Failing at Fairness: Getting the Story 180 Degrees Backwards

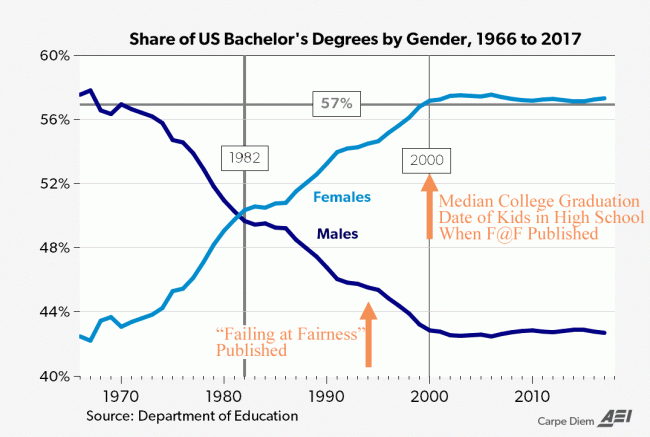

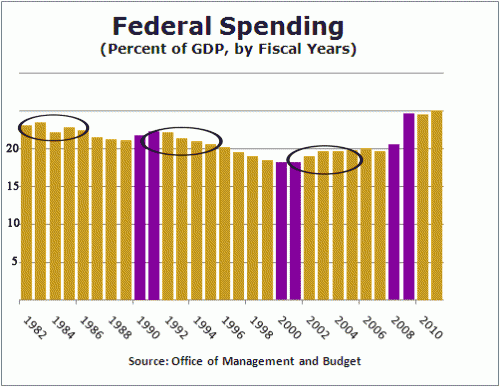

The other day the indispensable Mark Perry wrote:

....women have earned a majority of bachelor’s degrees for the last 36 years starting in 1982. Not shown here, but women previously earned a majority of associate’s degrees starting in 1978 and a majority of master’s degrees starting in 1981. By 2006, women earned a majority of doctoral degrees and the “takeover” of higher education by women was complete for degrees at all levels! But instead of declaring “victory” and moving on, many women are still claiming “victim status” in higher education with the need for special gender preferences in the form of funding, scholarships, centers, commissions, fellowships, awards, programs, and initiatives that are only available for women, or are primarily for women.

I have annotated his chart (shown below) to amplify his last sentence.

One of the seminal books on the topic of girls in education was "Failing at Fairness" by Myra P Sadker and published in 1994. The Google Books summary of the book is as follows:

Failing at Fairness, the result of two decades of research, shows how gender bias makes it impossible for girls to receive an education equal to that given to boys.

- Girls' learning problems are not identified as often as boys' are

- Boys receive more of their teachers' attention

- Girls start school testing higher in every academic subject, yet graduate from high school scoring 50 points lower than boys on the SAT

The book was very influential. I know it sat on my feminist wife's night table for quite a while. But note the publication date on Mark Perry's chart above. For kids in high school when that book was published, a fair median date for their college graduation would be 6 years later, or around the year 2000. It's fair to estimate that girls in high school at the time Sadker was writing were going to be 33% more likely to get a college degree than the boys in the same classes. Anyone who had read that book alone and nothing else on the topic would have called you a liar for predicting that.

Look, I have no doubt that one could easily put together a book about all the ways the public education system fails girls because I think the public education system in many parts of this country fails EVERYONE. But we seem to keep obsessively questioning whether we are doing enough for girls in education when the problem seems to be boys.

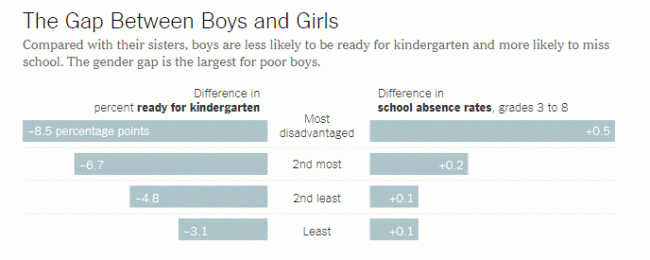

The New York Times actually talked about boys falling behind in education a few years ago, and had this telling chart about ways in which boys lagged in education. The article forced on poor boys, but note that boys of all socioeconomic classes lagged.

And this is before we even get to the most disturbing metrics about boys and girls, such as youth crime. While girls have closed the gender gap in crime somewhat, boys are still 10 times more likely than girls to be arrested for a homicide, and boys are more than twice as likely to be arrested for any sort of crime than girls (source). Remember that last mass shooter who was female? Neither do I.

I am not an expert on why this is. Shifting success norms from competition to cooperation, elimination of historic outlets for non-academic males like vocational programs, and huge amounts of money and counseling resources all dedicated to girls probably play a part. But the frustrating thing is you almost never see a discussion of this topic. Anyone who does try to address it is immediately pigeon-holed as some alt-right male rights extremist and defenestrated from the Overton Window.