem to affect private life less than a state control of the dealings in foreign exchange, and most people will regard its introduction with complete indifference. Yet the experience of most Continental countries has taught thoughtful people to regard this step as the decisive advance on the path to totalitarianism and the suppression of individual liberty. It is, in fact, the complete delivery of the individual to the tyranny of the state, the final suppression of all means of escape—not merely for the rich but for everybody.

Angola?

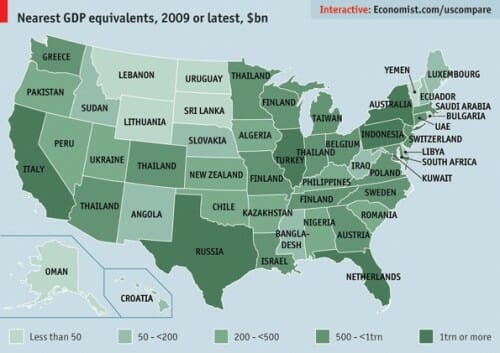

I love maps like this one, and a year or two ago I linked an earlier version. This one is from the Economist via Carpe Diem, and shows the name of the country whose GDP is similar in size to that of the state.

I have to criticize the map-maker, though. They used Thailand at least four times on this map -- the original version managed to do it without repeats. But I am amazed that Arizona ranks right there with Thailand. This is not to diss the rest of the state, which has a lot going for it, but in terms of population and economic activity, a huge percentage in in just one city, Phoenix.

I do have to wonder whether New Mexico being matched up with "Angola" is really very flattering, and pairing Mississippi with Bangladesh is funny on a couple of levels.

JonBenet Case Not Over

I'm not really into all that crime drama and true crime stuff. I have not watched a singled episode of either CSI:Whatever or America's Most Wanted. I don't even know what the whole Scott Peterson thing was about. But from 1996 to 1999, I lived in Boulder, Colorado. And for much of that time, the murder of JonBenet Ramsey dominated the news. You may think you got tired of hearing about it, but in Boulder we lived in it like a fish lives in water. There was no escaping it. One could become an expert on the case just by osmosis. The local paper seemed to have a whole section dedicated to the case. The US could have invaded a small nation in Asia and I would have missed it in those years.

That being said, I can't believe this guy they arrested in Thailand did it. Or at least did it alone. There is just too much evidence in the case that if the murderer was not one of the parents, it at least had to be someone very close to the family. I won't bore you with specifics: If you don't know it all by heart, you certainly don't want to hear it from me. But someone will somehow have to explain all the ransom note stuff. Someone who knew JonBenet would have an incentive to fake up the ransom note as a way to create a motive for the killing that diverted police attention away from people close to the child (who are always the police's first suspects). But why would a mysterious third party feel such a need, and how did the ransom demand exactly match the amount of Mr. Ramsey's recent bonus check? And if the Ramseys are entirely innocent, they have a lot of explaining to do about why they did absolutely everything they could to impede the investigation into the daughter's death. Already his story is breaking down. I guess the guy could conceivably be involved but in that case expect the story to be bizarre.

Update: In searching for news on this case, I found this insightful analysis of her murder based on astrology:

This opposition squares another opposition: the

opposition between the Sun and the Moon. The Sun often represents the

father in a birthchart

and the Moon the mother, and here it appears that the father was the

more nurturing parent and the mother was more dominant. Jonbenet's Moon

conjuncts the Midheaven, or cusp of the tenth house of career and

public life, showing Patsy Ramsey (Moon) was instrumental in Jonbenet's

young stage life (having herself been a beauty queen). The Sun, or the

father, is conjunct the cusp of the fourth house of the home and

Jonbenet may have been close to her father, but the square of both Mars

and Pluto to both the father and mother archetypes (Sun and Moon) shows

that there was very little safety in the relationship with either

parent. Pluto in particular, when in challenging aspect to the Sun (the

essential Spirit) and the Moon (emotional security and safety), can be

deeply frightening and there is a sense that the parents, and life

itself, are dangerous.

Random Impressions of Paris

After a couple of days here, some impressions:

- The airline flights that dump you off in Europe at 7am which seemed so convivial when I was consulting are less so when I am a tourist. We had the experience of arriving at our hotel about 8am, which of course did not yet have a room anywhere near ready. We had a nice day walking around, but we sure were exhausted by the time we got to our room and had a nap. Note: American Airlines 767's have very very uncomfortable business class seats - really a disgrace nowadays.

- The Louvre is magnificent, but is ridiculously big. It is impossible to digest. You really have to find a branch of art, like the Flemish painters, and stay in that area. The Musee d'Orsay, which focuses on 19th century French art, is much more digestible. Also, it has a cool location in a train station, which was a very important part of 19th century life.

- The French smoking thing has been joked about so much it is almost a caricature, but it is still a shock the first time in a restaurant. We observed many American smokers reveling in their smoking freedom. I wonder if there is a business opportunity to sponsor smoking trips to Paris, much like those Asia sex trips to Thailand.

- Wow, the food is expensive! $50-80 entrees in some places, and for that you can get two slices of tenderloin. It was good though, and we have yet to have a bad, or even so-so, meal.

- I would feel safer in a golf cart than some of the cars here. You can really see the trade-offs with fuel economy we make in the US by having crash test standards. Over here with no crash tests and $6.00 gas, you get lots of tiny cars. Mini-coopers look average to large-sized here.

- The Champs d'elysees was amazing on Sunday afternoon - a sea of people going up the hill. It looked like those pictures of the start of the NY marathon, but it went as far as the eye can see. Amazingly, with all this foot traffic past the door, half the businesses were closed that day (welcome to Europe, I guess)

- There are more shoe stores here than fast food restaurants in Phoenix. And my wife has stopped in every one of them

Scrappleface: White House to Boost Empathy Statements

As one unnamed reporter put it, "In the hours immediately following the disaster, millions of people in Thailand, India, Indonesia, Somalia and elsewhere turned their eyes toward America to discover whether the president would rush back to Washington D.C. and empathize with their plight. But Bush stayed in Crawford and made just one official statement, as U.S. military planes surveyed the damaged area and Air Force C-130 cargo planes with humanitarian goods headed for the region. It's as if Bush thinks that action is a substitute for news conferences."

LOL. I have always hated the empathy dance after disasters, particularly the now required visit by the President to the disaster site. What is he going to do? The visit to the WTC site soon after the attack on 9/11 had value because it made a statement about security that gave confidence to people that they could return to Manhattan. Why is it necessary, though, to tour hurricane damage by helicopter? Isn't that the experts job?

We had a number of our operations in Florida shut down for weeks after the recent hurricanes there. Several of my friends asked me if I was going to go visit the damage. "What for" I asked? The damage had been described to me, and the folks in charge there who knew the area had a good plan in place for fixing things. If I showed up, work would have to stop for a day while everyone showed me around. The time to go back is after it is cleaned up, when you can thank everyone for their hard work. But of course, I didn't have to deal with the media editorializing on my heartlessness because I didn't run to Florida and sight-see the damage.