Yet Again, Forgetting the Mix

I like reading Zero Hedge, though their laudable cynicism about government and financial markets sometimes edges into conspiracy theory.

Anyway, I wanted to highlight something in a post there today about BLS data. Various writers at the site have claimed for years that government economic data is being manipulated. I am not sure I buy it -- I distrust government a lot but am not sure their employees could sustain such a fraud over months and years. And besides, once you manipulate data one time to juice some metric, you have to keep doing it or the metric just reverses the next month. Corporations that play special quarter-end inventory games to increase reported sales learn this very quickly. Where there are apparent errors, I am much more willing to assume incompetence than conspiracy.

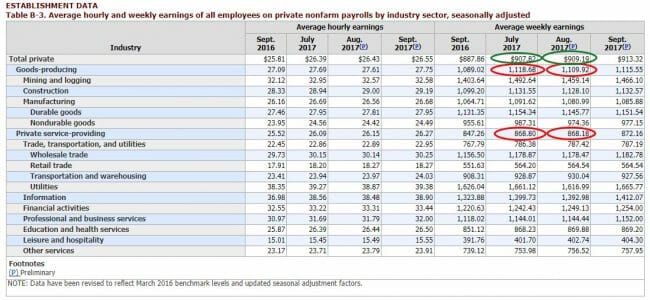

The example this week is from the BLS payrolls data, and I will quote from the article and show their chart:

Another way of showing the July to August data:

- Goods-Producing Weekly Earnings declined -0.8% from $1,118.68 to $1,109.92

- Private Service-Providing Weekly Earnings declined -0.1% from $868.80 to $868.18

- And yet, Total Private Hourly Earnings rose 0.2% from $907.82 to %909.19

What the above shows is, in a word, impossible: one can not have the two subcomponents of a sum-total decline, while the total increases. The math does not work.

Certainly this is an interesting catch and if I were producing the data I would take these observations as a reason to check my work. But the author is wrong to say that this is "impossible". The reason is that these are not, as he says, two sub-components of a sum. They are two sub-components of a weighted average. Total private average weekly earnings is going to be the goods producing weekly average times number of goods producing hours plus service producing weekly average times the number of service producing hours all over the total combined hours.

From this I hope you can see that even if the both sub averages go down, the total average can go up if the weights change. Specifically, the total average can still go up if there is a mix shift from service providing to goods producing hours, since the average weekly wages of the latter are much higher than the former. I will confess it would have to be a pretty big jump in mix. The percent goods producing hours would have to rise from 15.6% to almost 17%, which strikes me as a very large jump for one month. So I am not claiming this is what happened, but people miss the mix changes all the time. I had to explain it constantly back in my corporate days. Another example here.