How Government Interventions Affect Health Care Supply and Demand

My son is in Freshman econ 101, and so I have been posting him some supply and demand curve examples. Here is one for health care. The question at hand: Does government regulation including Obamacare increase access to health care? Certainly it increases access to health care insurance, but does it increase access to actual doctors? We will look at three major interventions.

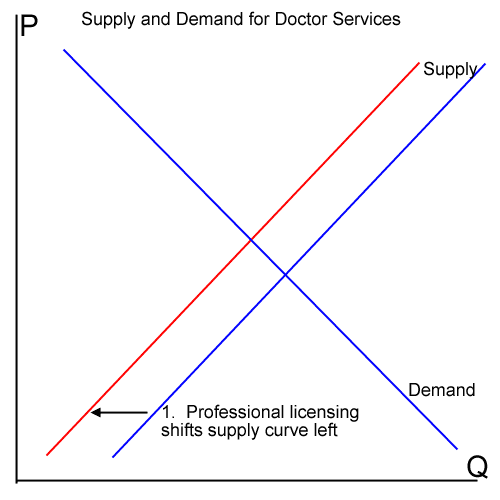

The first and oldest is the imposition of strong, time-consuming, and costly professional licensing requirements for doctors. At this point we are not arguing whether this is a good or bad thing, just portraying its inevitable effects on the supply and demand for doctors.

I don't think this requires much discussion. For any given price for doctor services, the quantity of doctor hours available is certainly going to increase as the barriers to entry to the profession are raised.

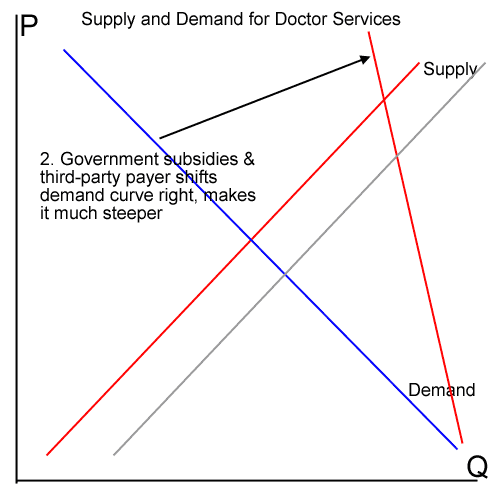

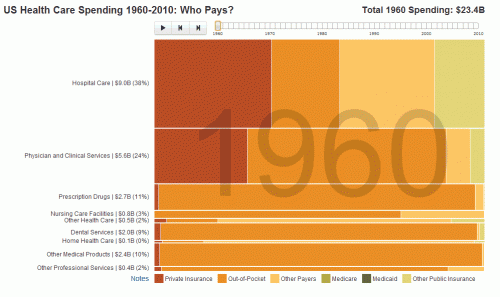

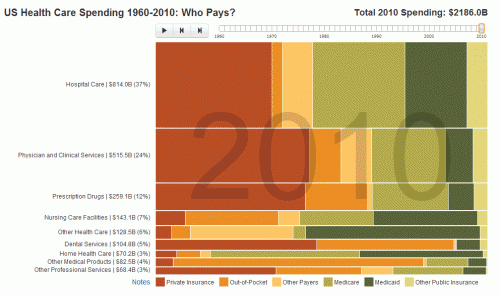

The second intervention is actually a set of interventions, the range of interventions that have encouraged single-payer low-deductible health insurance and have provided subsidies for this insurance. These interventions include historic tax preferences for employer-paid employee health insurance, Medicare, Medicaid, the subsidies in Obamacare as well as the rules in Obamacare that discourage high-deductible policies and require that everyone buy insurance rather than pay as they go. The result is a shift in the demand curve to the right, along with a shift to a more vertical demand curve (meaning people are more price-insensitive, since a third-party is paying).

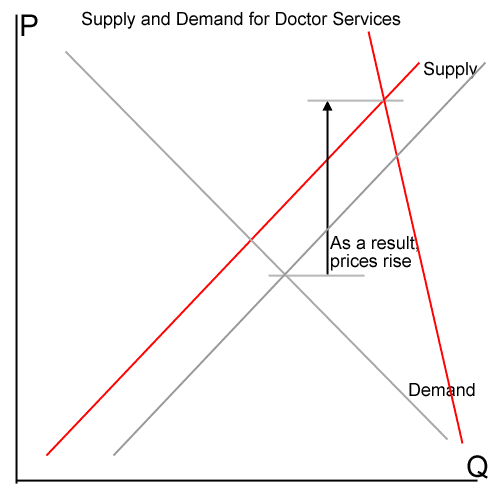

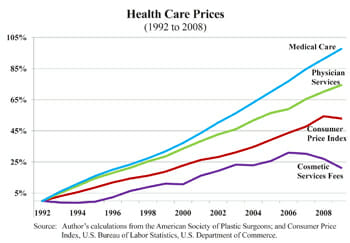

The result is a substantial rise in prices, as we have seen over the last 30 years as health care prices have risen far faster than inflation

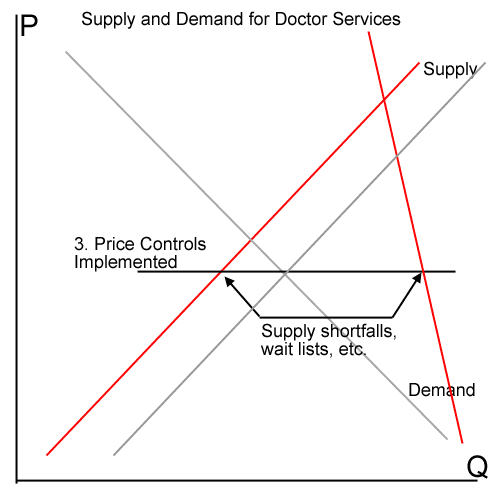

As the government pays more and more of the health care bills, this price rise leads to unsustainably high spending levels, so the government institutes price controls. Medicare has price controls (the famous "doc fix" is related to these) and Obamacare promises many more. This leads to huge doctor shortages, queues, waiting lists, etc. Exactly what we see in other state-run health care systems, The graph below posits a price cap that forces prices back to the free market rate.

So, is this better access to health care?

I know that Obamacare proponents claim that top-down government operation is going to reap all kinds of savings, thus shifting the supply curve to the right. Since this has pretty much never happened in the whole history of government operations, I discount the claim. When pressed for specifics, the ideas typically boil down to price or demand controls. Price controls we discussed. Demand controls are of the sort like "you can't get a transplant if you are over 70" or "we won't approve cancer treatments that only promise a year more life."

Most of these do not affect the chart above, since it is for doctor services and most of these cost control ideas are usually doctor intensive - more doctor time to have fewer tests, operations, drugs. But even if we expanded the viewpoint to be for all health care, it is yet to be demonstrated that the American public will even accept these restrictions. The very first one out of the box, a proposal to have fewer mamographies for women under a certain age, was abandoned in a firestorm of opposition from women's groups. In all likelihood, there will be some mish-mash of demand restrictions, determined less by science and by who (users and providers) have the best lobbying organizations.

My longer series of three Forbes articles on this and other economic issues with Obamacare begin here: Part 1 Information, Part 2 Incentives, Part 3 Rent-Seeking

Update: Pondering on this, it may be that professional licensing also makes the supply curve steeper. It depends on how doctors think about sunk cost.