Undercharging for Medicare

For a while now I have argued that if people really are attached to Medicare as it is today, then premiums need to triple.

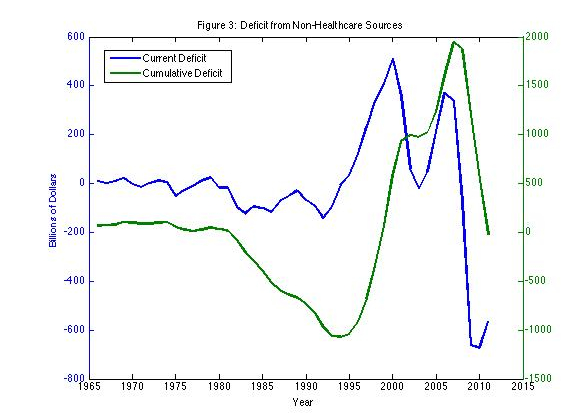

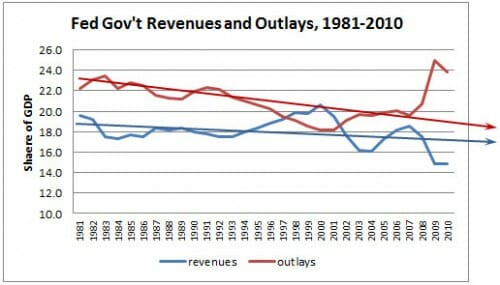

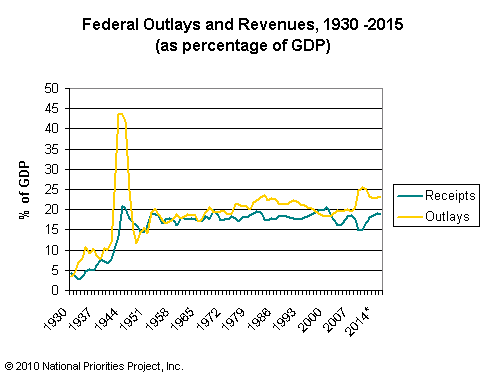

Along comes this analysis from Robert Dittmar via Hit and Run. He argues almost all the current federal deficit is created almost entirely by the difference between the cost of government medical services and the premiums it charges.

As a thought experiment, let’s suppose that medical expenditures had been self-financed since the inception of government health care in the 1960s. What would our debt and deficit look like today? To answer this question, I simply added the medical care expenditure deficit back into the total government deficit. The result is depicted in [the figure below[ and is astounding (at least to me). Outside of medical expenditures and revenues, the Federal government sometimes ran a surplus and sometimes ran a deficit from 1966 until 1980. Starting in 1980, and lasting until 1994, the government consistently ran a deficit outside of medical spending, but from 1995 until 2010, it consistently ran a surplus. In 1994, the cumulative excess spending would have reached a bit over $1 trillion. But by 1999, debt due to sources other than medical spending would have been completely eliminated by surpluses! The government wouldn’t have needed to borrow again until 2011.

Of course, this is not entirely a Medicare issue. Almost by definition, Medicaid and VA benefits are always going to be in deficit, since there are no premiums associated with these.

My normal response would be that the government not do this stuff. But that is clearly a political impossibility. We libertarians like to ignore realities like that, but it is true. As such, I think two things will both be necesary

- Substantial hikes in Medicare premiums

- Some sort of system-wide cost reduction

To his credit, I suppose, Obama recognizes the need for the latter. Unfortunately, he goes about it in exactly the wrong way. His approach is to federalize the entire health care system and impose the same type of government-set rates on the rest of the health care system that obtain in Medicare. But this does nothing to solve the government's cost problem. In fact, it is likely to do the opposite. To the extent that Medicare gets rates today that are subsidized by higher rates on non-Medicare customers, then forcing the entire health care system onto Medicare reimbursement rates will force an increase in Medicare rates, or a vast exit of health care capacity, or both.

If Medicare is going to continue to be a government program, we need to shift to a system that encourages price discovery and price shopping by medical consumers in the market end of the system. We should be encouraging high-deductible health insurance plans rather than effectively banning them.

Update: Here is the data

Update: Here is the data