A lot of folks, particularly on the left, look with some fondness at the political economy of continental Europe. They are attracted by high job security, short work weeks, long vacations, and a strong welfare system. They make the mistake of seeing in these traits a more promising society "for the little guy," when in fact just the opposite is true.

The European Corporate State

The political economy of companies like Germany and France are actually incredibly elitist, dominated by perhaps a hundred guys (and I do mean guys) who run the country in a model only a few steps removed from Mussolini-style fascism or the Roosevelt's National Industrial Recovery Act. In these countries, perhaps 20 corporations, ten or fifteen large unions, and a group of powerful politicians and regulators run the economy.

US workers sometimes make the mistake of seeing the political power of European unions and equating this power with being a more egalitarian environment for workers. But the European political economy is rule by the in-crowd over the out-crowd that exceeds any of the patronage relationships we complain about in this country. What we don't often see from our American perspective is the way the system is structured not to protect poor from the rich or the weak from the strong, but to protect incumbents (whether they be corporations or skilled workers) from competition.

In the European labor markets, mobility is almost impossible. The union system is built to protect current high-skilled workers from competition from new workers, whether in the same country of from abroad. Large corporations that form part of the cozy governance of the country are protected from new competition, and are bailed out by the government when they hit the rocks.

As a result, unemployment is structurally high in countries like France and Germany, hovering for decades between 8 and 12% -- levels we would freak out at here. Young and/or unskilled workers have a nearly impossible time breaking into the labor market, with entry to better jobs gated through apprenticeships and certifications that are kept intentionally scarce. Joe the plumber is an impossibility in Europe. Some Americans seem to secretly love the prospect of not easily being fired from their job, but they always ignore the flip side -- it is equally hard to ever be promoted, because that incompetent guy above you can't be fired either.

Entrepreneurship in Europe is almost impossible -- the barriers just to organizing your own corporation legally are enormous. And, once organized, you will quickly find that you need a myriad of certifications and permissions to operate in your chosen field -- permissions like as not that are gated and controlled by the very people you wish to compete with. The entire political economy is arrayed in a patronage system to protect current businesses with their current workers.

Here is a test, that works most places in the US except possibly in Manhattan. Ask yourself who are the wealthiest and/or most succesful people that you know. Then think about where they went to school. Sure, some of the more famous Fortune 25 CEOs went to name schools, but what about the majority of succesful people you meet in your life? If you are like me, most of them did not go to Ivy League or what one might call elite schools. They had normal state college educations. You will typically find a very different picture in Europe. While of course there are exceptions, it is much more likely that the wealthy people one meets were channeled through a defined set of elite schools.

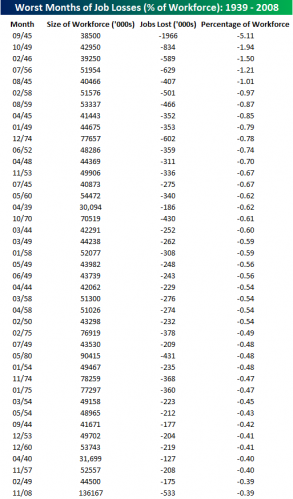

Corporations in Europe, particularly the cozy few who wield influence with the government, seldom fail and/or really gain or lose much market share. I always thought this a telling statistic: (Fortune 100 by year here)

[Olaf Gersemann] points out that of the top 20 largest publicly traded companies in the US in 1967, only 11 are even in the top 60 today, much less the top 20. In contrast, he points out that of the 20 largest German companies in 1967, today, thirty-five years and nearly two generations later, 19 are still in the top 60 and 15 are still in the top 20.

Its also an inherently anti-consumer society. The restrictions on foreign trade, entrepreneurship, and new competition all reduce consumer choice and substantially increase prices. EU anti-trust enforcement, for example, barely pretends any more to look out for consumer interests. Most of the regulators decisions are better explained by protection of entrenched and politically influential European competitors than it is by consumer power or choice.

"Progressives" in this country often laud the lower income inequality numbers in Europe vs. the United States. The implication is that the poor in Europe are somehow better off. But in fact this is not true. Careful studies have shown that the poor are at least as well off in the US as in Europe, particularly when one corrects for the number of new immigrants in the US. (That's another difference, by the way -- Europe is virtually closed to immigration, at least as far seeking new integrated citizens is concerned). What drives income inequality is that our middle class is richer than Europe's middle class, and our wealthy have more income than Europe's wealthy.

To this last point, I have always felt that comparisons of the wealthy in the US to those in Europe, and comparison of income inequality numbers, are a bit apples and oranges. The US is a country where access to most of the best perks is via money - they have a price. In Europe, access to most of the best perks can't be bought by money, they can only be accessed by those with the elite establishment club card. To some extent, the income numbers understate the difference between rich and poor in Europe for this reason.

Next Stop: America

We see many of the elements of the European economic system slipping into the US today. An increasing number of professions require certification by the government, with this certification often either controlled by the incumbents in the profession or with criteria that essentially require new entrants to compete in the same way incumbents do. We see the top companies with political influence, from Wall Street firms to banks to automobile manufacturers getting government assistance to stay in business or maintain their status. This, from the proposed GM bailout, is the European system personified:

General Motors and Cerberus Capital Management have asked the U.S. government for roughly $10 billion in an unprecedented rescue package to support a merger between GM and Chrysler, two sources with direct knowledge of the talks said on Monday....

one of the conditions of the merger would be that GM-Chrysler would spare as many jobs as possible in order to win broad political support for the government funding needed to complete the deal, people familiar with the merger discussions said.

This is the same political deal cut in Europe. Large powerful company is protected from failure by government. In turn, powerful company protects interest of powerful union. The only thing missing here, which I think is clearly on the agenda for the Obama administration, is a large protective tariff to shield this inefficient mess from competition. Left out of the equation are consumers, who get more expensive cars and suffer because GM is again given a hall pass from producing cars that people actually want to buy. Also left out are potential competitors, who don't get the government deal and who miss out on the chance to buy up GM assets and hire ex-GM employees out of bankruptcy and do a better job with them. This European system puts a premium on keeping productive assets in their current hands, rather than in the most productive hands:

Corporate DNA acts as a value multiplier. The best corporate DNA has a multiplier greater than one, meaning that it increases the value of the people and physical assets in the corporation. When I was at a company called Emerson Electric (an industrial conglomerate, not the consumer electronics guys) they were famous in the business world for having a corporate DNA that added value to certain types of industrial companies through cost reduction and intelligent investment. Emerson's management, though, was always aware of the limits of their DNA, and paid careful attention to where their DNA would have a multiplier effect and where it would not. Every company that has ever grown rapidly has had a DNA that provided a multiplier greater than one... for a while.

But things change. Sometimes that change is slow, like a creeping climate change, or sometimes it is rapid, like the dinosaur-killing comet. DNA that was robust no longer matches what the market needs, or some other entity with better DNA comes along and out-competes you. When this happens, when a corporation becomes senescent, when its DNA is out of date, then its multiplier slips below one. The corporation is killing the value of its assets. Smart people are made stupid by a bad organization and systems and culture. In the case of GM, hordes of brilliant engineers teamed with highly-skilled production workers and modern robotic manufacturing plants are turning out cars no one wants, at prices no one wants to pay.

Changing your DNA is tough. It is sometimes possible, with the right managers and a crisis mentality, to evolve DNA over a period of 20-30 years. One could argue that GE did this, avoiding becoming an old-industry dinosaur. GM has had a 30 year window (dating from the mid-seventies oil price rise and influx of imported cars) to make a change, and it has not been enough. GM's DNA was programmed to make big, ugly (IMO) cars, and that is what it has continued to do. If its leaders were not able or willing to change its DNA over the last 30 years, no one, no matter how brilliant, is going to do it in the next 2-3.

So what if GM dies? Letting the GM's of the world die is one of the best possible things we can do for our economy and the wealth of our nation. Assuming GM's DNA has a less than one multiplier, then releasing GM's assets from GM's control actually increases value. Talented engineers, after some admittedly painful personal dislocation, find jobs designing things people want and value. Their output has more value, which in the long run helps everyone, including themselves.

The alternative to not letting GM die is, well, Europe (and Japan). A LOT of Europe's productive assets are locked up in a few very large corporations with close ties to the state which are not allowed to fail, which are subsidized, protected from competition, etc. In conjunction with European laws that limit labor mobility, protecting corporate dinosaurs has locked all of Europe's most productive human and physical assets into organizations with DNA multipliers less than one.

Beyond the actual legislation, the other sign that the European model may be coming to the US is in attitudes. I think Michelle Obama is a great example of this. She and her husband checked all the elite boxes - Princeton undergrad, Harvard Law - but she is shocked that having punched her ticket into elite society, society didn't automatically deliver, as it might in, say, France. She's actually stunned that, had it not been for Barack's succesful books, they might have had to give up their jobs as community organizers and at non-profits to actually earn enough to pay back their 6-figure school loans.

Despite their Ivy League pedigrees and good salaries, Michelle Obama often says the fact that she and her husband are out of debt is due to sheer luck, because they could not have predicted that his two books would become bestsellers. "It was like, 'Let's put all our money on red!' " she told a crowd at Ohio State University on Friday. "It wasn't a financial plan! We were lucky! And it shouldn't have been based on luck, because we worked hard."**

The Progressive Irony

In all this, I think there is an amazing irony. In a nutshell its this: The "Change" that Barack Obama is selling to the electorate is in fact the creation of a government infrastructure to fight change. I have written before that progressives are actually inherently conservative.

Ironically, though progressives want to posture as being "dynamic", the fact is that capitalism is in fact too dynamic for them. Industries rise and fall, jobs are won and lost, recessions give way to booms. Progressives want comfort and certainty. They want to lock things down the way they are. They want to know that such and such job will be there tomorrow and next decade, and will always pay at least X amount. That is why, in the end, progressives are all statists, because, to paraphrase Hayek, only a government with totalitarian powers can bring the order and certainty and control of individual decision-making that they crave....

One morning, a rice farmer in southeast Asia might faces a choice. He can continue a life of brutal, back-breaking labor from dawn to dusk for what is essentially subsistence earnings. He can continue to see alarge number of his children die young from malnutrition and disease. He can continue a lifestyle so static, so devoid of opportunity for advancement, that it is nearly identical to the life led by his ancestors in the same spot a thousand years ago.

Or, he can go to the local Nike factory, work long hours (but certainly no longer than he worked in the field) for low pay (but certainly more than he was making subsistence farming) and take a shot at changing his life. And you know what, many men (and women) in his position choose the Nike factory. And progressives hate this. They distrust this choice. They distrust the change. And, at its heart, that is what the opposition to globalization is all about - a deep seated conservatism that distrusts the decision-making of individuals and fears change, change that ironically might finally pull people out of untold generations of utter poverty.

Don't believe me? Below is from an email I received. The writer was outraged that I would have the temerity to say that the middle class in the US had it better than even the very rich in the 19th century.

Sure, the average rural resident of a developing country earns more in dollars today than before. But you're missing the big picture. Wealth is about so much more than just money, and status symbols. It is about health, and well being, and contentedness, and happiness. The average peasant family in India in 1900 may have lived a spartan lifestyle by today's standards, but it probably could rely on more land per family, crops uncontaminated by modern pesticides and fertilizers, a stronger social network and village-based safety net. These peasants were self-sufficient. That is no longer the case

Progressives want to eliminate risk and lock in the current world. New technologies, new competitors, new business models all need to be carefully screened and gated by a government-labor-corporate elite. Entrepreneurship, risk, mobility, achievement all should be sacrificed to a defined and steady paycheck. In the name of dynamism, progressives, as well as many modern politicians, want to limit the dynamism of the American economy. In the name of egalitarianism, they wish to create a small political elite with immense power to manage everyone's life. In the name of progress, they wish to lock current patterns and incumbents in place.

** Postscript: By the way, here is how I responded to Michelle Obama's education debt rant

I don't know why I can't just move along from Michelle Obama's rant about the terrible cost of her Princeton / Harvard Law degree. Maybe its because I attended the same schools (different degrees) and my reaction is just so different -- I had a fabulous experience and live in awe that I had such a unique chance to attend these schools, while Michelle Obama seems to experience nothing but misery and resentment. Granted that I did not have to take on a ton of debt to get these degrees, but I have plenty of friends (and a wife) that did.

This analogy comes to mind: Let's say Fred needs to buy a piece of earth-moving equipment. He has the choice of the $20,000 front-end loader that is more than sufficient to most every day tasks, or the $200,000 behemoth, which might be useful if one were opening a strip mine or building a new Panama Canal but is an overkill for many applications. Fred may lust after the huge monster earth mover, but if he is going to buy it, he better damn well have a big, profitable application for it or he is going to go bankrupt trying to buy it.

So Michelle Obama has a choice of the $20,000 state school undergrad and law degree, which is perfectly serviceable for most applications, or the Princeton/Harvard $200,000 combo, which I can attest will, in the right applications, move a hell of a lot of dirt. She chooses the $200,000 tool, and then later asks for sympathy because all she ever did with it was some backyard gardening and she wonders why she has trouble paying all her debt. Duh. I think the problem here is perfectly obvious to most of us, but instead Obama seeks to blame her problem on some structural flaw in the economy, rather than a poor choice on her part in matching the tool to the job. In fact, today, she spends a lot of her time going to others who have bought similar $200,000 educations and urging them not to use those tools productively, just like she did not.