Medicare Taxes are Too Low

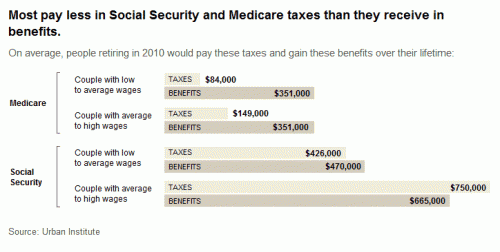

If Medicare is really an insurance program, than as I wrote last week, the premiums are absurdly low. And this isn't even a rich-poor transfer issue - the premiums are too low for everyone. See the bar chart about halfway down on this page at the NY Times. Here is a screenshot:

Take Social Security first. Taxes come fairly close to covering benefits, with some rich-poor redistribution. These numbers look sensible (leaving aside implied annual returns on investment and whether the government should be running a forced retirement program at all) -- the main reason social security is bankrupts is that in the years when premiums exceeded benefits, Congress raided and spent the funds on unrelated things.

Medicare, though, is a huge problem. Even for high income folks, premiums cover only 43% of the expected benefits (I am not sure how they treat present values and such, but again lets leave that aside, I don't think it affects the underlying point). Assuming we end up with some rich-poor transfer, it looks to me that premiums are low by a factor of three.

Everyone seems to think Medicare is a great deal. Of course it feels that way -- premiums are only covering a third of the costs. There is no way we can have intelligent debate on these programs when the price signals are corrupted. Its time to triple Medicare premiums.

It is te same old political crap. Just vote for me and you will get goodies for nothing. The first law of thermodynamics says you can't take out that which you didn't put in. Nothing more need be said.

Niether of these programs (Medicare & Social Security) are insurance programs. Sure politicians sold the programs to the public as insurance but this is a flat out lie. If you look at the actual laws that created both programs, both are pay as you go programs where current revinues cover current benifits.

The fatal flaw in both programs is one of demographics. When ss was created, there were more than 10 workers per benificiary and the average benificary only collected for around 5 years. With those demographics, the program could run indefinately in the black. The problem is the demographics are changing. There are now around 3 workers per benificiary and benficiaries can expect to collect for 20 year or more. By the time the last baby boomer retires, the ratio of payers to payees will approach or go under 1.

Yeah. Medicare needs to die; I don't believe in increasing premiums though, that'll just fortify the boondoggle. Constrain services and let's start making the medical sector more competitive by removing barriers to entry and doing some sensible cost control.

Mish has an interesting article (re: spending): http://globaleconomicanalysis.blogspot.com/2012/02/fatally-flawed-approaches-to-budget.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+MishsGlobalEconomicTrendAnalysis+%28Mish%27s+Global+Economic+Trend+Analysis%29&utm_content=Google+Reader

I don't think it's a great deal, but like many Americans, I am locked into it.

This means a couple of things:

1) There will be tremendous push against harming Medicare (including from me, because I know enough about health insurance to know there will be no free market alternative for many old folks, even if Medicare vanished tomorrow)

2) Recognize that doing away with it would greatly harm a whole lot of people.

It needs to be phased out, which is what is proposed by some Republican candidates. You can't kill it and you shouldn't kill it.

Furthermore, even if you get rid of it, you have to deal with the very real problem of pre-existing conditions - especially among the elderly. Medicare at least creates a broad risk pool (even if it under-funds it).

>>> Its time to triple Medicare premiums.

This is the liberal answer.

It's time to get government out of the freakin' business in the first place.

If we decide that there is to be some medical insurance program that people are required to own, then it should be done via private firms meeting government standards for coverage.

The same goes for Social Security.

>>> The first law of thermodynamics says you can’t take out that which you didn’t put in.

You can if someone ELSE is putting in more than both of you are taking out. Unfortunately, that's not the case.

John, you are, in many ways, and given certain assumptions not absolutely required, essentially correct... but the solution is some kind of medical voucher system that vouches for less and less the younger you are, and (assuming, as noted above, that one insists that all have coverage) requires younger people to put in more.

P.S., one thing that also needs to be done is to get rid of gold-plated government benefits. If the system is good enough to force it upon the rest of us who pay for it, then "it's good enough for government work"

If you took your SS payments and the matching employer payments in invested it in a tax free/deferred mutual fund you would have in excess of $4 million at the end of your 49 year working carear as a blue coller worker. If anything SS is ripping off the workers.

Check out http://www.mackinac.org/1487 to see how a few counties in Texas are doing after opting out of SS.

Let's see, the median household income is a little less than $50K per year. The average household health care outlay (including insurance, out of pocket expenses and copays is $20k per year. So if we allow for half of the $20K from an employer, the median household sees 1/3 of their earning diverted to health care. Considering most hourly workers saw any increase in compensation diverted to health care over the last decade, when will folks revolt over what health careis costing them, when its half of all earnings , two-thirds?

So, since they’re too low, Kevin Dumb will suddenly and mysteriously understand price caps?

Totally agree. Under Obamacare they go from 2.9%to 3.8% and extend to "unearned" income as well. That's a start.

It may feel good to talk about phasing out Medicare, but I don't see how this ever comes close to being politically doable.

@John - unfortunately, that kind of reasoning is counterproductive. If you have an unsustainable and unfair system, the correct course of action is not to allow all the people benefitting from it currently to reap the benefit but cut the potential future benefit to the payees. You have to replace it with something functional, as quickly as possible. And, as IGB states, it has to be equally functionable for all involved - establish baseline healthcare for anyone living in the US, no more boondoggles.

So those with higher incomes pay more into SS than they get out? Then can liberals shut up with their desires to remove the income cap above which SS taxes are not levied ($110,000 or whatever it is)?

"So those with higher incomes pay more into SS than they get out? Then can liberals shut up with their desires to remove the income cap above which SS taxes are not levied"

You're correct, the SS tax is progressive once the benefits structure is considered, which you will never hear a liberal admit. They want to make the SS tax system even more progressive. The 3.8% Obamacare surtax is just the start of eliminating the traditional exemption investment income has from FICA.

@Sean, you way overestimate the average outlay for a family. Only Detroit Union plans cost so much. More typically a plan for a family is 13,000 per year, and the company will charge a monthly premium to the employee of about 150 - 250 per month to cover some of that cost.

Mark2,

The number that I gave was based on the average health insurance premium for a family which is about $15K per year but I will grant you a few Cadillac plans where the cost exceeds $20K per year could be bringing up the average. Most employers pay about 70-75% of the premium these days so let's split the difference and use $13K but the employee pays 30% and that is $325 a month. But when calculating health care costs you also have to include out of pocket expenses that can add another $5,000 per year for a family or about $415 per month. That brings the total to about $740 per month for health care by the employee but another $760 is being paid by the employer. (People shouldn't kid themselves, wages are being held down by the cost of healthcare benefits. They are part of the cost of total compensation package that an employer pays to an employee.) $1500 per month is $18K per year or about 30% of the sum of median household income ($50K) plus the employer's healthcare contribution of $10K.

Healthcare is the biggest drain on the earnings of a the median household family. It's an absurd level particularly when you consider that we spend almost 2x as much per capita on healthcare than other developed nations. I don't think you can ask the middle class to spend more for health care.

I will say it out loud: We need aggressive use of euthanasia and acceptance of it--no matter what kind of health care system we have.

Also, whatever system the Japanese use, we should copy. They pay about 6 percent of GDP for health care, and we are getting close to triple for that. We are the world's worst.

Actually, free markets would solve this, if Congress (including the GOP) would allow insurers to use euthanasia when necessary, for elderly or others. The GOP, mind you, held a special session of Congress, and George Bsuh jr, cancelled a vacation (!) on account of Terri Schiavo. They wanted to keep the vegetable carcass "alive" for another 30 years.

You won't like this---it would mean you go to hospital with your mom, and the insurer says "We ain't paying. She is too old and too sick. You will get a few more weeks or months of bedridden misery. We are pulling the plug."

You can say, "Oh, we will pay the extra $200,000 out of pocket," or you can say, "Okay." You will say, "Okay."

The GOP says life is sacred and the Dems say spend as much money as possible. That's why tho will never happen.

We have a first rate mess on our hands.

It's not the taxpayer's fault. What if you paid into a 401-K or IRA to the tune of $150,000 over 30-40 years? It damn well better be worth much more than $350,000 at the end of the line. It's double rape. Actually, triple-rape if you are lucky enough to have to pay taxes on distributions on top of all that.

Although, maybe they are just putting the funds in a lock box instead of investing it, and Charles Ponzi is guarding it.

>>> when will folks revolt over what health careis costing them, when its half of all earnings , two-thirds?

When will folks stop whining when such comparisons are based on the fact that health care costs more because they're doing 97x more than they did decades ago? If you limit yourself to basic care that was all ANYONE really got, then I'd lay odds it doesn't cost any more than it used to as a percentage of salaries.

Wow. Benny managed to sound even stupider than he usually does, and this despite not mentioning either Iran/Iraq/Afghanistan, the military, or the Defense/HS budget.

Similar topic on HN: http://news.ycombinator.com/item?id=3661731

Read the original article for some interesting comparisons re: factors in health care costs.

Apparently Coyote Blog never considered that the high cost of Medicare is because of the government Medicare system.