Greece's Lesson for Gold Bugs

I have been predicting for years that the only solution for the Greece problem is for it to exit the Euro, go through a horrible economic crisis and deal with substantial devaluation, and then hopefully move on with a cheaper currency that makes its tourist industry look better and plugs the hole between taxing and spending with inflation. It appears we are closer than ever to this actually happening. The Greeks would likely be moving forward now, like Iceland, if they had taken their medicine years ago rather than try to kick the can. Now it is just going to be worse.

I have been enamored off and on with the idea of a gold standard but Megan McArdle made some powerful points today about how the Greek situation teaches us that a gold standard doesn't necessarily impose discipline on governments.

It's easy to moralize Greece's feckless borrowing, weak tax collection and long history of default, and hey, go ahead; I won't stop you. But whatever the nation's moral failures, what we're witnessing now shows the dangers of trying to cure the problems of weak fiscal discipline with some sort of externally imposed currency regime. Greek creditors and Brussels were not the only people to joyously embrace the belief that the euro would finally force Greece to keep its financial house in order; you hear the same arguments right here at home from American gold bugs. During the ardent height of Ron Paul's popularity, I tried to explain why this doesn't work: "You don't get anything out of a gold standard that you didn't bring with you. If your government is a credible steward of the money supply, you don't need it; and if it isn't, it won't be able to stay on it long anyway."

This goes double for fiscal discipline. Moving to a fixed exchange rate protects bond-holders from one specific sort of risk: the possibility that inflation will erode the real value of your bonds. But that doesn't remove the risk. It just transforms it. Now that the government can't inflate away its debt, you instead face the risk that they are going to run out of money to pay their bills and suddenly default. That's exactly what happened to Argentina, and many other nations on various other currency regimes, from the gold standard to a currency peg. The ability to inflate the currency had gone away, but the currency regime didn't fix any of the underlying institutional problems that previous governments had solved with inflation. So bondholders protected themselves from inflation, and instead took a catastrophic haircut.

Postscript #1: I had one issue with McArdle's piece when she writes

The only people this will be good for is people who long to vacation on the Greek Islands. If Grexit actually happens, book those plane tickets now, but hold off on the hotel. It will be cheaper in six months. Then try to enjoy it as you remember that those fabulous savings are someone else's whole life evaporating.

Hey, if Grexit occurs, you have no reason to feel guilty about taking advantage of the weak currency and low prices for a Greek vacation. There is nothing the Greeks need more than for you to do exactly that. It is the single best thing you could do for the Greek people.

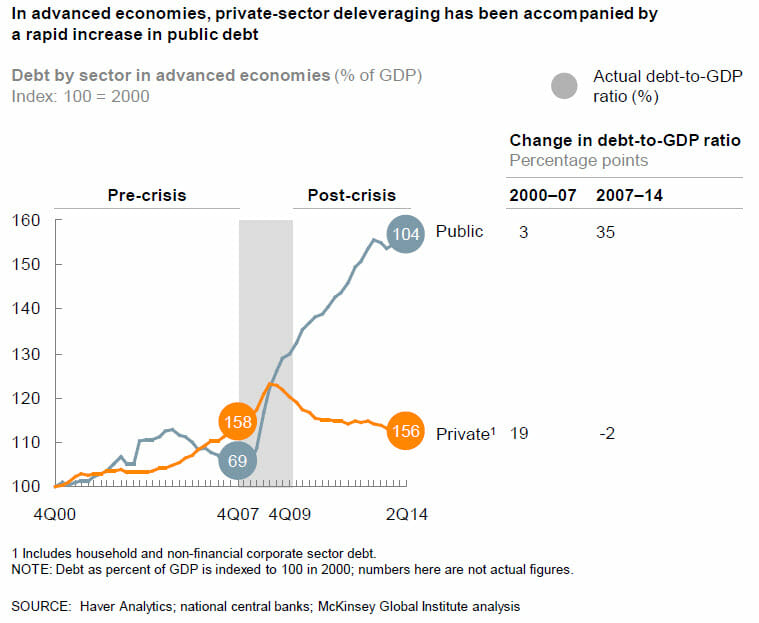

Postscript#2: Here is why exiting the Euro, devalutation, and inflation are the only way out for Greece at this point. Creditors allow countries to run long-term deficits and keep lending despite rising debt (see: Japan) because of a combination of a) the country can always just print the money they need; b) the country can raise taxes and take the money it needs or c) the country can keep spending flat and grow their way out from the debt.

None of these are available to Greece. They can't print money, at least without running up new debts (excess printing of Euros is automatically added to Greece's debt to the ECB). They can't raise taxes because their citizens don't pay the taxes that already exist. And they can't grow their way out because there is zero support for austerity or market-based reforms that would be necessary, and besides a huge portion of Greek deficit spending is for inherently unproductive activities. At this point Greece's only option is charity, that the other countries of the EU will forgive debt or write them new debt, either to be nice or to avoid bad precedents with other PIGS countries. But the EU seems at the end of its charity rope, and besides given zero prospects of any sort of Greek recovery, even after a major write-off of debt the EU would be in the position of still having to send Greece new money for its new debts.