I know what you are thinking -- in this post title Coyote has engaged in some exaggeration to get our attention. But I haven't! Felix Salmon actually says this, in reaction to a group of CEO's who wrote an open letter to the feds seeking less deficit spending.

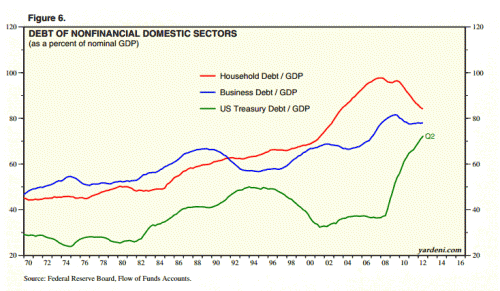

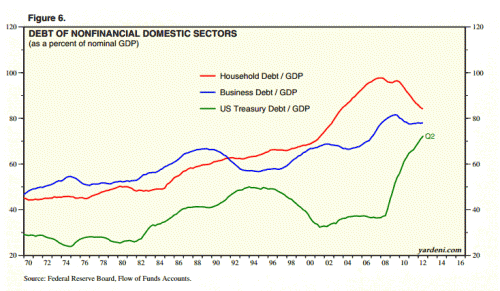

There are lots of serious threats out there to the economic well-being and security of the United States, and the national debt is simply not one of them. Nor is it growing. The chart on the right, from Rex Nutting, shows what’s actually going on: total US debt to GDP was rising alarmingly until the crisis, but it has been falling impressively since then. In fact, this is the first time in over half a century that US debt to GDP has been going down rather than up.

There are lots of serious threats out there to the economic well-being and security of the United States, and the national debt is simply not one of them. Nor is it growing. The chart on the right, from Rex Nutting, shows what’s actually going on: total US debt to GDP was rising alarmingly until the crisis, but it has been falling impressively since then. In fact, this is the first time in over half a century that US debt to GDP has been going down rather than up.

So when the CEOs talk about “our growing debt”, what they mean is just the debt owed by the Federal government. And when the Federal government borrows money, that doesn’t even come close to making up for the fact that the CEOs themselves are not borrowing money.

Money is cheaper now than it has been in living memory: the markets are telling corporate America that they are more than willing to fund investments at unbelievably low rates. And yet the CEOs are saying no. That’s a serious threat to the economic well-being of the United States: it’s companies are refusing to invest for the future, even when the markets are begging them to.

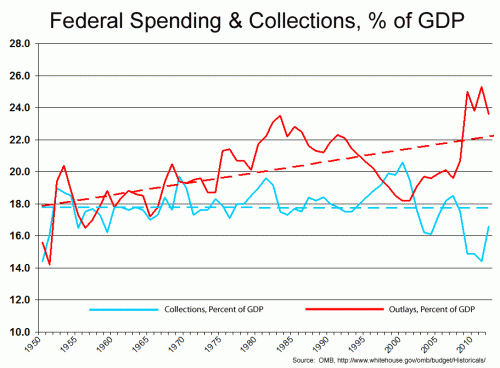

Instead, the CEOs come out and start criticizing the Federal government for stepping in and filling the gap. If it wasn’t for the Federal deficit, the debt-to-GDP chart would be declining even more precipitously, and the economy would be a disaster. Deleveraging is a painful process, and the Federal government is — rightly — easing that pain right now. And this is the gratitude it gets in return!

I seldom do this, but let's take this apart paragraph by paragraph:

There are lots of serious threats out there to the economic well-being and security of the United States, and the national debt is simply not one of them. Nor is it growing. The chart on the right, from Rex Nutting, shows what’s actually going on: total US debt to GDP was rising alarmingly until the crisis, but it has been falling impressively since then. In fact, this is the first time in over half a century that US debt to GDP has been going down rather than up.

So when the CEOs talk about “our growing debt”, what they mean is just the debt owed by the Federal government.

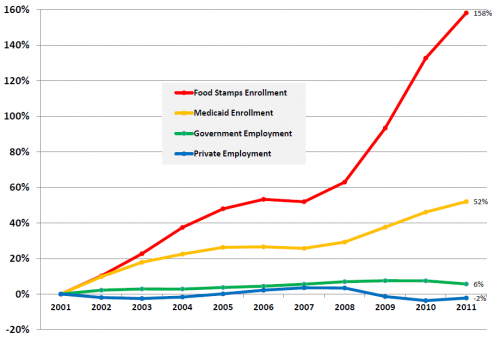

Duh. Of course they are talking about the government deficit and not total deficit. But he is setting up the game he is going to play throughout the piece, switching back and forth between government debt and total debt like a magician moving a pea between two thimbles. We can already see the game. "Look folks debt is not a threat, it is going down", but it is going down only at this total public and private debt number. The letter from the CEO's made the specific argument that rising government debt creates current and future issues (see: Europe). Just because all debt may be going down does not mean that the rise of one subset of debt is not an issue.

Here are two analogies. First, consider a neighborhood where most all the residents are paying down their credit card debt except for Fred, who is maxing out his credit cards and has just taken out a third mortgage. The total debt for your whole neighborhood is going down, but that does not mean that Fred is not in serious trouble.

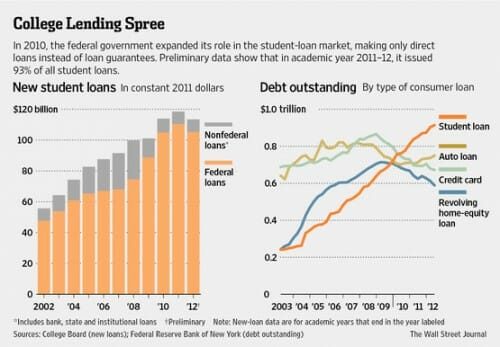

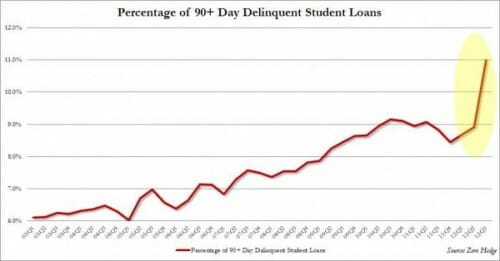

Or on a larger scale, take consumer debt. Most categories of consumer debt are falling in the US. But student debt is rising alarmingly. Just because total consumer debt may be falling doesn't change the fact that rising student debt is a serious threat to the well-being of a subset of Americans.

And when the Federal government borrows money, that doesn’t even come close to making up for the fact that the CEOs themselves are not borrowing money

What?? Whoever said that the role of the Federal government is to offset changes in corporate borrowing? In his first paragraph, he already called the rise in total debt "alarming", and I get the sense that both CEO's and consumers agree and so they have been trying to reduce their debts. So why should the Feds be standing athwart the private unwinding of an "alarming" problem? And how does he know CEO's and their corporations are part of this deleveraging? I see no evidence presented. Corporate debt is but a small part of total US debt. Corporations may be a part of this, or not.

In fact, they are not. Corporate borrowing in the securities market has increased almost every quarter since 2008, such that total corporate bond debt is about 10-15% higher than in 2008 (see third chart here). And here is total debt to GDP broken down by component (this is for non-financial sectors) source.

Government debt is basically offsetting the consumer deleveraging. Since consumers have to eventually pay this government debt off, as they are taxpayers too, then the government is basically flipping consumers the bird, forcing them to take on debt they are trying to get rid of. Hard working consumers think they are making progress paying off debt, but the joke is on them - the feds have taken the debt on for them, and the bill will be coming in future taxes for them and their kids.

He might argue, "this is Keynesianism." But is it? If corporations are actually deleveraging, we still don't know how. Is it through diverting capital investment to debt repayment (as I think Salmon is assuming) or are they raising capital from other sources and rejiggering the right side of their balance sheets? And even if this deleveraging is coming at the expense of corporate investment, I thought Keynesians virtually ignored investment or "I" in their calculations (you remember, don't you, from macro: C+I+G+X-M?). In fact, if I remember right, "I" is treated as an exogenous variable in the famous multiplier "proof".

Money is cheaper now than it has been in living memory: the markets are telling corporate America that they are more than willing to fund investments at unbelievably low rates. And yet the CEOs are saying no. That’s a serious threat to the economic well-being of the United States: it’s companies are refusing to invest for the future, even when the markets are begging them to.

This is the real howler -- that "markets" are sending a low-interest signal. Markets are doing nothing of the sort. The Federal Government, via the Fed, is sending this signal with near-zero overnight borrowing rates and $30-$40 billion a month in money printing that is used to buy up government debt from the market. If any signal is being sent at all, it is that the Federal Government is main economic priority is continuing to prop up the balance sheet and profitability of major US banks.

Investment is also not solely driven by the price of funds. There must be opportunities where businesses see returns that justify the spending. Unlike the Federal government, which is A-OK blowing billions on companies like Solyndra, businesses don't invest for the sake of spending, they invest for returns. A soft economy combined with enormous government driven uncertainties (e.g. what will be our costs to comply with Obamacare) are more likely to affect investment levels than changes in interest rates.

Instead, the CEOs come out and start criticizing the Federal government for stepping in and filling the gap. If it wasn’t for the Federal deficit, the debt-to-GDP chart would be declining even more precipitously, and the economy would be a disaster. Deleveraging is a painful process, and the Federal government is — rightly — easing that pain right now. And this is the gratitude it gets in return!

This is where economic thinking has ended up in 2012: To Salmon, it does not matter where the Federal government spends this money, so long as it is spent. He never even tries to justify that the government is running up debt in a good cause, because what it spends money on does not matter to him. For him, the worst possible thing for the economy is for people to spend their money paying down debt. Spend it on more drone strikes or more Solyndras or more squirrel research -- it does not matter to Salmon as long as the money is used for anything other than to pay down debt.

Here is the bottom line: Businesses and individuals are trying to reduce their debt. And many hard-working people think they are being successful at this. But the joke is on them. The government is running up trillions in debt in their name, thwarting American's desire to de-leverage. Mr. Salmon wants us to thank the government for this. Hah.

All-in-all, this is an awful argument to try to justify Congressional and Presidential fecklessness vis a vis the budget.

There are lots of serious threats out there to the economic well-being and security of the United States, and the national debt is simply not one of them. Nor is it growing. The chart on the right, from

There are lots of serious threats out there to the economic well-being and security of the United States, and the national debt is simply not one of them. Nor is it growing. The chart on the right, from