First Solar Update

A few years ago I was asked to give a presentation in front of a group of Phoenix business leaders on climate and alternative energy. I can't remember what particular group it was, but it was some public-private group that was heavily invested in advocating for local subsidies to promote strategic businesses - the sort of local MITI that most large cities have, that has this delusion that they can ramp up the city's growth by focusing public and private investment into a few selected industries (that they select, of course).

I told them that I thought their focus on solar manufacturing was dumb. First, the whole idea that because Arizona is a good solar market meant that it should have some advantage in solar manufacturing made absolutely no sense. This only makes sense for products with high transportation costs or a particular input cost that can be gotten more cheaply in one particular area (the location of aluminum manufacturing near cheap electricity in the Northwest comes to mind). By the same logic all car manufacturers would be located in LA.

Second, I said that the whole solar business was completely driven by subsidies. If the subsidies were to go away, the heart of the business would go away faster than pets.com. I specifically mentioned First Solar in a positive context here, saying that though they where wholly dependent on subsidies for their revenues, they at least acknowledged as a corporate strategy they needed to get costs low enough to compete without subsidies. (Someday, solar will get to that point, I hope, but I am skeptical that current approaches will yield the breakthrough, but that is another discussion).

If you want to understand the financial problems First Solar is having, let me show you four items.

First, from their 2010 annual report:

Geographic Risk. Our solar modules are presently predominantly sold to our customers for use in solar power systems concentrated in a single geographic region, Germany. This concentration of our sales in one geographic region exposes us to local economic risks and local public policy and regulatory risk in German.

This is way back in the notes on page 133. By the way, I took a whole course in business school on reading financial reports. Here is the key lesson for those not in the financial industry: read them from the back. Skip all the glossy crap at the front, go straight to the notes.

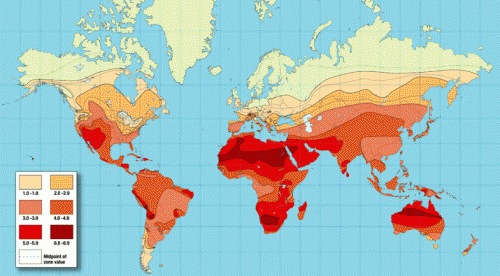

OK, here is the second bit of information. Here is a world map of solar insolation, which is essentially the total solar energy available to produce power in a location when adjusted for atmosphere, weather, latitude, etc.

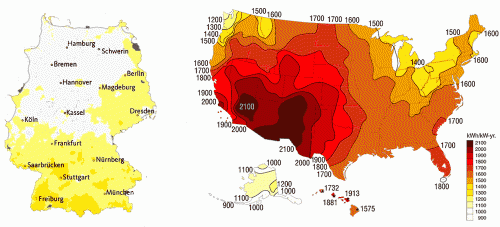

See Germany? I won't insult your geographic knowledge by pointing at it, but much of Germany is in that yellow-green color which, for solar potential, means (in scientific terms) "it sucks." Let's zoom in, and compare it to the US to get a feel for it (combined from two charts here)

Apparently the better sites in Germany have the same solar potential as ... Seattle! The sliver of absolute best sites in Germany have approximately the same solar potential as Buffalo, NY.

So we have a company whose fortunes are dedicated almost entirely to selling solar panels into one of the most unpromising solar sites in the world. Why is Germany buying so much solar?

OK, here is the third bit of information. For years Germany had enormous feed-in tariffs (mandated above-market minimum prices) for solar electricity:

The German feed-in tariff scheme has been in operation since 1991 and is regarded as one of the most successful in the world. In Germany, feed-in tariff rates are differentiated according to the source of the renewable energy. Separate tariffs are determined for biogas, biomass, hydroelectric, geothermal, solar and wind energy sources. The tariff paid for solar generators varies between EUR 45.7c/kWh and EUR 57.4c/kWh, depending on the capacity of the system and other design features. The tariff is greater for generators that are attached to the roof of a building or structure and greater again for generators that are attached to another part of a building. In Germany, the feed-in tariff is paid for a period of 20 years

Note the language from several years ago where "most successful" is determined without references to costs.

0.574 Euros per kWh is equal to about $0.75 today and even more several years ago when exchange rates were higher. Remember this is a wholesale price, and should be compared to a $0.04 to $0.06 wholesale electricity price in the US (I use US numbers to as its not clear to me Europe has a particularly competitive wholesale market. The French have some sort of fixed price system set around $0.06).

However one wants to look at it, these are enormous subsidies. People putting up solar panels in Germany were getting paid 10-15x what a market price for the same electricity might have been.

Finally, here is the fourth piece of evidence leading to First Solar's woes. In 2010 and 2011 Germany, whose consumers began to balk at paying the highest electricity rates in the world in order to subsidize the method of electrical generation least suitable to Germany, began substantially cutting these tariffs. In 2012 they will cut them even further:

German Environment Minister Norbert Roettgen and Economy Minister Philipp Roesler are set to hold a press conference on Thursday to outline the government's new approach on subsidies. However, the indications are that the cuts will be heavier than the market has been expecting:

- a 30% cut in the feed-in-tariff (FIT) to 13.5 cents per kilowatt hour for new large solar installations

- and a 20% cut in the FIT to 19.5 cents for new small plants

The market has of course been expecting cuts in the German FIT system. However, this news is decidedly worse than expected and likely to continue to pressure solar stocks - particularly those such as Yingli (YGE) with a significant exposure to German solar demand.

From a peak of $0.75 per kWh, Germany will now pay $0.255 per kWh for smaller installations, still four times the market price for wholesale electricity but only a third of what they paid during First Solar's boom years. As I wrote yesterday, Germany was essentially paying $2 for milk from brown cows and $25 for milk from black cows. This can't be sustained.

If one assumes a wholesale electricity price of 6 cents, First Solar's German customers were getting a 92% subsidy. Sure, First Solar now faces other problems like Chinese competition and they have shot themselves in the foot on quality, but at the end of the day the only way they can survive is to convince some other government to turn on the taxpayer money spigot to keep them in business. I am hoping we in Arizona and the US will not be the suckers, but I fear that we will. One can argue the projects I discussed the other day, including the one where we taxpayers loaned First Solar the money to sell its solar panels to its own subsidiary, are evidence of this. My guess is that First Solar will be throwing a lot of money and time towards Obama, praying for his re-election.