The Ultimate End of Social-Democratic Labor Policy

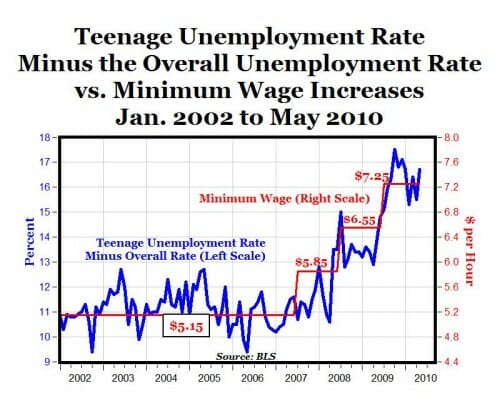

When a country

- Increases the minimum wage, and therefore the minimum skill / productivity needed for a job

- Adds substantially to the costs of labor through required taxes, insurance premiums, pensions, etc

- Makes employees virtually un-fireable, thus forcing companies to think twice about hiring young, unproven employees they may be saddled with, good or bad, for decades

- Puts labor policy in the hands of people who already have jobs (ie unions)

- Shift wealth via social security and medical programs from the young to the old

The bitterly ironic part is that when these folks hit the streets in mass protests, it will likely be for more of the same that put them there in the first place.

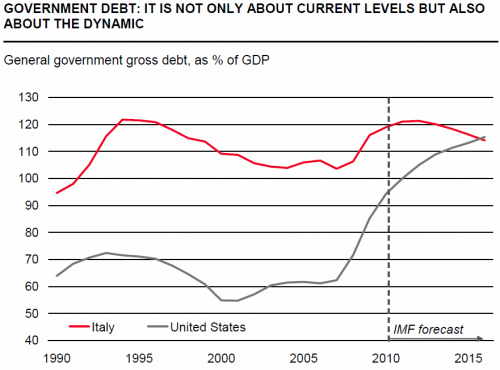

Want to argue that such policies are hurting workers rather than helping? Good luck, at least in Italy

Pietro Ichino, a professor of labor law at the University of Milan and a senator in the Italian legislature, is known as the author of several “neoliberal” books and studies recommending that the Italian government relax its extraordinarily stringent regulation of employers’ hiring and firing decisions. As Bloomberg Business Week reports, that means that Prof. Ichino must fear for his life: “For the past 10 years, the academic and parliamentarian has lived under armed escort, traveling exclusively by armored car, and almost never without the company of two plainclothes policemen. The protection is provided by the Italian government, which has reason to believe that people want to murder Ichino for his views.”

Memo to US: Don't get cocky, you are going down the same path

Update: Interesting and sort of related from Megan McArdle

An apparent paradox that frequently puzzles journalists is that Europeans work fewer hours than workers in the United States, while in some countries, hourly productivity appears to be the same, or even higher, than that of American workers.

This is not actually a paradox at all. Much of the decline in European hours worked per-capita came in the form of unemployment. Rigid labor laws which make it hard to fire (and thus, risky to hire) shut less productive workers out of the market, particularly the young, and those who had been displaced due to disruptive industry change. So does anything that raises the cost of labor, like, er, loads of mandatory vacation and leave. When you exclude your least productive workers from the labor force, your measured hourly productivity will be higher, particularly if you use metrics like GDP per hours worked.