Over the Cliff, My Fellow Lemmings!

I found this 2009 graph and comment by Paul Krugman (dredged up by Megan McArdle) to be a hilarious call to arms for all his fellow lemmings to follow him over the cliff

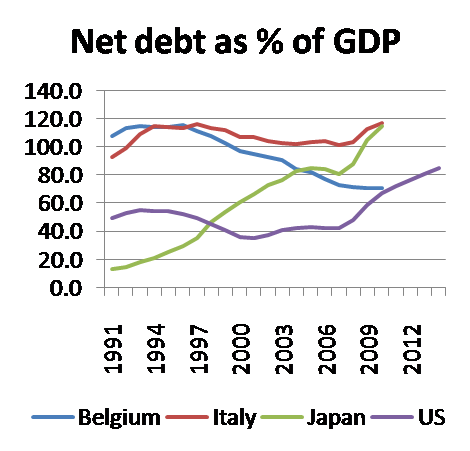

[from November 2009]: Why, people ask, would I want to compare us to Belgium and Italy? Both countries are a mess!

Um, guys, that's the point. Belgium is politically weak because of the linguistic divide; Italy is politically weak because it's Italy. If these countries can run up debts of more than 100 percent of GDP without being destroyed by bond vigilantes, so can we.

Today I spent time arguing with a group of folks about global warming and the precautionary principle. The others all argued that a slim chance of a catastrophe justified immediate action. I argued, of course, that they were understating the cost of the intervention, but that is another story.

Its amazing to me that so many on the Left squawk about the precautionary principle in the case of climate, but are ready to continue running up government spending and deficits despite the fact that the disaster of this approach, given the experience in Europe, is no longer even debatable. Its simply math.

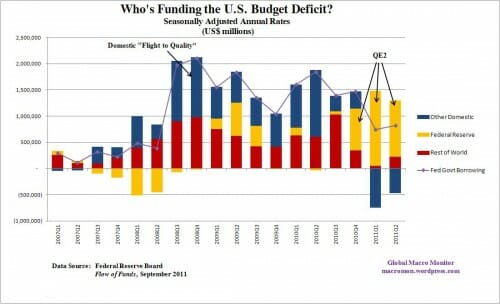

Our problem will play out differently than in Europe. Long before interest rates on US securities run up to the 6% or so tipping point, the Fed will be running the printing presses. Don't believe me, well, they already have been.

Savers beware, our path will be devaluation and inflation.

By the way, the speed with which hyperinflation can take hold is astounding. Here is the inflation rate in the Weimar Republic. As with the Fed today, the central bank of the Weimar Republic was buying up government debt with printed currency. Look how fast the inflation took hold:

(source) Imagine a quarterly meeting of the Fed in August of '22. They are probably looking at month-old data, and in July it looks like everything is under control. Boom, three months later, by the next schedule quarterly meeting, inflation is already out of control. Krugman would say not to worry about inflation, they will have plenty of time to act. Coincidently, this is exactly what Italy and France and Spain said about their sovereign debt, but in a flash, the crisis was upon them and so far out of control there is nothing they can do.