Who the HELL is Jay Carney to Tell Me My Health Insurance Policy is "Sub-Standard"?

The health-care law eliminates “substandard policies that don’t provide minimum services,” said Jay Carney, a White House spokesman, in response to the cancellations. The “80-plus percent” of Americans with employer plans or covered by government programs are unaffected.

I chose my policy very carefully, and don't think it is "sub-standard" because it does not include pediatric dental care for two people in their fifties. This is the worst consumer dis-empowerment that I can remember in my lifetime.

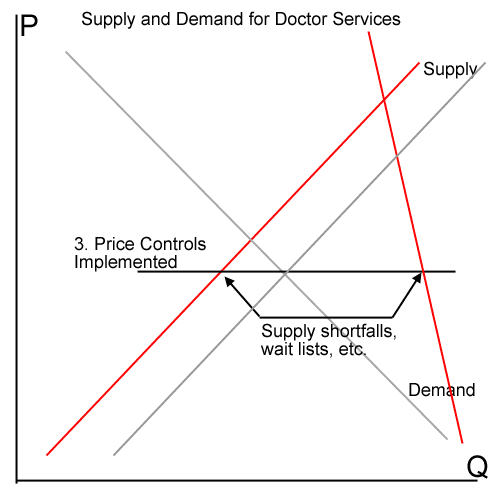

Now an effective levy of several thousand dollars on the small fraction of middle class Americans who buy on the individual market is not history’s great injustice. But neither does it seem like the soundest or most politically stable public policy arrangement. And to dig back into the position where I do strong disagree with Cohn’s perspective, what makes this setup potentially more perverse is that it raises rates most sharply on precisely those Americans who up until now were doing roughly what we should want more health insurance purchasers to do: Economizing, comparison shopping, avoiding paying for coverage they don’t need, and buying a level of insurance that covers them in the event of a true disaster while giving them a reason not to overspend on everyday health expenses.

If we want health inflation to stay low and health care costs to be less of an anchor on advancement, we should want more Americans making $50,000 or $60,000 or $70,000 to spend less upfront on health insurance, rather than using regulatory pressure to induce them to spend more. And seen in that light, the potential problem with Obamacare’s regulation-driven “rate shock” isn’t that it doesn’t let everyone keep their pre-existing plans. It’s that it cancels plans, and raises rates, for people who were doing their part to keep all of our costs low.

With my high deductibles, I am actually out shopping every day on health care prices and I can tell you from my experience that if everyone did so, we would see a reversal of health care inflation. More here