This post is based on playing around with some analogies to try to understand quantitative easing in my own mind. I can't decide if this approach is helpful or just wanking. I fear it is the latter, but if we banned all banned all intellectual wanking in blogs, my feed reader would be virtually empty.

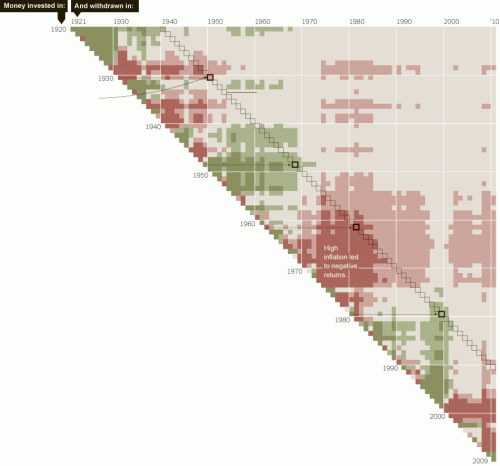

I haven't really written much about the Fed's latest round of quantitative easing, dubbed QE2. Basically they plan to print some significant fraction (I see different numbers in different articles) of a trillion dollars and use the newly created money to buy government bonds (they don't actually print the money but create it out of thin air in the memory banks of computers). As I understand it, the theory is that this will boost the price (and thus reduce yields) on the government bonds on the balance sheets of private banks. This will in turn have two effects: improve (at least on paper) the balance sheets of banks, hopefully making it more likely to lend; and it will reduce the yield on the bonds on their balance sheets, hopefully making private loans look like a better investment in comparison.

I am not an economist, and so won't get embroiled in issues I don't understand, but it strikes me that even if one accepts the theory of QE, it will be difficult to have any measurable impact as long as Congress and the administration keeps generating new debt at astounding rates.

But what is really happening here is that the dollar is being devalued. This is one of the semantic quirks that make me laugh -- when Argentina or Zimbabwe do this, its called devaluation. When a western nation does it, it is called quantitative easing. Because, uh, we are much smarter or something. But I have to believe that a lot of progressives have hitched their wagon to QE2 out of the hope for some inflation (wow, the revenge of William Jennings Bryant). Because inflation and dollar devaluation would nominally achieve some of the goals they are hoping for, including:

- making Chinese imports more expensive, creating a wealth transfer from consumers to a few politically powerful exporters

- re-inflating the housing bubble while devaluing long-term fixed rate mortgages, creating a wealth transfer from creditors to debtors

- continuing the wealth transfer from average workers (who typically don't have COLA's) to government and union workers (who typically do have COLA's)

- acts as wealth transfer from individuals to government since it creates an effective income tax rate increase, as key income levels in the tax tables, particularly where AMT kicks in, are not indexed for inflation

It is impossible to argue that devaluing a currency is a path to wealth generation. It can't be, though progressives, as always, are willing to tolerate a total reduction of wealth as the price for the type of re-distributions discussed above.

But excepting the re-distribution arguments, it strikes me that the only possible argument for this devaluation is that the economy is somehow trapped in a local minima from which the escape energy is too high. This would make QE a bit like annealing in a metal, where metal that is heated up and cooled too fast can be hard and brittle. The only way to get it to be ductile is to re-heat it and then allow it to cool slower.

This is kind of a pretty comparison, but in large part it is probably BS. The economy is way, way, way more complex and multi-variate than crystallization in a metal. Even if we were trapped in a local minima, which by the way it is pretty much impossible to determine, we don't know what kind of energy should be applied to the system to move it out. In fact, if we wanted to use this analogy, it would make far more sense to me to remove barriers to entrepreneurship and wealth creation which likely form a large part of the energy barrier that keeps us in such a local minima. In fact, the annealing analogy would likely point one in the direction of decalcifying markets and increasing labor mobility rather than massive government interventionism. It is much easier for me to argue that the missing energy is entrepreneurship rather than liquidity. Apparently, the German finance minister agrees with me:

The American growth model, on the other hand, is in a deep crisis. The United States lived on borrowed money for too long, inflating its financial sector unnecessarily and neglecting its small and mid-sized industrial companies. "¦I seriously doubt that it makes sense to pump unlimited amounts of money into the markets. There is no lack of liquidity in the US economy, which is why I don't recognize the economic argument behind this measure. "¦The Fed's decisions bring more uncertainty to the global economy. "¦It's inconsistent for the Americans to accuse the Chinese of manipulating exchange rates and then to artificially depress the dollar exchange rate by printing money.

Update: Chinese bond rating agency downgrades US treasuries

The United States has lost its double-A credit rating with Dagong Global Credit Rating Co., Ltd., the first domestic rating agency in China, due to its new round of quantitative easing policy. Dagong Global on Tuesday downgraded the local and foreign currency long-term sovereign credit rating of the US by one level to A+ from previous AA with "negative" outlook.