You Ungrateful Slobs Should Be Thankful That The Federal Government Is Running Up Huge Debt

I know what you are thinking -- in this post title Coyote has engaged in some exaggeration to get our attention. But I haven't! Felix Salmon actually says this, in reaction to a group of CEO's who wrote an open letter to the feds seeking less deficit spending.

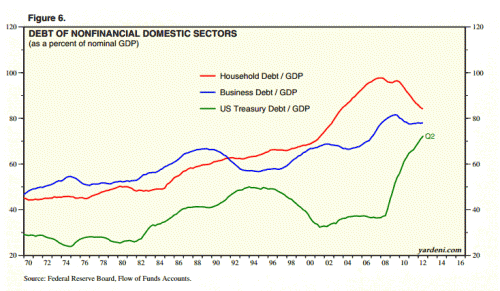

There are lots of serious threats out there to the economic well-being and security of the United States, and the national debt is simply not one of them. Nor is it growing. The chart on the right, from Rex Nutting, shows what’s actually going on: total US debt to GDP was rising alarmingly until the crisis, but it has been falling impressively since then. In fact, this is the first time in over half a century that US debt to GDP has been going down rather than up.

So when the CEOs talk about “our growing debt”, what they mean is just the debt owed by the Federal government. And when the Federal government borrows money, that doesn’t even come close to making up for the fact that the CEOs themselves are not borrowing money.

Money is cheaper now than it has been in living memory: the markets are telling corporate America that they are more than willing to fund investments at unbelievably low rates. And yet the CEOs are saying no. That’s a serious threat to the economic well-being of the United States: it’s companies are refusing to invest for the future, even when the markets are begging them to.

Instead, the CEOs come out and start criticizing the Federal government for stepping in and filling the gap. If it wasn’t for the Federal deficit, the debt-to-GDP chart would be declining even more precipitously, and the economy would be a disaster. Deleveraging is a painful process, and the Federal government is — rightly — easing that pain right now. And this is the gratitude it gets in return!

I seldom do this, but let's take this apart paragraph by paragraph:

There are lots of serious threats out there to the economic well-being and security of the United States, and the national debt is simply not one of them. Nor is it growing. The chart on the right, from Rex Nutting, shows what’s actually going on: total US debt to GDP was rising alarmingly until the crisis, but it has been falling impressively since then. In fact, this is the first time in over half a century that US debt to GDP has been going down rather than up.

So when the CEOs talk about “our growing debt”, what they mean is just the debt owed by the Federal government.

Duh. Of course they are talking about the government deficit and not total deficit. But he is setting up the game he is going to play throughout the piece, switching back and forth between government debt and total debt like a magician moving a pea between two thimbles. We can already see the game. "Look folks debt is not a threat, it is going down", but it is going down only at this total public and private debt number. The letter from the CEO's made the specific argument that rising government debt creates current and future issues (see: Europe). Just because all debt may be going down does not mean that the rise of one subset of debt is not an issue.

Here are two analogies. First, consider a neighborhood where most all the residents are paying down their credit card debt except for Fred, who is maxing out his credit cards and has just taken out a third mortgage. The total debt for your whole neighborhood is going down, but that does not mean that Fred is not in serious trouble.

Or on a larger scale, take consumer debt. Most categories of consumer debt are falling in the US. But student debt is rising alarmingly. Just because total consumer debt may be falling doesn't change the fact that rising student debt is a serious threat to the well-being of a subset of Americans.

And when the Federal government borrows money, that doesn’t even come close to making up for the fact that the CEOs themselves are not borrowing money

What?? Whoever said that the role of the Federal government is to offset changes in corporate borrowing? In his first paragraph, he already called the rise in total debt "alarming", and I get the sense that both CEO's and consumers agree and so they have been trying to reduce their debts. So why should the Feds be standing athwart the private unwinding of an "alarming" problem? And how does he know CEO's and their corporations are part of this deleveraging? I see no evidence presented. Corporate debt is but a small part of total US debt. Corporations may be a part of this, or not.

In fact, they are not. Corporate borrowing in the securities market has increased almost every quarter since 2008, such that total corporate bond debt is about 10-15% higher than in 2008 (see third chart here). And here is total debt to GDP broken down by component (this is for non-financial sectors) source.

Government debt is basically offsetting the consumer deleveraging. Since consumers have to eventually pay this government debt off, as they are taxpayers too, then the government is basically flipping consumers the bird, forcing them to take on debt they are trying to get rid of. Hard working consumers think they are making progress paying off debt, but the joke is on them - the feds have taken the debt on for them, and the bill will be coming in future taxes for them and their kids.

He might argue, "this is Keynesianism." But is it? If corporations are actually deleveraging, we still don't know how. Is it through diverting capital investment to debt repayment (as I think Salmon is assuming) or are they raising capital from other sources and rejiggering the right side of their balance sheets? And even if this deleveraging is coming at the expense of corporate investment, I thought Keynesians virtually ignored investment or "I" in their calculations (you remember, don't you, from macro: C+I+G+X-M?). In fact, if I remember right, "I" is treated as an exogenous variable in the famous multiplier "proof".

Money is cheaper now than it has been in living memory: the markets are telling corporate America that they are more than willing to fund investments at unbelievably low rates. And yet the CEOs are saying no. That’s a serious threat to the economic well-being of the United States: it’s companies are refusing to invest for the future, even when the markets are begging them to.

This is the real howler -- that "markets" are sending a low-interest signal. Markets are doing nothing of the sort. The Federal Government, via the Fed, is sending this signal with near-zero overnight borrowing rates and $30-$40 billion a month in money printing that is used to buy up government debt from the market. If any signal is being sent at all, it is that the Federal Government is main economic priority is continuing to prop up the balance sheet and profitability of major US banks.

Investment is also not solely driven by the price of funds. There must be opportunities where businesses see returns that justify the spending. Unlike the Federal government, which is A-OK blowing billions on companies like Solyndra, businesses don't invest for the sake of spending, they invest for returns. A soft economy combined with enormous government driven uncertainties (e.g. what will be our costs to comply with Obamacare) are more likely to affect investment levels than changes in interest rates.

Instead, the CEOs come out and start criticizing the Federal government for stepping in and filling the gap. If it wasn’t for the Federal deficit, the debt-to-GDP chart would be declining even more precipitously, and the economy would be a disaster. Deleveraging is a painful process, and the Federal government is — rightly — easing that pain right now. And this is the gratitude it gets in return!

This is where economic thinking has ended up in 2012: To Salmon, it does not matter where the Federal government spends this money, so long as it is spent. He never even tries to justify that the government is running up debt in a good cause, because what it spends money on does not matter to him. For him, the worst possible thing for the economy is for people to spend their money paying down debt. Spend it on more drone strikes or more Solyndras or more squirrel research -- it does not matter to Salmon as long as the money is used for anything other than to pay down debt.

Here is the bottom line: Businesses and individuals are trying to reduce their debt. And many hard-working people think they are being successful at this. But the joke is on them. The government is running up trillions in debt in their name, thwarting American's desire to de-leverage. Mr. Salmon wants us to thank the government for this. Hah.

All-in-all, this is an awful argument to try to justify Congressional and Presidential fecklessness vis a vis the budget.

Holy cow! We blogged the same thing at the same time. Let me know when the weird stuff happens...

http://thecivillibertarian.blogspot.com/2012/10/a-pissing-match.html

Most of the reason personal debt is going down is because it is being discharged in bankruptcy, or written off as bad debt in housing foreclosures/short sales.

That isn't exactly good for the economy - that represents a loss to business. Certain folks wishing to make the economy seem better pretend that all this debt reduction was because we have all saving our nickles and dimes again.

"Hard working consumers think they are making progress paying off debt, but the joke is on them"

Nah the consumers are playing the system too and having the debt discharged. It is not being paid back, see my comment below. - In fact some of the increase in federal debt is probably because the government is guaranteeing the home loans that are faltering.

The public is misled by statistics for government spending, because this increases GDP by accounting definition, no matter what is built. In reality, if you spend money (use resources) to dig a Keynesian ditch and refill it, then you starve, as the ditch fails to produce the food and other things which you really want.

Most government spending is false GDP, leading to nothing of value. A recession based on a decrease in this useless "production" is good for the future, not an economic disaster. It is the Keynesian spending which represents midirected resources and fruitless activity.

False Austerity

5/23/12 WSJ - David Malpass

=== ===

Economics has often ignored the critical distinction between austerity for the government and government-imposed austerity on the private sector. In the former, governments which are over-budget sell assets, restrain their hiring, and limit their mission to essentials. That's growth-oriented austerity.

In the private-sector version of austerity, governments impose new taxes and mandates on the private sector while maintaining their own personnel, salaries and pensions. That's the antigrowth version of austerity prevalent in Europe's austerity programs.

Many economic models, including the U.S. Congress's budget scoring system and Keynesian stimulus, ignore national debt levels and disregard whether spending decisions are made by the private sector or the government. This creates the absurd result that an economy in which the government spends and invests increasing amounts—even 100% of GDP—has the same projected growth rate as an economy where the government spends and taxes less.

=== ===

EasyOpinions.blogspot.com

Usually it is a good thing to reduce personal and corporate debt and build-up savings. Unfortunately, that isn't true today. The Fed's policies of cheap lending and money printing will bite us in the butt when this prolonged recession ends. We'll then experience big-time inflation. Those with debts (such as our federal government) will benefit from inflation. Those without debt will gain nothing. Those with savings will be the biggest losers because their assets will not appreciate enough to beat the inflation.

It's a joke to even assume that the government is deliberately running deficits in order to offset a reduction in consumer and business debt. The government spends money in order to pay off friends, buy votes, and to make work for bureaucrats.

Rex Nutjob is the moron at MarketWatch who is hilariously

confused by percentages: he posited that because Obama hasn’t increased

spending annually in double-digit percentages (the accelerator only goes down

so far, and it was on the floor in 2009 – 2010), he isn’t a “big spender.” Sure Rex.

What is that top chart?

It makes zero sense. My best

guess is that the right axis is total outstanding aggregate (private+public+everything)

debt amount times GDP, which fits Warren’s explanation. If so, it would look a lot scarier as

percentages (100%, 150%, 200%, 250%, etc).

Another reason for some dip is the meager economic recovery –

the GDP denominator got larger, so the debt overhang dipped below 3.5 (times

GDP).

Here is the correct chart to reference:

http://research.stlouisfed.org/fred2/graph/?s%5B1%5D%5Bid%5D=GFDEBTN

Same chart (smaller time scale), as percentage of GDP:

http://oregoneconomicanalysis.files.wordpress.com/2012/01/us_debtgdp_ratio.jpg

This is beyond idiotic economic analysis – it would get an F

in every major business school on the planet.

Typical leftist economic commentary: one imbecile quoting another.

I assume then that Felix then never gripes about the costs of the wars in Afghanistan and Iraq, since he contends that all government spending is good.

You need fixed rate debt. If the interest rate goes up on the debt as the inflation increase, I don't see the benefit.

Buy a dozen homes now on 30 year fixed. Might seem expensive at first, but after the inflation - pocket change.

The last regime this corrupt, this venal, this vile had their heads picked up out of baskets.

The Fed has traditionally been far more adverse to inflation than to anything else. The first sign of undenyable inflation and the Fed will be raising intrest rates so fast your head will spin.

Um, that's only true if you expect your real future income to keep pace with inflation. My recollection of the 70's was that this was NOT the case, and the average Joe took 4-5 years to have his salary adjusted upwards enough to catch up.

Those houses will look AWFULLY expensive when your food, housing and fuel costs double, the cost of maintaining those homes double, the cost of your property taxes double (at least), your paycheck goes up 5% and the bottom has dropped out of the housing market because you aren't the only sucker caught flat-footed with more mortgage than you can manage and interest rates are in the high 10's or low 20's in an attempt to reduce the already occurring inflation.

Buy the houses if you have the cash, otherwise, it's a sucker's bet.

I don't know why I would pay cash for a home today. I could buy one with someone else's money and then give them back worthless dollars in the future, while backing up the loans with rent payments. I doubt the investor with a dozen homes is just going to let them sit empty.

If the inflation is coming on strong it makes sense to get as many low interest fixed rate loans on investments as possible.

"Since consumers have to eventually pay this government debt off, as they are taxpayers too..."

Well, you are about half right on that last part.