Over the Cliff, My Fellow Lemmings!

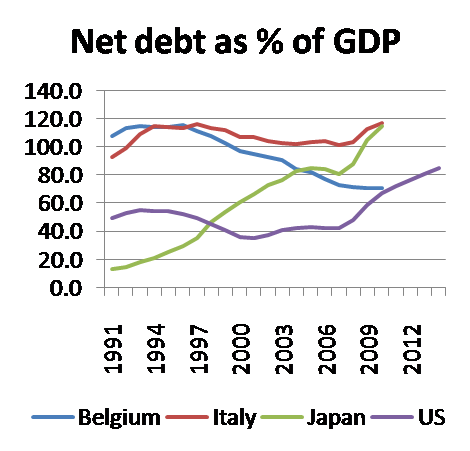

I found this 2009 graph and comment by Paul Krugman (dredged up by Megan McArdle) to be a hilarious call to arms for all his fellow lemmings to follow him over the cliff

[from November 2009]: Why, people ask, would I want to compare us to Belgium and Italy? Both countries are a mess!

Um, guys, that's the point. Belgium is politically weak because of the linguistic divide; Italy is politically weak because it's Italy. If these countries can run up debts of more than 100 percent of GDP without being destroyed by bond vigilantes, so can we.

Today I spent time arguing with a group of folks about global warming and the precautionary principle. The others all argued that a slim chance of a catastrophe justified immediate action. I argued, of course, that they were understating the cost of the intervention, but that is another story.

Its amazing to me that so many on the Left squawk about the precautionary principle in the case of climate, but are ready to continue running up government spending and deficits despite the fact that the disaster of this approach, given the experience in Europe, is no longer even debatable. Its simply math.

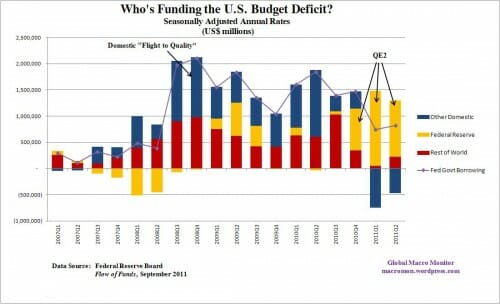

Our problem will play out differently than in Europe. Long before interest rates on US securities run up to the 6% or so tipping point, the Fed will be running the printing presses. Don't believe me, well, they already have been.

Savers beware, our path will be devaluation and inflation.

By the way, the speed with which hyperinflation can take hold is astounding. Here is the inflation rate in the Weimar Republic. As with the Fed today, the central bank of the Weimar Republic was buying up government debt with printed currency. Look how fast the inflation took hold:

(source) Imagine a quarterly meeting of the Fed in August of '22. They are probably looking at month-old data, and in July it looks like everything is under control. Boom, three months later, by the next schedule quarterly meeting, inflation is already out of control. Krugman would say not to worry about inflation, they will have plenty of time to act. Coincidently, this is exactly what Italy and France and Spain said about their sovereign debt, but in a flash, the crisis was upon them and so far out of control there is nothing they can do.

Germany isn't directly comparable because the US isn't paying large war repatriations. As bad as all fiat currencies are atm, the USD is still looking brighter than most. Don't take this as an endorsement of the US debt, just I don't think you can accurately say the US is on the verge of hyperinflation. I would guess Japan or China would blow up first.

The tipping point on US bonds would hardly be 6% though, with ZIRP the total debt increases but the interest payments on the debt decrease. It's a trap where rates can never be raised above 0 lest all government revenues be tied up in interest payments. I haven't done the math but I would suspect 2-3% be sufficient to kill the US government.

Only idiots use government debt as % of gdp. Government debt as % of government revenue is more relevant in determining ability to service debt.

The precautionary principle is neither; it's just window dressing for confirmation bias. In practice, it means that you should worry excessively about risks that worry progressives, and completely ignore all other risks. A libertarian applying the same "principle" would get wildy different results. Not exactly science, is it...

It's impossible for debt to get that high relative to GDP, since every dollar of stimulus probably produces two or three or eight dollars of GDP growth. In fact, anybody serious about reducing debt relative to GDP will agree to take out $10 trillion in debt so we can grow our economy by like $50 trillion and pay back the entire national debt.

I'm glad to have Nobel-winning economist Paul Krugman around to explain economics to the world; we might come up with some really idiotic ideas without him.

Why would US borrowing costs go up when the federal government has no need to borrow money? It creates dollars and destroys them with the click on a spreadsheet. This is not true for European countries and was emphatically not true for Weimar Germany. The latter had massive war debt denominated in a foreign currency which planted the seed and the occupation of the Ruhr, effectively decimating their productive capacity, sealed the deal. Neither of those things even remotely describes the US situation right now. We have a huge amount of idle capacity and virtually all US debt is denominated in dollars. If we start issuing RMB bonds or whatever then watch out- but why on earth would the US government start doing that? Right now there's still a huge demand for US currency around the world- or what's the other explanation for the persistant trade deficit? It can only exist because of government policy around the world targeted to accumulating dollars- otherwise exchange rates would shift until trade balanced out.

The US has no solvency problems, no inflation problems (perhaps cost push inflation with oil prices going up and feeding through the entire economy, but that's not a dollar problem) and a huge amount of productive capacity sitting around doing nothing.

@NL_ It depends on where the GDP is growing. Growth in the government component of GDP is not sustainable unless it in turn triggers growth in the private sector.

As for Nobel prize winning Paul Krugman. Now there is a badge of honor with the likes of Nobel prize winning Albert Gore and Nobel prize winning Barrack Hussein Obama. If you ever wanted proof of the demise of a once lofty award it is the selection of that trio.

QE1 and QE2 were more like bailouts to banks than actual expansion of the money supply. Almost all of that money is sitting in accounts at the Fed, the ratio of M1 to M2 has plummeted since Bernanke began quantitative easing. The main factor holding us back from inflation right now is interest: When the Fed stops paying interest on deposits, or when banks begin seeing expected returns on lending higher than what the Fed is paying, THEN we'll have to worry about inflation. And it will probably happen fast. The Fed is confident they can pull that cash out of banks before that happens, I'm not so sure.

Does that chart of who is financing the deficit take into account the fact that the Fed is actively retiring short term debt and replacing it with long term debt at low rates? http://articles.latimes.com/2011/sep/20/business/la-fi-0920-markets-fed-20110920

Hyperinflation requires that monetary authorities continue expansionary policies while remaining either ignorant of or indifferent about the inflation those policies are causing.

The Fed's current policies - expansionary as they are - are not presently causing inflation, at least not to any degree that should be alarming, i.e. no more inflation than usual. The Fed is hypervigilant about inflation. Should their policies ever start causing significant inflation, they can easily change their policies and curb it. And I see no reason that they would not do so, absent an act of congress changing their mandate or their independent status.

Public debt can't be dealt with "in a flash" because of the special interests and their beholden legislators who will refuse to back away from the public trough. Inflation can be dealt with by the Fed, overnight.

I wish I understood where you get all your vast generalizations about "the left." Most of us to the "left" of you, are all for fiscal sanity, just in the form of STOPPING THE WARS and scaling back our insane military intervention all over the world, scaling back the militarization of our police forces here at home, and ending the drug war, BEFORE looking at cutting aid to the poor, sick, or elderly. It's hard to take talk of budget-cutting seriously when it comes from a bunch of trigger-happy warmongers, in either major party.

@Fay for all "the lefts" complaining about the cost of the wars. The entire cost of the wars amounts to about 1 year of Obama deficit spending.

I suspect "the wars" while costly are only about 20% of the entire problem.

Fine. A 20% cut would still be pretty great, wouldn't it?

And by "the wars" I do also mean our entire military intervention policy in general... bases in 100+ countries, etc.

But I see your point.

Re the precautionary principle. I got into an argument with a 60 yr old Harvard MBA (wild-eyed liberal) about the cost of dealing with the perceived CO2 problem. I mentioned that I had read that the cost to stop CO2 was estimated to be 35 trillion dollars. I asked him "if the chance of catastrophic global warming was only 5%, wouldn't it be absurd to spend that much money". To my amazement, he thunderously exclaimed "NO!! We must spend the money!!". This is the wonderful example of the education that the eastern liberal colleges bestow on their grads: how to think (or not) like a zealot.

The prcautionary principle must be applied with careful study. In some cases (debt) it seems to be justified. The cost/benefit ration is favorable. In CGW, the reverse is true. You cannot apply the idea blindly.

As long as we have lots of people who put slogans and zealotry ahead of careful thought, we will have this sort of problem. I am sure if objective cool heads would study ANY of our nation's problems, workable ways to deal with them would be found. Otherwise, we will be stuck in lala land forever.

Fay:

Have you considered that the aid to the poor, sick, and elderly have increased those problems? For example, many do not go back to work until their unemployment runs out. Many poor girls have babies in order to get free money (look at illegitemacy rates since federal aid to dependent children started). Many whose unemployment has run out apply for disability money. etc. etc.

I could bore you with stories from my personal experience on the subject of welfare abuses. Bottom line: we all need the carrot and the stick. Freebies beget indolence and irresponsible behavior. Making this statement does not make me into a monster. I am simply stating a fact of human nature.

I don't know of anyone who wants grandma to go off a cliff or children starve. The problem is that noone has come up with assistance programs that avoid human nature: if you can get it for free, why work? Rather than just push more money out the door, liberals (and others) need to find incentive systems to go along with the handout programs. Therein lies the problem.

Many other than liberals decry the inclination of the USG to meddle in the affairs of the world. That is a seperate problem from the nanny state thing. The only thing they have in common is that money is being wasted.

On a personal note, as a retiree I would be glad to have a reduction in my SS or medicare benefits if the savings were put to good use. Historically, the USG pisses away more money every time there is a savings plan or tax increase. Thus, nothing beneficial is accomlished. Unless I see a plan that puts the higher taxes to good use (NOT more kookoo DOE schemes or nanny state buy-the-vote givaway plans), I will be very much against tax increases.

Fay:

One other point re ending the drug war. Everyone agrees that our efforts to stop drug use are a failure. Decriminalizing drug use and other ideas have been tried, with little success. Nobody, including myself, has any idea what to do.

I personally know people who have become hooked on painkillers, which ruined their lives. I know someone who robbed a drugstore of prescrioption drugs and is now in prison. I am tempted to say "let the idiots go around spaced out and ruin their lives if they want to". The problem is that they cannot hold a job and steal from the rest of us, as well as cause accidents and other problems. It is fine to say the present approach isn't working. Your comments suggest you have a better way. I would like to hear it.

Well said Sir! The precautionary principle is used to justify much of policies to combat global warming. However, here in Britain the high-risk strategies on spending are the same. For instance the switch to renewables, which the British Treasury calculates will push up gas and electric bills by 60-70% in the next 20 years, will actually save the consumer about 6-7%. The reason being that they estimate the cost of fossil fuels will rise by more than the 60-70%.

Another high risk impact is to assume that a small amount of carbon taxes will cause a huge long-term impact on CO2 emissions. There are two routes. First to get people to reduce waste / invest in greater efficiency. Second, to spur investment to find radical cost-effective alternatives. The evidence shows that greater efficiencies have a marginal impact. The second is hardly going to add much considering their has been a three-fold increase in the oil price.

The same sort of high-risk reasoning takes place to justify fiscal expansion in a crisis and QE. The hope is the multiplier effects on general economic activity will far outstrip the costs. Therefore the tax revenue impact of this wonder expenditure will cause the deficit to fall not rise. In the UK the most optimistic impact of GBP200bn of QE is 2% of gbp, or GBP30bn. (Commentators do not make this transaction). No-one has a plan for how this might be unwound without a negative impact.

Re: welfare: In my experience/anecdotes/personal stories, the fraudsters are a very small percentage of people who use the programs. Yes, you will always have people who abuse such things. But putting up with that percentage is better, to me, than going back to the 19th century and letting the poor roam the streets, begging and stealing... or leaving it up to private charity, which can decide that "certain people" don't deserve any help. To put it very succinctly. Even if we're very generous and say 20% of all welfare is obtained fraudulently, that still leaves the other 80% who generally receive benefits for a very short period of time.. and who generally really need them. It is also possible to design programs where there is more of a "carrot" out there than in others. I believe that the amount of abuse has been greatly exaggerated by the Reagan "welfare queen" myth; the answer isn't to get rid of it entirely, but to weed out abuses as best as possible. Also, remember that the reason Social Security even came about was a rather large problem of elderly poverty. Of course no assistance program avoids human nature; nor does the free market; nor does any other system. A robust social safety net is still, to me, an important part of a free society. Much more important than invading another country that never attacked mine, for example.

Re: the drug war, I think the government could take one-tenth of the money it spends on military police tactics, imprisoning pot smokers, the prison-industrial complex, etc. etc., and build government drug-rehab centers, and get thousandfold better results. And have you done any reading about decriminalization in Portugal? "Little success" is not quite the case in the few places it's been tried. I understand what you're saying about addicts whose lives are ruined; do you really think keeping something illegal makes it LESS dangerous? I propose that it's the same idea as with guns and abortion. By criminalizing, you create a black market that makes the problem a lot worse than it would otherwise be if it were out in the open. We are living Prohibition all over again on a much grander (and more deadly) scale.

http://www.treasurydirect.gov/instit/annceresult/press/preanre/2011/R_20111122_2.pdf

WIth 35 billion in 10 year t-bill sales at less than 1%, it's getting pretty hard to see the case for hyperinflation being just around the corner. The federal government should be taxing even less than it is right now if anything.

The tipping point for the dollar will be when China decides it wants to divest of dollars held as reserves. When that happens, bond prices will fall dramatically, so interest rates will rise. The Fed will be faced with the choice to either (a) swap dollar bills for dollar bonds to keep interest rates from rising too high or (b) to let higher interest rates cause a (deeper) recession. The first choice causes inflationary pressure because it further devalues the dollars and bonds held abroad, so other holders of those assets will also start dumping them. Shouldn't we be worried that the future of our economy is in the hands of the Communist Party of China?

@NL_

You postulate a multiplier of two to eight. I would suggest that the multiplier from the actual stimulus might be less than one. There's some academic support for this being the measurement for various portions of the stimulus and for the stimulus overall. For example, see http://weber.ucsd.edu/~vramey/research/NBER_Fiscal.pdf. If that's the case, the government could spend the economy into recession. (To know, you have to also know the effect that the money would have had, if it had been left where it was.)

In any case, I have never seen an academic study that suggested a multiplier approaching eight. The usual range that I have seen doesn't exceed 2.5. See http://www.theatlantic.com/politics/archive/2009/03/cbo-on-stimulus-multipliers/1126/ as an example. There's a decent sampling of academic literature in the appendix to http://weber.ucsd.edu/~vramey/research/JEL_Fiscal_14June2011.pdf.

Max

Fay:

My point re welfare was partly the fraud, but mainly how it screws up peoples incentives.

On the first point, let me provide a couple of anecdotes. On a construction project many years ago, a steel erector told me he worked in the North for six months and then went back to Georgia and sat on his porch for six months. He called unemployment "rocking chair insurance". I had a female neighbor who got fired rather than transfer to another state. I mentioned to her that she should get on with a temp agency which might lead to a permanent job. She gave me a startled look and said "but I would lose my unemployment benefits". I have known many people who work for six months, then pick a fight with the boss and get fired, go on unemployment for six months, and repeat the process. (This is a constant problem for small businesses). I could tell you many other similar stories from my PERSONAL experience. Many books have been written on the subject. I believe you are VERY mistaken if you think only 20% is fraud or deadbeats. I suggest you read up on the subject. By the way, I am no better than anyone else in this regard. I retired when I could afford to, even though I had a well paying (engineer) and interesting job. Everyone I know did the same. DO NOT MAKE IT ATTRACTVE TO NOT WORK! People would not beg and steal if there were no freebies. They would get their butts in gear and work. The bottom line is that we all need the carrot and the stick. I gather that you do not believe this, and that almost everyone at the bottom of the heap is there through no fault of their own. I think that view is completely wrong. Again, I suggest you do a literature search on the subject. I did that a number of years ago and it was quite illuminating. If you give people an alternative to working, many will avail themselves of it. The more attractive the alternative (better welfare /unemployment benefits), the more people go that route. If you could get $100K benefits, hardly anyone would work.

Yes, I am sure we all know cases where honest hard working people have fallen on hard times through no fault of their own. If there was some way to limit assistance to those people only, you would have a winner. Any suggestions?

As to the drug war, the Dutch and Swiss have tried all sorts of schemes along the line you suggest with not very good luck. I am not aware of any society which has successfully dealt with the substance abuse problem. I agree with you then incarceration of all drug users is not a good idea, but am not aware of any successful alternatives. Personally, my main concern is that the druggies get kids hooked. When my son was young, if a druggie had given him drugs I may very well have shot him. I hasten to add that I don't recommend that as a solution.

If the precautionary principle were applied to the risk of large extraterrestrial object striking the planets, something that has unquestionably had major effects in the past, we'd be out there mining the asteroids today and moving them around for our convenience. But we aren't.

Do you suppose it may be because developing our abilities in outer space wouldn't offer any advantage to wannabe leftist dictator types?

Speaking of precautions...

Fay, one reason we have our military in so many places is that it is hugely cheaper than fighting wars in those places, which happened with annoying regularity in previous centuries. It is the price we pay for keeping our foreign markets stable.

Great minds think alike. You might like my post "Budget Wars: Lemmings Face a Debt Cliff" at http://www.wisejargon.com/blog/budget-wars-lemmings-face-a-debt-cliff.html

I have this embedded youtube video with lemmings going over a cliff to Star Wars music:http://www.youtube.com/watch?v=5SOZ0kfUqSE