Words That Have Been Stripped of Any Meaning: "Spending Cuts" and "Austerity"

I have already written that the supposed European austerity (e.g. in the UK) is no such thing, and "austerity" in these cases is being used to describe what is merely a slowing in spending growth.

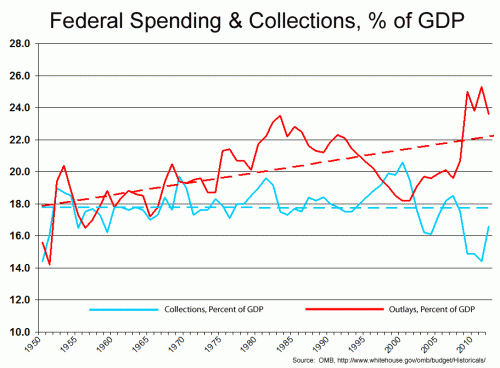

Apparently the same Newspeak is being applied to spending cuts in the US. How else can one match this data:

With these words from President Obama (my emphasis added)

"If we're going to raise revenues that are sufficient to balance with the very tough cuts that we've already made and the further reforms in entitlements that I’m prepared to make, then we’re going to have to see the rates on the top two percent go up"

Seriously? The only small reductions in the budget were because some supposedly one-time expenses (like TARP bailouts, war costs, and stimulus spending) were not repeated. Allowing one-time costs to be, uh, one-time does not constitute "tough cuts."

Tough cuts are when we knock government spending back down to 19-20 percent of GDP. Clinton level spending in exchange for Clinton tax rates. That's my proposed deal.

I laughed loudly watching him on the news last night.

}}} Tough cuts

Tough cuts are when we take the revenue we need out of Congress' hide.

I'm all for lots of tough cuts being made.

Does he not support the sequester? Isn't the GOP squealing like a stuck pig over proposed cuts to DOD?

I have to laugh a little every time someone is obsessing about the financial cliff (ie when the automatic tax increases and spending cuts will actually do us a world of good by actually reducing the deficit) and talks about it as a nightmare scenario to be avoided.

Exceptionally idiotic, even for our resident troglodyte, Larry.

Larry, there are no spending cuts.

None. Nil.

And while defense spending is certainly a contributor to the debt, the main driver is now entitlements, including Socialist Insecurity

- The $46.7B annual cash deficit is the third

in a row. The 2012 shortfall confirms it; SS will never see a cash flow surplus

again. Every dollar of the cash shortfall MUST be funded by selling

additional debt to the public.

I hope this is clear. I’ll repeat it. Social Security is adding to the debt held by the public. It is forcing the country to borrow more to fund

current operations. When Senate Democrats, like Dick Durbin and Harry Reid say,

“SS does not add a penny to our debt.” – they are lying.

http://www.zerohedge.com/contributed/2012-12-03/social-security-2012-results

mesa... do you intend on being ignorant?

there are more than 100 Trust FUnds like Social Security, INCLUDING the gasoline tax AND Military health care and pensions and THAT ALL WORK THE SAME WAY!

Social Security is an earmarked funded entitlement from FICA Taxes and BY LAW, it cannot

pay out more in benefits than it has revenues. It DOES have a trust fund balance that it accumulated from FICA taxes and is owed back but it's no different in that regard than Military pensions.

are you advocating the same treatment for military pensions as you might advocate for SS?

If SS just kept the FICA taxes and never loaned them to the govt - the govt would STILL have to borrow money to pay it's bills. The only thing that SS allows is for the govt to borrow less money from selling treasury notes - until they need to pay back SS - JUST LIKE THEY HAVE TO PAY BACK the military pension fund.

so what exactly is your point Meso?

Here - go educate yourself: http://www.gao.gov/assets/210/200562.pdf

get back after you do your homework.

Again, Larry, your head is so firmly impacted in your ass, it’s getting painful for the rest of us, not just you.

They SS “Trust Fund” (LOL) is nothing but intragovernmental IOUs- the money is already spent, but the obligations remain.

If you could do remedial math, you would then find that since not only is that money spent, we have a huge, super-colossal, gargantuan entitlements tab coming up (baby boomer retirement), so we’re about to be on the hook for much, much more.

As Krasting says,

“My guess is that the

Democrats will prevail on SS with regard to the current fiscal cliff debate. As

a result, there will be no changes to SS. Should that be the outcome, in about

five years the wheels will fall off the cart. By then, SS will be running cash

deficits of at least $200B a year. It will be much harder to “fix” than today. “

And thanks to Obama’s insanely stupid economic policies, this problem gets much worse much faster than originally predicted.

You, once again, are an ignorant fool of the first order.

Greece is your future – get used to it, fucking moron.

It will do nothing to reduce the deficit - you will see a (tiny) revenue spike, and then the economy will go straight into recession and revenues will drop off precipitously.

Mesa - what an idiot you are! do you understand that FICA is the funding source for SS and generates money year in and year out for as far as the eye can see?

the trust fund is only the surplus that built up over the years and if the trust fund went away tomorrow, FICA would still be generating revenues to pay benefits - albeit at a lower level but continuing on.

you fools make SS an issue during the budget when it has no material effect on the budget right now- and in fact, never will unless Congress intervenes to change it.

but that's not happening right now...

so all of this crap that you idiots go through is basically just partisan politics.. not anything of any real substance.

It's one thing to get it wrong, be ignorant and suck up the sound-bite propaganda... it's quite another to actually be that way on purpose so you can then pretend something that just is not true.

this is why you guys lost.. you live in LA LA Land...refuse to deal with realities and are totally incompetent when it comes to real issues.

Medicare is a real issue, but not social security. but I bet you don't know squat about the numbers...since you've spent all your time listening to propaganda about social security.

( http://www.forbes.com/2009/05/14/taxes-social-security-opinions-columnists-medicare.html )

A Payroll Tax Increase would pay for government's promises on Social Security and Medicare.

05/15/09 - Forbes by Bruce Bartlett [edited summary]

Bartlett does most of the Social Security tax math.

=== ===

The payroll tax rate would have to rise 1.9% [1.9 percentage points] immediately and permanently to pay all the benefits that have been promised over the next 75 years for Social Security and disability insurance.

But many people alive today who will be drawing Social Security benefits more than 75 years from now. A way of calculating the program's long-term cost is to do so in perpetuity, adjusted for the rate of interest, called discounting to present value.

Social Security's unfunded liability in perpetuity is $17.5 trillion (the trust fund is meaningless [See the article -AMG]). Social Security would need that much money today [real resources] in a real fund outside the government, earning a true return [3%] to pay for all the benefits that have been promised over and above future Social Security taxes. We don't have that fund. Alternatively, the payroll tax rate would have to rise by 4% [4 percentage points, from 15.3% to 19.3% of payroll].

=== ===

( http://www.taxpolicycenter.org/taxfacts/displayafact.cfm?Docid=46 )

The sum of the payroll taxes to be collected in Trust funds and Disability insurance payroll tax for 2012 is $658.7 billion. That is derived from 12.4% of qualified wages. An increase of 4 percentage points is an increase of 4/(12.4) = 32.3%.

That 4% increase would be $213 billion more in payroll taxes. That is only the part for Social Security. Medicare, Medicaid, and government retirement plans are also underfunded.

( http://www.politico.com/news/stories/0412/75603.html )

Social Security trustees: We’re going broke

04/25/12 - Politico by John C. Goodman

What the current value of the unfunded liability means:

=== ===

The latest report of the Social Security and Medicare trustees shows an unfunded liability for both programs of $63 trillion, about 4.5 times the U.S. gross domestic product GDP.

The unfunded liability is the amount we have promised in benefits, looking indefinitely into the future, minus the payroll taxes and premiums we expect to collect. It’s the amount we must have in the bank today, earning [3%] interest, for these entitlement programs to be solvent [fully funded].

=== ===

So, those programs would be paid for, if we collect the current Social Security and Medicare taxes, AND if we currently had a fund holding $63 trillion in cash (current resources) paying us 3% interest.

( online.wsj.com/article/SB10001424127887323353204578127374039087636.html )

$16 Trillion Only Hints at the True U.S. Debt

What part of that is due to Social Security:

=== ===

As of the most recent Trustees' report in April, the net present [negative] value of the unfunded liability of Medicare was $42.8 trillion. The comparable balance sheet liability for Social Security is $20.5 trillion.

=== ===

Larry, from Q1.9: "For example, the current and expected earmarked receipts from Social

Security are not structured to cover the expectations for future payments stemming from the program’s defined benefit structure."

The govt has run up a total debt of 16 trillion dollars. That's over $50,000 per citizen and over $140,000 per taxpayer.

Is that important? Should the govt continue to spend more than it collects?

EarlW - this is TRUE but it is ALSO TRUE that BY LAW Social Security cannot pay out more than FICA generates unless changes are made in the program.

Because of this - and it's dedicated funding source, it does not impact the deficit and debt in any material way and "cutting" it will do absolutely nothing to reduce the deficit.

Social Security needs to be reformed/restructured over the next few years but it's not the problem right now. What has happened is the folks who opposed to Social Security - as a CONCEPT have propagandized it and people, too lazy to actually verify the facts have assume the propaganda to be true.

All I would urge is that you find out the facts because assuming the claims are true.

We have a ton of people who do not seem to understand the difference between the "trust fund" and the FICA source of funding.

And IF/WHEN you DO fix Social Security - it will be one or more things like increasing payroll taxes or cutting benefits or changing retirement age or all 3 and other changes.

Social Security is not badly out of whack ...it's needs some changes to deal with the changing demographics but fundamentally as long as we collect payroll taxes, benefits will be paid and it has virtually no effect on the rest of the budget except when it redeems the securities in the trust fund - which is the very same issue for military retirements and health care, and gasoline taxes/roads, and more than a 100 other trust funds.

the govt set these up on purpose so than when receipts were received they go directly into the treasury and are spent for other bills due and when the time comes to pay benefits or build roads, the money is repaid. In a deficit scenario, the money to be repaid has to be borrowed by selling treasury notes - but those notes would have had to be sold anyhow - the only thing borrowing from the trust fund did was delay it.

but assume the trust fund is not going be honored - besides the meltdown it would cause on the public seeing the govt renege on it's debts - the only thing that would happen to ss is that benefits would have to be immediately reduced to not pay out more than FICA provided.

Imagine for a moment if the REST of the US budget worked that way and the spending was limited ONLY to what income taxes generated - about 1.5 trillion right now. What would happen to National Defense which spends about 1.5 trillion also - and other entitlements?

they'd all have to be cut - across the board - like the sequester works.

but again - you could kill SS tomorrow, and it would not change one iota the situation with the budget and deficit. The govt would still have to borrow money to pay it's bills just like it does right now.

It's a point worth raising. Really the word should just be dropped, though. It's hopelessly misleading. Even with your alternative target, we are talking about 20% of the GDP of the United States. That's not austere.

It's like calling it a crash diet if you go to McDonalds and only get a double bacon cheeseburger, a large fries, and a large CocaCola. Yeah, it's a ridiculous amount of food, but you *could* have gotten a chocolate milk shake.

You tell them Larry. They got all them FICA receipts locked up in a "lock box" just like Al Gore said. Not to worry. Besides when the government needs more money they just borrow it from the Federal Reserve. Right pocket, left pocket, what's the difference. It eventually comes out of our pocket.

That is correct. Short term revenue spike that will be quickly offset as the economy slows, joblessness increases with revenues following. And Norse, don't give us that Clinton tax rate didn't hurt bull. The Clinton economy was driven by technology innovation which was able to over-power the drag of higher taxes.

Look at the states that put in special tax the rich schemes, rates went up, revenue went down. Because the rich don't sit still and let their property be taken.

There is no "lock box" - never was - not for FICA/SS and not for the 100+ other trust funds including the military retirement trust funds.

but the whole "trust fund" narrative misses the most important point and that is FICA is what funds SS - day in, day out, not the trust fund.

FICA and SS are what is known as a "pay as you go" program and before we start into more "the govt is corrupt" talk - most types of insurance - like auto insurance is also pay-as-you-go.

you pay a premium and your money goes to pay for someone else's crash and/or vice-versa.

that's a pay-as-you-go insurance program and that is what FICA/SS are also.

In a auto insurance scenario - the premiums collected go into a fund and the insurance company then accesses that fund to pay claims and what is left is called the "surplus".

The company does not have a pile of dollar bills in a vault.. it has the fund invested in long and short term securities and it cashes in the securities when it needs money to pay claims.

this is how SS works with the Trust Fund. The FICA premiums are put into the trust fund account which is then "invested" in special-issue US securities - and when SS needs the money to pay benefits, it redeems the notes for cash and what is left in the "trust" fund is the "surplus".

http://frontal-lobe.info/econ/adkins.html

http://www.cbpp.org/cms/index.cfm?fa=view&id=3299

the problem we have is sound bite propaganda coming from people who KNOW that most people are simply too lazy to research the facts so they are prime targets of the propaganda mills whose goal is to undermine and kill social security because they disagree with it as a concept.

If the American people fully understand what SS is and is not and they do want to get rid of it,

then I support our country's Constitutional way of doing business but to have people oppose SS on false pretenses is a disservice to all of us.

Most folks when they do understand how SS works think it's worth keeping. It much more than a retirement fund - it is an inflation-indexed insurance annuity that also has death and disability coverage as well as survivor benefits. Many a kid and many a widow have benefited from the program when they lost their dad/spouse breadwinner.

Vacuous asshat.

Meh, I don't buy it. The US was running just fine for decades on much less revenue, and if we have to cut down on the enormously successful wars on drugs and terror, well, we might see as many planes flying into buildings as we did before 2011 or deal with drug issues like during the 70ies. We'd probably survive. Also, the office of congressional projection disagrees on the deficit (frankly, I don't much care, I just don't see the humongous terrible danger in spending cuts)

Jesus? Is that you?

This has to be parody.

The US was also running “just fine” on far, far fewer government regulations and attendant agencies.

You reap what you sow.

1.2% GDP growth.

Ah, bella spaghetti.

Nah, Larry has his own cold-fusion funding source.

PS, You may wish to refer to the “Office of congressional projection” as Congressional Budget Office, not that the moniker matters.

(Alternate suggestions: GIGO Agency, Ministry of Truth Justification Enforcement Division)

Heya, Lar, Europe has a really nifty social safety net, too.

http://www.zerohedge.com/sites/default/files/images/user3303/imageroot/2012/12/20121206_EUYouth.jpg

Couldn't agree more - but that's where I'd like us headed back to. And having a forcing function of less loot in the hands of our duly elected politicians can only help with that.

Also: http://www.nytimes.com/interactive/2012/11/30/us/tax-burden.html?ref=us

LOL, “forcing function of less loot” unicorn farts…

Dumbass.