Ka-chunk Ka-chunk

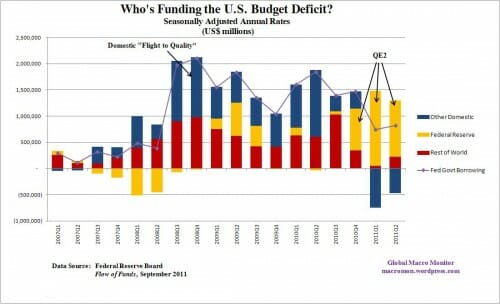

That is the sound of the printing presses running 24/7. Because that appears to be how we are funding all of Obama's spending right now (source)

When folks say they are not worried about the deficit, because folks still seem eager to buy our debt (as evidenced by the low interest rates) note that the general public has been a net seller of US debt the first 2 quarters of 2011. In fact, the only buyer has been Uncle Sam himself, buying up the debt with newly minted cash (or electrons, really).

One other interesting issue, the Fed seems to have been soaking up the money supply in the early days of the recession, before the high-profile business and financial failures really got things moving downward.

I don't get it. Are you advocating tighter monetary policy? The thing that, according to Milton Friedman, was most responsible for making the great depression as bad as it was?

All this is a wonderful recipe for family finance. Borrow from your spouse and blow the money on nonsense. Then your spouse can return the favor. Cover the deficit with kited checks. Wow! A great way to live the high life.

On a serious note, if we citizens ran our finances like the USG, we would be bankrupt and in jail (or shot by our creditors). Is there anyone in politics who will honestly deal with our problems rather than borrow more money and sweep it all under the rug? Apparently not.

What's bad about printing lots of money? It's that it causes too much inflation.

Do we have too much inflation? No.

If we started having too much inflation, should we stop printing money? Yes.

Would we then have to stop spending money we don't have? Yes.

The composition of Federal Reserve deposits and other Fed liabilities should be included in the chart. Only a small part of the Fed is newly printed money, most is deposits owned by banks.

That shrinking red bar will also go negative when Europe pulls its "flight from chaos" money out of US Treasurys and China's various bubbles burst.

>>>> That is the sound of the printing presses running 24/7. Because that appears to be how we are funding all of Obama’s spending right now

That does appear to be the only hope of getting on the other side of this mess. Getting onto the other side before people, especially debtors, realize that it's all fiat money is the tricky part.

>>>> I don’t get it. Are you advocating tighter monetary policy? The thing that, according to Milton Friedman, was most responsible for making the great depression as bad as it was?

I don't believe Friedman ever considered the abuse of the printing press a positive net effect on the economy. Tighter money policy is not the same as cutting back on fiat currency. Abuse of the printing press IS a central feature of Keynesian economic theory, however.

>>>> If we started having too much inflation, should we stop printing money? Yes. Would we then have to stop spending money we don’t have? Yes.

...Or we could be mature and responsible and STOP SPENDING MONEY WE DON'T HAVE.

Too mature? Yeah, apparently.

>>>> That shrinking red bar will also go negative when Europe pulls its “flight from chaos” money out of US Treasurys and China’s various bubbles burst.

Yes, indeed, and then we let loose the dogs of war, because when the crap hits the fan, that's how you collect what's owed. And, when you take the fiscal view of who-owed-what-to-whom-and-who-was-overdue, and correlate it with the various wars of history, it's an interesting coincidence that wars often seem to represent a kind of "past due notice" to the group in power somewhere.

Can You Say: "Hi, World War Three! We Gonna Have a Nice Big Smash-The-House Party, or What"?

I only hope it doesn't go nuclear or biological.

BTW, the part of the graph labeled "QE2" seems to be an error...

I think that part bears a lot closer of a resemblance to the Titanic than to the QE2...

Jus' Sayin'...

When it comes to expansion and contraction of the money supply often they talk of expansion being inflation and contraction being deflation. I don't hold the view of the two being the same, economists do so for the mathematical models to work. They are linked but that link is elastic and can't be represented by particular constant values over the long term average.

The way it was explained to me naively by a friend's father in high school, deflation is bad because as prices continue to drop demand is stalled as people supposedly wait for the prices to bottom out. And the inverse is that inflation causes immediate demand as prices are expected to rise in the future and not making such purchases in the present risked being priced out of making the purchase. I've never followed this model in personal purchasing decisions and can't imagine anybody else actually follow through with it. But thinking like this is why economists seek out mathematical models and can never grasp how fluid the flow of money is.

Seriously, economists might have a general idea of the large scale of why money moves the way it does at any given moment but that model doesn't scale down at all. The infinite choices that go into making decisions with money at the corporate and family and ultimately individual levels is impossible to calculate into any tangible model.

It's a guess, but I think that 2007-2008 negative Fed lending was them trading government securities for private, low valued securities. The off book bailout that Congress hadn't been able to audit. So that actually could have been loose monetary policy (trading known value government securities at par for private securities that would have been subject to fire sales otherwise,) just in a non-traditional manner. That's just a guess, though.

As for where the inflation is? Look at the "Excess" column in http://www.federalreserve.gov/releases/h3/hist/h3hist2.txt

Excess reserves in August 2011 are 845, that's Eight-Hundred-Forty-Five times as high as they were in August 2008. The inflation is sitting in banks' accounts at the Fed as excess reserves right now. When banks decide to start lending again, or the Fed decides to stop paying interest on reserves, that money is going to come out in a flood unless the Fed does something fast eliminate them.

The Fed can control one of those two situations. Right now with Europe screwed up as it is and the economy toying with a double dip, I'm not too worried about inflation. But this time next year? Things could change, and when they start changing, they'll change fast, very likely too fast for the Fed to keep in control.

Isn't the government monetizing its debt typically the first stop on the road to hyperinflation?

It may seem odd to say it, but I like this idea of printing money to extinguish the federal debt. I also like the idea of moderate inflation.

Milton Friedman went to Japan in the 1990s and told them to print more money and buy bonds. He was a big fan of QE for countries that have had a real estate bust and suffer from low demand and low inflation.

That's us.

Or, we can suffer for a few decades like Japan. With no end in sight. Equities markets and real estate markets down 75-80 percent in 20 years. You sure you hate inflation? Move to Japan.

I prefer prosperity. The Fed should target nominal GDP growth of about 7 percent and start buying and effectively retiring bonds until we get to that level of growth. If we get moderate inflation, all the better.

What we should care about is real economic growth, prosperity, innovation and economic freedoms and rights. Lower taxes and less regs.

A perverted worship of gold, and a sickly obsession with inflation is retarding true GOP progress. Worshiping gold is exactly the wrong way to boost an economy.