Archive for the ‘Economics’ Category.

Inequality Metrics Exclude Effects of Government Actions to Reduce Inequality

I have seen this fact a number of times and am always amazed when I read it, since poverty figures are never, ever presented with this bit of context

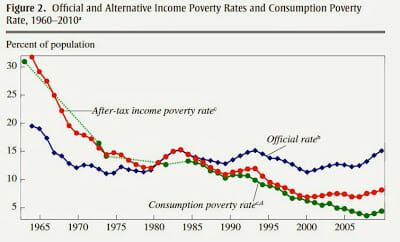

LBJ promised that the war on poverty would be an "investment" that would "return its cost manifold to the entire economy." But the country has invested $20.7 trillion in 2011 dollars over the past 50 years. What does America have to show for its investment? Apparently, almost nothing: The official poverty rate persists with little improvement.

That is in part because the government's poverty figures are misleading. Census defines a family as poor based on income level but doesn't count welfare benefits as a form of income. Thus, government means-tested spending can grow infinitely while the poverty rate remains stagnant.

Rector argues that poor today is very different than poor in Johnson's day, and that perhaps we might celebrate a bit

Not even government, though, can spend $9,000 per recipient a year and have no impact on living standards. And it shows: Current poverty has little resemblance to poverty 50 years ago. According to a variety of government sources, including census data and surveys by federal agencies, the typical American living below the poverty level in 2013 lives in a house or apartment that is in good repair, equipped with air conditioning and cable TV. His home is larger than the home of the average nonpoor French, German or English man. He has a car, multiple color TVs and a DVD player. More than half the poor have computers and a third have wide, flat-screen TVs. The overwhelming majority of poor Americans are not undernourished and did not suffer from hunger for even one day of the previous year.

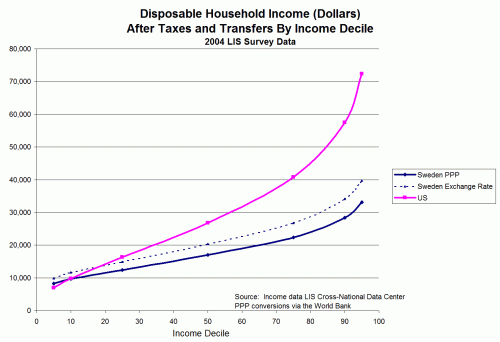

Remember what I presented a while back. This is what the Left thinks, or wants us to think, American income inequality looks like -- our rich are richer than comparable European welfare states because our poor are poorer.

And this is what income inequality in the US actually looks like -- our rich and middle class are richer, but our poor are not poorer. A less redistributionist approach floats all boats. I compared the US to many European welfare states, using the Left's own data source. Here is an example, but hit the link to see it all.

Laissez Faire and the Potato Famine

As explained by historian Stephen Davies, after defeating James II in 1690, protestants subjected Irish Catholics to harsh restrictions on land ownership and leasing. Most of Ireland’s people were thus forced to farm plots of land that were inefficiently small and on which they had no incentives to make long-term improvements. As a consequence, Irish agricultural productivity stagnated, and, in turn, the high-yield, highly nutritious, and labor-intensive potato became the dominant crop. In combination with interventions that obstructed Catholics from engaging in modern commercial activities – interventions that kept large numbers of Irish practicing subsistence agriculture well into the 19th century – this over-dependence on the potato spelled doom when in 1845 that crop became infected with the fungus Phytophthora infestans.

To make matters worse, Britain’s high-tariff “corn laws” discouraged the importation of grains that would have lessened the starvation. Indeed, one of Britain’s most famous moves toward laissez faire – the 1846 repeal of the corn laws – was partly a response to the famine in Ireland.

Had laissez faire in fact reigned in Ireland in the mid-19th century, the potato famine almost certainly would never had happened.

Arnold Kling Provides An Interesting Framework for Economic Growth

I thought this was a useful simple picture from Arnold Kling, vis a vis countries and their economies:

| Low Creation | High Creation | |

|---|---|---|

| Low Destruction | Corporatist Stagnation | Schumpeterian Boom |

| High Destruction | Minsky Recession | Rising Dynamism |

He suggests the US may currently be in the lower-left quadrant. Europe and Japan in the upper left. My sense is that China is in the upper right, not the lower right (too much of the economy is controlled by the politicians in power for any real destruction to occur).

Once a government gains powerful tools for economic intervention, it becomes politically almost impossible to allow destruction to occur, no matter how long-term beneficial it can be. The US is one of the few countries in the world that has ever allowed such destruction to occur over an extended period. The reason it is hard is that successful incumbents are able to wield political power to prevent upstart competition that might threaten their position and business model (see here for example).

It takes a lot of discipline to have government not intervene in favor of such incumbents. Since politicians lack this discipline, the only way to prevent such intervention is by castrating the government, by eliminating its power to intervene in the first place. Feckless politicians cannot wield power that does not exist (though don't tell Obama that because he seems to be wielding a lot of power to modify legislation that is not written into my copy of the Constitution.).

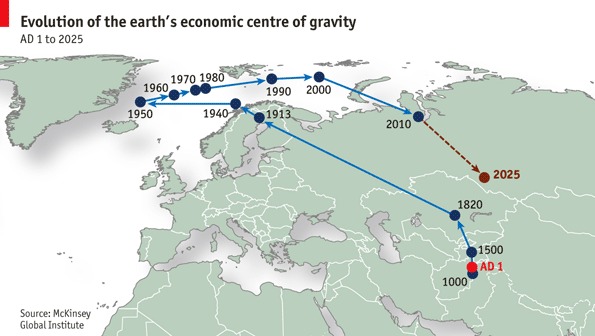

Wealth and China Through History

The media tends to talk about the growth of the Chinese economy as if it is something new and different. In fact, there probably have been only about 200 years in the history of civilization when China was not the largest economy on Earth. China still held this title into the early 18th century, and will get it back early in this century.

This map from the Economist (via Mark Perry) illustrates the point.

Of course there is a problem with this map. It is easy to do a center of gravity for a country, but for the whole Earth? The center in this case (unless one rightly puts it somewhere in the depths of the planet itself) depends on arbitrary decisions about where one puts the edges of the map. I presume this is from a map with North America on the far left side and Japan on the far right. If one redid the map, say, with North America in the center, Asia on the left and Europe on the right, the center of gravity would roam around North America through history.

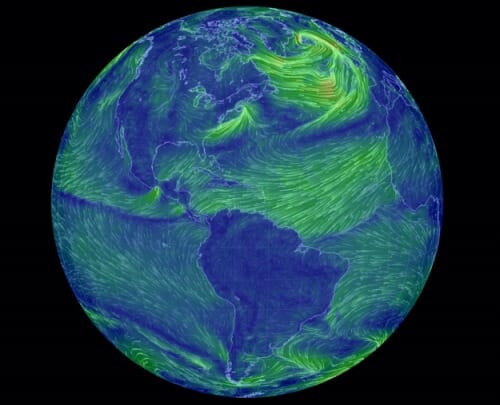

Triangle Trade and Physics

You have heard of the Atlantic triangle trade in school. It is always discussed in terms of its economic logic (e.g. English rum to African slaves to New World sugar). But the trade has a physical logic as well in the sailing ship era. Current wind patterns:

Real time version here. Via Flowing data.

Seriously, click on the real time link. Even if you are jaded, probably the coolest thing you will see today. One interesting thing to look at -- there is a low point in the spine of the mountains of Mexico west of Yucatan. Look at the wind pour through it like air out of a balloon.

Do We Care About Income Inequality, or Absolute Well-Being?

I have a new column up at Forbes.com, and it addresses an issue that has bothered me for a while, specifically:

Do we really care about income inequality, or do we care about absolute well-being of our citizens? Because as I will show today, these are not necessarily the same thing.

What has always frustrated me about income inequality arguments is that no one ever seems to compare the actual income numbers of the poor between countries. Sure, the US is more unequal, and I suppose from this we are supposed to infer that the poor in the US are worse off than in “more equal” countries, but is this so? Why do we almost never see a comparison across countries of absolute well-being?

I have never been able to find a good data source to do this analysis, though I must admit I probably did not look that hard. But then Kevin Drum (in a post titled “America is the stingiest rich country in the world”) and John Cassidy in the New Yorker pointed me to something called the LIS database, which has cross-country income and demographic data. I can't vouch for the data quality, but it has the income distribution data and it struck me as appropriate to respond to Drum and Cassidy with their own data.

In short, Cassidy made the point that the Gini coefficient (a statistical measure of income inequality) was higher in the US than for most other wealthy western countries. Drum made the further point that the US is "stingy" because we do the least to coercively alter this pattern through forced redistribution.

But all we ever see are Gini's are ratios. We never, ever see a direct comparison of income levels between countries. So I did that with the data. I won't reiterate the whole article here, but here is a sample of the analysis, in this case for Sweden which has one of the lowest Gini ratios of western nations and which Drum ranks as among the least "stingy". This is the model to which the Left wants us to aspire:

I argue that the purchasing power parity(ppp) numbers are the right way to look at this since we are comparing well-being, and on this basis Sweden may be more equal, but more than 90% of the people in the US are better off. Sweden does not have a lower Gini because their poor are better off (in fact, if you consider the bottom quartile, the poor are better off in the US).

We are going to see months of obsession by the Left and Obama over income inequality -- but which country would you rather live in, even if you were poor?

Read the whole thing, there are lots of other interesting charts.

Wal-Mart and GINI

I am working on some posts on income inequality, especially as compared between nations. One thing I have been thinking about is whether the US GINI (a measure of income inequality) is overstated because the US has a tiered retail system that gives lower income people access to lower prices (though for sometimes lower quality goods). We have Wal-Mart and Family Dollar, discount retail concepts that are rare, and often illegal (due to limitations on retail discounting) in European countries.

On a sort of purchasing power parity basis, I wonder if this has any impact in narrowing the US effective GINI. Of course, this mitigating factor is somewhat mitigated itself by the fact that a number of urban areas with some of the poorest families (e.g. Washington DC) restrict entry of these low-cost retail establishments.

Hidden Employment Impacts of the Minimum Wage

I have seen several stories of late suggesting that minimum wage phase-ins tend to mask the full employment effects of the wage change. That is because people tend to look at employment before and after the wage change itself, when in fact many companies may have already adjusted their employment long before the wage change goes into effect based on the original announcement.

This certainly rings true with me. We decided to close one operation in California after the state passed legislation to raise the state minimum wage (the minimum wage change was one of three factors leading to the closure, the other being the PPACA employer mandate which would be particularly expensive at this location and vexing litigation harassment in this one particular area). This means that for a minimum wage change that does not take effect until July 1, 2014, our decision to reduce staff came in the fall of 2013 and the jobs will go away on December 31, 2013, months before the minimum wage change actually takes effect.

I can certainly see how this would make designing a study to capture the employment effects of the minimum wage change very difficult. From a more cynical point of view, it also makes it far easier for minimum wage supporters to understate the employment effects.

This same phase-in effect can be seen with the Obamacare employer mandate. I criticized Brad Delong for arguing that we would not see any shifts to part time labor until the employment report after the actual start date of the employer mandate. But I know our company had been shifting people to part-time status in anticipation of the start date nearly a year earlier, as had most other retail businesses. While it may be normal for the government to put off working on something until on or after the due date (e.g. the Obamacare web site), private industry tends to start planning and implementation of responses to government regulations months or years in advance.

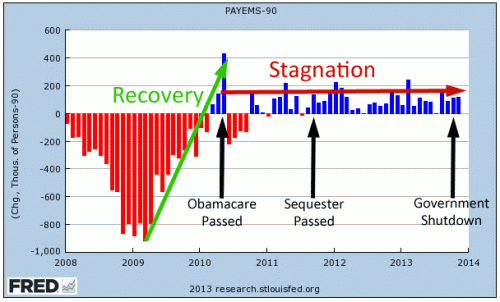

Connecting Government Actions to the Jobs Report

This is an update of a chart I have published a couple of times. The Obama Administration in the past couple of years has threatened at various times that a) the sequester and b) the government shutdown would have a devastating impact on employment. Here is the most recent job addition data (I would prefer just private job changes but this is public and private, via here).

I have helpfully annotated it with two government actions the Left claimed would negatively affect employment growth, and one item I claimed would do so. You be the judge:

The media published 6 zillion articles worrying or outright predicting in advance that the government shutdown would hurt the economy and destroy private employment. No such thing appears to have happened. But of course the media never, ever, ever goes back and retrospectively revisits predictions of doom gone wrong.

What I Hate Most About Political Discourse...

..is when people attribute differences of opinion on policy issues to the other side "not caring."

I could cite a million examples a day but the one I will grab today is from Daniel Drezner and Kevin Drum. They argue that people with establishment jobs just don't care about jobs for the little people. Specifically Drum writes:

Dan Drezner points out today that in the latest poll from the Council on Foreign Relations, the opinions of foreign policy elites have converged quite a bit with the opinions of the general public. But among the top five items in the poll, there's still one big difference that sticks out like a fire alarm: ordinary people care about American jobs and elites don't. Funny how that works, isn't it?

Here are the specific poll results he sites. Not that this is a foreign policy survey

The first thing to note is that respondents are being asked about top priorities, not what issues are important. So it is possible, even likely, the people surveyed thought that domestic employment issues were important but not a priority for our foreign policy efforts. Respondents would likely also have said that (say) protecting domestic free speech rights was not a foreign policy priority, but I bet they would still think that free speech was an important thing they care about. The best analogy I can think of is if someone criticized a Phoenix mayoral candidate for not making Supreme Court Justice selection one of her top priorities. Certainly the candidate might consider the identity of SCOTUS judges to be important, but she could reasonably argue that the Phoenix mayor doesn't have much leverage on that process and so it should not be a job-focus priority.

But the second thing to note is that there is an implied policy bias involved here. The Left tends to take as a bedrock principle that activist and restrictive trade policy is sometimes (even often) necessary to protect American jobs. On the other hand many folks, including me and perhaps a plurality of economists, believe that protectionist trade policy actually reduces total American employment and wealth, benefiting a few politically connected and visible industries at the expense of consumers and consumer industries (Bastiat's "unseen"). Because of the word "protecting", which pretty clearly seems to imply protectionist trade policy, many folks answering this survey who might consider employment and economic growth to be valid foreign policy priorities might still have ranked this one low because they don't agree with the protectionist / restrictionist trade theory. Had the question said instead, say, "Improving American Economic Well-Being" my guess would be the survey results would have been higher.

Whichever the case, there is absolutely no basis for using this study to try to create yet another ad hominem attack out there in the political space. People who disagree with you generally do not have evil motives, they likely have different assumptions about the nature of the problem and relevant policy solutions. Treating them as bad-intentioned is the #1 tendency that drags down political discourse today.

Postscript: This is not an isolated problem of the Left, I just happened to see this one when I was thinking about the issue. There likely is a Conservative site out there taking the drug policy number at the bottom and blogging something like "Obama state department doesn't care about kids dying of drug overdoses." This of course would share all the same problems as Drum's statement, attributing the survey results to bad motives rather than a sincere policy difference (e.g. those of us who understand that drugs can be destructive but see the war on drugs and drug trafficking to be even more destructive).

@kdrum Missing the Point. Doctors May Control the Cartel, but Government Gives it Power.

The other day, Kevin Drum wrote a post wondering why we had so few doctors per capital in the United States and observing, reasonably, that this might be one reason to explain why physician compensation rates were higher here than in other countries.

He and Matt Yglesisus argued that this smaller number of doctors and higher compensation rates were due to a physician-operated cartel. This is a proposition I and most libertarians would agree with. In fact I, and many others apparently, wrote to him saying yes there is a cartel, but ironically it owed its existence to government interventionism in the economy and health care. In a true free market, such a cartel would only have value so long as it added value to consumers.

Drum seems to have missed the point. In this post, he reacts to themany commenters who said that government power was at the heart of the cartel by saying no, it's not the government because doctors control the nuts and bolts decisions of the cartel. Look! Doctors are in all the key positions in the key organizations that control the cartel!

Well, no sh*t. Of course they are. Just as lawyers occupy all the key slots in the ABA. But neither the ABA nor these doctors cartels would have nearly the power that they have if it were not for government laws that give them that power (e.g. giving the ABA and AMA monopoly power over licensing and school credentialing). I had never heard of the RUC before, which apparently controls internship slots, but its ability to exercise this control seems pretty tied to the billions in government money of which it controls the distribution.

Let's get out of medicine for a second. I am sure Best Buy wishes it had some mechanism to control new entrants into its business. Theoretically (and it may have even done this) it could form the Association of Bricks and Mortar Electronics Retailers (ABMER). It could even stake a position that it did not think consumers should shop at upstarts who are not ABMER members. Take that Amazon! Of course, without any particular value proposition to do so, consumers are likely to ignore the ABMER and go buy at Amazon.com anyway.

Such cartel schemes are tried all the time, and generally fail (the one exception I wonder about is the Visa/Mastercard consortium, but that is for another post). Anyway, the only way the ABMER would really work is if some sort of government licensing law were passed that required anyone selling consumer electronics to be ABMER members. And my guess is that the ABMER might not invite Amazon.com to join. All of a sudden, Amazon is out of the electronics business. Or maybe it just gets forced to deliver all its product through Best Buy stores, for a fee of course.

Crazy stupid, huh? The government would never write licensing laws to protect a small group of incumbent retailers, right? Well, tell that to Elon Musk. Tesla has been trying for years to bring its cars to consumers in innovative ways, but have time and again run up against state auto dealership laws that effectively force all cars to be sold through the state dealer cartel. Or you can talk to California wine growers, who have tried for years to sell directly to consumers in other states but get forced into selling through the state liquor wholesaler cartels.

All these cartels are controlled and manned by the industry, but they are enforced -- they are given their teeth -- by the government.

Here are a few off-the-top-of-my-head examples of cartel actions in the medical field admittedly initiated and supported and administered by doctors, that are enforced by state and federal law:

- Certificate of need laws prevent hospitals from expanding or adding new equipment without government permission. The boards in this process are usually stacked with the most powerful local hospitals, who use the law to prevent competition and keep prices high. This is a great example where Drum could say that the decisions are essentially being made by hospitals. Yes they are, but they only have the power to do so because the government that grants them this licensing power over competitive capacity. Without this government backing, new hospitals would just laugh at them.

- Government licensing laws let the AMA effectively write the criteria for licencing doctors, which are kept really stringent to keep the supply low. Even if I wanted to only put in stitches all day to busted up kids, I would still have to go through 8 years of medical school and residency. Drum and Yglesias focus on the the number of medical schools and residencies. I do not know if these are an issue or not. But what clearly is an issue is the fact that one has to endure 8 expensive years or more just to be able to hand out birth control or stitch up a skinned knee.

- Government licensing laws help doctors fight a constant rearguard action against nurse practitioners and other less expensively trained folks who could easily do half or more of what doctors do today.

- The FDA and prescription drug law not only helps pharma companies keep profits up, but also increases business to doctors as people have to have a prescription for certain drugs they could easily buy on their own (e.g birth control pills, antibiotics).

- The government limits immigration and thus labor mobility, reducing the ability of doctors from other countries to move here.

I am sure there are more.

There is no denying that in the middle of every industry cartel are insiders who are maneuvering to increase the rents of the incumbent players. In fact, I am sure that every industry has participants who dream about getting off the competitive treadmill and creating a nice industry cartel, and would be the first to sign up. But none of these dreams are ever going to happen unless they are enabled by the coercive power of government.

Of course, the consistent answer is, well, we just have the wrong guys running things. If we had the right guys, it would work great. But this kind of co-option always happens. Look at taxis and liquor license holders and the entire banking sector. Five years ago I would bet that progressives thought they finally had that right guy in the administration. And look what has happened. Banking cronyism is as strong as ever. Obama's signature health legislation is full of crony giveaways. In 6 months the health insurers are going to be running the entire PPACA infrastructure to their own benefit.

update: This post is verging on the "is cronyism capitalism's fault" argument. Rather than go into that again, it is here.

Arkansas orthodontist Ben Burris was hauled in front of the state dental board in September after dentists in northeast Arkansas complained that he was offering dental cleanings to the general public in his Braces by Burris orthodontics clinics. The price for dental cleanings was $98 for an adult and $68 for a child, which Burris has said is about half of what dentists in northeast Arkansas typically charge.

Burris said most of the patients who need cleanings don’t have a dentist, but are checked by one of the three orthodontists in his clinic. Also, Burris said he offered the service because it was good for his business and good for the public. Some of his competitors “have gone absolutely ballistic†over the price and complained to the board, Burris said.

MP: Of course, the Arkansas dental cartel has no basis to complain directly about the low prices for dental cleaning at Braces by Burris clinics, so they are instead complaining that the clinic’s low-cost teeth cleaning services violate the states Dental Practice Act, which prohibits orthodontists and other specialists from practicing “outside their specialty.â€

Yep, the Current Economic Stagnation Must Have Been Due to the Sequester and "Austerity"

Monthly job additions, taken from Kevin Drum's site, who blames this on.... austerity and the sequester. Yes, I can't prove that the PPACA helped drive the stagnation, but the Left can't prove the austerity link either, and at least I have correlation on my side.

Trading $1 in Debt for 85 cents of Economic Activity

UPDATE: Mea culpa. One point in the original post was dead wrong. It is possible, contrary to what I wrote below, to get something like a 0.7% difference in annual growth rates with the assumptions he has in the chart below (Drum still exaggerated when he called it 1%). I don't know if the model is valid (I have little faith in any macro models) but I was wrong on this claim. Using the 0.7% and working more carefully by quarter we get a cumulative GDP addition a bit lower than the cumulative debt addition. There is still obviously a reasonable question even at a multiplier near 1 whether $1 of economic activity today is worth $1 of debt repayment plus interest in the future.

I am not a believer, obviously, in cyclical tweaking of the economy by the Feds. To my thinking, the last recession was caused by a massive government-driven mis-allocation of capital so further heavy-handed government allocation of capital seems like a poor solution. But what really drives me crazy is that most folks on the Left will seductively argue that now is not the time to reduce debt levels, implying sometime in the future when the economy is better will be the appropriate time. But when, in any expansion, have you heard anyone on the Left say, "hey, its time to reduce spending and cut debt because we need the fiscal flexibility next time the economy goes wrong."

I will leave the stuff in error below in the post because I don't think it is right to disappear mistakes. For transparency, my spreadsheet reconstruction both confirming the 0.7% and with the updated numbers below is here: reconstruction.xls.

Kevin Drum is flogging the austerity horse again

I see that Macroecomic Advisors has produced a comprehensive estimate of the total effect of bad fiscal policies. Their conclusion: austerity policies since the start of 2011 have cut GDP growth by about 1 percentage point per year.

Something seemed odd to me -- when I opened up the linked study, it said the "lost" government discretionary spending is about 2% of GDP. Is Drum really arguing that we should be spending 2% of GDP to increase GDP by 1%?

Of course, the math does not work quite this way given compounding and such, but it did cause me to check things out. The first thing I learned is that Drum partook of some creative rounding. The study actually said reductions in discretionary spending as a percent of GDP reduced GDP growth rates since the beginning of 2011 by 0.7% a year, not 1% (the study does mention a 1% number but this includes other effects as well).

But it is weirder than that, because here is the chart in the study that is supposed to support the 0.7% number:

Note that in the quarterly data, only 2 quarters appear to show a 0.7% difference and all the others are less. I understand that compounding can do weird things, but how can the string of numbers represented by the green bars net to 0.7%? What it looks like they did is just read off the last bar, which would be appropriate if they were doing some sort of cumulative model, but that is not how the chart is built. If we interpolate actual values and are relatively careful about getting the compounding right, the difference is actually about 0.45%. So now we are down to less than half the number Drum quoted see update above (I sent an email to the study author for clarification but have not heard back. Update: he was nice enough to send me a quick email).

So let's accept this 0.45% 0.7% number for a moment. If GDP started somewhere around 16 trillion in 2010, if we apply a 0.45% the quarterly growth numbers from his chart, we get an incremental economic activity from 2011 through 2013:Q2 of about $333 billion.

So now look at the spending side. The source says that discretionary spending fell by about 2% of GDP over this period. From the graph above, it seems to bite pretty early, but we will assume it fell 1/12 of this 2% figure each quarter, so that by the end of 2013 or beginning of 2014 we get a fall in spending by 2% of GDP. Cumulatively, this would be a reduction in spending over the 2.5 years vs. some "non-austere" benchmark of $388 billion.

Thus, in exchange for running up $677 billion $388 billion in additional debt, we would have had $445 billion $333 billion in incremental economic activity. A couple of reactions:

- Having the government borrow money and spend it definitely increases near-term GDP. No one disputes that. It is not even in question. Those of us who favor reigning in government spending acknowledge this. The question is, at what cost in terms of future obligations. In fact, this very study Drum is quoting says

Economists agree that failure to shrink prospective deficits and debt will bestow significant economic consequences and risks on future generations. Federal deficits drive up interest rates, “crowding out” private investment. If government borrowing supports consumption (e.g., through Social Security and major health programs) rather than public investment, the nation’s overall capital stock declines, undermining our standard of living. The process is slow but the eventual impact is large.2 In addition, accumulating debt raises the risk of a fiscal crisis. No one can say when this might occur but, unlike crowding out, a debt crisis could develop unexpectedly once debt reached high levels.

High deficits and debt also undermine the efficacy of macroeconomic policies and reduce policymakers’ flexibility to respond to unexpected events. For example, in a recession, it would be harder to provide fiscal stimulus if deficits and debt already were high. Furthermore, fiscal stimulus might be less effective then. Additional deficit spending could be seen as pushing the nation closer to crisis, thereby forcing up interest rates and undercutting the effects of the stimulus. With fiscal policy hamstrung, the burden of counter-cyclical policy is thrust on the Federal Open Market Committee (FOMC) but, particularly in a low interest-rate environment, the FOMC may be unable (or unwilling) to provide additional monetary

stimulus.

- I guess we have pretty much given up on the >1 multiplier, huh? Beggaring our children for incremental economic growth today is a risky enough strategy, but particularly so with the implied

.66.85 multiplier here.

Understanding "Mix": Is Flattening in Income Growth Due in Part to Geographic Cost of Living Differences and Migration Within the US?

For 20 years, before I liberated myself from corporate America, I spent a hell of a lot of time doing business and market analysis (e.g. why are profits declining in Division X). I was pretty good at it. If I had to boil down everything I learned in those years to one lesson, it would be this: Pay attention to changes in the mix.

What do I mean by "changes in the mix"? Here is an example. A company has two products. One has a 20% margin, and the other has a 30% margin, and both margins have been improving over time because of a series of cost reduction investments. But overall, company margins are falling. The likely reason: the mix is shifting. The company is selling a higher proportion of the lower margin product.

Here is a real world example: When I was at AlliedSignal (now Honeywell) aviation, they had exactly this problem. They were operating in a razor and blades business -- ie they practically gave the new parts away to Boeing and Airbus to put on their planes, because they made all their money selling aftermarket replacements at a premium (at the time, government rules made it almost impossible to buy anything but the original manufacturer's part, so they could charge almost anything for a replacement, especially given that an airline likely had a $50 million plane sitting dormant until the part was replaced). I routinely would tell managers in the company that essentially our business made money from unreliability -- the less reliable our parts, the more money we made. Because newer technology, competition, and pressure form airlines was forcing us to greatly improve our reliability (at the same time we were giving stuff to Boeing at ever greater losses), all our newer products on newer planes were less profitable than the old stuff. As planes aged and dropped out of the fleet, our product mix was getting less and less profitable.

This same effect can be seen in many economic and political issues. Take for example an argument my mother-in-law and I had years and years ago. She said that Texas (where I was living at the time) had crap schools that were much worse that those in Massachusetts, her argument for the blue political model. She observed that average educational outcomes were much better in MA than TX (which was and still is true). I observed on the other hand that this was in part a result of mix. Texas had better outcomes than MA when one looked at Hispanics alone, and better outcomes for non-Hispanics alone, but got killed on the mix given that Hispanics typically have lower educational outcomes than non-Hispanics everywhere in the US, and Texas had far more Hispanics than MA.

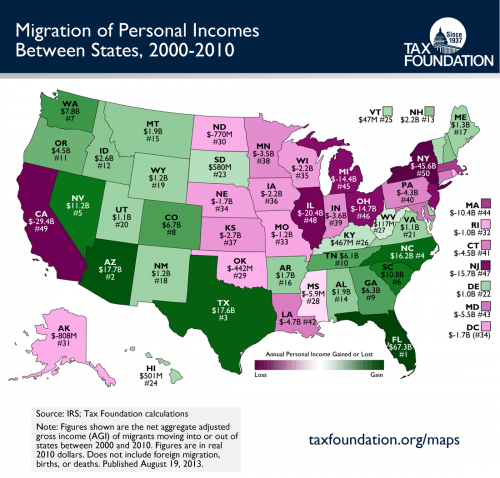

All of this is a long introduction to some thinking I have been doing on all the "Average is Over" discussion talking about the flattening of growth in median wages. I begin with this chart:

There is a lot of interstate migration going on. And much of it seems to be out of what I think of as higher cost states like CA, IL, and NY and into lower cost states like AZ, TX, FL, and NC. One of the facts of life about the CPI and other inflation adjustments of income numbers is that the US essentially maintains one average CPI. Further, median income numbers and poverty numbers tend to assume one single average cost of living number. But everyone understands that the income required to maintain lifestyle X on the east side of Manhattan is very different than the income required to maintain lifestyle X in Dallas or Knoxville or Jackson, MS.

Could it be that even with a flat average median wage, that demographic shifts to lower cost-of-living states actually result in individuals being better off and living better?

For some items one buys, of course, there is no improvement by moving. For example, my guess is that an iPhone with a monthly service plan costs about the same anywhere you go in the US. But if you take something like housing, the differences can be enormous.

Let's compare San Francisco and Houston. At first glance, San Francisco seems far wealthier. The median income in San Francisco is $78,840 while the median income in Houston in $55,910. Moving from a median wage job in San Francisco to a media wage job in Houston seems to represent a huge step down. If you and a bunch of your friends made this move, the US median income number would drop. It would look like people were worse off.

But something else happens when you take this nominal pay cut to move to Houston. You also can suddenly afford a much nicer, larger house, even at the lower nominal pay. In San Francisco, your admittedly higher nominal pay would only afford you the ability to buy only 14% of the homes on the market. And the median home, which you could not afford, has only about 1000 square feet of space. In Houston, on the other hand, your lower nominal pay would allow you to buy 56% of the homes. And that median home, which you can now afford, will have on average 1858 square feet of space.

So while the national median income numbers dropped when you moved to Houston, you actually can afford a much nicer home with perhaps twice as much space. Thus, it strikes me that there are important things happening in the mix that are not being taken into account when we say that the "average is over".

Of course, while this effect is certainly real, I have no idea how much it affects the overall numbers, ie is it a small effect or a large effect. Fortunately my son is studying economics in college. If he ever goes to grad school, I will add this to my list of research suggestions for him.

Postscript: This exact same discussion could apply to US poverty statistics. We have one poverty line income number whether you live in Manhattan or Tuscaloosa. I have always wondered how much poverty statistics would change if you created some kind of purchasing power parity test rather than a fixed income test.

The True Poverty Rate

I thought this was interesting. I guess I never realized that poverty rate excludes anti-poverty programs, nor that frequent comparisons made by the Left that our poverty rates compare unfavorably to those in Europe are essentially completely disingenuous as they are comparing apples and oranges.

the only way anyone’s ever really found to reduce the number living in poverty is to give the poor money n’stuff so that they’re no longer living in poverty. But if we don’t count the money n’stuff that is being given to the poor then we’re not going to be able to show that giving the poor money n’stuff alleviates poverty, are we?

And that’s the point at the heart of this necessary correction to the US poverty numbers. The 15% number is not the number living in poverty. It is the number who would be living in poverty if it weren’t for all the money n’stuff we give to the poor. For when we calculate the poverty number we ignore almost all of what is done to alleviate poverty. We leave out all four of the largest anti-poverty programs in fact. We don’t count the money spent on Medicaid, we don’t count the EITC, we ignore the costs of SNAP and we completely overlook Section 8 housing vouchers. That’s hundreds of billions of dollars worth of spending on poverty alleviation right there and all of it is entirely ignored when calculating the poverty numbers. What’s worse, we could double the amount of money we spend to alleviate poverty and the number under the poverty line wouldn’t change by one single digit.

These alternative measures are explained in WAY more depth here (pdf) by Bruce Meyer and James Sullivan

The Ignorance of Pundits

What are they thinking?

I mean, some employers are going to drop hours below 30 a week once the employer pay-or-play hits. But we won't see that until the February 2015 employment report, and there is no reason for employers to start that eighteen months in advance. It isn't there in the data. And nothing would lead anybody to expect that it would be visible in the data right now.

So why are they claiming that it is?

I am amazed at how even prominent pundits don't bother to educate themselves on even the most basic aspects of the policy issues they discuss.

Let's go back before the 1-year delay in the employer mandate, which was scheduled to take effect on Jan 1, 2014. In the implementation rules, employees would be classified as part-time or full-time on Jan 1, 2014 based on a 3-12 month look back at actual hours worked in 2013. That means that for many companies, such as ours, to have employees classified as part-time on day 1 of Obamacare, we had to have them working part time in January of 2013. By the time the Obamacare employee mandate was delayed, we had already made changes in our operations, so we are not going back and will just maintain them until 2015.

So for our company, and likely for many others, the change to part-time showed up in the first quarter of 2013.

So why is DeLong claiming otherwise?

OK, This Is The Most Absurd Defense I Have Seen of Obama, At Least This Week

Dave Weigel notes a conundrum today: according to a new poll, 54 percent of the public disapproves of Barack Obama's handling of the deficit. And yet, as the chart on the right shows, the deficit is shrinking dramatically. Last year it dropped by $200 billion, and this year, thanks to a recovering economy, lower spending from the sequester, and the increased taxes in the fiscal cliff deal, it's projected to fall another $450 billion.

Weigel notes that this has deprived conservative yakkers of one of their favorite applause lines: "You don't hear Republicans lulz-ing at Obama for failing to 'cut the deficit in half in my first four years,' because he basically did this, albeit in four and a half." That's true. It's also true that contrary to Republican orthodoxy, it turns out that raising taxes on the rich does bring in higher revenues and therefore reduces the deficit.

The logic here is that Obama has been diligent about cutting the deficit, so therefore Republicans are wrong to try to use the debt ceiling and continuing resolution as a vehicle for forcing more cuts.

It is just possible that a person from another planet landing today might buy this story, but how can anyone who has lived through the last 5 years read this without laughing their butts off? Every one of Obama's budgets have been dead on arrival, even within his own party, because they have raised spending to such stupid levels. There has not been even a hint of fiscal responsibility in them. And the Democratic Senate has passed one budget in something like five years**.

The only fiscal discipline at all has come from the Republican House, and they have only had success in keeping these deficit down by ... using continuing resolutions and debt ceilings as bargaining chips. This is the President that treated the almost insignificant sequester as if it were the end of the world, and now these sycophants from team Donkey are giving Obama the credit for the deficit reduction?

PS- This is not an advocacy for Republicans as much as for divided government. The Republicans when they had years of controlling the Presidency and both houses of Congress under Bush II did zero to get our fiscal house in order and in fact with the Iraq war and Medicare part D, among other things, showed a profligacy that belies their current pious words.

PPS- Kevin Drum needs to have the balls not to play both sides of the street. He has made it clear in other articles that he thinks it is an economic disaster that the government is spending so little right now. When he shows a deficit reduction chart, if he were consistent, he should be saying that Republicans suck for forcing this kind of deficit reduction against Obama's better judgement and we need the deficit to go back up. Have the courage of your convictions. Instead, he plays team loyalty rather than intellectual consistency, crediting Obama for deficit reduction while at the same time hammering Republicans for austerity. Dude, its one or the other.

PPPS- For the first time during this Presidency, both the President and both house of Congress offered a budget:

[The] House passed a budget calling for spending $3.5 trillion in 2014, the Senate passed one calling for $3.7 trillion, and Obama submitted one calling for $3.77 trillion

So the actor that submitted the highest budget gets the credit for deficit reduction?

Eeek! Austerity! Oh, Never Mind.

Yesterday I challenged a graph by Kevin Drum in Mother Jones as being a disingenuous attempt to paint US government spending as some sort of crazed austerity program which is making the recovery worse. He uses this graph to "prove" that our fiscal response to this recession is weak vis a vis past recessions. The graph is a bit counter-intuitive -- note that it begins at the end of each recession. His point is that Keynesian spending needs to continue long after (five years ?!) after the recession is over to guarantee a good recovery, and that we have not done that.

For anyone not steeped in the special reality of the reality-based community, it is a bit counter intuitive for those of us who have actually lived through the last 5 years to call government spending austere.

The key is in the dates he selects. He leaves out the actual recession years. So by his chart, responses that are late and occur after the recession look better than responses that are fast and large but happen during the recession. This seems odd, but it is the conclusion one has to draw.

I took roughly the same data and started each line two years earlier, so that my first year is two years ahead of his graph and the zero year in my graph is the same as the zero point in Drum's chart. His data is better in the sense that he has quarterly data and I only have annual. Mine is better in that it looks at changes in spending as a percentage of GDP, which I would guess would be the more relevant Keynesian metric (it also helps us correct for the chicken and egg problem of increased government spending being due to, rather than causing, economic expansion).

Here are the results (I tried to use roughly the same colors for the same data series, but who in the world with the choice of the entire color pallet uses two almost identical blues?)

You can see that Drum makes spending look lower in the current recession by carefully dating the data series to the peak of the spending, rather than comparing it to pre-recession levels. The right hand scale is the difference in government spending as a percentage of GDP from the -2 year. So, for example, in the current recession government spending was 34.2% in 2007 and 41.4% in 2009 for a reading of 7.2% in year 0.

Even with the flat spending over the last three or four years in the current recession (flat nominal spending leads do a declining percent of GDP) the spending increase from pre-recession levels is still about twice as high as in other recent recessions.

Does this look like austerity to anyone?

Trying to Overcome My Ignorance on the Banking System

Over the last year, I have learned that those of us who took economics back in the 1980's with textbooks written in the 1960's and 1970's are not very well prepared to understand the modern banking system. This was a pretty good article that whetted my appetite for understanding what has changed. A couple of interesting bits from the piece:

One cannot think straight about the future impact of different exit strategies without understanding of the role of bank reserves in today’s financial markets.

- Banking and money creation has not worked for at least two decades in the way that most people learned in school.

The old system was rather simple in the textbooks. The basic assumptions were (i) all credit was provided by banks; (ii) all bank credit (assets) were funded by the issuance, or creation, of depository liabilities (money) subject to a reserve requirement; and (iii) central banks controlled credit/money/inflation by rationing bank reserves. A stable 'money multiplier' was hypothesised to allow central banks to accurately predict the eventual impact of changes in bank reserves on money and credit.

The problem with the old theory of monetary operations is that none of the three assumptions has been true for at least a generation.

Most credit in the US is created by nonbanks; virtually all bank lending is funded by the creation of liabilities that are not subject to reserve requirements,3 and central banks do not ration reserves. In fact they take great pains to provide banks with the amount of reserves they desire. Central banks influence credit not by rationing the quantity of reserves but by altering the interest rate that banks must pay to obtain the quantity of reserves they desire.

- Today, credit creation in general and money creation in particular are no longer tied to the stock of reserves (i.e. the stock of banks’ deposits at the Fed).

This gets to the heart of the question of why over $2 trillion in excess bank deposits built up at the Fed over the last 4 years are not really moving the needle on bank lending (of course, this is a supply AND demand problem, and part of the issue with flat bank lending is tie to lack of demand as many businesses deleverage). But in terms of supply, I am increasingly coming to terms with the following statement which seems counter-intuitive to someone who studied banking 30 years ago

One of the unintended consequences of Fed LSAPs has been the withdrawal of high quality liquid collateral such as US Treasuries from the financial markets paid for by crediting commercial bank reserve accounts. As discussed above, the banking system as a whole cannot dispose of these assets (reserves). At the same time, banks are under massive pressure world-wide to deleverage. This can take place either by increasing capital (a bank liability), which is costly to shareholders, or by reducing assets. Thus banks’ massive holdings of reserves at the Fed are ‘deadwood’ as far as the banks and their credit-creation capacity are concerned. They may crowd out credit.

The deadwood problem will get worse if the US tightens regulatory leverage ratios – that is, reduces the maximum ratio permitted between a bank’s total assets and capital.6

There is a great irony in the journalistic history of monetary policy. What many are calling central bank “money creation” “helicopter money” or “rolling the printing presses” may – in combination with tighter leverage ratios – lead to a tightening of bank credit and deflationary pressures. And all this is occurring while the spectre of uncontrolled credit expansion and monetary debasement are being decried countless times by those who have not recognized that yesteryear’s monetary paradigm is defunct.

Interesting. I hear this from a lot of people in the know about the system. The author suggests one solution is having the Fed begin to do reverse repos with non-banks, which would drain excess reserves while adding high quality collateral back to the banking system which would allow more lending. Which appears to be exactly what the Fed is considering.

I am reading this article next to see if I can get a better handle on how all this works. I will let you know if I find it useful.

We Are In the Best of Hands: Janet Yellen Edition

The Arizona Republic today reviews a speech given by Yellen in January, 2007 in Phoenix:

It was January 2007 when Yellen, then head of the Federal Reserve Bank of San Francisco, spoke here about financial literacy before transitioning into comments about the economy — comments that now look remarkably unperceptive.

Back then, months before the real-estate and banking crisis took down the economy, Yellen expressed concern that inflation was uncomfortably high while job gains were coming too swiftly.

“If labor markets are as tight as the unemployment rate suggests, then there may be reason for concern about building inflationary pressures,” she said according to my Jan. 18, 2007, article.

Subsequent events showed that inflation was the last thing we had to worry about, while the lack of jobs has emerged as a central drag on the economy. Back then, U.S. unemployment was around 4.5 percent. But after the recession took hold, it more than doubled, peaking at 10 percent in late 2009. At 7.3 percent currently, it remains well above where it should be this far into an economic recovery.

In contrast, core consumer inflation (which excludes food and energy costs) of 1.8 percent today has hardly budged from the 2.2 percent rate that had Yellen all worked up back then.

In another comment during her Phoenix talk that now looks wildly off-base, Yellen, who later was named vice chair of the Fed’s board of governors, said recession risks had receded despite lingering weakness in housing. She cited the Valley as a place where home-price appreciation had come down from unsustainably high rates of increase.

The Great Recession, as we all now know in hindsight, began later that year, triggered by a home-price slide of epic proportions.

I don't want to beat her up too bad for missing the bubble burst, since most everyone did. They also all missed the last bubble burst, and the one before that, etc.

This is what makes me crazy: not that these folks were wrong, even consistently brutally wrong, but that they display absolutely no modesty in their actions given that they were so wrong. They propose policy steps, such as seemingly eternal QE, that are astoundingly risky unless one assumes that they have a very, very good grasp on exactly where the economy is going. Which they clearly never have had in the past. If they acted like they had been wrong most of the time, then I would have little to criticize. But to be consistently wrong and then make huge risky bets as if you have reliable predictive powers is hubris of the worst sort.

Raise Medicare Taxes

I have made this argument before -- your lifetime Medicare taxes cover only about a third of the benefits you will receive. Social Security taxes are set about right -- to the extent we come up short on Social Security, it is only because a feckless Congress spent all the excess money in the good years and has none left for the lean years.

But Medicare is seriously mis-priced. I have always argued that this is dangerous, because there is nothing that screws up the economy more than messed up price signals. In particular, I have argued that a lot of the glowy hazy love of Medicare by Americans is likely due to the fact that it is seriously mis-priced. Let's price the thing right, and then we can have a real debate about whether it needs reform or is worth it.

A recent study confirms my fear that the mispricing of Medicare is distorting perceptions of its utility.

As debate over the national debt and the federal budget deficit begins to heat up again, an analysis of national polls conducted in 2013 shows that, compared with recent government reports prepared by experts, the public has different views about the need to reduce future Medicare spending to deal with the federal budget deficit. Many experts believe that future Medicare spending will have to be reduced in order to lower the federal budget deficit [1] but polls show little support (10% to 36%) for major reductions in Medicare spending for this purpose. In fact, many Americans feel so strongly that they say they would vote against candidates who favor such reductions. Many experts see Medicare as a major contributor to the federal budget deficit today, but only about one-third (31%) of the public agrees.

This analysis appears as a Special Report in the September 12, 2013, issue of New England Journal of Medicine.

One reason that many Americans believe Medicare does not contribute to the deficit is that the majority thinks Medicare recipients pay or have prepaid the cost of their health care. Medicare beneficiaries on average pay about $1 for every $3 in benefits they receive. [2] However, about two-thirds of the public believe that most Medicare recipients get benefits worth about the same (27%) or less (41%) than what they have paid in payroll taxes during their working lives and in premiums for their current coverage.

Update: Kevin Drum writes on the same study. Oddly, he seems to blame the fact that Americans have been trained to expect something for nothing from the government on Conservatives. I am happy to throw Conservatives under the bus for a lot of things but I think the Left gets a lot of the blame if Americans have been fooled into thinking expensive government freebies aren't really costing them anything.

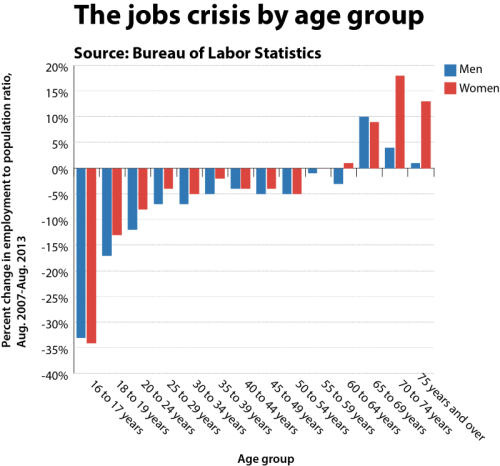

The Inevitable Result of Government Policy on the Labor Market

Assume the following conditions:

- I am increasingly liable for any dumbass thing my employees say or do. It does not matter if it is absolutely against my values and company rules, if someone, say, uses a racial epithet with a customer or another employee, I will likely at least get sued. Given my deductibles on insurance, I am out $20,000 a case even if I win.

- Minimum wages have increased faster than the production value of unskilled, inexperienced laborers.

- Obamacare is raising the minimum cost of a full-time employee by at least $2,000-$3,000 a year, not including the as-yet-to-be-define but likely expensive record-keeping and administrative requirements

- In states like California, the law increasingly gives employees the ability to make new claims on my income (e.g. fake workers comp and disability claims) or to even make themselves un-firable (by asking for a family medical leave, or claiming a disability, or claiming to be a whistle-blower).

Against this backdrop, what am I going to do? I am going to hire more skilled and experienced workers who justify my minimum employment costs. I am going to hire mature people less likely to get me in trouble via their immature actions. I am going to hire people with a long work history so I can see there is not a history of scams and fraud.

In other words, I am going to hire older people. And thus:

Of all the issues I raised above, the first one gets the least attention but in our customer contact business is perhaps the most important. The cost of hiring a knucklehead is immense. And the folks that do stupid stuff in 1 are often the very same people who try to take us in 4.

Keynesian Multiplier of 0.05

So much for that Keynesian stimulus notion (emphasis in the original)

With everyone focused on the 5th anniversary of the Lehman failure, we are taking a quick look at how the world's developed (G7) nations have fared since 2008, and just what the cost to restore "stability" has been. In a nutshell: the G7 have added around $18tn of consolidated debt to a record $140 trillion, relative to only $1tn of nominal GDP activity and nearly $5tn of G7 central bank balance sheet expansion (Fed+BoJ+BoE+ECB). In other words, over the past five years in the developed world, it took $18 dollars of debt (of which 28% was provided by central banks) to generate $1 of growth. For all talk of "deleveraging" G7 consolidated debt has been at a record high 440% for the past four years.

The theory of stimulus -- taking money out of the productive economy, where it is spent based on the information of hundreds of millions of people as to the relative value of millions of potential investments, and handing it to the government to spend based on political calculus -- never made a lick of sense to me. I guess I would have assumed the multiplier in the short term was fractional but at least close to one, indicating in the short run that if we borrow and dump the money into the economy we would get some short-term growth, only to have to pay the piper later. But we are not even seeing this.

The Problem With Affirmative Action

Janet Yellen may soon be a victim of affirmative action. I know that sounds odd, but I think it is true.

To preface, I have no preferences in the competition to become the next head of the Federal Reserve, and assume that Janet Yellen and Larry Summers are equally qualified. I don't think the immense power the Fed has to screw with the economy can be wielded rationally by any individual, so it almost does not matter who sits in the chair. Perhaps someone with a bit less hubris and a little more self-awareness would be better with such power, which would certainly mitigate against Summers.

But Yellen has a problem. When this horse race first emerged in the press, many in the media suggested that Yellen would be a great choice because she was a woman, and qualified. Most of the press coverage centered (probably unfairly given that she does seem to be quite qualified) on her woman-ness. This leaves Yellen with a problem because many people were left with a first impression that the reason to choose her was primarily due to her having a womb, rather than her economic chops.

This is the downside of affirmative action.