Beware Applied Underwriters Workers Compensation Insurance

Update 2/1/2016: I will not comment further at the moment on Applied Underwriters as they are currently suing me to have this article below removed. So you will need to look elsewhere for news on AU, of which there appears to be plenty. For example, here and here. The State of California Insurance Commission, via an Administrative Law Judge's decision, has ruled on the legality of the AU product discussed below. That ruling (pdf) can be downloaded here. I would love to comment on it but I will have to leave the evaluation to you. If you can't read the whole thing pages 33 and 34 are worth your time, as well as the conclusions that begin on page 59.

After you read this, there are more updates on 4/18

Well, I have managed to get myself into a scam. It is not your normal scam, like the ones that are run by some mafia boiler room with guys working under aliases. This scam comes via a major insurance company called Applied Underwriters (working under the names California Insurance Company and Continental Indemnity Company) which is owned by Berkshire Hathaway and none other than Warren Buffett. If you feel sorry for Warren Buffett and want to give him a large interest-free loan for an indeterminate number of years, this is your program.

Update 4/16: Let me insert here that Applied Underwriters has sent me a letter threatening a libel suit if I do not take down this post and a parallel review at Yelp. AU Takedown demand here (pdf). The gist of the matter seems to be the word "scam". By the text of their letter, they seem to believe that "scam" is libelous because their company is well-rated financially and that they provide reasonable claims service. I concede both these facts. However, I called it a "scam" because there is a big undisclosed cost to their product that was never mentioned in the sales process, and that could only be recognized by its omission in the contract I signed -- that there is nothing in the contract committing them to any time-frame under which to return deposits and excess premiums I have paid, which may well amount to hundreds of thousands of dollars. This fact about the contract is confirmed by their customer service staff, who have said further that the typical time-frame to return such over-collections and deposits is 3-7 years after the contract ends, or at least 6-10 years after the first of the deposits was made.

So is this a "scam"? I believe that this issue is costly enough, and hard enough to detect, and far enough outside of expected business practices to be called such. You may have your own opinion, but ask yourself -- When you enter into, say, a lease and have to put down a security deposit, is it your reasonable expectation that the landlord has the right in your lease to keep your deposit for 3-7 years (or more) after you move out? /Update

Anyway, let's take a step back and look at this in detail.

First, I need to give a bit of background on how workers comp works. When you are a new company, they assign you an experience rating -- that is a multiplier of your premium based on past loss experience. There is some default starting number that if I remember right, in most states, is a bit over 1.0x. Each year, the workers comp world looks back at your past history and computes a new loss rating -- higher if you have had more payouts, lower if not. Generally it is based on three years experience not counting the last year (so 2-4 years in the past). Your future premiums get multiplied by this loss rating.

Several years ago we had a couple bad injuries that drove our loss number into the 1.7-1.9x area. Neither were really due to a bad safety issue, but both involved workers in their seventies where a minor initial injury led to all sorts of complications. Anyway, my agent at the time calls me one day a couple of weeks before renewal and says that none of the major companies will renew me. This seemed odd to me -- I understood that my recent claims history was not good, but isn't that what the premium multiplier was for? In fact, if my loss history returned to normal, they would make a fortune as I paid high rates based on old losses but had fewer new ones.

Apparently, though, insurance companies have fixed rules that keep them from underwriting higher loss ratings. Probably for the same reason Vegas won't take action on Ivy League football games any more -- just too much variability. I found out later with my new broker we could probably have overcome this, but I learned that too late.

My broker at the time put me into a 3-year program from Applied Underwriters, in part because they were taking everybody. This program was set up differently from most workers comp programs. You had a basic policy, but there was a second (almost indecipherable to laymen) reinsurance agreement that adjusted the rates of the basic policy based on you actual claims. Here is the agreement (pdf) In other words, based on your claims, they would figure up at the end how much you owed and what your premium multiplier would be.

I saw two red flags that I ignored in signing up. 1) The reinsurance agreement was impossible to understand, violating one of my foundational rules that I shouldn't sign things I don't understand. And 2) The rate structure was very suspicious. They touted a rate structure that could go as low as, say, $100,000 a year and was capped around $400,000 a year. But when you pulled out a calculator, the $100,000 was virtually unobtainable. It would require about zero claims. If there were any claims at all, even for a few bandaids, the price would march up to $400,000 really fast. It was the equivalent of a credit card teaser rate, and it should have made me suspicious.

Anyway, I was desperate. For a business like mine, being told I had no workers comp insurance just a few weeks before the old policy ran out was a death sentence. No one would write me or even quote me a policy that fast. So I took the Applied Underwriters offer. Shame on me, I should have worked on this much harder.

I won't bore you further with my voyage of discovery in trying to figure out how this thing works. I will just tell you the results that I have found. There are apparently other companies with similar issues, one of which is documented here: Applied Underwriter Suit (pdf)Newsletter publisher objected to scan of article, so I have taken it down at their request. Here is a link to roughly the same article.

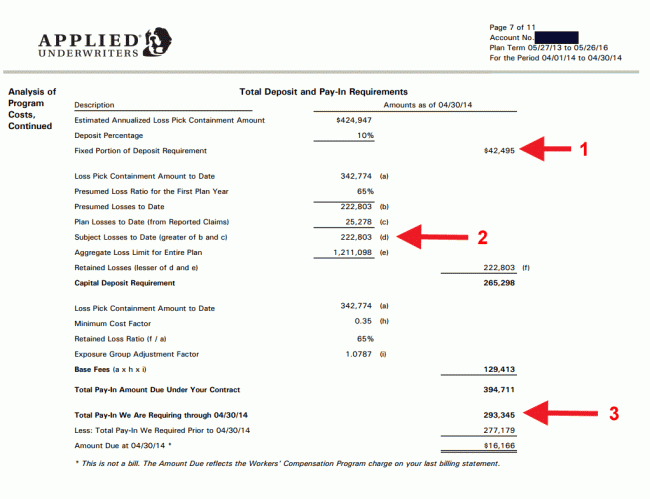

I spent hours and hours trying to figure out AU's statements. There is a whole set of terminology to learn that is actually not used in most of the rest of the workers comp world. The key page of the statement is page 7, which I will show below because it highlights several of the issues with Applied. Page 7 is the page where the monthly premium is "calculated". I have added the red numbers and arrows for the discussion below.

Here are some of the Applied Underwriter problems:

- Large deposits that must be made each year and may never be returned. You can see that I am making deposits over $40,000 a year. And that is each year. The first year deposit is not returned. The second year and third year are just added to it. And I have found out since I joined this program that they are not contractually obligated to return them in any time frame. Maybe some guy who was hurt in his thirties has a relapse and claims more money when he is 75. Gotta keep your deposit just in case, don't we? The timing of the return of your deposits (and overpaid premiums below) is entirely at their discretion, and that has been confirmed by their customer service staff. In fact, their standard answer is that on average, such monies are not returned to customers for 3-7 years after the contract ends, or at least 6-10 years after the first deposits were made.

- Premiums based on the worst of your experience and their estimate of your losses, and they keep the difference for years and years. For those in the same trap as me, I will try to explain the numbers above. The estimated loss pick containment at the top is basically their estimate of your losses. Note that it drives every number on the page and is basically their arbitrary number -- they could have set it anywhere. The loss pick containment to date is just pro rated for the amount of the year that has gone by. The 65% is an arbitrary number. The $25,278 is my actual losses to date. You can see where I point with #2 above, though, that my losses are irrelevant to my premiums. They take the higher of my losses and what is essentially their estimate of my losses and I pay based on that. Note that their higher number is not based on the reserved amounts on actual claims -- the $25,278 includes their reserves. It is just the number they established at the beginning of my policy they think my claims are going to be and gosh darnit they are going to stick to that (and my claims even in my worst year in history were never even half of their estimate). Yes, at the end of the policy if my losses stay low, they owe me money back for all the premium they overcharged me based on their arbitrarily high estimates. But see #1 above -- there is no time horizon under which they have to return the money. They can keep it for years and years.

- The final premium is, after all these calculations, entirely arbitrary. So after this loss calculation (which essentially just defaults to their arbitrarily high estimate and not my actual loss history) they do some premium calculations. These actually sort of make sense if you stare at the agreements for a really long time. But then we get to the line I point to in red labelled 3. It is the actual amount I owe. But it does not foot to any other number on the page. How do they come up with this? They won't say. To anyone. It might as well be arbitrary. I actually had some dead time and took all my reports and tried to regress to a formula they use for this, but I couldn't figure it out. So all the calculation on this page is just a sham, it's the mechanical wizard in the Wizard of Oz. It looks good, but does not actually directly lead to what you are billed.

So I thought I understood my problems. I put in large deposits and overpaid premiums based on arbitrarily high loss estimates they make -- all of which will take me years and years of effort to maybe get back. It turns out that I likely will have a third problem. In the lawsuit linked above, the plaintiff complains that when they left the program after three years, Applied arbitrarily wrote up all their estimated losses on open claims to stratospheric levels and then demanded a large final premium payment at the end. Folks on Yelp complain of the same thing. You should know how this works by now -- the plaintiff will theoretically get all this back someday, maybe, when the claims prove to be less costly, but in the mean time Warren Buffet gets to invest the money for years and years (cost of capital = 0) until it is returned.

This is why I think Applied Underwriters actually likes companies with high lost histories. Rather than costs, losses for them are excuses to over-collect on deposits and premiums -- money that can then be invested and held for years free of charge.

As an aside, I want to thank my new agents at Interwest Insurance for helping decipher all of this. They actually flew a guy in to help me understand this policy. They didn't get me into it, but they are helping me pick up the pieces as best we can.

Sounds a lot like medical malpractice insurance and "tail coverage". These requirements can make moving from one state to another virtually impossible for doctors in many specialties.

Illinois has an "assigned risk pool" for businesses that experience excessive losses and become uninsurable in the open marketplace. The state is otherwise a work comp nightmare. I own an excavation and concrete construction company and, over a 5 year period, was able to reduce my experience mod from 1.36 to 0.82 by doing the following:

-Strict enforcement of pre-employment and post-accident drug and alcohol testing.

-Requiring pre-employment physicals.

-Requiring very strenuous pre-employment work screen evaluations (I had a third-party physical therapist model our job-site duties and create and administer a strength and endurance testing regime that, quite frankly, you will not pass unless you're in extremely good shape). While some might view the work screen as age/gender discrimination, it has held up in court as a reasonable test for necessary job-site abilities.

A final alternative is to retain people only through an employment agency. Your wage rates are higher, but the work comp insurance headaches are theirs, not yours.

Good luck with your experience mod and work comp issues in general.

One final thought......the system you were trapped in actually incentivizes the insurer to keep claims open for as long as possible. This truly is a scam. Buffet shows over and over again that his books are his absolute top priority; his country and countrymen be damned.

Warren, have you looked into a PEO? They pool many small business' Workers Comp.

Applied Underwriters entices employers into their 3-year EquityComp program by showing low minimum rate premiums, but the reality is

that an employer will never actually pay those low rates, even if they are claim free. Any employer considering signing up for the program should read the reinsurance agreement CAREFULLY. You will be charged for a loss ratio of 60% in the first year, 40% in year two, and 30% in year three, even if you are loss free. If your actual loss ratio is over these percentages, you will be charged the higher rate. You may get some money back 3 years after the end of the program, but no one at Applied can say if they have ever actually returned money to an

insured. If you decide not to renew with them after the 3 years, they will double and triple the loss development factors on the open claims. This causes large premiums bills after the end of the contract, while you are responsible for premiums to your new carrier. BEWARE!!!

Their claims adjusters will not proactively communicate with employers about their claims. They do not discuss claims handling or settlement. If you are used to this kind of communication with your carrier, Applied will not provide this service. The adjusters are not

interested in your opinion about claim management or strategy. They'd prefer you to stay out of their business, even though their business is your business. They will settle claims without your consent, even it is suspected fraudulent claim. This is despite the fact that you will be charged for the total incurred dollars on the claim.

Your premium bills can vary largely from month to month. Applied will not give you a heads up if there has been a significant increase in reserves, which could mean a large premium for that month. They will not disclose the formula about how they reached the premium they are billing.

A positive note though, they do seem to close claims quicker and usually for less money, but that doesn't mean that you will save money.

Thanks for your magnificent article.Now this time insurance are very effective our life.This scam comes via a major insurance company called Applied Underwriter which is owned by Berkshire Hathaway and none other than Warren Buffett.This is so effective for our life.

auto insurance

Kudos to Coyote for journalism.

My company is currently awaiting arbitration with the exact problem you had with Applied Underwriters. They are definitely a "scam" and I'd love to know if Warren Buffet realizes he is contributing to the hardships to small businesses throughout the United States. Mr. Buffet is supposed to be a philanthropist and I wouldn't think he'd want to be a part of hindering the growth of small businesses everywhere - let alone being a part of such a shameful insurance "scam".

Our mod factor is currently at .68% and if my memory serves me correctly it was around .76% when we signed up for our three year contract with Applied. So as you can see, they not only go after small companies with high mod factors - they go after everyone!

They need to be stopped!!

I think this might be a good show for 60 Minutes!

I currently have been caught with the same Auw trap for 3 years. My contract just expired. Everything seemed fine, than boom got hit with 50k ach of my account. No notice, no letter, no call..... These guys are pretty much thieves/scammers.

What's happening with the matter of you calling Applied a "scam"? I hope you haven't written an apology to those bastards. Stick to your guns on this. We need to remain loyal to the fact that this is a simple case of right and wrong. AUI is wrong and must be stopped!

I'm calling for everyone who feels they've been "scammed" by Appllied Underwriters Insurance Company to come forward and end an email to 60 Minutes and briefly explain your story to 60 Minutes Production Staff. I think this is a perfect story for 60 Minutes and I feel very strongly that if the 60 MInutes Production Staff receives enough emails complaining about AUI, they might consider investigating AUI and even put the stories on their show. Just google 60 Minutes and you'll find the link to contact them.

after termination while on sick leave AU stopped sending disability checks. after winning case with edd still can"t get them to pay!

I think we should all get together and file a class action suit against AUI and Warren Buffet. He's a f__k__g crook, a scam artist and he clearly has absolutely zero ethics. AUI targets small companies and take full advantage of the fact they don't have a team of attorneys on staff. They should be put out of business and Warren Buffet should have his balls cut off - if indeed he has any!

I had a client in this some time ago and he ended up filing a lawsuit against them to get his money back. There are much better cash flow plans available nowadays.

spam

Tell me you shut down that corporate account and made it impossible for them to raid it for more of your money. Reading those yelp pieces was eye opening.

Who was your agent at this time? I read this morning on Workers' Comp Executive that brokers are now being sued for advising clients to sign up with AU. My condolences to you, we are in the same ship....

I ran a one man business for 40 years. Sometimes I think about, and regret not doing more to expand it. This makes me feel better about my decisions. I am truly sorry for this pure nightmare and aggravation you are going through. You make a dollar, and everybody gets in line wanting their share. No wonder small business is dying in this country.

60 minutes going after Warren Buffet? What century are you living in?

you should reach out to me. Find me on linkedin https://www.linkedin.com/in/williamely