My View on Oil Markets

A number of readers have written me, the gist of the emails being "you have written that X or Y is NOT causing higher oil prices -- what do you think IS causing high oil prices?" Well, OK, I will take my shot at answering that question. Note that I have a pretty good understanding of economics but I am not a trained economist, so what follows relates to hard-core economics in the same way pseudo-code relates to C++.

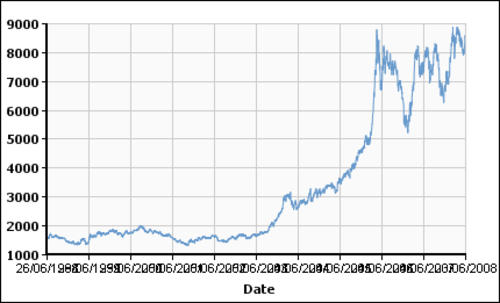

My first thought, even before getting into oil, is that commodity prices can be volatile and go through boom-bust periods. Here, for example, is a price chart of London copper since 1998:

While oil prices have gone up by a factor of about four since 1998, copper has gone up by a factor of about 15! But the media seldom writes about it, because while individual consumers are affected by copper prices, they don't buy the commodity directly, and don't have stores on every street corner with the prices posted on the street.

For a number of years, it is my sense that oil demand has risen faster than supply capacity. This demand has come from all over -- China gets a lot of the press, but even Europe has seen increases in gasoline use. Throughout the world, we are on the cusp of something amazing happening - a billion or more people in Asia and South America are emerging from millennia of poverty. This is good news, but wealthier people use more energy, and thus oil demand has increased.

On the supply side, my sense is that the market has handled demand growth up to a point because for years there was some excess capacity in the system. The most visible is that OPEC often has been producing below their capacity, with Saudi Arabia as the historic swing producer. But even in smaller fields in the US, there are always day to day decisions that can affect production and capacity on a micro scale.

One thing that needs to be understood - for any individual field, it is not always accurate to talk about its capacity or even its "reserves" as some fixed number. How much oil that can be pumped out on any given day, and how much total oil can be pumped out over time, depend a LOT on prices. For example, well production falls over time as conditions down in the bottom of the hole deteriorate (think of it like a dredged river getting silted up, though this is a simplification). Wells need to be reworked over time, or their production will fall. Just the decision on the timing of this rework can affect capacity in the short term. Then, of course, there are numerous investments that can be made to extend the life of the field, from water flood to CO2 flood to other more exotic things. So new capacity can be added in small increments in existing fields. A great example is the area around Casper, Wyoming, where fields were practically all shut-in in the 1990's with $20 oil but now is booming again.

At some point, though, this capacity is soaked up. It is at this point that prices can shoot up very rapidly, particularly in a commodity where both supply and demand are relatively inelastic in the short term.

Let's hypothesize that gas prices were to double this afternoon at 3:00PM from $4 to $8. What happens in the near and long-term to supply and demand?

In the near term, say in a matter of days, little will change on the demand side. Everyone who drove to work yesterday will probably drive today in the same car -- they have not had time to shop for a new car or investigate bus schedules. Every merchandise shipper will still be trucking their product as before - after all, there are orders and commitments in place. People will still be flying - after all, they don't care about fuel prices, they locked their ticket price in months ago.

However, people who argue that oil and gas demand is inelastic in the medium to long term are just flat wrong. Already, we are seeing substantial reductions in driving miles in this country due to gas price increases. Demand for energy saving investments, from Prius's to solar panels, is way up as well, demonstrating that prices are now high enough to drive not only changed behaviors but new investments in energy efficiency. And while I don't have the data, I am positive that manufacturers around the world have energy efficiency investments prioritized much higher today in their capital budgets.

There are some things that slow this demand response. Certain investments can just take a long time to play out. For example, if one were to decide to move closer to work to cut down on driving miles, the process of selling a house and buying a new one is lengthy, and is complicated by softness in the housing markets. There are also second tier capacity issues that come into play. Suddenly, for example, lots more people want to buy a Prius, but Toyota only has so much Prius manufacturing capacity. It will take time for this capacity to increase. In the mean time, sales growth for these cars may be slower and prices may be higher. Ditto solar panels.

Also, there is an interesting issue that many consumers are not yet seeing the full price effects of higher oil and gas prices,and so do not yet have the price incentive to switch behavior. One example is in air travel. Airlines are hedged, at least this year, against much of the fuel price increase they have seen. They are desperately trying not to drive people out of air travel (though DHS is doing its best) and so air fares have not fully reflected fuel price increases. And since many people buy their tickets in advance, even a fare increase today would not affect flying volumes for a little while.

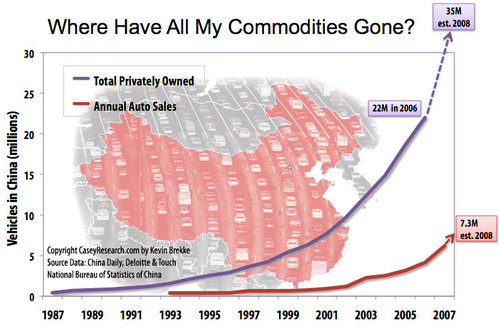

Another such example that is probably even more important are countries where consumers do not pay world market prices for gas and oil, with prices subsidized by the government (this is mostly true in oil producing countries, where the subsidy is not a cash subsidy but an opportunity cost in terms of lost revenue potential). China is perhaps the most important example. As we mentioned earlier, Chinese demand increases have been a large impact on world demand, as illustrated below:

All of these new consumers, though, are not paying the world market price for gasoline:

While consumers in much of the world have been reeling from spiraling

fuel costs, the Chinese government has kept the retail price of

gasoline at about $2.60 a gallon, up just 9% from January 2007.During that same period, average gas prices in the U.S. have surged

nearly 80%, to about $4 a gallon. China's price control is great for

people like Tang, who drives long distances in his gas-guzzling Great

Wall sports utility vehicle.But

Tang and millions of other Chinese are bracing for a big jump in pump

prices. The day of reckoning? Everybody believes it's coming right

after the Summer Olympics in Beijing conclude in late August.

Demand, of course, is going to appear inelastic to price increases if a large number of consumers are not having to pay the price increases.

Similarly, there are factors on the supply side that make response to large price increases relatively slow. We've already discussed that there are numerous relatively quick investments that can be made to increase oil production from a field, but my sense is that most of these easy things have been done. Further increases require development of whole new fields or major tertiary recovery investments in existing fields that take time. Further, we run up against second order capacity issues much like we discussed above with the Prius's. Currently, just about every offshore rig that could be used for development and exploration is being used, with a backlog of demand. To some extent, the exploration and development business has to wait for the rig manufacturing business to catch up and increase the total rig capacity.

There are also, of course, structural issues limiting increases in oil supply. In the west, increases in oil supply are at the mercy of governments that are schizophrenic. They know their constituents are screaming about high oil prices, but they have committed themselves to CO2 reductions. They know that their CO2 plans actually require higher, not lower, gas prices, but they don't want the public to understand that. So they demagogue oil companies for high gas prices, while at the same time restricting increases in oil supply. As a result, huge oil reserves in the US are off-limits to development, and both the US and Canada are putting up roadblocks to the development of our vast reserves of shale oil.

Outside of the west, most of the oil is controlled by government oil companies that are dominated by incompetence and corruption. For years, companies like Pemex have been under-investing in their reserves, diverting cash out of the oil fields into social programs to prop up their governments. The result is capacity that has not been well-developed and institutions that have only limited capability to ramp up the development of their reserves.

One of the questions I get asked a lot is, "Isn't there a good reason for suppliers to hold oil off the market to sustain higher prices?" Well, let's think about that.

Let's begin with an analogy. Why wouldn't Wal-mart start to hold certain items off the market to get higher prices? Because they would be slaughtered, of course. Many others would step in and fill the void, happy to sell folks whatever they need and taking market share from Wal-mart in the process. I think we understand this better because we know the players and their motivations better in retail than we do in oil. But the fact is that Wal-mart arguably has more market power, and in the US, more market share than any individual oil producer has worldwide. Oil producers have seen boom and bust cycles in oil prices for over a hundred years. They know from experience that $130 oil today may be $60 oil a year from now. And thus holding one's oil off the market to try to sustain prices only serves to miss the opportunity to get $130 for one's oil for a while. People tend to assume that the selfish play is to hold oil off the market to increase prices, but in fact it is just the opposite. The player who takes this strategy reduces his/her own profit in order to help everyone else.

This is a classic prisoner's dilemma game. Let's consider for a moment that we are a large producer with some ability to move prices with our actions but still a minority of the market. Consider a game with two players, us and everyone else. Each player can produce 80% of their capacity or 100%. A grid showing reasonable oil price outcomes from these strategies is shown below:

Reductions in our production from 100% to80% of capacity increases market prices, but not by as much as would reductions in production by other producers, who in total have more capacity than we. Based on these prices, and assuming we have a million barrels a day of production capacity, the total revenue outcomes for us of these four combinations are shown below, in millions of dollars (in each case multiplying the price times 1 million barrels times the percent production of capacity, either 80 or 100%):

We don't know how other producers will behave, but we do know that whatever strategy they take, it is better for us to produce at 100%. If we really could believe that everyone else will toe the line, then everyone at 80% is better for us than everyone at 100% -- but players do not toe the line, because their individual incentive is always to go to 100% production. For smaller players who do not have enough volume to move the market individually (but who make up, in total, a lot of the total production) the incentive is even more dramatically skewed to producing the maximum amount.

The net result of all this is that forces are at work to bring down demand and bring supply up, they just take time. I do think that at some point oil prices will fall back out of the hundreds. Might this reckoning be pushed backwards a bit by bubble-type speculation? Sure. People have an incredible ability to assume that current conditions will last forever. When oil prices were at $20 for a decade or so, people began acting like they would stay low forever. With prices rising rapidly, people begin acting like they will continue rising forever. Its an odd human trait, but a potentially lucrative one for contrarians who have the resources and cojones to bet against the masses and stick with their bet despite the fact that bubbles sometimes keep going up before they come back down.

I don't have the economic tools to say if such bubble speculation is going on, or what a clearing price for oil might be once demand and supply adjustments really kick in. I do have history as an imperfect guide. In 1972 and later in 1978 we had some serious price shocks in oil:

Depending on if you date the last run-up in prices from '72 or '78, it took 5-10 years for supply and demand to sort themselves out (including the change in some structural factors, like US pricing regulations) before prices started falling. We are currently about 6 years into the current oil price run-up, so I think it is reasonable to expect a correction in the next 2-3 years of fairly substantial magnitude.

Postscript: I have left out any discussion of the dollar, which has to play into this strongly, because what I understand about monetary policy and currencies wouldn't fill a thimble. Suffice it to say that a fall in value of the dollar will certainly raise the price, to the US, of oil, but at the same time rising prices of imported oil tends to make the dollar weaker. I don't know enough to sort out the chicken from the egg here,

I find your post oddly comforting - your thesis is basically that after a few years of turmoil, the market will sort itself out, as it did after the shocks of the 1970s.

However, those shocks were geo-political; whereas, as you note, the current shock is supply and demand related. Now it's possible that there remain oceans of oil under our feet and if the political players would get out of the way, those oceans could be drilled and supply and demand would get back into gear. But many geologists believe oil production is basically at its peak, and can only stay at current levels for a few years before declining precipitously.

If this decline happens as quickly as some scientists believe, it will be very difficult for the relatively calm scenario you envision (people trading gas guzzlers for more efficient cars, etc.) to take place. Instead, there could be chaos. And you don't even mention the problems caused by the fact that fossil fuels are a component of just about everything we use in modern civilization today, from the keyboard I'm typing on to the cereal I had for breakfast (fossil-fuel-based fertilizers).

I like your analysis, and think it's a good one if you were discussing, say, the market for corn. But oil is a special animal, and I don't think your views take that fully into account.

I assume, Dan, that you advocate government intervention to prevent the chaos. What actions should the government take?

Josh,

You're incorrect. I don't advocate government action. I think the market is doing what it should be doing - prices are going up and people are shifting to alternates, albeit slowly - as the blog writer notes. However, I don't know if this can be as smooth a transition as he seems to think, and market moves may become even more volatile over time. I think a lot of people are going to get hurt badly, but I don't think there's much the government can do to prevent that. I would say that opening additional U.S. areas to oil drilling makes sense, so that's something the government should do - open them up. But that won't solve the problem -it will just put off the day of reckoning a little.

"But many geologists believe oil production is basically at its peak, and can only stay at current levels for a few years before declining precipitously."

First, I have heard that one before; several times in fact, and each time they have been proven wrong (remember that guy who started the recurring Peak Oil scare in 1957? Well, he did not predict North Sea Oil, did he?).

Second, others disagree (for example, http://www.independent.co.uk/environment/climate-change/oil-shortage-a-myth-says-industry-insider-842778.html).

Third, on a longer-than-five-years period, there is no reason why nuclear power cannot take all the slack from declining oil production without much disruption; the only obstacles are political, not engineering. Currently the only strict need for oil products is transport, all other needs (electricity production, for example) could be supplanted by nuclear power.

I'm with Dan about the key omission in Coyote's discussion of the oil markets. If you don't look at peak oil, you're missing entirely too much. The reason, for example, that the 1973 oil shock was so dramatic was that U.S. domestic oil production peaked in 1971 ($1.75/bbl, 30% of domestic consumption was imports).

Incidentally, even if the U.S. pumped every bit of oil that's supposed to be in ANWR or offshore, it wouldn't make a significant difference, and it certainly wouldn't return us to the 1971 peak. The API (the oil lobby) says this, not just your humble servant. Common sense also says that if we consume roughly 25% of the world's energy, and increase our production by as much as 10% (not likely), we'll only add 2.5% to the world's supply.

Anyway, the 1973 oil shock was the first time the U.S. couldn't produce its way out of a shortfall in oil -- and sure enough, the recession that followed was the worst since the Great Depression. Daniel Yergin says that at no time was more than 3% of the world oil supply missing. He also calls this period of hefty oil price increases the greatest peacetime transfer of wealth in history.

The Reagan presidency saw reduced oil demand because of the recession, and increased supplies because Alaska's North Slope coincidentally came online then. Inflation went away because Paul Volcker started a recession with Fed monetary policy (prime rate: 21% in 1982!).

Master of foresight that he always was, Reagan removed Carter's solar collectors from the White House and rolled back the CAFE fleet mileage standards, because that oil was going to last forever. After all, the globe is just full of oil, sort of like a creamy nougat center. And global climate instability? Ha!

Reagan's administration also transformed the U.S. from the world's largest creditor nation to its largest debtor, and transformed the inherited trade surplus into a trade deficit. This is the administration that also created the worst political and financial scandal in U.S. history -- the S&L bailout. One lingering effect: One of the Keating Five (five senators accused of corruption for a part of this scandal) is running for president now. Hint: It's not Obama or Nader.

The peak in U.S. domestic oil production was correctly predicted by M.King Hubbert, a Shell oil geologist, who observed that the bell-shaped-curve of production mirrored, with a 40-year lag, the bell-shaped-curve of discoveries.

Incidentally, the world peak in discoveries was in the early 1960's. You can look all this up in the March 1998 Scientific American. The article title: "The end of cheap oil." So if the world is not at peak oil now, it's awfully close. Google "peak oil" if you like.

As for government actions: With relatively few exceptions, governments are as clueless as the general population about this stuff. Why on earth is the U.S. continuing to build sprawl, a development style that literally sets long commutes and a high demand for petroleum in concrete -- even though the market clearly prefers the pedestrian-friendly, mixed-use alternative? Ya got me, pilgrim.

And why do petroleum companies continue to get demand-increasing subsidies like the depletion allowance. That new Jack field found in the deep Gulf waters -- estimated at 10 billion bbls -- won't make a dent in the U.S. shortfall of petroleum, but the lease owners got a wonderful bonus from the Feds: because of a flaw in the lease they pay zero royalties. That *never* happens. Of course the Bush administration hasn't acted to fix the lease, or to reduce the (World Resource Institute, wri.org) estimated $300 billion plus in annual petroleum subsidies. If anything it's acted to increase them

News from the far-flung suburbs, though, is that owners are dissatisfied with the expensive commutes they bought into. They'd sell if they had any equity. See Google news "suburban commute expense" for a several recent stories like this.

There are a few enlightened sources of public policy: The Norwegians haven't frittered away their North Sea oil revenues, nor have the Danes (now the world leader in wind power). The Germans are ahead of schedule for having 20% of their domestic power come from renewables. Curitiba Brazil continues to inspire in a variety of ways, including energy efficiency, even though it's had far smaller budgets to spend than its first-world "betters."

Nevertheless, public policy, intelligent or clueless is going to have a significant impact in the aftermath of peak oil. If we don't have an alternative to single-auto commuting (70% of U.S. petroleum consumption is for transportation), or better insulation standards for our homes, or some encouragement for less petroleum-intensive agriculture, we're going to be in a world of hurt.

A word about agriculture: There's a 15-mile dead zone at the mouth of the Mississippi because of all the petroleum-produced nitrogen fertilizer rinsing off of those Iowa (and other) cornfields. Forty percent of U.S. agricultural income is subsidy, so the subsidy ("Laundering money for Cargill and ADM," says one farmer) is encouraging that petroleum-intensive brand of agriculture. Couldn't we even change this? Apparently not.

Closing our eyes and hoping for better, or whistling past the graveyard is going to hurt no matter how we slice it. The "conservatives" reading this may not like mass transit, but it may be as inevitable as death and taxes. And sure, you can have stupid death and stupid taxes, but the opposite is also true.

If you get the video "The Power of Community" (http://www.powerofcommunity.org/) you'll see an account of how Cuba handled peak oil. When the Soviets broke up, they were shipping Cuba 13,000 tons of oil annually. This went to four virtually overnight.

From 1990 - 94, Cuban GNP declined 34% (almost exactly the U.S.' experience from 1930 - 34). and the average adult Cuban lost 20 lbs. Many of them did get in shape as they began riding bicycles, though...8^) The Cuban government said anyone who wanted to leave the island could leave (hence the influx of Cubans to the U.S. and elsewhere in the early '90's), and continued to supply free education and medical care to an extremely stressed population.

The kindly U.S. tightened its sanctions, hoping to persuade the Cubans to depose Castro. Oddly, the Cubans interviewed in the video don't appear to hold a grudge.

There is some comfort to be found in this post, although I don't find Warren emphasizing it, but rather simply pointing out the inevitable corrections one could expect if market forces were left to operate without intervention.

I'm optimistic about the overall timing and effects of this price surge for two reasons, both of which potentially herald solutions that will see us through the middle term when adjustments must be made in energy sourcing. The first is simply that the steep price surge has stimulated development across the board in new sources of all forms of energy without (as yet) the intrusion of too much government mismanagement of any combination of them (although the politicizing of ethanol may come close). The second reason for mild optimism, again focused on government influences, is that a trend toward deregulation is evident in fields as varied as nuclear power and petroleum exploration, extraction, and refining. These trends are essential to avoid a crash, and I'm hoping they become structural in time to avoid a catastrophe. There is no ultimate shortage of hydrocarbons, nationally or internationally, that would by itself and without government assistance, create a collapse of society in the short to midterm. In short, I view the surge as a wakeup call, and I don't think we've overslept. Yet.

This seems germane (from http://www.huffingtonpost.com/david-fiderer/why-mccains-drill-here-dr_b_109449.html) The author was a banker covering the energy industry for several global banks for more than 20 years in New York. He is trained as a lawyer.

The article:

Why McCain's "Drill Here, Drill Now" Proposal Fails the Supply/Demand Reality Check by David Fiderer

Posted June 26, 2008 | 04:17 PM (EST)

There were two reasons why the Truth-O-Meter at CQ Politics gave a "FALSE" rating to John McCain's "drill here, drill now" proposal for reducing oil prices: supply and demand. The impact on supply, achieved years after oil companies greenlighted any new development projects, would be at most "a couple of hundred thousand barrels a day" or about the same amount that Saudi Arabia promised to add in the next few months. That's well below 1% of today's global production. The impact on satisfying new demand, driven primarily by economic growth in Asia, would be nothing more than a rounding error. McCain's rhetoric on global oil, and the mainstream media narrative, seems stuck in the mid-1980s, when the U.S. produced as much oil as Iran, Iraq, Kuwait and Saudi Arabia combined.

Things were far simpler in 1986, when Saudi Arabia racheted up its oil production to 5.2 million barrels a day, up from 3.6 million daily barrels in 1985. Oil nosedived from $28 a barrel in 1985 to $15 a barrel a year later. But those days, when our good friends the Saudis could easily turn on the spigot to change the supply/demand balance, are long gone. To understand oil prices today, you need look beyond the U.S. and the Persian Gulf, to places where the U.S. has limited influence, places like Nigeria and China and Mexico.

And until we start dealing with the basics of global supply and demand, our political dialogue will be clouded with more empty rhetoric.

Global Oil Supply: A Quick Overview

Back in the 1980s, when three broadcast networks dominated the news business and three Detroit companies dominated automobiles, the majority of the world's oil production came from three major sources, the Soviet Union, the U.S. and the Middle East. But the U.S. oil production has experienced a long steady decline, one comparable to the declines experienced by the networks and the auto companies. After Communism collapsed, so did oil production in the former Soviet states, although things turned around beginning in 2000. Up until a few years ago, most of the growth in global oil production came from the Middle East.

Oil Production

[millions of barrels a day]

1985

Soviet Union 12.0

USA 10.6

Middle East 10.6

Worldwide 57.5

1989

Former Soviet Union 11.6

USA 8.9

Middle East 17.5

Worldwide 65.5

1994

Former Soviet Union 7.4

USA 8.4

Middle East 20.1

Worldwide 67.1

2000

Former Soviet Union 8.0

USA 7.7

Middle East 23.5

Worldwide 74.9

2004

Former Soviet Union 11.4

USA 7.2

Middle East 24.8

Worldwide 80.3

2007

Former Soviet Union 12.8

USA 6.9

Middle East 25.2

Worldwide 81.5

Saudi Arabia's announcement that it may increase its daily production by 200,000 to 500,000 barrels was greeted with great fanfare in the press, but as the Financial Times rightfully pointed out, those gains could be wiped out by political violence in Nigeria. According to the BP Statistical Review of World Energy June 2008, the source of all numbers used herein, Saudi production in 2007 declined by 440,000 barrels a day when compared with 2006. Also in 2007, Saudi consumption of oil increased by 148,000 barrels a day from a year earlier, the biggest increase of any country other than China and India. In other words, we cannot count on the Saudis to provide any solutions to global shortages.

Here are some basics known to everyone in the oil industry.

Largest Oil Producers in 2007

[millions of barrels a day]

1. Saudi Arabia 10.4

2, Russia 10.0

3. US 6.9

4. Iran 4.4

5. China 3.7

6. Mexico 3.5

7. Canada 3.3

8. UAE 2.9

9. Kuwait 2.6

10. Venezuela 2.6

Worldwide 81.5

Countries which Experienced

the Biggest Declines in Oil Production

[Change from 2004 to 2007, millions of barrels a day]

1. Norway 0.63

2. UK 0.39

3. US 0.35

4. Mexico 0.35

5. Venezuela 0.29

6. Saudi Arabia 0.23

7. Indonesia 0.16

8. Nigeria 0.15

9. Syria 0.10

10. Vietnam 0.09

Total 2.73

Many of the world's top oil producers have experienced declining or stagnant production.

On a combined basis, the U.S., Mexico, Venezuela, and Saudi Arabia produced 1.2 million fewer barrels on a daily basis in 2007 than in 2004. The reasons:

Natural declines: North Sea oil production (Norway and the UK) has been falling off precipitously. As is true everywhere, the oil in the ground is finite and it comes out at a much faster rate in the early years of a well's productive life. No one anticipates that this natural decline will be reversed. The same applies to Indonesia and, many believe, Saudi Arabia.

Lack of investment and mismanagement: The national oil companies of Mexico and Venezuela have their investment budgets set by the government. Because of a lack of investment and poor management, those countries have been unable to exploit there domestic reserves efficiently. Petroleos de Mexico is forbidden by law to enter into joint ventures with large private oil companies that could share access to the latest most sophisticated technologies. About 10 years ago, Petroleos de Venezuela had independent management and was considered one of the best run oil companies in the world. But Chavez replaced management with his cronies, and the company's operations have deteriorated.

Political instability: Rest assured, Exxon desperately wishes that our government. could exert more influence in Nigeria, the single country where it produces more oil than anywhere oustide the United States. Nigeria is case study in what can go wrong when a country fails to use its mineral wealth to promote a greater social good.

And of course, there are a number of other countries that have not begun to attain their potential in terms of oil production because of a combination of local mismanagement and political instability, i.e. Iraq, Iran, Sudan and elsewhere.

Where is oil production ascendant?

Countries which Experienced

the Biggest Gains in Oil Production

[Change from 2004 to 2007, millions of barrels a day]

1. Angola 0.75

2. Russia 0.69

3. Azerbaijan 0.55

4. Brazil 0.29

5. China 0.26

6. UAE 0.26

7. Libya 0.22

8. Canada 0.22

9. Qatar 0.21

10. Kazakhstan 0.19

Total 3.65

As you can see, countries that make up the former Soviet Union (Russia, Azerbaijan, Kazakhstan) produced about 1.4 million barrels a day more in 2007 than they did in 2004. This represents a shift of strategic power back to Russia. Putin exerts a stranglehold over Russia's mineral resources and he will not hesitate to use them as a political and strategic weapon. And Russia exerts a lot more influence over its oil producing neighbors than we do.

(An aside: The price of oil was a central cause of the fall of Communism, the breakup of the Soviet Union, Yeltsin's failure and the ascendance of Putin. It's remarkable how many books and articles on Russia are written by authors who fail to grasp this basic point.)

Can the U.S. restore its production to 1980s levels the way Russia has? Not likely. U.S. reserves have been efficiently exploited with the best equipment and technology for many years. Until recently, Russia's oil and gas has been underdeveloped because of lack of investment, backward technology and poor operating practices.

Bottom Line on Supply: More than ever, the world is susceptible to supply shocks because of political circumstances over which the U.S. has no control and very limited influence.

Global Oil Demand: A Quick Overview

In 2007, the United States consumed as much oil as the next five largest consuming nations combined. Put another way, 304 million people living in America consumed as much oil as 2.8 billion living in China, Japan, India, Russia, and Germany.

Largest Oil Consumers in 2007

[millions of barrels a day]

1. US 20.7

2. China 7.9

3. Japan 5.1

4. India 2.7

5. Russia 2.7

6. Germany 2.4

7. South Korea 2.3

8. Canada 2.0

9. Brazil 2.2

10. Saudi Arabia 2.2

Total 50.1

The chart below explains the commonly accepted view of the global economy: China and India are the economic engines that have driven both global economic growth and the run-up in all commodity prices. In other words, if we asked China to consume less, we would be shooting ourselves in the foot economically. Not that China, which consumes on a per capita basis a tiny fraction of the oil we do, believes that we have standing to criticize others. China and India have been very willing to do business with countries considered pariahs by the U.S., countries like Iran, Sudan and Venezuela.

Countries which Experienced

the Biggest Increases in Oil Consumption

[Change from 2004 to 2007, millions of barrels a day]

1. China 1.08

2. Saudi Arabia 0.35

3. Brazil 0.19

4. India 0.18

5. Singapore 0.17

6. Mexico 0.11

7. Chile 0.11

8. UAE 0.10

9. Russia 0.08

10. Poland 0.07

Total 2.44

One trend that we have overlooked: The developed world is taking steps to reduce its consumption of oil. In Germany, where they love cars and love to drive fast on the autobahn, consumption has declined by 9% over a three year period. Since per capita consumption of oil is about 1.3 gallons a day in Germany, compared to 2.9 gallons a day in the U.S., and because the depreciation of the dollar is reasonably correlated to price increases in oil, we are becoming less economically competitive than other developed nations like Germany.

Countries which Experienced

the Biggest Declines in Oil Consumption

[Change from 2004 to 2007, millions of barrels a day]

1. Germany 0.24

2. Japan 0.23

3. Italy 0.13

4. UK 0.07

5. Indonesia 0.07

6. France 0.06

7. Philippines 0.04

8. Turkey 0.02

9. Portugal 0.02

9. Switzerland 0.02

Total 0.88

What about speculators? This topic warrants another piece for a full analysis, but most of the evidence suggests to me that this hypothesis is overblown. Players like Enron were able to manipulate the price of electricity and natural gas because they figured out how to create and exploit distribution bottlenecks in comparatively small regional markets. It is much harder to have a similarly large impact on the global oil market.

The Bottom Line on Demand: In terms of energy security, and in terms of altering the supply/demand balance, our biggest bang for the buck will come from reducing domestic consumption through new technologies. We hesitate at our economic peril.

Regarding peak oil: Hubbert's peak oil theory is grossly misunderstood by most anyone who's had to hear people try to use it to make some political point. It's far better to go look at what Hubbert actually predicted and the caveat's he placed on his estimates.

I've been involved in the oil business in various aspects since 1981, and I have to say that Hubbert's model, when applied as he intended and when the limits he placed on it are observed has always been remarkably accurate. So why are there claims that Hubbert's theorem has been "proved wrong many times?" Because people grabbed onto the idea to push an agenda and ignored anything in the theory that didn't fit their agenda. That's happening to a large extent today - but Hubbert's theory is still correct, when used properly.

First qualification - the area in question has to be well explored, enough so that a reliable reserve estimate can be made. This doesn't mean completely explored, but explored to an extent that the vast majority of the easy to find and produce oil has been found. This doesn't mean that all discoveries have been made, not by any means - but once you have made a significant number of discoveries, and they begin the ordinary life cycle of an oil field (30 - 40 years for all but the Arabian fields) then new discoveries tend to only replace the old fields that are in the process of dying, and don't actually increase your production rate. That's peak oil. You can maintain this peak rate for quite a while if you keep making new discoveries, but at this point you are paddling as hard as you can just to keep at the same point. In the US, for example, all of the wells drilled during the last boom in the early 80's are now dead or dying. That's what oil wells do. The US has to mount a huge exploration boom just to tread water. At some point, the world hits the same wall. Where is that point? No one can say for sure until all corners of the world have been thoroughly explored, and we're not there yet. But we're close.

Regarding the North Sea - that's the wrong analogy. You should use Prudhoe Bay, because Hubbert's most famous and most accurate prediction concerned US production. When the US was producing 6.5 million BOPD in the 50's, Hubbert predicted US peak production of approx. 9 million BOPD in 1970, and forecast declining US production from that point forward. Prudhoe Bay was discovered right about that time - but all Prudhoe Bay did was replace the dying East Texas oil field for a while. Now, nearly 40 years later, US oil production is 5 million bopd and falling steadily. (Prudhoe dies completely by 2017, if you didn't know, and it's production is far off it's highs already) Hubbert was exactly right about US production, even though he never predicted the discovery of a new supergiant like Prudhoe.

And you may say that the shale oils - such as the Barnett, Haynesville, Marcellus, and Bakken - will change this outlook, but they will not. Those formations are very difficult and expensive to drill, and will require thousands, perhaps tens of thousands of wells. These will take many years to develop, and although the total amount produced should be good, the rate of production will be slow. It means we may have a long, slow gentle slide down, but the US production rate will not go up.

The predictions made by Hubbert's equations are extremely accurate for any well defined individual field that has matured, meaning the exploration phase is over and full development has begun. Hubbert's equations also predicted future US production with extreme accuracy when he published in 1956. They worked because at the time the US was the most heavily explored chunk of real estate in the world. When the world has finally been fully explored - and with the move into deep water, we're close - then the prediction for true peak oil, worldwide, can be made. We're probably not there yet - but we get closer every day. Personally, I think it will take only about 4 - 5 years more data to be able to make an accurate calculation, because by then there will have been at least one exploratory rig running in every interesting piece of geology on the planet.

One more thing to remember - peak oil is NOT peak gas. Oil and gas, although always lumped together, are two different fuels, two different production curves, two different markets. I still see a great future for Nat Gas, although the price still has a good double left in it before it starts to level out. But we've got a lot of that stuff, especially in Alaska, if we'd just get around to actually building some pipelines to get it. Same goes for the Florida and California coasts. That's where this country's efforts need to be focused.

Most of Yoshidad’s post is (as usual) complete economic garbage.

China’s oil consumption has doubled every 10 years. They will easily overtake us next decade. Bad comparison.

Germany’s per capita oil consumption has little to do with economic competitiveness, especially since Germany’s economy is approximately 1/5th the size of the US, and geographic size is slightly smaller than Montana. Bad comparison.

Massively subsidizing economically nonviable sources (wind, solar, etc.) forcing adoption results in massive inefficiencies and competitive disadvantages. Dumb idea.

Many (most?) countries (including Germany) exploring alternatives to oil are hopelessly mired in high-tax, high-intervention economically burdensome socialist policies putting them at serious economic disadvantage.

Also, from the first post, the trade deficit is not a [meaningful] deficit.

One correct point: the influence of "speculation" on oil prices is highly overblown.

Do you truly believe that the politicians understand the economics involved here and just want prices to be high for environmental concerns?

You give them more credit than I.

WWS does a good job explaining Hubbert's peak. Anyone who's sanguine about oil supplies should read that post. Note that discovery of new oil peaked in the early 1960s and despite nearly 50 years of improving technology has only gone down since then.

"While oil prices have gone up by a factor of about four since 1998, copper has gone up by a factor of about 15!"

I just stopped reading about there. It's foolproof to say that you know nothing about what's going on.

In 1998, oil was at 7-9$. Now, 140$. Divide 140 by four and see if you get 9$, you dolt.

Mesa Econoguy says: "Most of Yoshidad’s post is (as usual) complete economic garbage."... and then proceeds to comment about China’s oil consumption, saying "Bad comparison."

Sorry Econoguy, no comprendez. I didn't mention China. How is this germane?

Incidentally, this is fairly typical for several replies I've read on this blog, too - an unsupported statement or invective followed by irrelevancies unconnected to the previous discussion. I'm just as bad as the next guy at following the thread of reasoning, so I won't complain too loudly, but y'all really need to read what I wrote, not what the voices in your head are saying if we're going to have a conversation.

Then Mesa Econoguy says "Germany’s per capita oil consumption has little to do with economic competitiveness, especially since Germany’s economy is approximately 1/5th the size of the US, and geographic size is slightly smaller than Montana. Bad comparison."

Again, Econoguy, it's not controversial that all of Europe (and Japan) use half the energy the U.S. does per dollar of GDP. Confining this observation to a single economy or country isn't really germane, IMHO. If you've got some other point to make -- besides agreeing that the U.S. is a high-energy-use economy that subsidizes petroleum use orders of magnitude more than it does renewables or things like transit -- then you've got to clarify before I'll be able to get it.

Mesa Econoguy says: "Massively subsidizing economically nonviable sources (wind, solar, etc.) forcing adoption results in massive inefficiencies and competitive disadvantages. Dumb idea."

But is that dumber than the orders-of-magnitude bigger subsidies for petroleum? Straining at a gnat, swallowing a camel is what I'd call this kind of comment. And subsides = inefficiencies in both our worlds, I'd say.

Incidentally, I won't disagree that wind, solar, etc. are not going to have as high a rate of return as petroleum (energy returned on energy invested, or EROEI actually). That's a no-brainer, but doesn't make renewable energy nonviable.

Or do you say an infant is "non-viable" because he can't run a decathlon or get one of the really well-paid jobs?

Oil has the highest EROEI, without a doubt. It stores the solar energy of millenia, so how could solar for a day or a year be comparable? The real question is not "Why is solar so expensive?" It's "Why is oil so cheap?"

The motivation to try something that might be less-than-optimum in the short term is that the oil, or at least the cheap oil, is running out. Google "peak oil" if you don't believe me. -- and the sun and wind aren't running out.

Should we have the foresight to build the infrastructure alternative that takes advantage of energy that won't run out before the high-short-term-return one that is running out runs out?

And should we send our children out to work in the coal mines because they're not pulling their own weight either? Unreasonable expectations lead to that kind of conclusion.

Reasonable people can disagree about how soon their kids should get jobs, what to fund and how much renewable energy we'll need, and how much to encourage conservation. But dismissing all such impulses as "garbage economics" seems extreme, if not extremely short-sighted, to put it mildly.

Econoguy again: "Many (most?) countries (including Germany) exploring alternatives to oil are hopelessly mired in high-tax, high-intervention economically burdensome socialist policies putting them at serious economic disadvantage."

Of course, and those not exploiting child labor are at (at least) a (temporary) disadvantage because they don't have as much labor at their disposal as those who sanction child labor. Again, this is a fairly short-sighted remark.

Public policies (governments) can, and have made important contributions to new discoveries. Oh I know Rush Limbaugh claims only individuals can innovate, but ask him where nuclear energy would be without the Manhattan project, or the internet without DARPA, or semiconductors without NASA, or the 30-year mortgage without FHA, to name a few.

Incidentally, the high tax, etc. German state you criticize was put together that way with the consent of the governed when last I checked. Is that not OK? On a smaller scale, could a neighborhood pool its resources and buy a swimming pool, or does everybody have to build their own?

IMHO, the difference between the Europeans' willingness to put up with a relatively high tax burden, and the intolerance for that idea expressed repeatedly on this blog, is twofold: 1) Europeans understand that building a public or neighborhood pool is orders of magnitude cheaper than making everyone own a private one (and probably more fun for the kids to play in), and 2) the Europeans see and appreciate real personal good coming from collective action, rather than the toxic waste that the "conservative" U.S. administrations of the last 30 years have made.

Actually "toxic waste" is not an accurate description. The average tax burden for most people has risen as, in the name of fostering "growth," taxes have grown less progressive in the U.S. Successive administrations, with the exception of Clinton's, have lowered the top income tax brackets while increasing the payroll tax fourfold. Something like this occurred in Europe too, BTW, but less dramatically.

The bankruptcy of this theory of lower-progressive-tax-induced growth is amply demonstrated by the fact that the theory has worked exactly backwards in practice. The high marginal rates of the 1950's (with a 92% top bracket) coexisted with the best GDP growth. The lower rates of recent decades have seen less growth. Q.E.D.

Anyway, when people see public policy distorted to favor a few (while median income has stagnated for the last three decades in the U.S., the top .01% of income earners have seen their incomes increase 400% plus) they aren't likely to look kindly on government that is robbing poor Peter to pay rich Paul. This observation isn't my exclusive property. Read David Cay Johnston's "Free Lunch" for many more such tales of woe.

Anyway, if the Germans see high taxes bringing benefit to their public realm, then that's their right, isn't it? Or will you compel everyone to adopt your point of view, Econoguy?

Econoguy writes:"Also, from the first post, the trade deficit is not a [meaningful] deficit."

Wow, a naked, unsupported assertion that has no connection to facts or footnotes, or, as far as I can tell, meaning. Quelle surprise!

OK, that was just rude. What I really need to say is this: Econoguy, if you want me to even have the possibility of agreeing with you, you're going to have to explain this further.

Econoguy: "One correct point: the influence of "speculation" on oil prices is highly overblown."

Nice! See, we're not that far apart after all!

Yoshidad,

There are so many problems with you arguments that is just don't have time to go through each and every point. So, I'll just stick one. You said:

"The bankruptcy of this theory of lower-progressive-tax-induced growth is amply demonstrated by the fact that the theory has worked exactly backwards in practice. The high marginal rates of the 1950's (with a 92% top bracket) coexisted with the best GDP growth. The lower rates of recent decades have seen less growth. Q.E.D."

Here is a question about a your high progressive tax, lets say if you work the last day of week you could earn another $300. This will get taxed at the 92% rate. So your take home on the $300 is $24. What would you do if something broke in your house that needed to be fixed right away, and you were capable of fixing it? Stay home and fix it your self and for go you $24 income? Or get someone to come in to fix it for $50 and bring home your $24, a net loss of $26 on the day. This would have a huge effect on the economy.

It’s been awhile since I’ve study GDP numbers, so I might be a little off on this. But if I remember correctly, the service industry numbers are under estimated in the calculation of GDP. The service industry has probably been the fastest growing industry since the 1950’s as machines have started to replace people in the work place. So, your GDP growth comparison is useless.

Yoshidad, you are an economic neophyte. Your post above contains more errors than I have time to correct. You are also a very poor writer, with typical illogical leftist meandering thoughts instead of concise statement and evidentiary support.

I am not here to get you to agree with me, or anybody else; I’m here to correct your numerous economic misconceptions and factual misstatements, of which you have very many.

The high marginal rates of the 1950's (with a 92% top bracket) coexisted with the best GDP growth. The lower rates of recent decades have seen less growth.

This is an incredibly stupid statement. What do you mean by "best?" That is economically meaningless. The 1940's and 50's saw dramatic percentage gains in GDP, due to factors such as postwar private sector recovery, demographics, and a variety of other factors (such as size of government, which was not nearly as large as it currently is, though the New Deal had expanded it significantly).

It had little or nothing to do with high tax rates, which actually hindered growth, robust though it was. And as we saw during the Carter years, nobody paid those taxes, with enormous loopholes and catches built into the tax code.

See here.

Leaving aside for the moment that income tax "progressivity" is somehow desirable, you state

The average tax burden for most people has risen as, in the name of fostering "growth," taxes have grown less progressive in the U.S.

Wrong. Also see here,

and here.

You should also go here, here and here.

But you won't, because you are stupid.

Yoshi, most of your statements are economic crap, culled from incredibly ignorant left-wing blogs. I recommend from commenting about matters economic henceforth.

Aren't you late for your monthly Leo DiCaprio fan club meeting or something?

And one final thought Yoshalist:

As Sallie discusses, it is a problem for a democracy–particularly one less constrained by constitutional rules than in the past–to have such a large and growing share of residents not paying any tax because these folks are unconstrained in campaigning for more benefits for themselves at the expense of others.

This is incredibly important, because it is the exact problem of your utopian vision outlined above: once the state takes over, which you fully endorse, you can’t go back.

But that’s entirely unimportant to you, because you think you’re just being a reasonable, responsible, and intelligent citizen, when in fact you know absolutely nothing about economics and liberty.

You are the cause of the very problems you seek to eliminate.

Don't be so hard on Yoshidad. He is only repeating things he has been told, so in his mind they must be true.

Like the peak oil comments above, supporting Hubbert's "theory." The US is almost the only place in the entire world where exploration has been extensive enough to apply the King's ideas.

"Peak oil" in Saudi Arabia, for example, is due to poor production and maintenance practises and limited exploration, combined with the desire of the royal family to preserve the wealth for more generations--in lieu of any plans to develop a real economy in the kingdom.

[E]ven if the U.S. pumped every bit of oil that's supposed to be in ANWR or offshore, it wouldn't make a significant difference...

At current oil prices, that's $ 7 trillion worth of production that would benefit the American economy, not overseas producers. Calling that an "insignificant difference" is CRAZY - and that's putting it mildly.

Master of foresight that he always was, Reagan removed Carter's solar collectors from the White House and rolled back the CAFE fleet mileage standards, because that oil was going to last forever.

Reagan was right about that for TWENTY-SEVEN YEARS, which is a full generation. That indeed makes him a Master of Foresight, especially among politicians. Further, he was right about how to bring down the late, unlamented Soviet Union.

And global climate instability? Ha!

Since nobody was talking about that until six years after Reagan left office, and indeed at the time Reagan was elected the prevailing fear was of a new ICE AGE, to knock Reagan for not being a Global Warming Cultist is both petty and irrational.

Reagan's administration also transformed the U.S. from the world's largest creditor nation to its largest debtor, and transformed the inherited trade surplus into a trade deficit.

The U.S. is not the world's largest debtor, except in the most crude, basic, and therefore misleading sense. As Thomas Sowell has written, "Donald Trump probably has a bigger debt than I do — and less reason to worry about it. Debt means nothing unless you compare it to your income or wealth."

As a percentage of GDP, Spain, Italy and Japan are all more indebted than are the U.S. - and all are also going to have far lower economic growth than will the U.S. over the next few decades. Relative demographics guarantee that.

As for the trade-surplus-to-debt... That's the fault of American consumers and workers. Are you going to take the average American to task for wanting high pay, (which prices American goods out of reach for most of the world), and low-cost goods, (lately mostly produced by Asia) ?

And when you get done upbraiding the American for wanting to be well-paid and yet not wanting to pay a lot for consumer goods, will you then castigate the Chinese, Vietnamese, South Korean, etc., for bettering their lot by meeting a demand ?

A person who would do that is at best a self-centered, selfish scold.

[Reagan's] is the administration that also created the worst political and financial scandal in U.S. history -- the S&L bailout.

The S&L debacle was indeed a horrible political and financial scandal, but let us not forget that it originated in THE U.S. CONGRESS, and so again, blaming it on Reagan is both petty and irrational. Further, calling it "the worst political and financial scandal in U.S. history" demonstrates a lack of knowledge about U.S. history.

Why on earth is the U.S. continuing to build sprawl, a development style that literally sets long commutes and a high demand for petroleum in concrete -- even though the market clearly prefers the pedestrian-friendly, mixed-use alternative? Ya got me, pilgrim.

Maybe because the market clearly doesn't prefer urban living over suburban.

But, if you're completely convinced that Americans long to live where they can walk to everything they need, then now is an EXCELLENT opportunity to snap up downtown condos almost everywhere for a song. You'll make a killing !!!!!

(Not).

From 1990 - 94, Cuban GNP declined 34% [but Cuba] continued to supply free education and medical care to an extremely stressed population.

A) There's rarely such a thing as "free". For instance, in America, students at public schools don't pay a per-head fee, and so it is "free" to them, but anybody who owns or rents housing is paying part of the cost of educating the students.

In Cuba, the cost of educating students is similarly borne by the extremely stressed Cuban population. The resources to do so don't just fall from the sky.

B) In the Cuba of the 90s, "free" medical care DIDN'T INCLUDE MOST DRUGS, which not only had to be paid for, but COULD NOT BE PURCHASED USING CUBAN PESOS, which tells a thinking person everything they need to know about the Cuban medical system and Cuba in general.

Bad Cuban Medicine :

"Begging for medicines is common in Havana - next to begging for money to feed children, it is the most common plea...

"Cubans with access to dollars - typically those in the tourist industry who receive tips in dollars - can obtain the drugs they need. Others have relatives in the United States who can ship them. The rest - middle class Cubans included - must resort to begging, the black market or, increasingly, to prostitution.

"Cuba is renowned for having a universal health-care system and, in fact, doctors are plentiful and doctor visits are free. But without access to antibiotics, insulin, heart drugs and other life-saving medicines, doctors cannot perform their duties. Too often, for lack of medicine, doctors have no choice but to amputate limbs, or to put patients through painful therapies without painkillers. In one celebrated case, Dr. Hilda Molina, the founder of Havana's International Center for Neurological Restoration, returned the medals that Fidel Castro had awarded her for her work and resigned in protest, outraged that Cubans were denied critical care..."

Also (all emphasis mine):

For Cubans, a bitter pill

[Canadian] National Post, July 7, 2004

(Even as Cuba is abandoned by long-time allies for its human rights violations, Canada continues to display affection for Fidel Castro's one-man state. In the second of a three-part series, Isabel Vincent explores the myth of of the Caribbean nation's health care system.)

by Isabel Vincent

MORON, Cuba - In this historic town of 70,000 people in central Cuba, a small bottle of tetracycline costs US$5 and a tube of cortisone cream will set you back as much as US$25.

But neither are available at the local pharmacy, which is neat and spotless, but stocks almost nothing. Even the most common pharmaceutical items, such as Aspirin and rubbing alcohol, are conspicuously absent. In their place there is a neat display of green boxes of herbal diet teas from Spain.

One of the myths Canadians harbour about Cuba is that its people may be poor and living under a repressive government, but they have access to quality health and education facilities. It's a portrait encouraged by the government, but the reality is sharply different.

Antibiotics, one of the most valuable commodities on the cash-strapped Communist island, are in extremely short supply and available only on the black market. Aspirin can be purchased only at government-run dollar stores, which carry common medications at a huge markup in U.S. dollars. This puts them out of reach of most Cubans, who are paid little and in pesos. Their average wage is 300 pesos per month, about $12. [...]

Still, the residents of Moron are luckier than most Cubans because many of them work in the nearby resorts, where they often receive foreign medications as tips.

"We know how difficult life is here, so when we come for a vacation, we always bring a few bottles of antibiotics and Tylenol," says Laura, a housewife from Oakville, Ont., who was recently vacationing at a large resort in nearby Cayo Coco.

A 72-year-old pensioner from Toronto who did not want to be identified also said she had arrived for her recent vacation well- stocked with tubes of antibiotic cream, Aspirin, decongestants and bandages.

"My doctor in Toronto told me that there is nothing available in Cuba, so I came prepared just in case I needed any of these things for myself," she said. "But I am leaving most of what I brought for the maids and the bartender."

For years, supporters of the Communist regime of Fidel Castro have praised the island's universal health care system as a model for the developing world. Indeed, Cuba has the world's highest concentration of physicians and health care is free. "If you need the most complicated operation, you can get it at a Cuban hospital," [a local pharmacist] said. "But medicines are the problem." [...]

[H]ospitals are falling apart, surgeons lack basic supplies and must re-use latex gloves. Patients must buy their own sutures on the black market and provide bedsheets and food for extended hospital stays.

The situation is so bad that a Canadian pro-Castro group urges tourists in a recent issue of its monthly newsletter to take "a suitcase full of medical supplies to drop off at a local clinic or hospital with a letter about humanitarian aid." [...]

[T]ourist hospitals in Cuba are well-stocked with the latest equipment and imported medicines, said a Cuban pediatrician, who did not want to be identified. [...] "Tourists have everything they need," said the pediatrician, who spoke on the condition he would not be identified in any way. "But for Cubans, it's different. Unless you work with tourists or have a relative in Miami sending you money, you will not be able to get what you need if you are sick in Cuba. As a doctor, I find it disgusting." [...]

These days, officials in the Castro government say they rely on money earned from joint-venture operations on the island with foreign companies to finance the universal public health system. Cuban workers contracted for joint venture operations are paid indirectly. The Cuban government receives about US$450 per worker per month from the foreign company. While the worker typically makes 5% of this total amount --in pesos-- the government directs most of the foreign currency earned in this scheme to pay for its social services, including health care for ordinary Cubans. [...]

[W]orld labour regulatory bodies such as the International Labour Organization have condemned the practice, in which the Cuban government essentially pockets 95% of a worker's wages. "There is absolutely nothing free about Cuban health care and other social services," says Ismael Sambra, president of the Cuban-Canadian Foundation. "Social services are financed from the sweat of the poor Cuban workers." [...]

But for most Cubans, the question of who is financing health care is rather academic. "We have nothing," said Jasmin, a nurse who lives in Moron. "I haven't seen Aspirin in a Cuban store here for more than a year. If you have any pills in your purse, I'll take them. Even if they have passed their expiry date."

##########

This basic information about the Cuban healthcare system was obtained in A MERE TEN MINUTES of web-searching. Is there really any excuse for being so ill-informed as to believe that Cuban medical care should be held out as an example of anything but the total incompetence, brutal callousness and extreme dysfunction of Cuban leadership ?