Question for Keynesians: What Are You Doing To Prepare for the Next Cycle?

When I was in school learning macro 101 from Baumol and Blinder, my memory is that the theory of Keynesian stimulus and managing the economic cycle was that deficits should be run in the bottom part of the economic cycle, paid for with surpluses in the top half. So we are now almost certainly in the top half of the cycle. But I don't hear any Keynesians seeking to run a surplus, or even to dial back on government deficits or spending. In fact, our Keynesian-in-chief says he is done with "mindless austerity" and wants to start spending even harder in 2015.

Its enough to make one suspicious that all the stimulus talk is just a Trojan Horse for a desire to increase the size and power of government.

But for Keynesians who really believe what they are saying, that deficit spending somehow saved us from a depression in 2009 and 2010, then I ask you -- what are you going to do next time? It appears that when we enter the next recession in this country, that US debt as a percentage of GDP is going to be almost twice what it was entering the last recession. Don't you worry that this limits your flexibility and ability to ramp up deficit spending in the next recession?

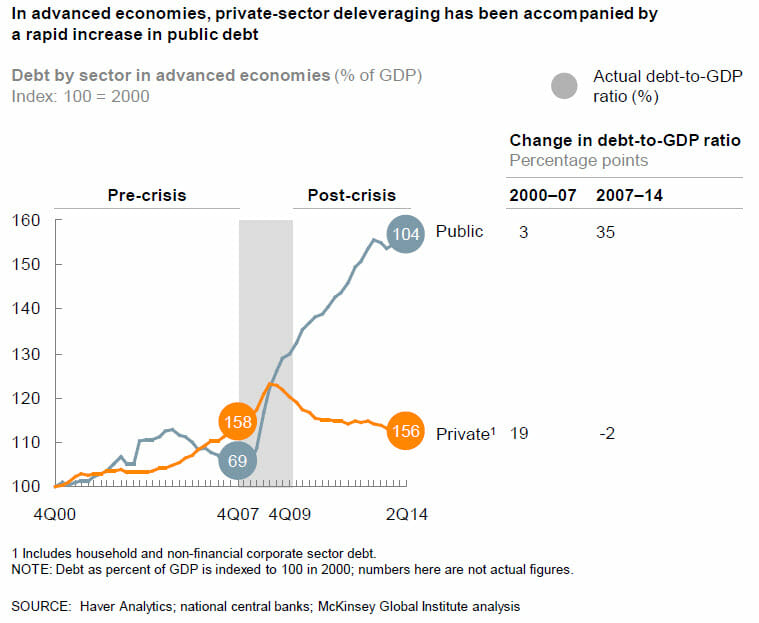

The situation in the US is the same as it is worldwide. While those evil private short-term-focused private actors have used the improving economy to de-leverage back below 2007 levels, governments have increased their debt as a percentage of GDP by just over 50% since just before the last recession.

Since 2007, according to my old friends at McKinsey, global government debt has risen by $25 trillion since 2007. If you really care about Keynesian stimulus in recessions, and not just "mindlessly" (I can use that term too) increase government spending, wouldn't you want to be building up some reserves for next time?

Once again, spot on. Of course the reply goes along the lines of:

The free market so damaged the economy that the govt has to keep spending up to keep it going and save the future for our children.

And that we won't have another recession if we keep govt spending up because the ever-elusive point at which the economy "catches" will eventually come as long as we don't engage in that awful "austerity"; etc. ad nauseum.

What are you talking about? There won't be a next recession because we Keynesians have solved the problem of the business cycle this time, for real.

/sarc

They have only one answer whatever the question: SPEND!

Since it's impossible by definition for a fiat currency government to go bankrupt, no problem! Just print harder.

Far be it from me to defend Keynes, who even when read correctly is still wrong...but they're not Keynesians. They're state-worshippers usurping the name of a dead economist to give extra credibility to their religion, while adopting only that portion of his ideas which are useful to their present political desires, and ignoring the larger share which is inconvenient to those desires. (That would be the bit about paying off, during times of prosperity, the public debt that one accumulates during times of hardship by supposedly "counter-cyclical" spending, rather than using that prosperity as an excuse to go on an even bigger spending spree.)

And what do you do when you have devalued the currency so far (due to triple and even quadruple digit inflation) that even your own citizens won't use it?

Start printing a new currency, I should expect.

One economists (or economics writer, I forget the guy) said we don't know if Keynesian policies work because it has never been tried. He was referring to gov saving during the good times so that the policy was like a shock absorber to the economy smoothing it out.

In a letter Keynes said the best way to stimulate the economy (best gov spending) was to reduce or eliminate payroll taxes during the downturn as it gets the money out fast. Further, tax reductions themselves stimulate the economy.

If they already ran one currency into the ground, why would anyone use the new one (other than for paying taxes).

Come now, we'll simply pass a law that says that people must use it.

I get it ... Keynesian thinking will NEVER work. Why, because it depends on the government intervention to NOT be run by humans. Wow ... why didn't I see this before. The reason that people don't spend in recessions (even if they have money) is because of fear. Fear, that human emotion that can't be gotten rid of, not in individual humans and most certainly not in groups of humans. Keynesians think that the government will know to spend at the time when the fear is at it's greatest. LOL how can this ever happen? The people in the recessionary economy aren't spending because they are afraid, but somehow the people in the government in the recessionary economy are immune to the effects of the general fear. I think not. Done ... Keynesian Doctrine discredited.

Do you honestly believe that even that will work once your currency is so worthless that you need a wheelbarrow full to buy groceries and it's more efficient to weight it than to count it?

That's going to depend on who's definition of "bankrupt" you use. If you scaled the numbers down from trillions to thousands, I'm pretty sure most people would be looking to declare bankruptcy. Governments don't do that because it makes the politicians look bad (not their favorite thing) and to not get re-elected (the thing they fear only slightly less than prison and in some cases, more than prison).

The problem with Keynesian thought is; they have no way to separate vote buying policies from economic policies - to follow though on the surplus Idea you have to stop using tax money to buy votes and that's just never going to happen. Well, that's not the only problem with Keynesian thought, it's simply the most direct, obvious, and effective proof that the theory can't work.

To ask the question is to answer it.

The proposed budget would result in a deficit below the 40 year average. Whether it gets past congress . . .

Keynsian theory was to run budget surpluses at the peak of the business cycle, reducing the debt to GDP ratio and moderating growth: Government is supposed to save in the fat times so it can spend in the lean times. If you're perpetually running deficits of any scale, that's not what Keynes proposed in "The General Theory," or anywhere else.

But the debt won't be twice as much... because Government policy is to create continual inflation to inflate the debt away, then express it as a part of GDP which will have grown thanks to Government's brilliant idea to hold interest rates down too low in order to ensure debt-fuelled consumer spending, and then insist that debt actually is smaller than before, thanks to the Government-of-the-day's brilliant handling of the economy and paying down the deficit/debt which they will conflate confident that Joe Public does not make the distinction between deficit and debt.

Watch my right hand not my left hand. I blame the electorate.

As I said before, new currency will be issued to resolve that problem. We can keep adding zeros to the end.

It's all relative when it comes to politicians.

They all seem to be into pumping up the economy with spending, tax cuts, and low interest rates when their relection is coming up (a belief in Keynsian mechanisms, if not Keynsian long term planning). A lower than average deficit is about as good as you can expect.

1. It really does not matter if Keynes' theory "works" or not because it involves government spending and deficits. These decisions are not based on economics, but rather politics. To tie "managing" the economy to a governmental body is foolishness to begin with.

2. The critical feature of Keynes is the claim of a multiplier. And while I believe that at one time the multiplier on government spending was significant, think of the building of the Erie Canal or even the interstate freeway system, like all economic factors it has a diminishing marginal return. So, the initial marginal dollars spent building I-95 might have had a big multiplier as businesses boomed along its route, the multiplier of a $4 trillion dollar federal budget is probably way less than one.

Their are countries that have tried that before. It never works. Every government that has tried to do that has collapsed.

America is exceptional.

Bull.

>Don't you worry that this limits your flexibility and ability to ramp up deficit spending in the next recession?

Apparently not. "Fiscal freedom of maneuver" (ie. shrink debt to leave room for more) has been one my favorite drums to beat for years. No-one responsible for actual public fiscal policy seems to share my enthusiasm.

Coyote Blog: So we are now almost certainly in the top half of the cycle. But I don't hear any Keynesians seeking to run a surplus, or even to dial back on government deficits or spending.

The economy is still soft, so some investment might still make sense. In any case, if the budget deficit is kept below the growth rate, then the debt will tend to decrease as a percentage of GDP over time. That's sufficient to constitute countercyclical policy.

A more disciplined policy going forward makes sense, but the U.S. system has a strong ideological component against government surpluses. The Americans had a chance with Gore, but decided to go with the guy who counted trillions of dollars in tax cuts on his fingers instead.

I agree that the stimulus was just an excuse for growing the power of government. Remember the stimulus of 2009 had provisions to lay some of the groundwork for Obamacare and Cap and Trade. Obamacare eventually passed while Cap and Trade stalled in Congress. But the President is looking to to go around Congress and have the EPA implement regulations that would achieve some of the goals of Cap and Trade. I wonder if some of these regulations have their roots in the stimulus.

That's the old joke about Marxism, too: it has never been tried. And both of these are illustrations of Warren's point about leftist policies that might work "if only the _right_ people are in charge" - but the right people never stay in charge. Marx's concept was that . In Russia, the idealistic-socialist Kerensky government was overthrown by the Bolsheviks, led by the brutal Lenin, and Lenin was succeeded by the cynically murderous Stalin.

And in the US, FDR may have actually been a full Keynesian, once - as the economy improved circa 1936, he moved to reduce the deficit. But he did not dismantle the vast regulatory apparatus he'd put in place, and so the economy was strangled again. Rather than look critically at all his anti-capitalist achievements, he promptly ran another huge deficit, and that continued past his death. FDR is the last US politician I can think of that even tried to be Keynesian on the upside.

Zach: What, besides the voices in your head, makes you imagine that Gore wasn't going to run just as big a deficit? He would have done it with spending rather than tax cuts (not that the damned RINO Bush didn't spend, too), but that would have been even worse for the economy.

markm: What, besides the voices in your head, makes you imagine that Gore wasn't going to run just as big a deficit?

The Clinton Administration, of which he was a part, ran cash surpluses, and accrual balances. He also campaigned on continuing to set money aside for Social Security.

My intention was to note that all the Keynesian “talk” is about go-spending and there was more to it including how to do the spending (tax relief). I've not read Keynes, nor the New-Keynesian which I understand to be adopted by some modern economists to solve problems (?) with the original – "I know nuting." I do like tax relief, though.

More than the “right people” never stay in charge, they can ever get in charge. With gov's size, scope & power (all growing) it gets ever less likely. I wish I had saved a description of all the Republicans did to thwart Ron Paul's presidential run including breaking their own rules, even when such was not necessary as he had little chance. Regardless of any pro-/anti- thoughts about RP, no one out of the club has a chance and no one in the club are the “right people.” Note: The Republicans have rewritten, and continue to rewrite their rules to make it easy to thwart anyone off the reservation. Next time they won't be charged with breaking their own rules as now their rules are whatever they say they are, no more & no less.

Clinton's surplus was an accounting fiction done by recording loans from the SS trust fund as revenue. National debt went from $4.3T to $5.6T over his presidency & $5.4T to $5.6T while the surplus was claimed.

After pushing for more taxes Clinton worked with a Republican controlled congress and reduced capital gain & estate taxes, added $500/child tax credits, & created the new Roth IRA benefiting taxpayers boosting the economy.

Kennedy was probably the last D-president who understood taxes were a deadweight cost to the economy (reducing economic activity) and cut them to the economic benefit of the nation.

The main problem with Democrat lies is that not only do Democrats believe them, but the media does as well -- but perhaps I repeat myself. Even in the static analysis of Bush's tax cuts, the bulk of it went to lower income levels. And in the dynamic analysis of the tax cuts -- which turned out to be accurate -- the rich paid MORE in taxes because it was no longer worth the costs and hassles to characterize wealth and income in tax-preferred status. Tax cuts to families and lower incomes do little to increase taxable income -- so their tax burden went down. Meanwhile, debt to GDP level was relatively constant for most of Bush's presidency. And the debt to GDP level is the key measure of affordability.

Zachriel, you really should spend some time understanding the difference between tax rates and tax collections.

Where you alive during the 1990s? What you describe was not part of the Clinton Administration economic proposals. Yes, Dick Morris finally persuaded to sign the final packages, but the surplus came from Republican initiatives -- cuts to Capital Gains taxes, welfare reform, and deregulation. These were the attributes that led to the surpluses -- definitely not Clinton's initiatives. Clinton fought these attributes for a while, but eventually agreed to them.

As a former Keynesian, I will share some insights which seem to have been true for over 30 years, now.

1. We Keynesians missed some key features of the economy, and I am embarrassed that our analysis of the economy was so incomplete -- in fact, I can't believe that we were that incompetent.

2. The absolute level of the federal debt matters little -- just like a bank can lend me $100,000 reliably but cannot lend $1000 to my son without great risk, so too federal debt the size of $15 trillion is not in itself unmanageable if the GDP is $17 trillion.

3. Although GDP to debt is a useful measure, the key question is CAN THE GOVERNMENT REFINANCE THE DEBT WHEN BONDS COME DUE? As long as that question is YES, we do not have a crisis.

4. However, there are some problems even if we do not have a crisis. For example, if interest payments on the debt could consume such a huge portion of the budget that we do not have funds for our priorities. Right now, interest rates are extremely low at unprecedented levels, and those low rates are masking what huge portion of the budget might be needed for interest payments.

5. Debt levels could be so high that creditors will ask for austerity measures before refinancing the debt. And those austerity measures could really, really hurt -- see Greece.

6. Key principle for household or nation -- go not into debt unless the debt is used for investment which generates a cash flow sufficient to make payments needed to cover the debt. Main problem in Greece is the debt was incurred to make payments to government workers -- a political tactic resulting in spending, not investment.

7. The multiplier concept in Keynesian economics is BUNK. The money comes from somewhere -- taxes or borrowing. The dollar leaving that origin has a negative multiplier impact equal to the positive multiplier of government spending -- unless the government spending is in some investment that will boost productivity in the economy.

8. When Supply Side Economics have been used, we have great results in greater growth and less inflation -- along with increased tax revenue from people who can best afford it!

TruthisaPeskyThing: What you describe was not part of the Clinton Administration economic proposals.

That is simply incorrect. Clinton campaigned in 1992 on fiscal discipline, universal health care, and reducing welfare dependency.

The 1993 Omnibus, which was the primary mechanism leading to cash surpluses was passed without a single Republican vote. Gore, as president of the Senate, had to cast the deciding vote there. Republicans repeatedly claimed it would lead to a severe economic recession, when, in fact, it began the longest peacetime economic expansion in modern U.S. history.

The Republican Congress does get credit for continuing to push Clinton on welfare reform, which Clinton signed in 1996, fulfilling his 1992 pledge.

tex: Clinton's surplus was an accounting fiction done by recording loans from the SS trust fund as revenue.

Oh gee whiz. The last years of the Clinton Administration saw huge *cash* surpluses ($200 billion in 2000), and was balanced based on accrual accounting.

http://www.cbo.gov/sites/default/files/cbofiles/attachments/45010-breakout-AppendixH.pdf

You don't think the Clinton surplus had anything to do with Newt Gingrich. Oh yeah, forgot about that, the budget comes from the house.

Every democrat in my lifetime has campaigned on fiscal prudence, which usually means they want to increase your taxes, rather than cut fluff from government. Some dems were actually brave enough to say during the campaigns that they would raise your taxes, to stop the evil deficits.

I call BS.

Fiscal discipline is a campaign slogan which means little because it is a campaign slogan. Basically, most of Clinton's initiatives were stymied (UHC and BTU tax, etc.). Yes, there was a tax rate increase for high income earners in 1993, and tax collections from the rich went down! Also, many people saw decreases in the value of their retirement plans because of the tax impact on the stock market. Clinton later called the tax rate increase a mistake.

The budget surplus came after Clinton agreed to huge cuts in the tax rate on capital gains. Of course, the welfare reform, and deregulation initiatives helped also. The great economic expansion was due to the implementation of supply-side economics. The economy performed as supply-side models said it would.

Zachriel, tex does have a point -- but only one point. The unified budget does in effect count the loans from the SS trust funds as revenue. In the annual budget, the procedure overstates revenues and hides the SS obligations that have been kicked down the road. Tex did not say it, but let us be clear: Clinton did not start this accounting procedure -- both Democrats and Republicans have used unified budget for decades.

TruthisaPeskyThing: Fiscal discipline is a campaign slogan which means little because it is a campaign slogan.

The claim is that deficit reduction was not part of Clinton's economic proposals. That was a false claim.

TruthisaPeskyThing: Yes, there was a tax rate increase for high income earners in 1993, and tax collections from the rich went down!

Tax revenues increased from $1.15 trillion in 1993 to $2.02 trillion in 2000. Truth is a pesky thing.

TruthisaPeskyThing: The budget surplus came after Clinton agreed to huge cuts in the tax rate on capital gains.

Yes, Clinton also oversaw cuts in the capital gains tax, though that had only a marginal effect on revenues.

marque2: Every democrat in my lifetime has campaigned on fiscal prudence, which usually means they want to increase your taxes, rather than cut fluff from government.

Clinton oversaw tax increases, as well as welfare reform.

TruthisaPeskyThing: The unified budget does in effect count the loans from the SS trust funds as revenue.

That's right. And when we say the federal government is running a surplus, we are referring to the cash basis. The Clinton Administration left the U.S. with a structural cash surplus, and the accrual budget in balance. The effect of the cash surplus was to pay down the publicly-held debt, strengthening the financial position of the U.S., including Social Security. Indeed, there was talk about the elimination of publicly-held U.S. securities, and what that would mean to the world economy which used U.S. securities as a means of transaction. But the problem of the U.S. not owing any publicly held debt was 'solved' during the Bush Administration.

Zack is a leftist retard that has an over-blown opinion of his intellectual capacity. Attempting to reason with the filthy sphincter is pointless. He continually displays his ignorance every time he puts words on the screen.

TruthisaPeskyThing: 2. The absolute level of the federal debt matters little -- just like a bank can lend me $100,000 reliably but cannot lend $1000 to my son without great risk, so too federal debt the size of $15 trillion is not in itself unmanageable if the GDP is $17 trillion.

That much is true. Debt-to-income is a primary indicator of ability to pay. However, if the economy is growing, or with even moderate inflation, then the debt-to-income tends to reduce over time. $15 trillion may not be such a big number in twenty years.

TruthisaPeskyThing: 5. Debt levels could be so high that creditors will ask for austerity measures before refinancing the debt. And those austerity measures could really, really hurt -- see Greece.

A significant difference is that Greek debt is denominated in a currency they do not control.

TruthisaPeskyThing: 7. The multiplier concept in Keynesian economics is BUNK.

That's simply not correct. There is substantial empirical evidence of the multiplier effect; however, it only applies when there is slack in the economy and in the money markets, otherwise it results in inflation or an increase in interest rates respectively.

marque2: You don't think the Clinton surplus had anything to do with Newt Gingrich.

We addressed that below. Clinton campaigned on welfare reform, but the Republican Congress gets credit for continuing to push the issue. Ultimately, Clinton signed welfare reform in 1996, fulfilling his 1992 campaign promise.

TruthisaPeskyThing: Meanwhile, debt to GDP level was relatively constant for most of Bush's presidency.

The end of the Bush Administration saw the economy in free fall. Truth is a pesky thing.

I accept "surplus" in the CBO report, but Clinton's surpluses were no surpluses in reducing the National Debt which rose while Clinton was claiming a “budget surplus” and I'm not alone objecting to CBO's “surplus” accounting.

“It turns out the budget scored a surplus only because it borrowed money from the 'trust' funds that secure entitlement payments, such as Social Security and Medicare. Since, in the real world, those funds would be considered obligated, those intergovernmental borrowings actually increase the federal debt. They are included in the debt figure that is published by the Bureau of Public Debt.”

--WL Dean, Adjunct Prof, George Town Law

Clinton was better than following presidents as under his term: real deficits were reduced; gov spending as % of GDP reduced; capital gains taxes & other taxes reduced. There are good arguments that his good record was a result of his cooperation with an opposition (Republican) controlled congress.

tex: I accept "surplus" in the CBO report

It's called a cash surplus. Running cash surpluses is generally better than running cash deficits.

tex: Since, in the real world, those funds would be considered obligated, those intergovernmental borrowings actually increase the federal debt.

The budget was in close accrual balance at the end of the Clinton Administration. Again, accrual balance is generally better than deficits.

America chose another course after that.

Our economy was on the mend, under Clinton/Republican control, including nearly balancing the budget in any measure, and I assume that due to Clinton's agility. And not as good as Reagan and Reagan wasn't great, just better than most.

I don't think “America chose” in the sense citizens knowingly changed course, but rather the politicians changed course by selfish intent. Decades ago in a speech about SS, M Friedman said all major gov initiative are the result of gov's Madison Av type marketing rather than a groundswell of public demand (they are led, not followed, into policies of gov's making). Within the past several months, an article asserted voters don't really count at all in forming gov policy.

Aside from the Keynes shock absorber purposes of damping the booms (which I'm noting rather than promoting), it is not certain we should run “cash surpluses” as that is taking $ from the private sector that gov does not need and a drain on the economy, i.e. we'd be richer today without Clinton's cash surplus & ought to just keep reducing gov's involvement in the economy (and damn near everything else as well – my 3rd grader public school science lesson last wk taught her “Starts shine because of pollution;” another booklet said our sun was a “yellow dwarf” star; & an on-line science test came up in Spanish with no way to switch it to English. Common core math is worse).