Model Railroad Update #2

Yes, I know you are excited, because it is time to document progress on my model railroad. In the last episode I had build most of the benchwork and was starting to lay out the track. Since then I have made a fair amount of progress.

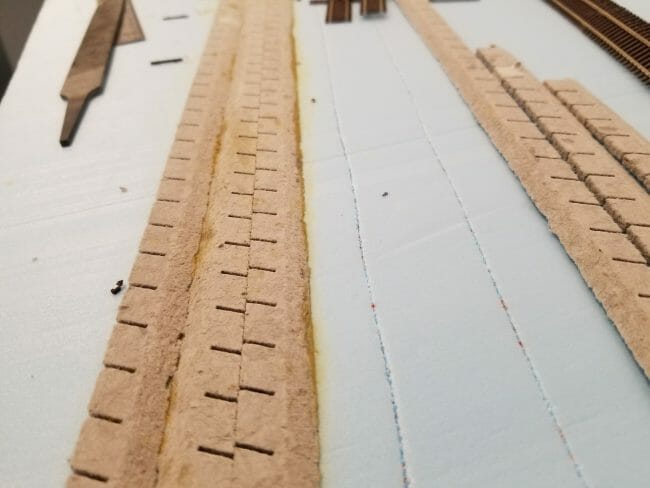

So as we were saying last time, I printed the track plan full size, and then traced the lines onto the foam below using a pounce wheel, a sewing tool that looks like a spur. You can see below that the traced lines were a bit wavy so I thin used an 8 foot long straight edge and a sharpie to draw the final centerlines for the track. Then, I started putting down the sub roadbed, which are pre-milled pieces of homosote.

I wanted to hand lay some track, but I also wanted to get started and have some basic track up and running, so I have decided to use use code 55 flex track for the main lines and to hand lay code 40 track for the spurs, branches, and yards. You can see below I am starting to lay the mainline flex track. As mentioned in the last episode, I started from the crossings in the distance and started working outward from them in all four directions.

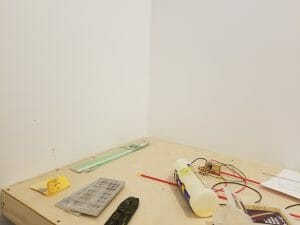

Below, more progress. You can also see wires poking through as I start the tedious process of wiring power to all the track. Also in the foreground you can see a code 40 turnout I built. I am using it to figure out how to do the transitions from code 55 to code 40 track.

At the same time I am starting to build the turnout controllers. I will be using the FastTracks bullfrog control, which is basically a manual control using flexible control rods.

At this point I realized I should have really mounted the backdrop before I started laying track so I paused and got the backdrop up. I have used masonite before but it is really heavy. This time I used 0.09" thick styrene sheet. There are lots of vendors on the Internet (people use the large sheets for signs) and I was able to order sheets cut to 24" x 8 feet. I then had to splice two together. I used a 6" wide piece of styrene and plastic weld (bought a big can from Amazon). It was sort of awkward, particularly to butt them exactly square.

Here it is starting to go up. I screwed thin hardwood shims into the joists, and then glued the styrene to the wood with E6000 (I tested liquid nails but the joint was not very strong). I put in screws to hold it at the very top and bottom. The bottom ones will be hidden by the scenery and the top by the upper valence.

It turned out that near the corners, the shim spacing was not close enough. I had to slip some extra shims in from above after it was installed to get the backdrop reasonably flat. In retrospect, this was a LOT easier than masonite, though masonite is stiffer and would not have needed as much support to be flat.

Why not just paint the walls, you might ask? Well the styrene sheet is a lot smoother even than drywall, but the payoff is really in the corner. Here is the corner with and without the sheet. Sky does not have corners.

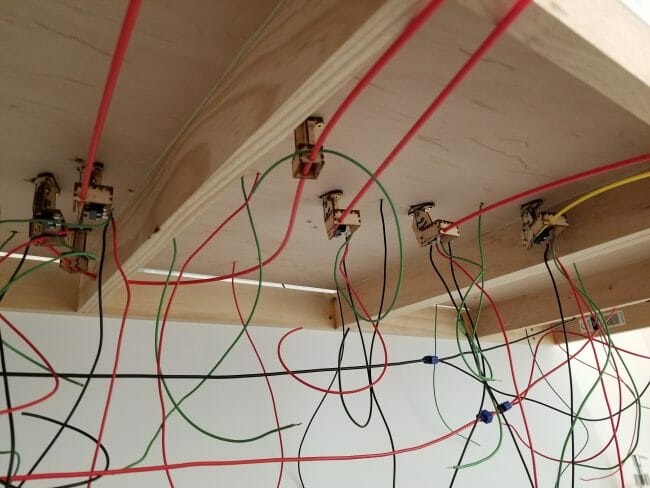

The next step was to start on the wiring. I find the wiring to be extremely tedious, but it is easier for this layout than on my past efforts because the benchwork is relatively high so I can sit in a chair and work on the wiring underneath.

Thank god for suitcase connectors, it makes wiring leads to the bus wire way easier. And here is the growing proliferation of switch machines.

And the payoff - the first train!