Cargo Cult Social Engineering

Once upon a time, government officials decided it would help them keep their jobs if they could claim they had expanded the middle class. Unfortunately, none of them really understood economics or even the historical factors that led to the emergence of the middle class in the first place. But they did know two things: Middle class people tended to own their own homes, and they sent their kids to college.

So in true cargo cult fashion, they decided to increase the middle class by promoting these markers of being middle class. They threw the Federal government strongly behind promoting home ownership and college education. A large part of this effort entailed offering easy debt financing for housing and education. Because the whole point was to add poorer people to the middle class, their was a strong push to strip away traditional underwriting criteria for these loans (e.g. down payments, credit history, actual income to pay debt, etc.)

We know what happened in the housing market. The government promoted home ownership with easy loans, and made these loans a favorite investment by giving them a preferential treatment in the capital requirements for banks. And then the bubble burst, with the government taking the blame for the bubble. Just kidding, the government blamed private lenders for their lax underwriting standards, conviniently forgetting that every President since Reagan had encouraged such laxity (they called it something else, like "giving access to the poor", but it means the same thing).

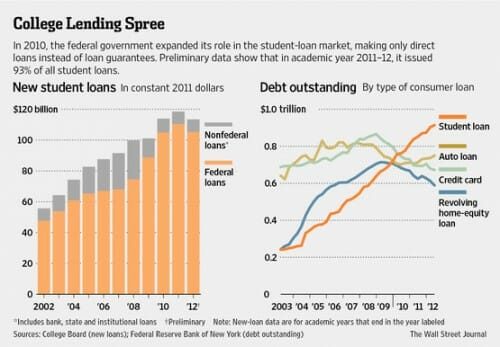

A similar bubble is just about to burst in the college loan market, and this time it will be much harder for the government to blame private lenders, since the government effectively nationalized the market several years ago and for years has been the source of at least 90% of all college loans. In the Wall Street Journal today, it was reported that student loans are now the largest component of consumer debt, and growing

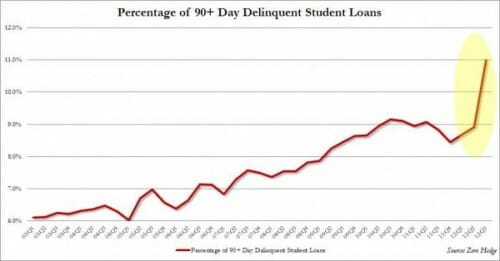

Further, a Fed report yesterday said that student loan diliquencies have jumped substantially of late

The scary part was found by Zero Hedge in the footnotes of the report, which admit that this number is understated by as much as half, meaning the true delinquency rate of student debt may be north of 20%.

The Journal article linked above explains why this is:

Nearly all student loans—93% of them last year—are made directly by the government, which asks little or nothing about borrowers' ability to repay, or about what sort of education they intend to pursue.

President Barack Obama championed easy-to-get loans during the campaign, calling higher education "an economic imperative in the 21st century." A spokesman for Education Secretary Arne Duncan said the goal is "to make student loans available to as many people as possible," and requiring minimum credit scores would block many Americans

Any of this sound familiar? I seldom learn much from anecdotes in new stories since it is too easy to craft a stirring anecdote on either side of just about any issue. But I was amazed at the story of the woman who was issued $184,500 in student debt to send her son to college when her entire income is a $1600 a month disability check.

the govt did encourage home ownership but never encouraged no doc loans, liar loans, and Alt A loans and in fact, if the banks that did these loans had been FDIC - they would not been able to.

they made these loans precisely because they WERE NOT regulated by the govt.

There is more culpability with student loans, I agree but I'd have to see some serious details about how some

lady got 184K in college loans. I know college has gotten expensive but that's pretty bad. I believe the AVERAGE college loan debt is around 15-20K if not mistaken.

Reynold's Law http://philoofalexandria.wordpress.com/2010/09/25/reynolds-law/

LarryG,

You are wrong on the mortgage issue. The no doc loans and in fact almost all sub-prime loans were and are backed by Freddy and Fannie. Mortgage companies created and run by the federal government. Freddy and Fannie created the sub-prime mortgage market.

As Matthew already stated, once again you have your head firmly lodged up your ass Larry.

Not only did government control the lending guidelines, they (HUD Secretary Andy Cuomo) actively drove lending targets, and Fannie Mae CEO (and criminal) Jim Johnson "partnered" with Henry Gonzalez (D-TX, dead) to lower lending standards

http://www.realclearmarkets.com/articles/2011/06/29/housing_and_reckless_disregard_for_risk_99102.html

"But they did know two things: Middle class people tended to own their own homes, and they sent their kids to college."

It isn't what you don't know, it's what you know that isn't so. The bit they missed? Middle class people tended to WORK HARD TO own their own homes, and they WORKED HARD TO SEND their kids to college AND MADE THE KIDS WORK HARD TO GET IN."

The one interesting thing about higher educational loans -- you aren't loaning against current credit score and income; you're loaning against potential future credit score and income.

So the question shouldn't be "Is the student a worthy credit risk *now*?"; it should be "Will the student be a worth credit risk *when the graduate*?"

It might seem like a big roll of the dice, but student loan access should be scored based on primary school achievement, intended field of study (yes, the world needs liberal arts majors; but they will make less than STEM students), and probability of successfully entering a field that uses that education. (A STEM degree-holder won't be able to pay off a large student loan debt if they're working outside their field.)

The more important question is how can I profit from this bubble?

buy put options on the for profit schools?

Larry G, Now I really understand the message that a friend gave me last week: there is no greater threat to America than the low-information voter. Likely, the low-information voter re-enforces other threats by not only tolerating bad policies, but also by encouraging bad policies. Moreover, they seem to easy prey for politicians who are far more concerned about power than about what is good for America.

Low-information voters call for more regulations when regulations got us into these problems in the first place. Low-information voters are quick to agree that the other guy is to blame. Low information voter like the easy-way-out of Chamberlain and dislike the reality of Churchill. Low-information voters love the idea of government goodies because somebody else is going to pay for it.

Those loans that you mentioned were the key to get subprime borrowers approved. And of course, once those loans come into existence, they cannot be given just to one segment of the population. Those loans were enthusiastically endorsed by the government, and those who questioned the proliferation of them were called racists.

The average college debt is twice what you are saying; the average is climbing; the number of borrowers is expanding; and average is NOT a good measure here. The average mortgage borrower did not default. The average mortgage lender supposedly had good recourse to defaults. Student loan debt now exceeds $1.5 trillion, and that debt is owed to a government that is ambivalent about whether it really wants to collect the debt or use it as a political weapon.

Middle class values.