Non-Monetary Job Benefits Example

The other day I wrote about non-monetary job benefits. Here is an example:

A small-time vintner's use of volunteer workers has put him out of business after the state squeezed him like a late-summer grape for $115,000 in fines -- and sent a chill through the wine industry.

The volunteers, some of them learning to make wine while helping out, were illegally unpaid laborers, and Westover Winery should have been paying them and paying worker taxes, the state Department of Industrial Relations said.

"I didn't know it was illegal to use volunteers at a winery; it's a common practice," said winery owner Bill Smyth.

State law prohibits for-profit businesses from using volunteers.

Before the fine, volunteer labor was common at wineries in the nearby Livermore Valley, said Fenestra Winery owner Lanny Replogle.

...

About half the people the state considered Westover employees were taking a free class at the Palomares Canyon Road winery. Students learned about growing vines, harvesting and blending grapes and marketing the finished product.

"This was an incredible opportunity for me," said Peter Goodwin, a home winemaker from Walnut Creek who said he dreams of opening a winery with some friends. "I got to learn from someone who knows the business."

The winery sometimes asked Goodwin if he wanted to assist in different tasks.

"That's what I wanted, to be as involved as much as possible -- it was all about learning," he said. "I don't understand the state's action. It was my time, and I volunteered."

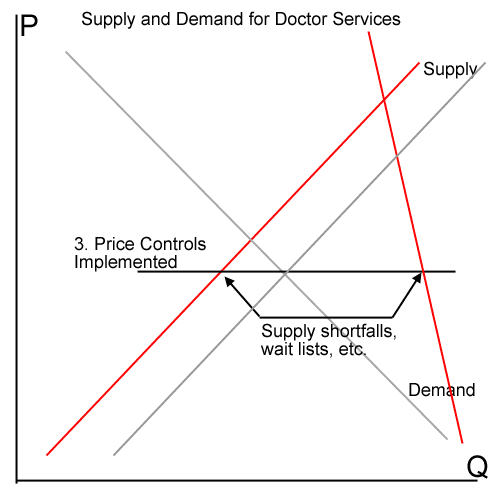

I have mixed feelings on this. On the one hand, this demonstrates the appalling violation of individual freedom that minimum wage laws create -- not just for the employer, but for the employee as well. Minimum wage laws mean that you are not allowed to perform labor for less than that minimum, even if you choose to and get non-monetary benefits that you feel fully compensate you for the time.

On the other hand, you have to be particularly clueless, especially in California, to claim ignorance on this. I work in an industry that 10 years ago routinely accepted volunteer labor (illegally) and I was never lulled by the "everyone else is doing it in the industry" excuse. I will say that it is irritating to try to run a business in compliance with the law and to find yourself undercut by folks who are avoiding the more expensive parts of the law. Years ago there used to be a couple of non-profits who competed against me running campgrounds. They were really for profit - they just paid their president a large salary rather than dividends - but used the non-profit status** as a dodge to try to accept volunteer labor. Eventually, they were stopped by several courts from doing so.

Yes, I know this is kind of odd. You might ask yourself, why are there so many people willing to take their volunteer position when you are offering paid jobs? It turns out here are a lot of non-monetary benefits to this job such that people will do it for free. In fact, that huge fountain of hypocrisy that is the Federal Government exempts itself from paying minimum wage and accepts volunteers to run its campgrounds where I must pay them.

** the non-profit status helped them in one other way. We take over operation of recreation areas under concession contract from the government. Many government employees hate this sort of outsourcing partnership, and really find it - for the lack of a better word - dirty to sully themselves interacting with a profit-making entity. The non-profit status helped my competitors seem friendlier -- ie less capitalistic -- than I. California recently passed a law allowing lower cost third party operation of certain parks functions but only if this was performed by a non-profit. I had a US Forest Service District Ranger in Kentucky tell me once that he was offended that I made money on public lands, providing services in the National Forest. I answered, "Oh, and you work for free?" I said that I did not know how much he made but I guessed $80-100 thousand a year. I said that would be over double what my company made in profit in the same forest operating and paying for hundreds of camp sites. Why was I dirty for making money in the Forest but he thought he as "clean"?