A CoyoteBlog First -- Foodblogging!

OK, I am not a foodie. I enjoy good food, but have never really appreciated sophisticated food or food that takes hours of preparation. The steak on the grill is at least as appealing as the veal dish that took all afternoon to put together.

I know other bloggers often publish recipes. If I were to do so, it might look like this (from an, unfortunately, actual experience)

1 bowl of Cap'n Crunch

Substitute 1/2 cup cheap vodka for milk

Preparation notes: Never, ever do this again

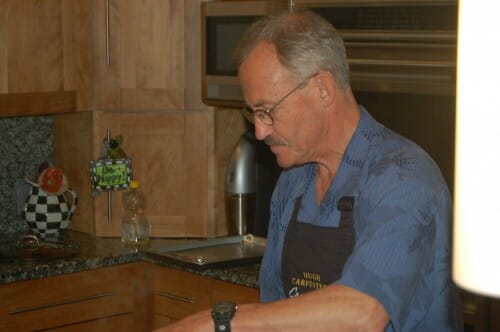

That being said, we had the opportunity to have a world famous chef and writer, Hugh Carpenter, over to our house last night. Hugh is a friend of my wife's from his summer cooking school and was kind enough to help us host a dinner party for some friends when he was in town in exchange for his room and board. The fun part was he agreed to whip up a dinner with whatever we had in the house, which was pretty amazing. Sort of an Iron Chef Arizona, with everything as the secret ingredient. I would still be agonizing over how many teaspoons are in a tablespoon in the first recipe item in the time he whipped up a couple of sauces and some appetizers.

Here is Hugh with my wife. Our guests are chipping in to help make the wontons (Hugh actually is a big believer in this, and often advocates getting the guests to chip in on the preparation like this - its fun, a great icebreaker, and reduces pre-party stress on the host.

The list of folks Hugh has cooked for is amazing. I find his cookbooks to be easy and down to earth and have good food in them. They are here, and he has a new book entirely dedicated to chicken wings which may actually get me in the kitchen.

What people like my wife who are really into cooking really rave about is his cooking school in the Napa Valley. There is a lot of cooking and wine drinking, of course, but the venues are great, often in the private homes of many of his friends and associates. Highly recommended if you are into that sort of thing.

Oh, and since I am foodblogging, I guess I should tell you about our meal. We had these pork wonton thingies in some sort of brown sauce. We had black cod in some kind of chutney stuff with some sort of mixed rice thingie and this other vegetable deal. We drank some sort of white wine except when we were drinking some sort of red wine.

Rachel Ray, watch out.

PS- OK, I was actually able to introduce Hugh to a new food product. He asked what I usually made the kids for breakfast, and I said "spray pancakes." He had never heard of this, and so I proudly showed him my spray can of pancake batter (from Whole Foods, no less). I couldn't tell if he was shocked or amazed.